Bloomberg/Bloomberg via Getty Images

Following our recent update on the London Stock Exchange Group and the just-released results, we are back analyzing Euronext (OTCPK:EUXTF). Post Q2, we stated: Patience Pays Off, The Company Is Still A Buy. Our buy rating was supported by:

- Non-volume revenue growth now represents 60% of the company’s total turnover. As a result, Euronext is less dependent on market volatility and trading volume. Still, we positively view the MTS upside on fixed-income trading

- Lower-than-expected costs thanks to higher synergies

- An ongoing deleverage coupled with a tasty DPS

- Ongoing share repurchase combined with a discount to peers. In addition, we positively see the EU regulatory frameworks

Q4 Results

Looking at the Q4 result, we are delighted with our past analysis.

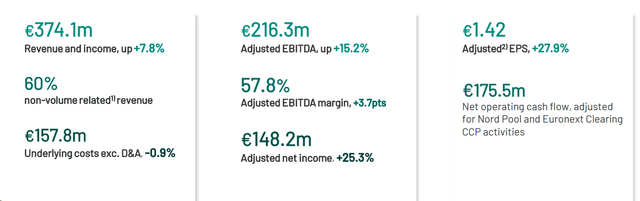

The company delivered a Q4 adjusted EBITDA of €216.3 million, signing a plus 15.1% on a yearly basis. This result was a 3.2% beat compared to the Wall Street consensus. The solid performance was backed by better-than-expected sales and a positive one-off €6.3 million accrual cost release. In detail, the company reached sales of €374.2 million thanks to post-trade sales and Fixed Income higher trading volume. That said, 60% of non-volume related revenue was achieved (Fig 1).

Euronext Q4 results in a Snap

Fig 1

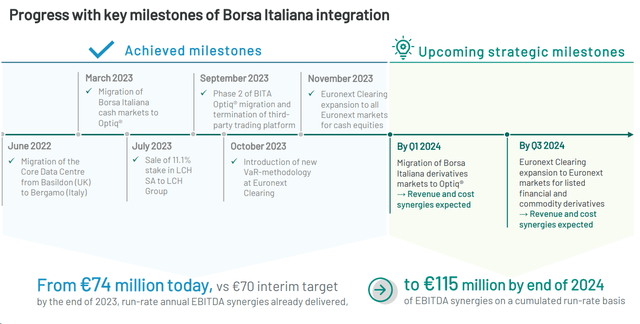

In Q4, Euronext delivered €26 million of annualized EBITDA synergies from the Borsa Italiana acquisition. This led to the total annualized synergy at €74 million, compared to a target of €70 million (Fig 2).

Euronext synergies target

Fig 2

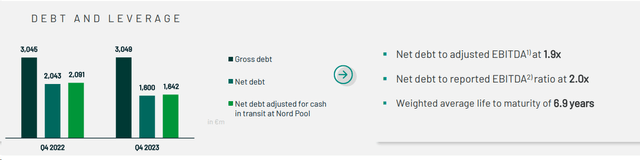

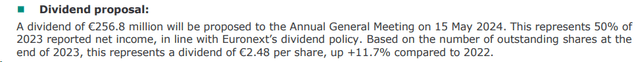

The company’s net debt-to-adjusted EBITDA ratio reached 1.9x, with net debt that fell by 5% to €1.64 billion (Fig 3). In addition, the company increased the dividend per share by 11.7%, 4% higher than consensus (Fig 4).

Euronext debt development

Fig 3

Euronext DPS proposal

Fig 4

Ongoing Upside

Starting with the positive news, the Italian government confirmed the IPO bonus. Italian companies might request a tax credit equal to 50% of the consultancy costs incurred, up to a maximum of €500k. This is a valuable tool for listing new SMEs. More companies in the Stock exchange mean higher revenue for Euronext (for higher trading volume and higher income on non-volume related revenues). This was already reported in our previous publication called: “We Are Still Positive.” In details, we knew that Borsa Italiana was

We are working to increase the admission process efficiency by streamlining bureaucracy, time, and costs.

