vitapix

Hold faithfulness and sincerity as first principles.”― Confucius.

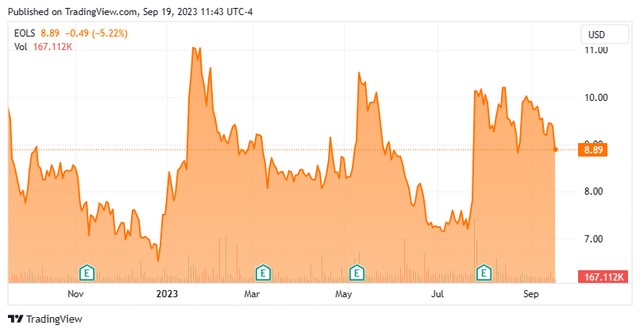

We last visited Evolus, Inc. (NASDAQ:EOLS) one year ago. In that article, the stock was recommended as a small, covered call candidate pending further developments. The stock is down just over 15% over that time, but I have been able to “roll” my options, making it a somewhat profitable position for my portfolio despite the decline in the equity. What is the proper strategy around this small cap concern currently? An updated analysis follows below.

Seeking Alpha

Company Overview:

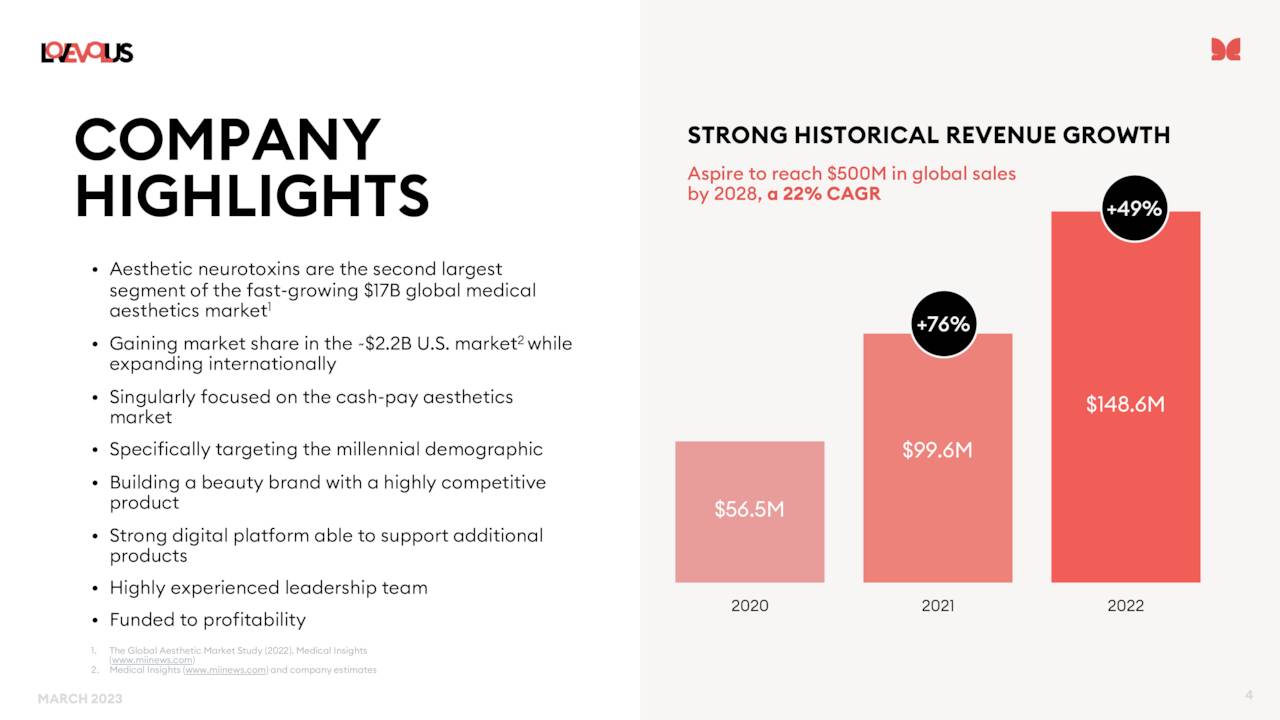

The company is headquartered just outside of Los Angeles in Newport Beach, CA. Evolus provides medical aesthetic products for physicians and their patients. Its main product is called Jeuveau which is a proprietary 900 kilodalton purified botulinum toxin type A. The product competes against market leading Botox to deliver temporary improvement in the appearance of moderate to severe glabellar lines in adults. The stock trades around nine bucks a share and sports an approximate market capitalization of $530 million.

