cofotoisme/E+ by way of Getty Photos

Funding Thesis

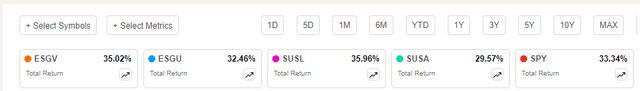

I final reviewed the Vanguard ESG U.S. Inventory ETF (BATS:ESGV) on April 3, 2023, after I really useful that ESG traders keep away from it and select the basically stronger iShares ESG MSCI USA Leaders ETF (SUSL). Since that article was revealed, ESGL has lagged behind SUSL by 0.94%, nevertheless it has outperformed different friends just like the iShares ESG Conscious MSCI USA ETF (ESGU) and the iShares MSCI USA ESG Choose ETF (SUSA).

Looking for Alpha

These outcomes had been higher than I anticipated, and after re-evaluating, I consider ESGV is now the higher decide over SUSL due to its higher diversification, a function I anticipate to be useful because the market broadens. Under, I will evaluation these screens and spotlight the highest 25 firms ESGV excludes. I will even consider efficiency and basically analyze the 5 funds listed above, revealing which of them have the best development potential and which of them present the perfect worth. I hope you benefit from the learn.

ESGV Overview

Technique and High Ten Holdings

ESGV tracks the FTSE US All Cap Selection Index and seeks to supply social traders with whole market publicity by following an exclusions-based method primarily based on an organization’s merchandise and conduct. Particularly:

- Non-renewable power (fossil gas and nuclear energy).

- Vice merchandise (grownup leisure, alcohol, playing, tobacco).

- Weapons (chemical and organic, cluster munitions, anti-personnel landmines, nuclear and traditional navy weapons, civilian firearms).

- Controversies (primarily based on the UN World Compact Rules).

- Variety rules.

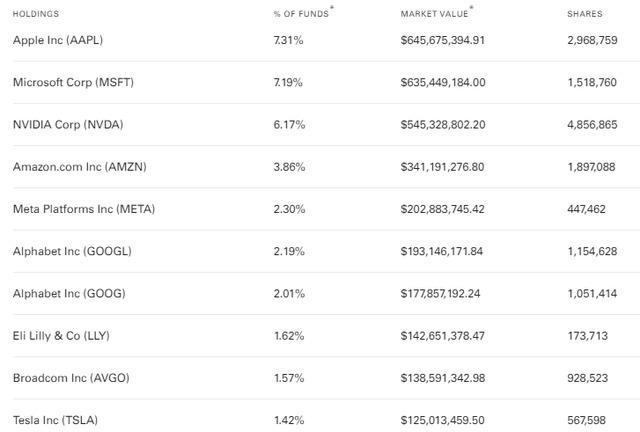

The Index is market-cap-weighted, so many exclusions will not have a sensible affect. As an instance, ESGV’s high 10 holdings account for 35.64% of the portfolio in comparison with 35.78% for SPY. It additionally holds all of the Magnificent Seven shares (Apple Inc. (AAPL), Microsoft Company (MSFT), NVIDIA Company (NVDA), Amazon.com, Inc. (AMZN), Meta Platforms, Inc. (META), Alphabet Inc. (GOOG) (GOOGL), Tesla, Inc (TSLA)).

Vanguard

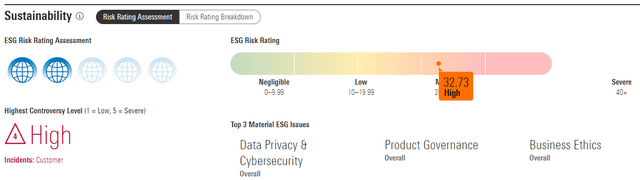

Whereas these shares do not fall into the Index’s exclusions classes, that does not imply they’re essentially ESG-friendly. For instance, Morningstar has assigned Meta Platforms, Inc. (META) a excessive 32.73 ESG threat ranking, noting “Product Governance” as a fabric problem. Amazon’s 29.32 rating will not be significantly better.

Morningstar

These inclusions are why traders should analysis the ETF’s underlying technique quite than counting on its title. Whereas the “Vanguard ESG U.S. Inventory ETF” seeks to enchantment to ESG traders, it is nonetheless primarily based on a algorithm that will not be complete sufficient for you.

ESGV Key Exclusions and Sector Exposures

ESGV excludes 115 S&P 500 Index firms with weights totaling 16.55%, indicating about 83-84% overlap by weight with SPY. I’ve listed the highest 25 under, which whole 10.22%.

- Berkshire Hathaway Inc. (BRK.B): 1.73% (Financials).

- Exxon Mobil Company (XOM): 1.16% (Power).

- Johnson & Johnson (JNJ): 0.85% (Healthcare).

- Walmart Inc. (WMT): 0.66% (Client Staples).

- Chevron Company (CVX): 0.60% (Power).

- Wells Fargo & Firm (WFC): 0.46% (Financials).

