benedek

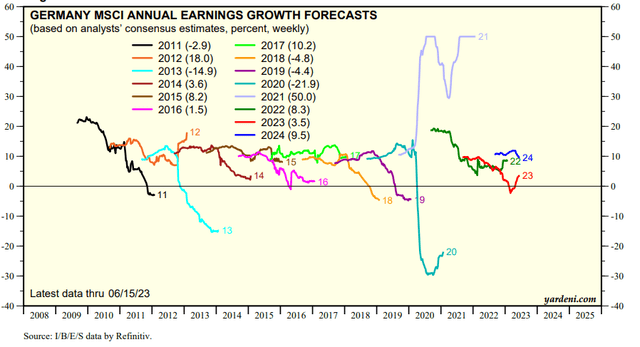

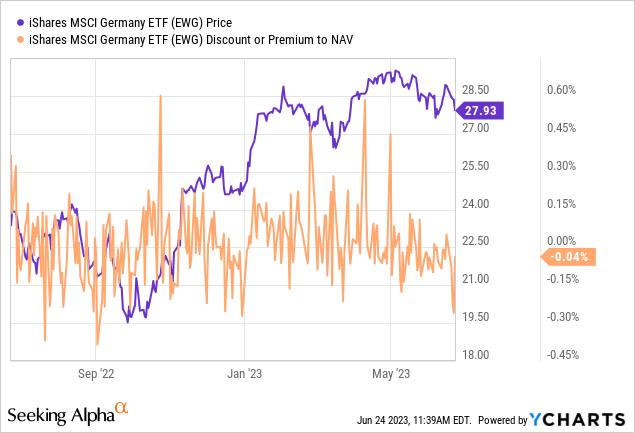

Germany’s latest Q1 GDP data revision confirmed what many had long anticipated – the economy had already entered a technical recession (albeit a shallow one) in the winter. This was followed by a series of weak manufacturing sector data, in line with the deteriorating PMI reports in the rest of the developed world and, more surprisingly, China. I wouldn’t rush to underwrite an earnings downturn anytime soon, though, as auto manufacturing and capital goods further rebound amid easing supply chain constraints and falling energy prices. The consumer isn’t doing too bad either – helped by their accumulated savings through the pandemic, steady wage growth, and decelerating food prices, a pick-up in household spending may well be on the cards. At ~13x P/E, the iShares MSCI Germany ETF (NYSEARCA:EWG) doesn’t screen cheaply compared to other Euro area funds. But relative to consensus expectations for ~10% EPS growth in 2024 and a high-single-digits % mid-term growth algorithm, EWG seems very reasonably priced.

Fund Overview – Low-Cost Exposure to a Portfolio of German Champions

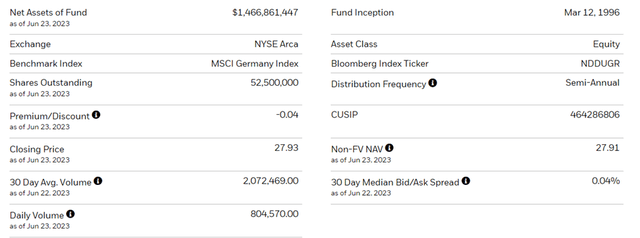

The US-listed iShares MSCI Germany ETF seeks to track, before fees and expenses, the performance of the MSCI Germany Index, which comprises large and mid-cap German equities (~85% of the free float-adjusted market cap). The ETF held ~$1.5tn of net assets at the time of writing and charged a 0.5% expense ratio, making it a cost-effective option for US investors looking to express a single-country view. A summary of key facts about the ETF is listed in the graphic below:

iShares

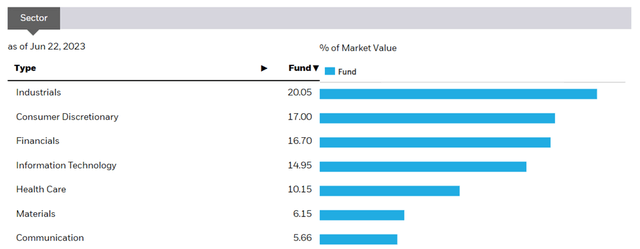

The fund is spread across 59 holdings, with the largest sector allocation going to Industrials at 20.1%, followed by Consumer Discretionary at 17.0% and Financials at 16.7%. Other sector exposures above the 10% threshold include Information Technology (15.0%) and Health Care (10.2%). The fund also has a material presence in Materials (6.2%) and Communication (5.7%). On a cumulative basis, the top five sectors accounted for ~79% of the total portfolio, making EWG a relatively top-heavy Euro area ETF from a sector perspective. In line with the fund’s exposure to cyclicals, its equity beta is relatively high at 1.13 to the S&P 500 (SPY).

iShares

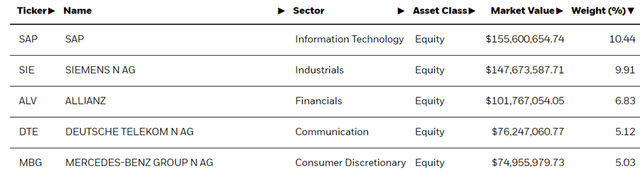

The single-stock allocation is better spread out, with the fund’s largest holding, software and technology solutions company SAP SE (SAP), contributing 10.4% of the portfolio. The second largest holding is multinational conglomerate Siemens AG (OTCPK:SIEGY) at 9.9%, followed by financial services leader Allianz SE (OTCPK:ALIZF) at 6.8%. Rounding up the top five are telco giant Deutsche Telekom AG (OTCQX:DTEGY) and automotive manufacturer Mercedes-Benz Group AG (OTCPK:MBGAF) at 5.1% and 5.0%, respectively. In total, the top five holdings account for ~37% of the EWG portfolio.