March Company Presentation

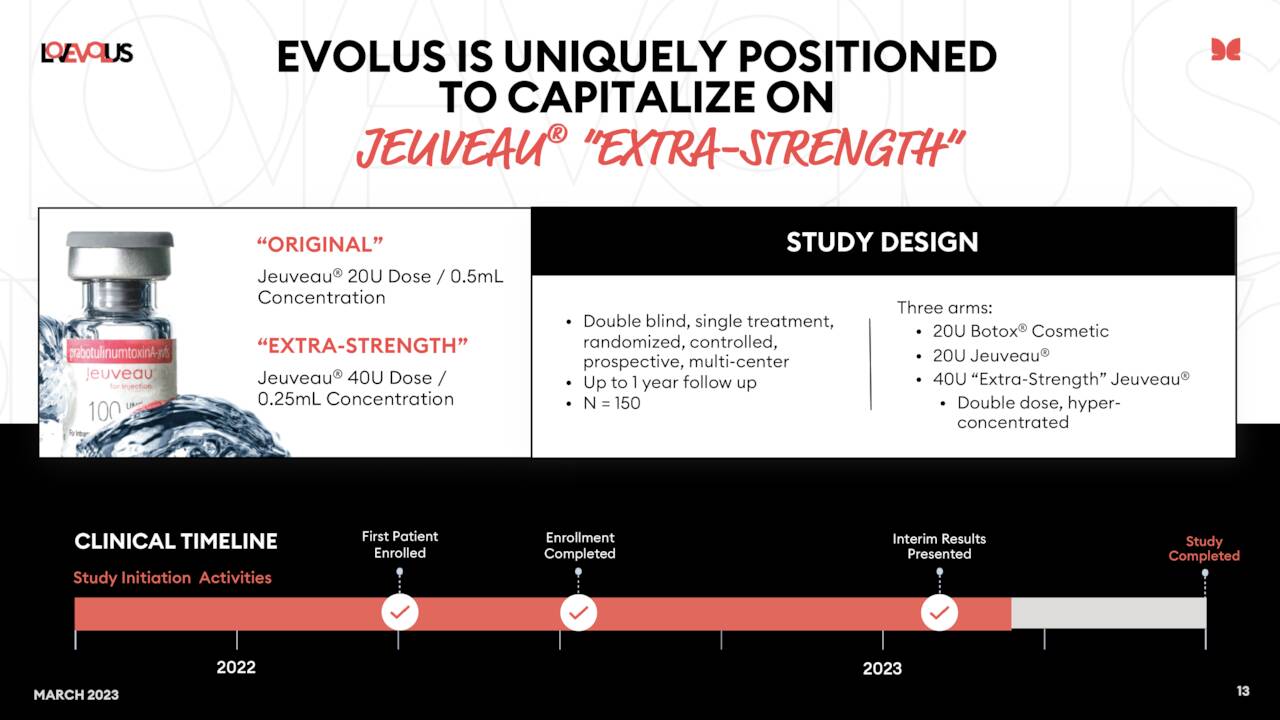

The company launched a version of Jeuveau called Nuceiva in core markets in Europe. Evolus also expects to launch two filler products under the brand name Evolysse sometime in 2025. An extra-strength version of Jeuveau just completed Phase 2 development as well.

March Company Presentation

Second Quarter Results:

On August 2nd, the company reported its second quarter numbers. The company had a GAAP loss of 32 cents a share even as revenues rose 32.5% on a year-to-year basis to $49.3 million. Sales rose $41.7 million in 1Q 2023 allowing the company to gain one full point of market share to 10%. Evolus also added 64,000 members to its Evolus Rewards Consumer Loyalty program, which now stands at 638,000 members. This program incents return customers as it offers $40 discounts on each treatment.

Management bumped up full year revenue guidance by $5 million to between $185 million to $195 million for FY2023. This would represent approximately a 30% year-over-year rise in sales, three times the current category average as Jeuveau continues to garner market share. The company has room to grow given Jeuveau has only penetrated approximately one third of overall potential accounts that currently provide neurotoxin.

Analyst Commentary & Balance Sheet:

Since second quarter results were posted, a half dozen analyst firms including Cantor Fitzgerald and Needham have reiterated Buy/Outperform ratings on EOLS. Price targets proffered range from $20 to $27 a share. Barclays is the outlier in the analyst community reissuing its Hold rating and $10 price target on the stock.

Approximately one of every dozen shares outstanding are currently held short. Several insiders have disposed of just over $2.3 million worth of equity collectively so far in 2023. There have been no insider purchases year-to-date. In addition, a couple of beneficial owners sold over four million shares combined in February of this year.

Evolus ended the first half of this year with just over $41 million in cash and marketable securities on its balance sheet after a net operating loss $15.1 million for the quarter. This included a non-recurring $4.4 million license milestone expense. Total cash on the balance sheet did go up nearly $10 million from the end of the first quarter as Evolus utilized additional borrowings of $25 million under the company’s credit facility with Pharmakon. Management does believe that its existing cash will fully fund the company to sustained profitability in 2025, it should be noted. The company has some $40 million in long-term debt.

Verdict:

Evolus had a loss of 93 cents a share on just over $146 million in FY2022. The analyst firm consensus has sales growing 30% in both FY2023 and FY2024, with losses being cut to 60 cents and 39 cents a share, respectfully.

When we last revisited Evolus, management had stated they expected the company to be profitable sometime in 2024. That now seems to have been moved out to the 2025 fiscal year. The insider selling also is a minor red flag.

The company is continuing to deliver sales growth in the 30% range and the analyst community remains positive about Evolus’ longer-term prospects. Management believes it can achieve $700 million worth of annual sales by FY2028. In addition, the company has advanced extra strength Jeuveau into late-stage development since we last looked at Evolus in September of last year.

Given this, I am happy to maintain my small, covered call position in this small aesthetic concern. However, I am not adding to it at this time. A fresh set of data points will also be available in early November, when Evolus, Inc. reports their third quarter results.

Your friends will believe in your potential, your enemies will make you live up to it.”― Tim Fargo.