FeelPic

By Andrew Kim, Research Associate and Nicholas Grous, Associate Portfolio Manager

Now that 3.2 billion players are spending $180 billion per year, the global video game sector is the largest entertainment market in the world.[1] Historically, developing video games has been difficult and costly, requiring software engineering, graphic design, production, distribution, and marketing.

As a result, the studio model – in which one company employs hundreds of people to produce a single game – has dominated. But what if all video gamers could become developers?

Until recently, video game development had been too costly for user-generated content (UGC). Now, thanks to technology, consumers have become creators in other entertainment media, pointing the way for games. With minimal upfront costs, online platforms in audio (Spotify), text (Twitter), photo (Instagram), and video (YouTube) have enabled anyone with an internet connection and a smartphone to create songs, podcasts, blogposts, photos, and videos.

Roblox’s (RBLX) CTO, Daniel Sturman, recently suggested[2] that generative AI could be an important catalyst in the video game space, because it can learn patterns, structure data, and generate new 3D content much faster and cost effectively than historically has been the case. As a result, the inflection point for gaming could be upon us.

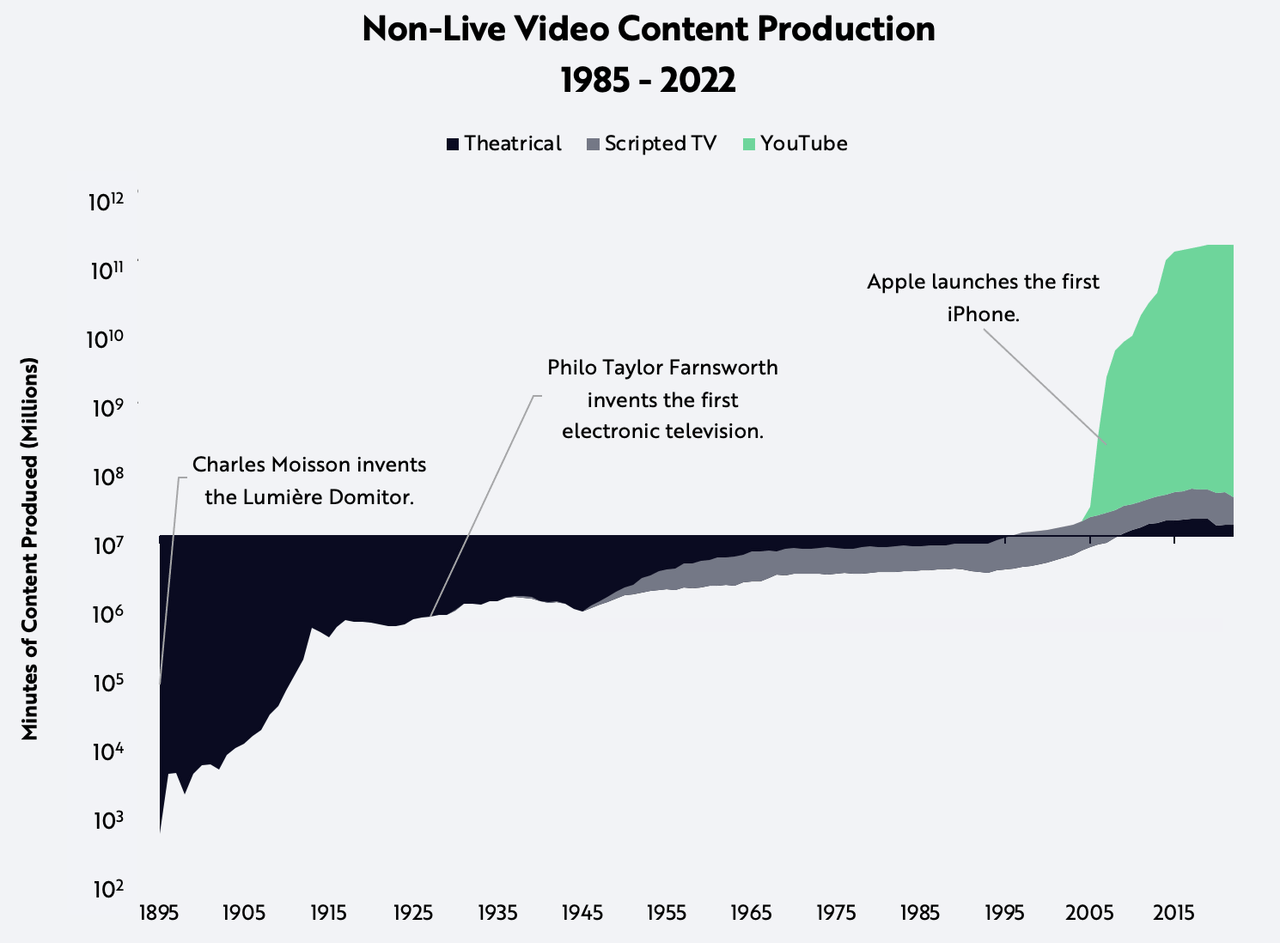

To inform our expectations for gaming, we examined video content production since the birth of film in the late 19th century, as shown below. In the 1930s, scripted TV entered the market and, by 1956, surpassed theatrical releases, as measured by annual minutes.[3]

Similarly, according to our estimates, rapid internet adoption and the debut of Apple’s iPhone early in the 21st century enabled YouTube to scale to more than one billion minutes per year of content by 2011 – in just six years.[4]

By 2022, total minutes of YouTube content uploaded reached ~15 billion, more than 4,000 times the total minutes of scripted theatrical and TV content produced in the same year, according to our estimates.[5] We attribute YouTube’s dominance to meaningful cost declines in video content production that democratized the creative process.

Source: ARK Investment Management LLC, 2023.[6]