iShares

Fund Performance – Solid Long-Term Track Record but Beware the Cyclical Swings

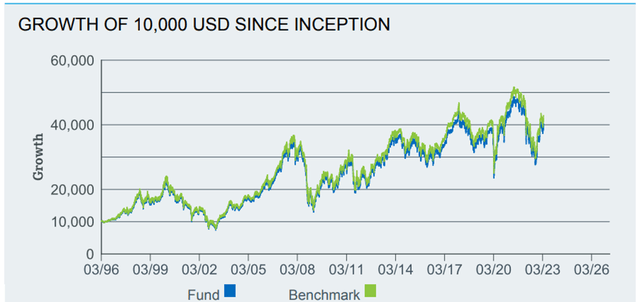

On a YTD basis, the ETF has risen by 11.1% and has compounded at a steady 5.3% rate in market price and NAV terms since its inception in 1996. Returns have been volatile, though, with EWG’s portfolio hit particularly hard by the energy shock last year at -22.2% – the second >20% drawdown since 2018. Still, over the long run, investors willing to stomach the volatility have generally been well rewarded, with the ten-year return holding up well at +3.9%. The total return for EWG since inception has outpaced comparable Euro ETFs like the iShares Europe ETF (IEV) as well.

iShares

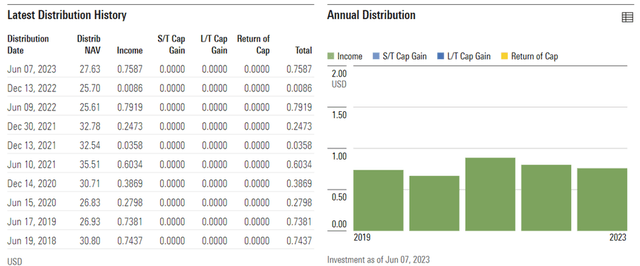

Despite the cyclicality of EWG’s returns, the fund’s semi-annual distribution has generally been steady through the cycles. Even through the COVID-impacted years, the income-driven yield has been consistent, supported by the fund’s holdings in cash-generative industry leaders. The current trailing twelve-month yield stands at 2.7%, though this year’s yield is likely to be higher, given the YTD run rate. In addition, the fund’s underlying 13.0x P/E valuation screens very reasonably relative to the improving fundamentals post-COVID, so patient, long-term investors stand to be well rewarded.

Morningstar

Silver Linings in the Economic Data

With Germany officially revising its initial Q1 real GDP growth print to -0.3% QoQ (from flat % previously), the country has officially entered a recession. The key detractor has been manufacturing, with exports to China (mainly capital goods) faltering and the manufacturing PMI suffering a further dip to 41.0 in June (i.e., to pandemic-era levels). Yet, German large caps seem to be navigating the headwinds well – corporate earnings for key EWG holdings like Mercedes-Benz and Siemens have outpaced expectations on the back of easing supply chain congestion. Backed by a robust backlog, expect more beat-and-raise quarters ahead. While external demand weakness is a concern, particularly following China’s worsening ex-services data, falling energy/commodity prices (a major earnings headwind last year) offer a helpful cushion to margins in a worst-case scenario.

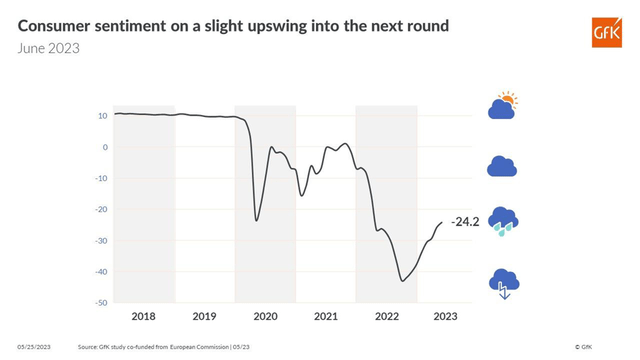

Another bright spot for the German economy has been its resilient consumer confidence – the GfK consumer climate index most recently improved in May, helped by an unwinding of household savings and higher income expectations (reflecting continued labor market tightness). Also positive was the latest acceleration in German retail sales (+0.8% MoM) on broad-based strength across food and non-food categories. As inflation continues to trend downward and fears of credit contagion from the US/EU banking crisis continue to fade as well, expect a further private/public consumption boost to German growth in the coming quarters.

GfK

Look Past the German Recession Fears

Germany may have entered a technical recession over the winter, but there are silver linings. On the one hand, aggregate manufacturing data has been poor, with recent months seeing renewed pressure after a strong start to the year. But corporate earnings tell a different story, especially for the large caps, many of which have benefited from normalizing supply chains post-COVID. Mercedes-Benz, a key EWG holding, led the Q1 rebound for the German auto sector, while the fund’s second-largest holding Siemens hiked guidance yet again in fiscal Q2, supported by a massive backlog. The consumer side remains strong as well, with ample room still left for a rally in household spending on the back of a strong labor market and decelerating inflation. With EWG’s large-cap portfolio poised to grow earnings at ~10% in 2024, the risk/reward seems favorable at the current low-teens P/E valuation.

Yardeni