Maximilien Dufau

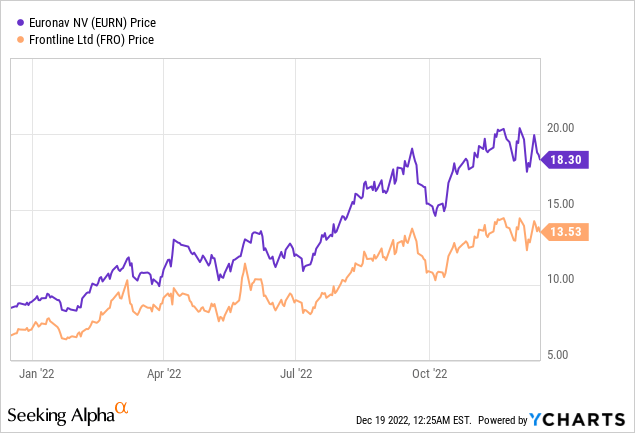

Leading global crude tanker company Euronav (NYSE:EURN) had initially looked set for a tie-up with Frontline (FRO), but the deal could come under significant pressure in the coming months. The roadblock here is major shareholder Saverys Group, which has recently taken its shareholding up to ~25%. Recall that they have been opposed to the deal from the start, citing the need for EURN to transition toward clean energy and decarbonizing the shipping and heavy industry instead of doubling down on crude oil transport. With a merger also dependent on FRO clearing a high 75% acceptance threshold at its upcoming tender offer, a deal seems unlikely at this point. Given FRO’s NAV outperformance relative to EURN in recent months, a no-deal scenario likely entails relative upside for FRO and downside for EURN stock. Net, the current EURN discount to the merger exchange ratio seems justified, in my view.

A Major Roadblock Emerges as the Saverys Group Builds Up its Euronav Stake

Through its holdings in Compagnie Maritime Belge (CMB), the Saverys group has taken its EURN shareholding up to ~25% per a recent 13D filing with the SEC. For context, Euronav was formerly a Compagnie Maritime Belge subsidiary before being spun off in 2004 and subsequently becoming a leading publicly-listed tanker company via organic growth and M&A. Alongside the filing, the group also attached a letter to EURN’s Supervisory Board setting out a detailed case for the termination of the FRO merger. The crux of the issue is that the merger is at odds with the group’s plan to transition the EURN business toward clean energy and the decarbonization of shipping instead of increasing its exposure to the crude oil transport business.

Having initially pushed for a merger between Euronav and the CMB.Tech platform, the Saverys group appears to be changing tack. Per a recent interview, Alexander Saverys “rules out Plan A, which is the merger,” but also sees a merger with Frontline as “mathematically impossible.” He also cited the prospect of combining two major crude tanker companies as “a mess.”

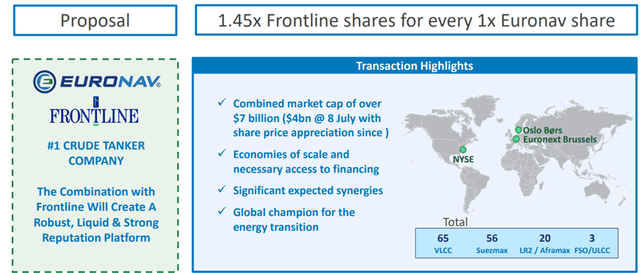

By contrast, the EURN management and Board view are that the EURN/FRO merger is good for shareholders, providing a less value-destructive path forward for the company than the CMB alternative. Per deal terms, FRO will allow EURN CEO Hugo De Stoop to lead the combined entity but with Frontline as the surviving entity, and EURN shareholders will be granted a larger slice of the combined company (per the 1.45x exchange ratio).

On balance, I suspect the proposed FRO combination is likely the more accretive step forward – the economic benefit of a more consolidated crude tanker market (assuming no antitrust blocks) should more than outweigh any execution difficulties with integration of this scale. In contrast, the Saverys’ proposal for EURN to abandon its core business and instead transition into ‘cleantech’ is risky. While a ‘green’ EURN would attract ESG flows, it is perhaps a step too far beyond the company’s competencies and, thus, presents significant execution risk.

Changed Financial Terms Point to a Likely Deal Break

Per the current merger terms, both companies will exchange stock at a 1.45x ratio of FRO shares per EURN share. The exchange mechanism will see FRO acquiring all ~202m of issued and outstanding EURN shares for ~292m FRO shares. On a pro-forma basis, this will result in a EURN/FRO shareholding split of 59%/41% of the merged entity, which will bear the Frontline name.

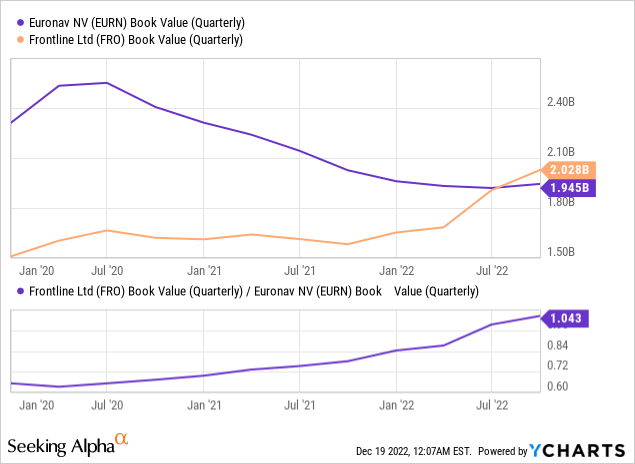

Euronav

While this had been a fair ratio at the time on a NAV-to-NAV basis, the performance differential between both companies means the terms are much less attractive to FRO shareholders. With FRO’s book value at a larger premium to EURN today, a lower exchange ratio would present a fairer deal for FRON shareholders; thus, a renegotiation seems like a plausible outcome from here. Plus, FRO also has a higher-quality and younger fleet – the FRO fleet has an average age of <6 years compared to the EURN fleet age of >8 years. In essence, a merger at current terms would also be dilutive to FRO shareholders on a fleet-on-fleet basis.

Euronav-Frontline Merger Facing a Roadblock

While FRO has shown intent to complete the EURN merger as planned, there is now a real likelihood that the deal falls through. The recently scheduled FRO shareholders meeting on December 20th to re-domicile in the EU (from Bermuda to Cyprus) indicates intent, but major shareholder moves present potential roadblocks ahead. Of note, the largest FRO shareholder, John Fredriksen, has disposed of ~2m Euronav shares in recent weeks; this was followed by Saverys’ stake rising to 25%. Given Saverys has been clear on its stance against the deal, the 75% acceptance threshold could be out of reach.

A deal-break scenario wouldn’t be all bad, in my view. While there are scale benefits from the merger, both companies are also profitable and should do fine as standalone entities. In the meantime, the tanker market looks to be holding up well heading into the winter, more than offsetting any excess capacity headwinds. While EURN trades below the 1.45x deal exchange ratio, the higher likelihood of a no-deal scenario, as well as its NAV outperformance in recent months, means any EURN upside is likely capped for now.