To add some numbers and look at the Italian market, the IPO market was extremely good. There were 39 admissions, four on the main list, and 36 companies were added to Euronext Growth Milano (EGM). As a comparison, in 2023, the worldwide IPOs were 1,429. This is the lowest number since 2019, minus 16% versus 2022 results. Here at the Lab, we believe similar results could also be achieved in 2024.

More importantly, the EU is in the process of approving the Listing Package.

The proposal seeks to streamline the rules applicable to companies going through a listing process and companies already listed on EU public markets to simplify for them by alleviating their administrative burdens and costs, preserving sufficient transparency, investor protection, and market integrity.

This set of legislative proposals aims to reform the stock market listing rules in the European Union. This is a clear upside for the company. With the new legislation, the European Union markets might attract new issuers and retain those already present. Member States have notable differences, and Euronext might gain market share.

As a major stock exchange, Euronext operates in several European countries and provides a platform for companies to list their shares. Even if we do not anticipate any numbers, the Listing Package could have positive implications for Euronext:

Harmonization and Streamlining: If the EU introduces harmonized rules for listing and disclosure requirements, it could simplify the process for companies seeking to list on Euronext. Streamlined regulations would enhance transparency, reduce administrative burdens, and attract issuers.

Increased Investor Confidence: Stricter regulations often lead to greater investor confidence. If the EU’s Listing Package includes measures to protect investors and ensure accurate information disclosure, Euronext-listed companies may benefit from improved market perception.

Access to Capital: Euronext-listed companies could gain better access to capital markets if the EU’s regulations encourage cross-border listings and facilitate capital raising. A consistent framework across EU member states would promote liquidity and investment opportunities.

Market Competitiveness: Euronext competes with other global exchanges. If the EU’s Listing Package enhances Euronext’s attractiveness by aligning it with international standards, it could strengthen its position as a preferred listing venue.

Changes in Estimates

The company guided for 2024 full-year costs of approximately €625 million compared to the €616 million achieved in 2023, considering the Q4 accrued costs. The company reiterated its 2024 annual synergies. Our previous estimates anticipated sales and EBITDA growth of 3-4% and 5-6%, respectively. Post Q4 results and following the company’s outlook, we now project higher sales to €1.57 billion (from a previous forecast of €1.54 billion) and a lower EBITDA margin. We also report that the company has disclosed an additional €10 million to finance ongoing growth projects. For this reason, we arrive at an adjusted EBITDA of €887 million (from a previous forecast of €920 million). That said, Euronext’s 2024 cost outlook is marginally better than consensus. Therefore, we see a significant upside to consensus earnings. As a reminder, the CEO has a long-established track record of over-delivering and under-promising. We are leaving Euronext’s deleveraging plan unchanged. This is approximately set at €350 million per year. With a lower leverage, in line with our previous expectations, Euronext also has a higher M&A firepower.

Valuation and Risks

Following the above results and leaving our P/E target 15x unchanged, we are raising our valuation from €85 to €90 per share. This is based on an adjusted 2024 EPS of €6. LSEG and Deutsche Boerse AG trades at a P/E of 24x and 19x, respectively. We believe LSEG’s premium valuation is backed by market share gain with Workspace’s opportunity with Microsoft, but we find it hard to justify such a discount with Deutsche Boerse AG.

The company is exposed to several downside risks, and the most relevant is the regulatory framework. Indeed, new regulations could have a material impact on Euronext’s earnings, including intervention in financial transaction taxes and data pricing. On the other hand, regulations could positively impact Euronext, as is the case of the Italian IPO bonus and the EU Listing Package mentioned above. The company faces competitive risks of alternative trading venues (such as Binance and other crypto platforms). In addition, the EU stock exchange faces macroeconomic risk. In detail, a negative macroeconomic shock in Europe could impact the market participants with significantly lower trading volumes.

Conclusion

- Despite the buyback, the company’s debt decreased.

- Euronext increased its DPS and offers a compelling valuation with a resilient business model.

- We see the Italian IPO bonus as a critical advantage to attract new companies to the listing. And there is a favorable EU regulatory framework that could sustain the company’s upside.

- Euronext trades at a depressed valuation compared to its main competitors.

For the above reason, our buy rating is confirmed.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.