PM Photographs

Written by Nick Ackerman, co-produced by Stanford Chemist

The Eaton Vance Tax-Managed Purchase-Write Alternatives Fund (NYSE:ETV) is a closed-end fund that invests in an underlying portfolio closely tilted towards the know-how sector. Just like most different tech-heavy funds, that is primarily pushed by the mega-cap tech names which have been driving a lot of the good points within the final couple of years within the broader market.

Nonetheless, since our final replace, there was fairly a little bit of volatility beginning to kick up. The area had been recovering since hitting a correction degree, which was admittedly fairly temporary. That stated, it would not seem that we’re within the clear but, because the mega-cap tech names as soon as once more are sinking. I consider that ETV is an fascinating consideration for a long-term investor portfolio, with the fund’s low cost nonetheless at comparatively enticing ranges.

Moreover, since we final touched on the fund, we even have the newest semi-annual report to provide a have a look at the numbers for the primary half of the yr.

ETV Fundamentals

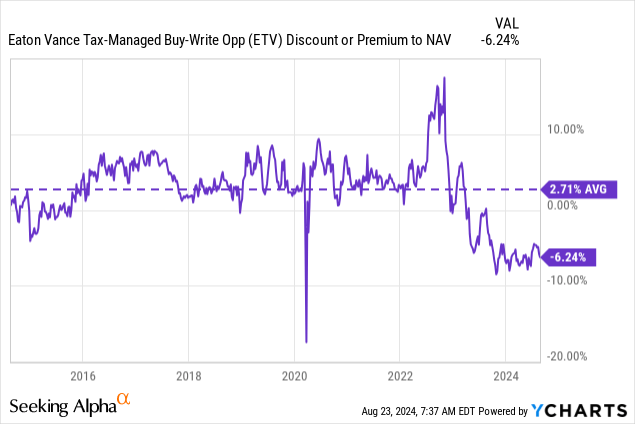

- 1-12 months Z-score: -0.16

- Low cost/Premium: -6.24%

- Distribution Yield: 9.01%

- Expense Ratio: 1.08%

- Leverage: N/A

- Managed Belongings: $1.647 billion

- Construction: Perpetual

ETV’s funding goal is to “present present revenue and good points, with a secondary goal of capital appreciation.” To attain this, the fund will make investments “in a diversified portfolio of widespread shares and writes name choices on a number of U.S. indices on a considerable portion of the worth of its widespread inventory portfolio to hunt to generate present earnings from the choice premium.”

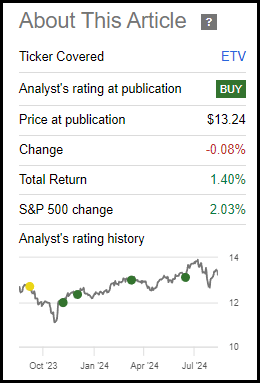

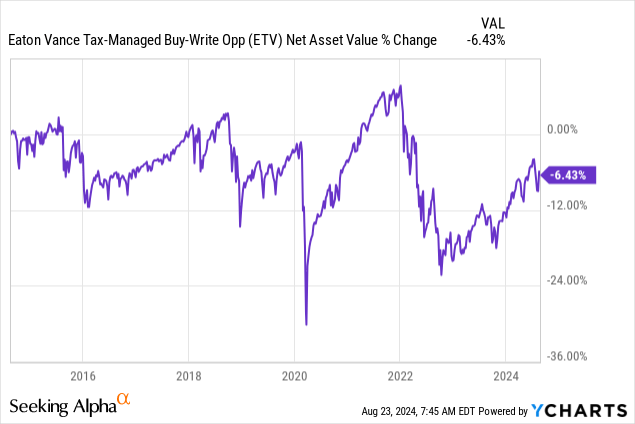

Efficiency – Low cost Nonetheless Interesting

Since our final replace, the market has been unstable, with the Nasdaq hitting correction territory-though it was for a moderately temporary time frame. Provided that ETV appears to benchmark towards the S&P 500 Index and the Nasdaq, that is the place ETV will get a heavy tilt towards the know-how sector weighting that it carries. Due to this fact, whereas the market and Nasdaq have been dropping significantly, ETV was additionally heading decrease.

