Nastassia Samal

Introduction

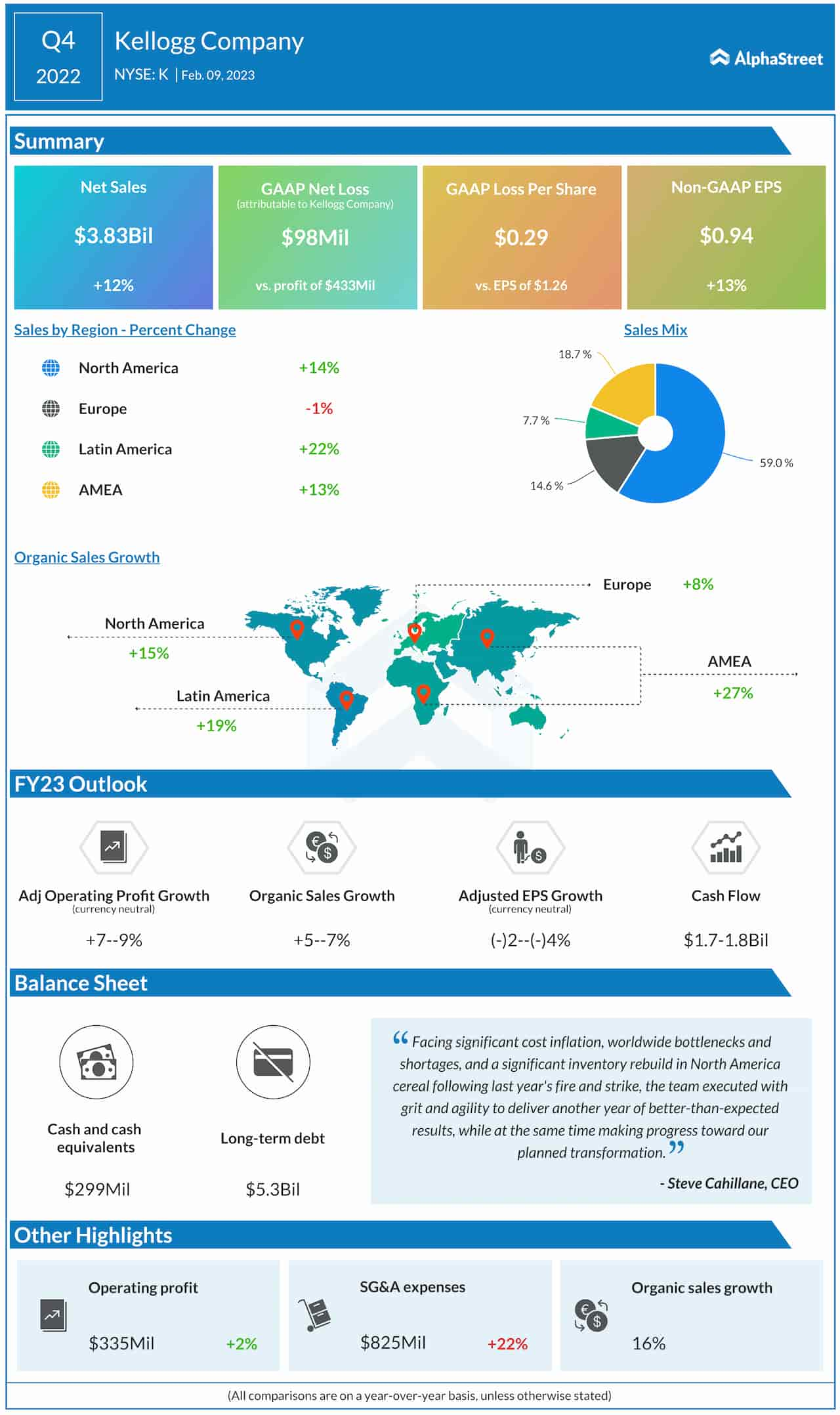

The iShares MSCI Europe Financials ETF (NASDAQ:EUFN) has been on a run recently, with returns over the past year significantly above the ten-year average:

Return overview (iShares website, March 2024)

In this article, I will highlight the ETF’s characteristics and discuss whether the good performance is set to continue.