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

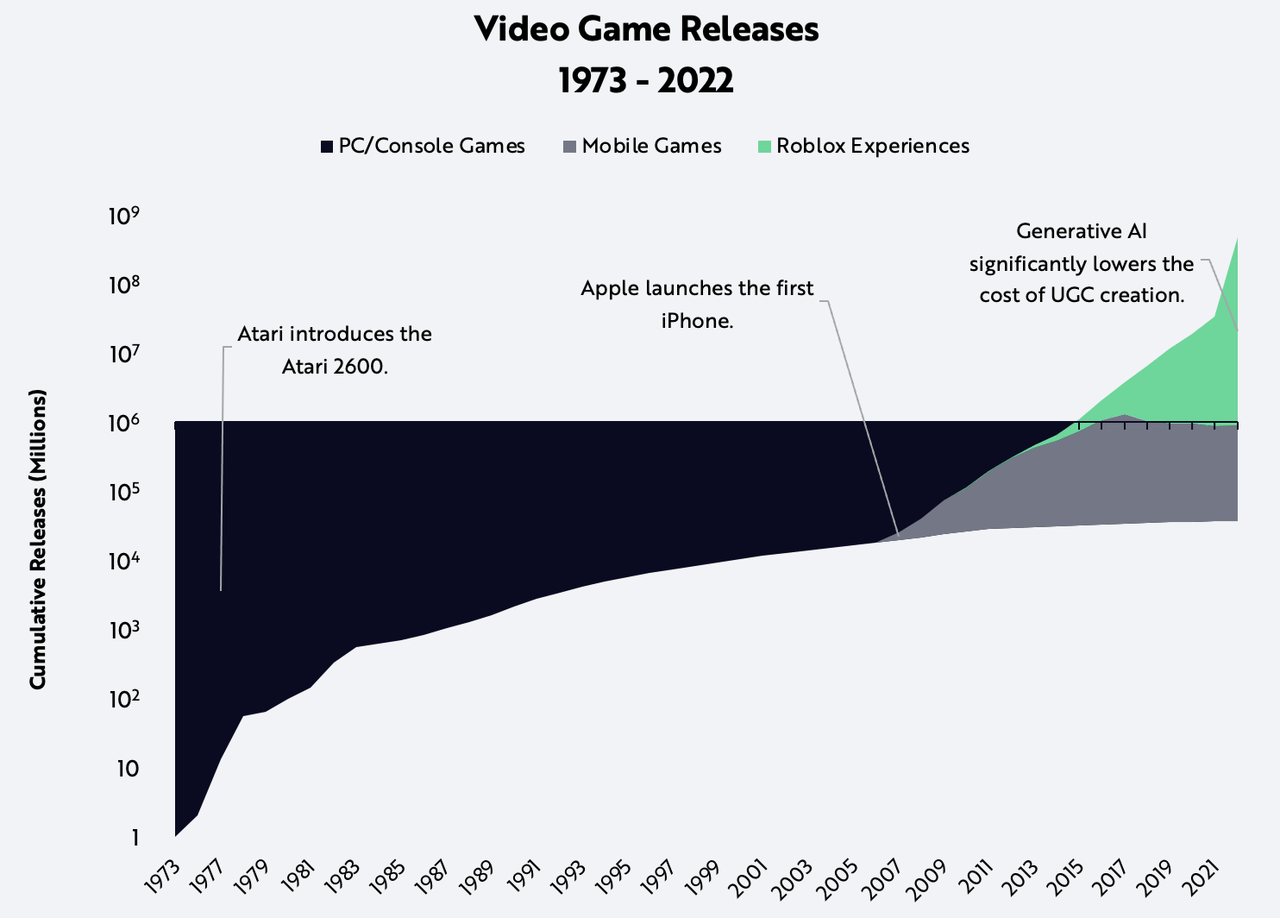

A similar trend seems to be evolving in gaming thanks to the adoption of mobile devices, viable hardware, and game engine platforms like Unity (U) and Unreal Engine, as shown below.

By the end of 2009, the number of mobile games on iOS and Android overtook the number of PC and console titles released ever since Pong debuted 37 years earlier in 1972.[7]

In 2017, Roblox Studio overtook the number of PC, console, and mobile app titles with ~2.5 million virtual experiences on the platform.[8] According to our estimates, it now offers ~470 million experiences, 530 times more than the cumulative number on PC, console, and mobile app games.[9]

Source: ARK Investment Management LLC, 2023.[10] Note: User-generated Content (UGC).