ETV Efficiency Since Prior Replace (In search of Alpha)

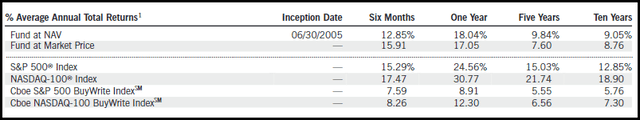

This fund would not simply carry a portfolio that mirrors these indexes, although. As a substitute, it additionally employs an choices writing technique. That’s the reason benchmark comparisons of their studies additionally embrace the CBOE S&P 500 BuyWrite Index and the CBOE NASDAQ-100 BuyWrite Indexes.

Whereas the fund has seen decrease complete annualized returns relative to the straight S&P 500 and Nasdaq Indexes, the fund has outperformed the extra acceptable purchase/write indexes. When utilizing a call-writing choices technique that naturally limits the upside or generates losses throughout robust bull market runs.

This fund targets almost a 100% overwrite, with the newest reality sheet exhibiting it was 96% overwritten. They’re writing at-the-money choices with the proportion written out-of-the-money at 0.40%, which suggests there’s almost no upside earlier than hitting the upside cap. The typical days to expiration are available at 15 days, that means they’re rolling these trades roughly each two weeks.

With a lot of the final over decade now being primarily a powerful climb upward for broader equities, we naturally would count on to see that underperformance. The efficiency breakdown beneath is as of June 30, 2024.

ETV Annualized Efficiency (Eaton Vance)

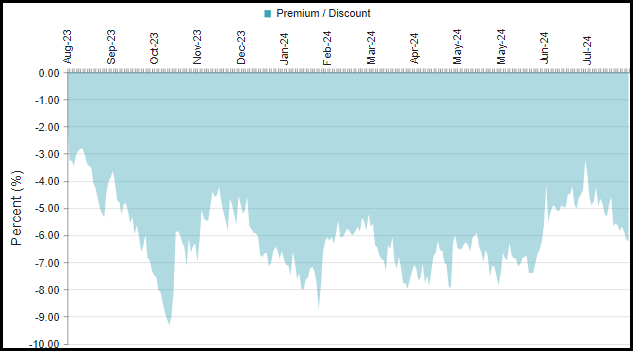

Typically, throughout these extra unstable instances, CEFs will see their reductions/premiums impacted, primarily by seeing reductions widen. That had occurred with ETV, however it’s really buying and selling round the place the low cost was throughout our final replace. This was as a result of the fund’s low cost narrowed materially earlier than the market correction took maintain, which noticed the low cost widen again out.

ETV 1-12 months Low cost Chart (CEFConnect)

Over the long run, ETV has typically traded at a slight premium. That is what makes the present low cost pretty enticing to contemplate.

Ycharts

Distribution – Wanting Wholesome

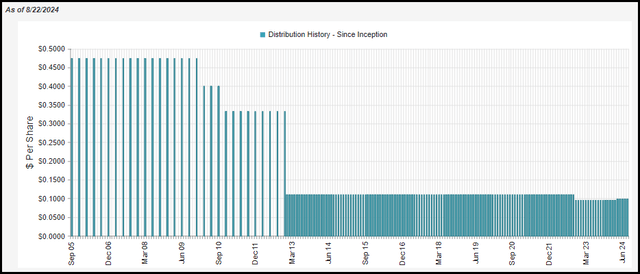

Whereas the low cost is enticing now, the fund’s distribution change was clearly a think about pushing the premium to a reduction. Throughout more often than not the fund was buying and selling at a premium, the distribution was fairly predictable. For a few years, it paid out the identical month-to-month distribution earlier than it was reduce in 2022.