ETF Overview

You can access all relevant EUFN information on the iShares website here. Despite a focus solely on European financials, under the hood, EUFN is exposed to quite different economies, each with an idiosyncratic economic, monetary and fiscal outlook. Broadly, we can divide EUFN’s exposure into Eurozone countries at about 50.95% of fund assets, the United Kingdom at 22.62%, Switzerland at 14.99%, and Nordic countries outside the Eurozone at 9.13% of fund assets (amounts do not add to 100% due to cash and other assets).

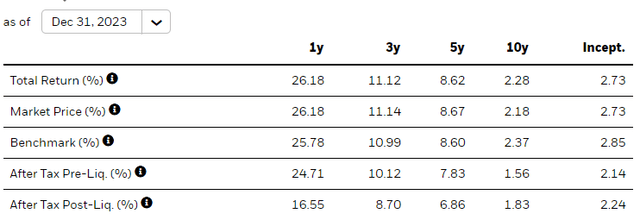

From a sector perspective, Banks comprise 45.49% of fund assets, followed by Insurance at 29.63%, and Financial Services at 24.16%, with cash accounting for the remainder of fund assets:

Sector breakdown (iShares website, March 2024)

Valuation characteristics

On the surface, EUFN is not prohibitively expensive, with a P/E ratio of 8.34 and P/B of 1.06, especially when compared to the iShares S&P 500 Financials Sector UCITS ETF:

| MetricETF | MSCI Europe Financials ETF | S&P 500 Financials ETF |

| P/E | 8.34 | 15.68 |

| P/B | 1.06 | 1.96 |

| Expense ratio | 0.51% | 0.15% |

Source: iShares, March 2024

That said, considering over 45% of EUFN’s exposure is to banks, results in 2023 were likely as good as it gets. Key tailwinds were expanding net interest margins and a benign credit risk environment. Going forward, I expect EUFN’s earnings to grow in the low single digits, largely driven by the remaining Insurance and Financial Services allocation of the portfolio.

With an earnings yield of about 12%, considering the growth outlook and expense ratio of 0.51%, I think investors can reasonably expect a low-double digit return in the years to come, which in itself is not bad, but far from the returns observed over the past year. Over the past three years, EUFN has delivered 11.12% on average, which seems attainable going forward, especially if there is some catch-up relative to the S&P Financials index.

Risks

The main risk looming large on the horizon is the easing monetary policy around the world, with lower central bank rates impacting banks’ replicating portfolios and the returns insurers receive on their short-term investments. The question is not if, but when and how much central banks will loosen monetary policy.

Financial stocks are highly sensitive to the economic cycle. The current background of stock indices hitting record highs, cryptocurrency all-time-highs, and a soft economic landing, without major geopolitical risks escalating, is unlikely to continue indefinitely. Financial stocks are set to be one of the worst affected if the current Goldilocks environment ends.

Last but not least, economic turmoil is associated with extremely accommodative monetary policy. In such periods, rates are set at very low levels, further undermining financial stocks’ profitability. The 2.73% EUFN since inception return shows you what happens to returns once you factor in adverse economic events.

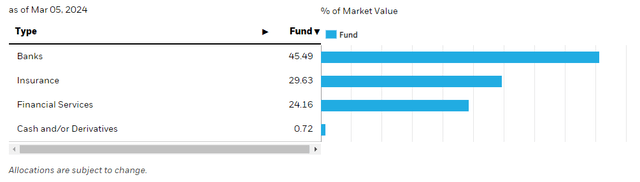

Large Holdings and Concentration

EUFN currently has about 82 holdings, with the top ten names accounting for about 41.43% of ETF assets:

Top Ten Holdings (iShares website, March 2024)

As you can see from the table above, EUFN is a fairly concentrated ETF. Considering that the management fee of 0.48% accounts for the bulk of the ETF’s 0.51% expense ratio, you may well consider buying some of the top holdings individually, largely replicating the ETF’s returns with a lower expense.

Conclusion

The iShares MSCI Europe Financials ETF delivered an exceptional return of 26.18% over the past 12 months. Looking further back, we see that such returns are the exception rather than the norm. Based on the ETF’s current valuation, expense ratio, and economic outlook, I reckon a low double-digit return is certainly achievable, especially considering the discount European financials trade at relative to their S&P 500 peers.

Financial companies operate in a complex regulatory and economic environment. EUFN’s lackluster results of just 2.28% over the past 10 years show that should risks materialize, investors sell first and ask questions later. As such, EUFN is only suitable for investors looking for above-average returns with elevated risk. In investing, the old saying that there is no free lunch holds particularly true.

Thank you for reading.