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

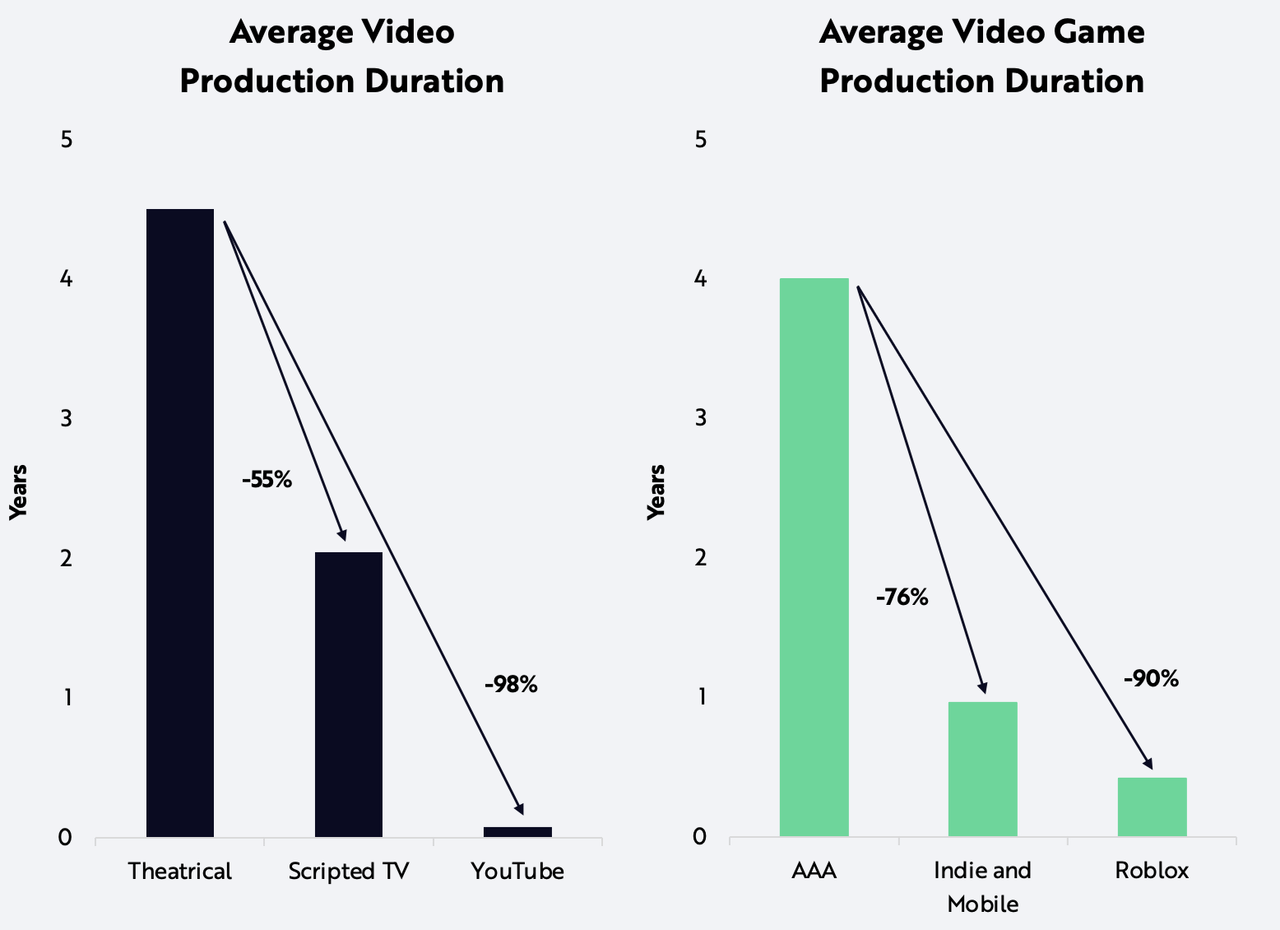

Moreover, the cost to produce videos and video games is likely to collapse. According to our estimates, thanks to generative AI, the time to produce UGC should decline at a rate similar to that between professional films and YouTube videos, as shown below.

Source: ARK Investment Management LLC, 2023.[11]

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