Proper earlier than they reduce, we are able to really see above that the fund began to commerce at a few of the highest premium ranges, which actually made the draw back transfer rather more dramatic than it in any other case would have been. Earlier this yr, they raised the distribution and that hadn’t appeared to materially slender the low cost. A minimum of, it wasn’t an thrilling sufficient transfer to get buyers to begin pushing the fund to a premium as soon as once more.

ETV Distribution Historical past (CEFConnect)

At present, the present distribution price involves 9.01%; because of the low cost right here, the fund’s precise NAV price is a bit decrease at 8.45%. I consider a extra necessary dialogue on this could be for the distribution protection, though-as closed-end funds can actually pay out no matter they’d like so long as NAV would not hit $0.

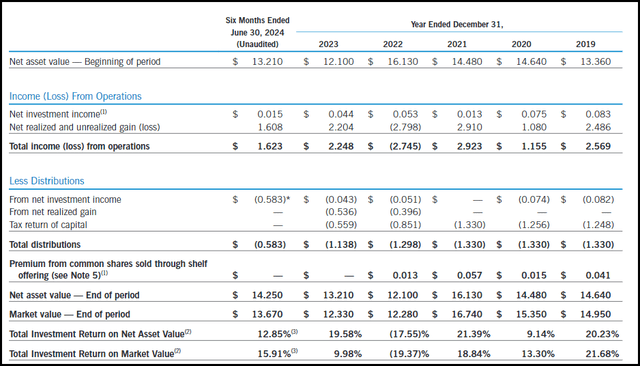

For ETV, like many fairness CEFs, they’ll depend on capital good points to fund their distributions, and that may come from the underlying portfolio or the choice premiums acquired from its index name writing technique. Within the newest report, internet funding revenue per share got here to $0.015-which was really a fabric decline from final yr on a relative foundation, however on an absolute foundation, it was actually solely a small transfer.

ETV Monetary Metrics (Eaton Vance Semi-Annual Report)

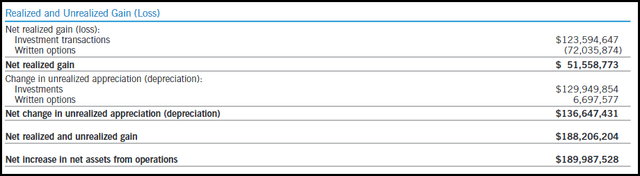

Web realized and unrealized good points have been fairly robust throughout this six-month interval, as we might have suspected, because of a very robust first half of the yr for the market as effectively. As we regularly see throughout robust intervals of broader market efficiency, ETV’s possibility writing technique really generated losses.

ETV Realized/Unrealized Good points/Losses (Eaton Vance)

It is because the fund writes calls towards indexes, and they’re cash-settled. When the indexes are rallying, which means losses are being created, and to shut out the commerce, they should pay greater than they really acquired on the preliminary premium. An index cannot be owned instantly, however given the underlying portfolio goes to reflect the indexes, they’re just about not directly ‘coated.’ That is why we see that the underlying portfolio noticed important good points, which they realized a good portion, in addition to left a great portion unrealized.

With all this being stated, the very best barometer for measuring protection is watching the NAV per share over time.

NAV may have pure gyrations, which shall be excessive typically as a result of that is merely what you’re getting once you spend money on equities. So the longer the time frame, the higher, the place I might say wanting not less than a yr at a time is smart. For a greater broader overview, here’s a have a look at the NAV per share over the past decade.

Ycharts

We get to see a transparent illustration of simply how unstable the fund may be, but in addition that there was some slippage technically in protection because the NAV declined. Within the grand scheme of issues, this slippage was comparatively small for a decade interval.

