XH4D

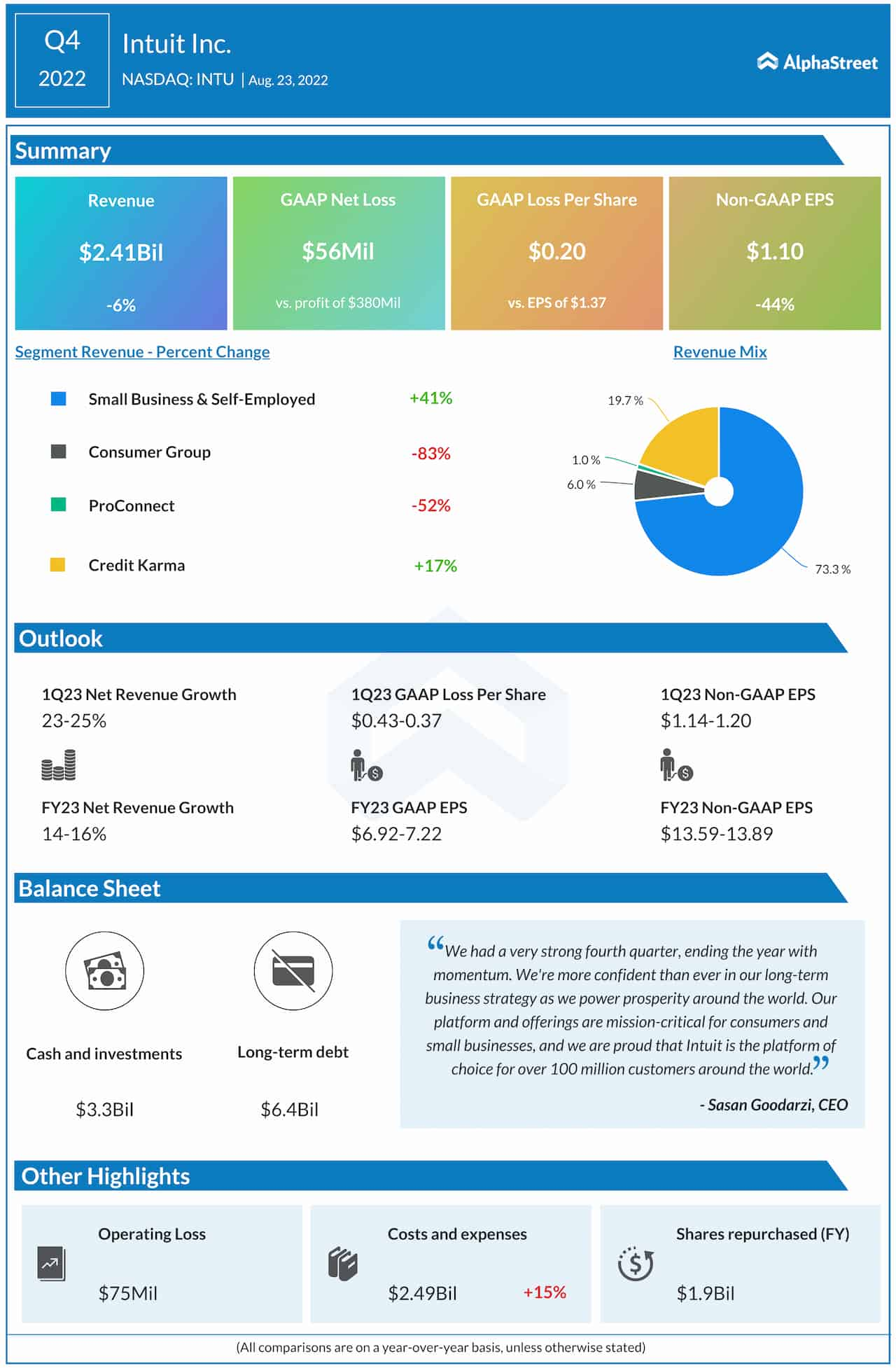

In October, I lined Eve Holding (NYSE:EVEX) with a purchase score. Since then, the inventory value has carried out horribly with a share value decline of over 60%. To me that continues to indicate the dangers on the commercialization path of city air mobility options. On this report, I might be discussing the newest outcomes with a give attention to the dangers and liquidity.

The Dangers And Alternatives Of City Air Mobility

One threat I am seeing with protection of UAM or eVTOL names is that the disruptive expertise is commonly equated to worth creation. This isn’t essentially the case.

In a earlier report, one of many article bullet factors was the next:

The eVTOL improvement is in its early part and it is seemingly that most of the eVTOL designs will not enter the market or create sustained success.

That comment will apply for the foreseeable future. In some methods, city air mobility on the present stage shouldn’t be a lot totally different from biotech or disruptive expertise utilized in commercializing area. There is a disruptive expertise which must be examined completely, and UAM resolution suppliers have to develop their product, check, after which scale up manufacturing. With the numerous UAM gamers lively, there is no doubt that some won’t be able to ship on their prospects and may run out of liquidity runway even earlier than the product is launched.