By shifting the gating factor in video game creation from acquired skills to individual creativity, easy-to-use text-to-2D and text-to-3D models could turbocharge the creator revolution.

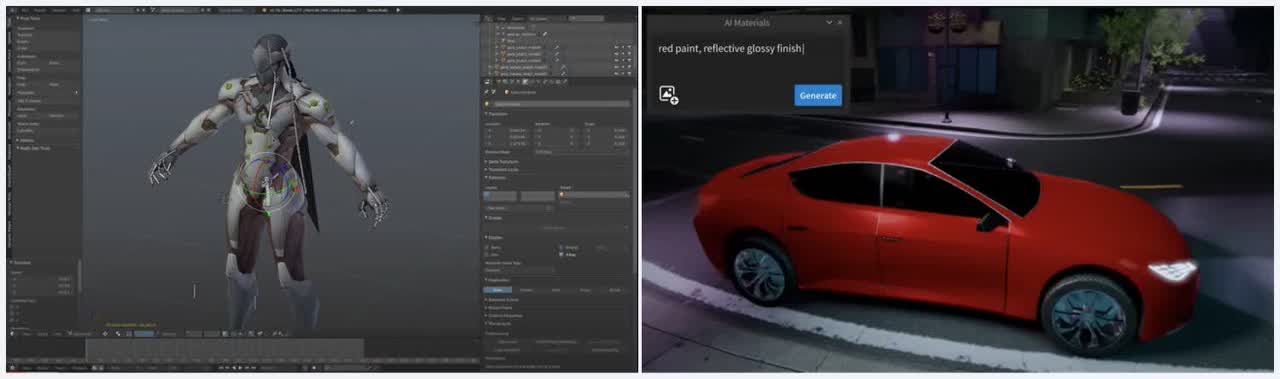

Consider the two images below, for example. On the left is a complicated 3D asset dashboard on which creators design their assets today while, on the right, is a single prompt bar that specifies a 3D asset’s textures using natural language.