Additional, wanting ahead extra can be what one may be capable of count on by way of complete returns. Because it stands, from this level transferring ahead, ETV must earn the 8.45% NAV price plus the expense ratio of 1.08%. If they will obtain the ~9.5% required, then the distribution may be sustained. Whereas that’s fairly a excessive hurdle to clear, particularly after already hitting common market highs this yr, it would not appear an unimaginable process. That is why I consider that presently the ETV distribution is wanting fairly wholesome.

In our earlier piece, we mentioned in-depth the distribution tax classifications. Specifically, we centered on the return of capital distributions, which is a optimistic for the fund.

ETV’s Portfolio

By way of the fund’s portfolio, we by no means actually have an excessive amount of to replace on this entrance. Within the first half of the yr, the fund’s turnover price got here to solely 2%. That places it on tempo to be beneath final yr’s already low 8%. The very best turnover price the fund had was in 2022, with a 19% turnover price, and that was simply over double the prior two years when turnover got here in at 9% in every of 2021 and 2020.

Total, that is why there actually is not an excessive amount of to replace on; the energetic a part of the technique they make use of is the choices technique that’s extra energetic for this fund, not shopping for and promoting the underlying investments.

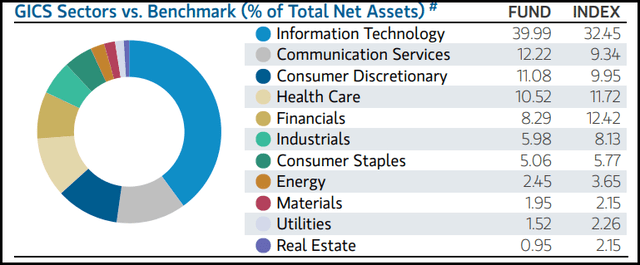

When wanting on the sector breakdown, the fund’s info know-how and communication providers allocation is definitely larger than the benchmark.

ETV Sector Allocation (Eaton Vance)

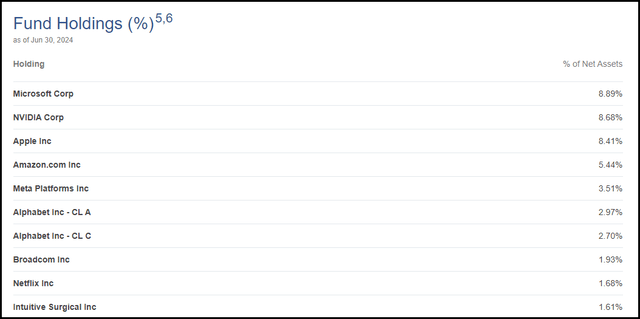

Although there won’t be many modifications within the prime ten holdings between updates, it’s all the time price noting that this fund is sort of concentrated, with the highest ten accounting for almost 46% of the fund’s holdings. A complete of 40.6% is allotted to the Tremendous Six names, that are all of the fund’s prime holdings-which contains each courses of Alphabet (GOOG)(GOOGL) holdings.

ETV Prime Ten Holdings (Eaton Vance)

This makes ETV present extra focus relative to one thing just like the SPDR S&P 500 ETF (SPY) however is definitely much less concentrated than Invesco QQQ ETF (QQQ). Nonetheless, that is precisely the place we might count on the fund, proper within the center because it incorporates a mix of those two benchmarks into its technique.

Conclusion

ETV is a tech-heavy centered CEF that gives a horny distribution price paid month-to-month to buyers. The fund will rely considerably on capital good points to fund its distribution, and the present payout price would not look too elevated to any excessive degree. That stated, with the broader market hitting up towards new all-time highs as soon as again-after a moderately short-lived interval of volatility-there might be some cause to provide pause earlier than getting too aggressive.

Alternatively, I consider that given the fund’s present low cost and optimism for equities over the long run, it may well nonetheless be acceptable for a long-term centered revenue investor. That is the place using a extra cautious method by dollar-cost averaging into or rising one’s place can be extra acceptable, moderately than getting too aggressive and going all in at the moment.