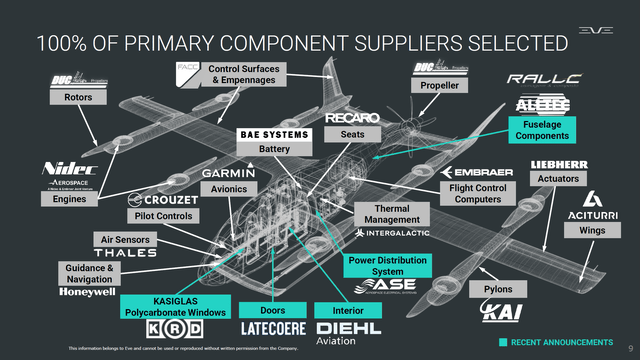

As an increasing number of city air mobility options are heading in direction of a path of commercialization, I imagine the chance of shareholder dilution can also be growing. eVTOLs seemingly have to be produced at excessive portions to make the manufacturing worthwhile and that requires the choice of the suitable suppliers in addition to having the infrastructure to scale up manufacturing considerably. Eve has a bonus in comparison with many different city air mobility builders, since it may faucet into the data and sources of Embraer.

Nonetheless, even earlier than that commercialization part absolutely kicks within the threat of elongated improvement and certification timelines stays which might add monetary strain to the enterprise.

Eve Rolls Out Its eVTOL

Eve Holding

In July, Eve rolled out its first prototype which marked the completion of its prototype airframe meeting. The corporate additionally continued to pick extra suppliers for the fuselage, energy distribution methods, doorways, inside and home windows. With that, the choice of the first part suppliers has been accomplished. So there may be positively progress on the event.

The prototype doesn’t embrace a cockpit and after floor exams, the corporate will carry out hover and flight exams later this yr with the prototype being remotely managed.

Eve Raises Extra Capital

What we’ve been listening to for a really very long time is that the corporate believes it has ample obtainable liquidity to fund its operations via 2025. So, maybe it might need come as a shock that the corporate raised $94 million in capital which diluted shareholders by roughly 7% and one other $1.6 million was raised via a further fairness increase issuing 0.4 million shares. The non-public placements have been dilutive in nature, however as a part of the settlement there was a cancellation of warrants that may have allowed the acquisition of 8.3 million widespread shares. That has now been changed by the issuance of three.3 million widespread shares.

The Q2 2024 professional forma liquidity stood at $340 million and to me that raises some questions. For 2024, a money burn of round $130 million to $170 million is anticipated with the expectation that it is going to be nearer to the decrease finish of the vary. If we might assume $140 million in money burn for 2024 and consider the free money stream of $67.3 million within the first half of the yr, then we get to a year-end stability of $267.3 million. In 2025, the money consumption is anticipated to accentuate as 5 prototypes might be constructed and investments in manufacturing will choose up tempo. So, I might count on the free money stream burn to be materially increased. If we might assume that it’s 50% increased than the anticipated decrease finish of the 2024 money stream burn, we might see free money stream use of round $195 million in 2025 which might carry the year-end stability of 2025 to $72.3 million. What this principally would point out is that the $95.6 million capital increase was a necessity and never a lot including liquidity on a secure buffer. Moreover, trying into 2026 I don’t imagine that that’s going to be the inflection level for Eve’s money burn.

Wanting on the liquidity, I don’t imagine the buffer is as huge as one would assume once we take a look at administration remark and I additionally imagine that moreover liquidity raises are seemingly sooner or later and the one offset could be both elevating capital via issuing debt or milestone funds beginning to stream. Eve expects that conversion of half $14.5 billion pipeline will begin changing into agency orders over the subsequent 12 months and that ought to present some incremental money inflows. Nonetheless, I do imagine that the dilution threat stays. There are also 11.5 million warrants which expire in Might 2027. These warrants could be redeemed within the case the share value of Eve is above $18 for a chronic interval, which at the moment shouldn’t be the case. The general public warrants could be exercised at a value of $11.50. So, the one tangible method for this to be really dilutive is that if the share value snaps again to at the very least $11.50 through which case it is smart for warrant holders to train and at that time I additionally do imagine that increased inventory costs are reflective of a profitable commercialization. Moreover, the corporate has new warrant excellent that may convert to 37.4 million widespread shares if exercised and 14.3 million non-public placement warrants.

In concept, the train of all warrants would increase round $530 million whereas diluting current shareholders by 18%, which is a greater fairness increase than the one the corporate agreed on within the second quarter however exercising these warrants solely is smart if there may be some indication that Eve is heading in the right direction and timeline for commercialization.

Is Eve Holding Inventory A Good Purchase?

Eve Holding

If you’re contemplating to buy inventory of Eve Holding, I imagine you have to be very conscious of the capital necessities and dilution threat. The tangible worth per share at the moment is $0.39. The median price-to-book worth for Eve is 10.33x which would offer a $4.03 value goal, which offers 43.3% upside from present costs which is in extra of the attainable dilution. So, I might mark the inventory a speculative purchase.

Conclusion: Eve Holding Is A Excessive Threat Speculative Purchase

My view on Eve has been unchanged, and that view is that there’s a extremely speculative shopping for alternative with important threat of dilution. That shouldn’t essentially scare traders off, however Eve is an organization that you’d wish to incrementally put money into for a speculative wager on its city air mobility success. The massive query is how a lot shareholder might be diluted earlier than the corporate begins worthwhile manufacturing on its city air mobility autos. That’s a solution no one is aware of, however that commercialization timeline goes to be dictating whether or not finally a speculative purchase will repay or not. I proceed to mark the inventory a purchase, a really speculative one, with the word that the corporate’s liquidity has been much less robust than initially anticipated and I discover a service entry by 2026 extremely optimistic. Maybe the one causes I’m marking this a purchase quite than a maintain is the low cost to the price-to-book and the partnership with Embraer (ERJ), which ought to profit the commercialization path for Eve.