Over time, we anticipate that game engines, regardless of sophistication, will look more and more like the right over time, deprecating manual tools for AI.

Sources: bugzilla2001. 2017; Roblox Corporation 2023a. Data as of February 17, 2023.

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

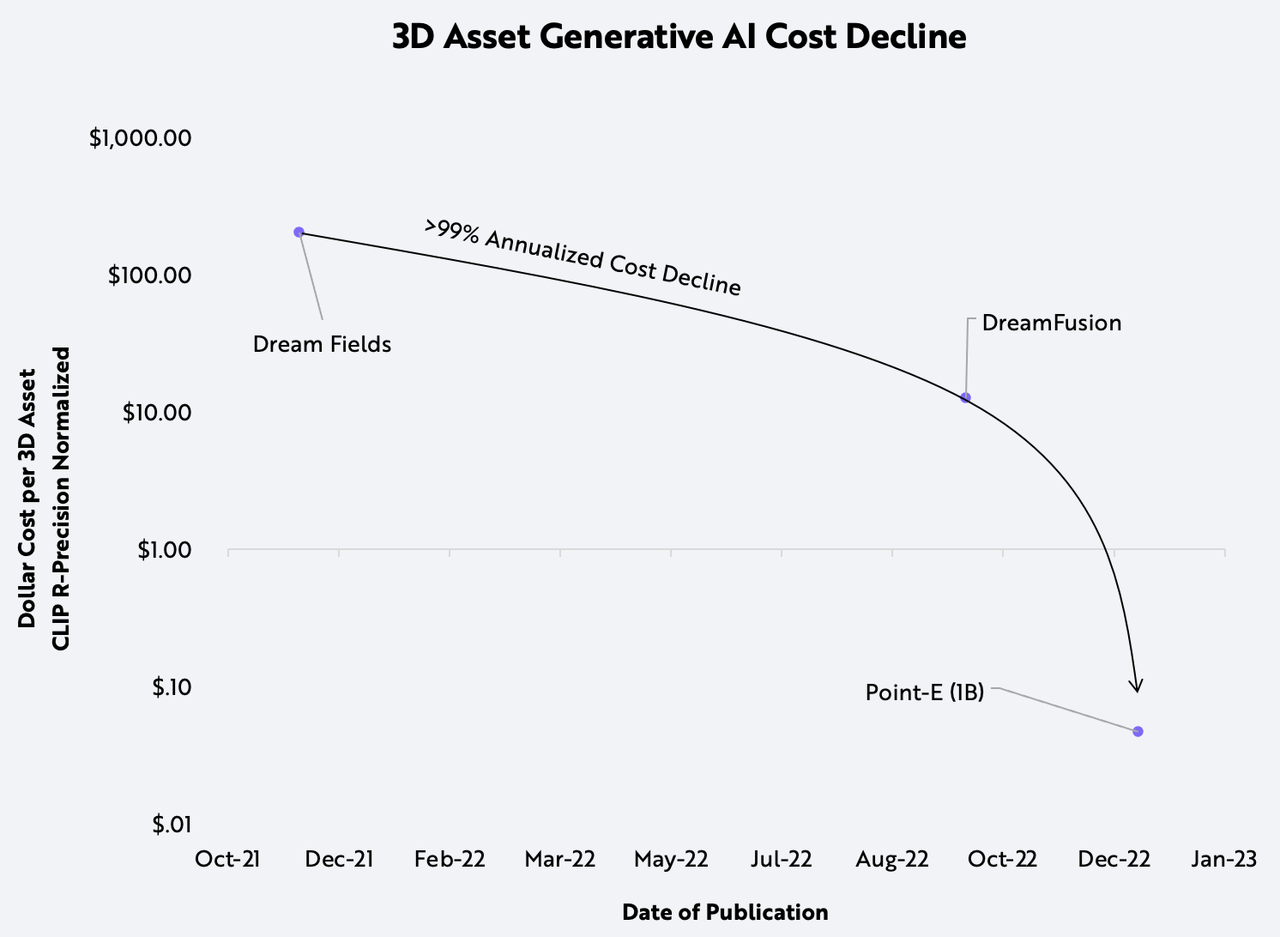

During the past year, the innovation in text-to-3D models has decreased the cost to generate 3D assets at an annual rate of ~99%, as shown below.

Source: ARK Investment Management LLC, 2023.[12]

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

In 2021, researchers from UC Berkeley and Google Research published Dream Fields, an AI model that generates 3D models from natural language prompts.[13]

While prior methods used a small amount of 3D training data with text-3D asset pairs, Dream Fields’ neural radiance field (NeRF) inferred multiple viewpoints to reconstruct text-labeled 2D images in 3D space, limiting the need to train on sparse 3D data.[14]

Nine months later, the same team published DreamFusion, a higher-fidelity model that requires no 3D training data to generate 3D assets.[15] After normalizing for asset accuracy and calculating based on Nvidia’s V100 spot price as of June 9, 2023, we estimate that the cost to generate a single 3D asset dropped 94% in just nine months, from $196 per asset with Dream Fields to $12 with DreamFusion.[16]

In December 2022, OpenAI released Point-E, a text-to-3D model that takes text-to-image model output and produces a 3D point cloud.[17] Point-E sacrifices 3D asset fidelity and accuracy for lower latency, generating a 3D asset in one-and-a-half minutes compared to Dream Fields’ 200 hours and DreamFusion’s 12 hours.[18]

After normalizing for asset accuracy, we estimate that the cost of generating a single 3D asset with Point-E is less than five cents at today’s V100 spot price as of June 9, 2023, suggesting more than a 99% improvement in performance from Dream Fields to Point-E.[19]

If advances in text-to-3D models were to continue at the same pace, then the cost of generating a 3D asset would drop to that of the computation necessary for a game within the next year.[20]

Despite impressive cost declines in text-to-3D models, the next wave of reductions in video game development cost and time will require more model flexibility.

While current models can generate various 3D assets with ease, their output remains monolithic, requiring game artists and developers to break apart the output generated into smaller segments and create dynamic game assets.

Existing models also focus on the generation of discrete 3D items, rather than large-scale environments. We believe Epic Games, Roblox, and Unity are well-positioned to break those barriers.

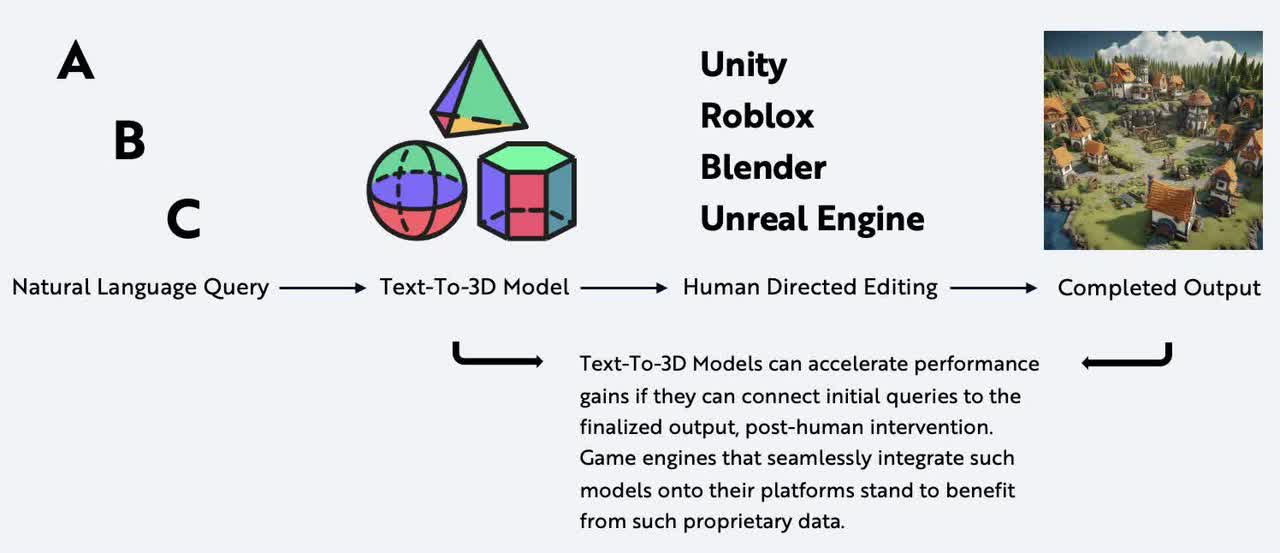

As readily available game engines integrate text-to-3D models, creators and developers should be able to generate and edit their assets on these platforms. The platforms that train models on finished assets should have proprietary data advantages, as shown below, and proprietary data is likely to separate the winners from the losers.

Source: ARK Investment Management LLC, 2023.

For informational purposes only and should not be considered investment advice or a recommendation to buy, sell, or hold any particular security.

Recent advances in text-to-3D generative AI should be gaming’s next inflection point, merging the roles of user and developer to accelerate adoption dramatically.

Works Cited

Birrell, M. 2022. “Every iPhone Release In Chronological Order.” Screen Rant. Every iPhone Release In Chronological Order

bugzilla2001. 2017. “Rigging SFM Models in Blender.” YouTube. Rigging SFM Models in Blender

Ceci, L. 2023. “Hours of video uploaded to YouTube every minute 2007-2020.” Statista. YouTube: hours of video uploaded every minute 2022 | Statista

Celebrity.fm. 2023. “How long does it take to produce a TV episode?” Celebrity.fm. How long does it take to produce a TV episode?

Curry, D. 2023. “App Store Data (2023).” Business of Apps. App Store Data (2023)

DeGuzman, K. 2021. “How Long Does it Take to Make a Movie — Production Timeline.” Studio Binder. How Long Does it Take to Make a Movie?

Google Cloud. 2023. “GPU pricing.” Data as of June 8, 2023. GPU pricing | Compute Engine: Virtual Machines (VMs) | Google Cloud

Hosch, W. 2023. “Pong.” Encyclopaedia Britannica. Pong | electronic game

Jain, A. et al. 2021. “Zero-Shot Text-Guided Object Generation with Dream Fields.” Working Paper. Zero-Shot Text-Guided Object Generation with Dream Fields

IMDb 2023. “IMDb Datasets.” IMDb. https://datasets.imdbws.com/

MasterClass. 2021. “Movie Camera History: Who Invented Motion Picture Cameras?” MasterClass. https://www.masterclass.com/articles/movie-camera-history-guide

Narakeet. 2022. “What Is The Ideal YouTube Video Length In 2022?” What Is The Ideal YouTube Video Length In 2022?

Narayanan, V. 2019. “How Long Does It Take To Create A YouTube Video?” Rizzle, Medium. How Long Does It Take To Create A YouTube Video?

Nichol, A. et al. 2022. “Point-E: A System for Generating 3D Point Clouds from Complex Prompts.” DeepAI. Point-E: A System for Generating 3D Point Clouds from Complex Prompts

Poole, B. et al. 2022. “DreamFusion: Text-to-3D using 2D Diffusion.” Working Paper (GitHub). DreamFusion: Text-to-3D using 2D Diffusion

Roblox Corporation. 2020a. “How long does it take to code a game style adopt me?” Roblox Developer Forum, October 2020. How long does it takes to code a game style adopt me?

Roblox Corporation. 2020b. “Form S-1, November 19, 2020. S-1 – Roblox Corporation – BamSEC

Roblox Corporation. 2021. “Investor Day November 2021.” Roblox – Investor Day

Roblox Corporation. 2022. “Investor Day September 2022.” Roblox – Investor Day

Roblox Corporation. 2023a. “Generative AI on Roblox.” YouTube. https://www.youtube.com/watch?v=e2w0mBheCQ4

Roblox Corporation. 2023b. “Form 10-K, February 28, 2023. 2022 10-K – Roblox Corporation – BamSEC

Rocket Brush Studio. 2022. “How Much Does It Cost To Develop A Game.” How Much Does It Cost to Develop a Game

Stephens, M. 2000. “History of Television.” Grolier Multimedia Encyclopedia. https://stephens.hosting.nyu.edu/History%20of%20Television%20page.html

Titov, A. 2022. “Mobile Game Development Process: How Mobile Games Are Created?” Stepico. Mobile Game development process: How Mobile Games Created?

VGChartz. 2023. “Game DB.” Accessed March 1, 2023. Video Game Charts, Game Sales, Top Sellers, Game Data – VGChartz

Wijman, T. 2022. “The Games Market in 2022: The Year in Numbers.” Newzoo. https://newzoo.com/insights/articles/the-games-market-in-2022-the-year-in-numbers

1 Wijman 2022.

2 Roblox 2023a.

3 IMDb 2023.

4 Ceci 2023.

5 IMDb 2023; Ceci 2023.

6 See also IMDb 2023; Ceci 2023; MasterClass 2021; Stephens 2000; Birrell 2022.

7 See VGChartz 2023; Curry 2023; Hosch 2023.

8 VGChartz 2023; Curry 2023.

9 Roblox Corporation 2022.

10 See also Curry 2023; Roblox Corporation 2022; Roblox Corporation 2021; Roblox Corporation 2020b; VGChartz 2023.

11 See also DeGuzman 2021; Celebrity.fm 2023; Narayanan 2019; Narakeet 2022; Rocket Brush Studio 2022; Titov 2022; Roblox Corporation 2020a.

12 See also Jain et al. 2021; Poole et al. 2022; Nichol et al. 2022; Google Cloud 2023.

13 Jain et al. 2021

14 Jain et al. 2021

15 Poole et al. 2022.

16 Jain et al. 2021; Poole et al. 2022; Nichol et al. 2022; Google Cloud 2023.

17 Google Cloud 2023.

18 3D asset generation latency is presented as V100 hours (or minutes) across all three models. See Nichol et al. 2022.

19 Nichol et al. 2022.

20 We calculate the cost of gaming compute by dividing Roblox’s total infrastructure and trust & safety expense by the total hours engaged during the 2022 fiscal year. We then normalize the cost by estimating the infrastructure expense per 1.5 minutes engaged for a uniform comparison against the latency of Point-E (1B). See also Roblox Corporation 2023b.

©2021-2026, ARK Investment Management LLC (“ARK” ® ”ARK Invest”). All content is original and has been researched and produced by ARK unless otherwise stated. No part of ARK’s original content may be reproduced in any form, or referred to in any other publication, without the express written permission of ARK. The content is for informational and educational purposes only and should not be construed as investment advice or an offer or solicitation in respect to any products or services for any persons who are prohibited from receiving such information under the laws applicable to their place of citizenship, domicile or residence.

Certain of the statements contained on this website may be statements of future expectations and other forward-looking statements that are based on ARK’s current views and assumptions, and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in such statements. All content is subject to change without notice. All statements made regarding companies or securities or other financial information on this site or any sites relating to ARK are strictly beliefs and points of view held by ARK or the third party making such statement and are not endorsements by ARK of any company or security or recommendations by ARK to buy, sell or hold any security. The content presented does not constitute investment advice, should not be used as the basis for any investment decision, and does not purport to provide any legal, tax or accounting advice. Please remember that there are inherent risks involved with investing in the markets, and your investments may be worth more or less than your initial investment upon redemption. There is no guarantee that ARK’s objectives will be achieved. Further, there is no assurance that any strategies, methods, sectors, or any investment programs herein were or will prove to be profitable, or that any investment recommendations or decisions we make in the future will be profitable for any investor or client. Professional money management is not suitable for all investors. For full disclosures, please go to our Terms & Conditions page.

The Adviser did not pay a fee to be considered for or granted the awards. The Adviser did not pay any fee to the grantor of the awards for the right to promote the Adviser’s receipt of the awards nor was the Adviser required to be a member of an organization to be eligible for the awards. For full Award Disclosure please go to our Terms & Conditions page. Past performance is not indicative of future performance.

Disclosure:

ARK’s statements are not an endorsement of any company or a recommendation to buy, sell or hold any security. For a list of all purchases and sales made by ARK for client accounts during the past year that could be considered by the SEC as recommendations, click here. It should not be assumed that recommendations made in the future will be profitable or will equal the performance of the securities in this list. For full disclosures, click here.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.