- Basic Electrical Firm (GE): 0.40% (Industrials).

- Worldwide Enterprise Machines Company (IBM): 0.39% (Know-how).

- Philip Morris Worldwide Inc. (PM): 0.39% (Client Staples).

- NextEra Power, Inc. (NEE): 0.33% (Utilities).

- RTX Company (RTX): 0.33% (Industrials).

- Honeywell Worldwide Inc. (HON): 0.29% (Industrials).

- ConocoPhillips (COP): 0.29% (Power).

- Eaton Company plc (ETN): 0.26% (Industrials).

- Lockheed Martin Company (LMT): 0.25% (Industrials).

- Analog Gadgets, Inc. (ADI): 0.24% (Know-how).

- The Boeing Firm (BA): 0.23% (Industrials).

- The Southern Firm (SO): 0.20% (Utilities).

- Altria Group, Inc. (MO): 0.19% (Client Staples).

- Duke Power Company (DUK): 0.18% (Utilities).

- KKR & Co. Inc. (KKR): 0.17% (Financials).

- Amphenol Company (APH): 0.16% (Know-how).

- EOG Sources, Inc. (EOG): 0.16% (Power).

- Parker-Hannifin Company (PH): 0.15% (Industrials).

- Schlumberger Restricted (SLB): 0.15% (Power).

The Index excludes a number of Power and Industrials shares for his or her publicity to fossil fuels and weapons. Nevertheless, essentially the most impactful exclusion is Berkshire Hathaway, which has a decrease ESG threat ranking than Meta Platforms and Amazon, doubtless as a result of it holds Power shares like Chevron Company (CVX) and Occidental Petroleum Company (OXY). As well as, the Index excludes Healthcare shares like Johnson & Johnson (JNJ), presumably on account of controversies associated to its talc-based child powder merchandise.

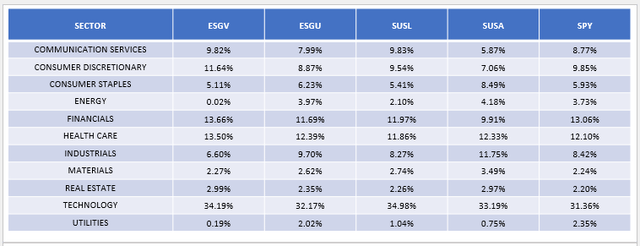

Power and Industrials are the 2 sectors most impacted, with allocations of about 2-4% much less every in comparison with SPY. ESGV additionally underweights Utilities, excluding all S&P 500 Index shares besides Exelon Company (EXC) and American Water Works Firm, Inc. (AWK). The beneficiaries are primarily shares within the Know-how sector, giving ESGV a barely increased development profile.

The Sunday Investor

ESGV Evaluation

Efficiency Abstract

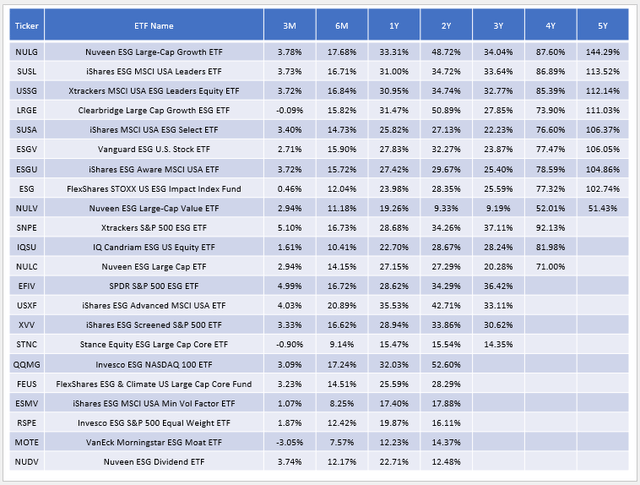

ESGV is one among a handful of large-cap ETFs with no less than a five-year monitor document. The next desk highlights its 106.05% whole return for the 5 years between July 2019 and June 2024, which ranks #6 on this pattern. SUSL and SUSA are barely forward at 113.52% and 106.37%, whereas the Nuveen ESG Massive-Cap Development ETF (NULG) is method forward at 144.29%.

The Sunday Investor

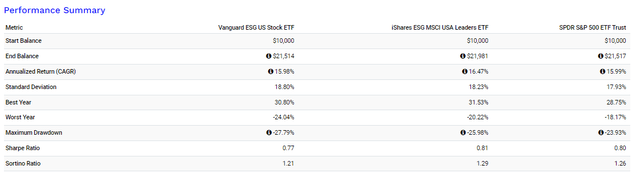

During the last three years, ESGV’s 23.87% whole return ranks #12/16, whereas its 27.83% one-year return ranks #10/22. These outcomes are strong however not distinctive. Since June 2019, ESGV was additionally extra unstable, leading to worse risk-adjusted returns (Sharpe and Sortino Ratios) in comparison with SUSL and SPY.

Portfolio Visualizer

ESGV Basic Evaluation

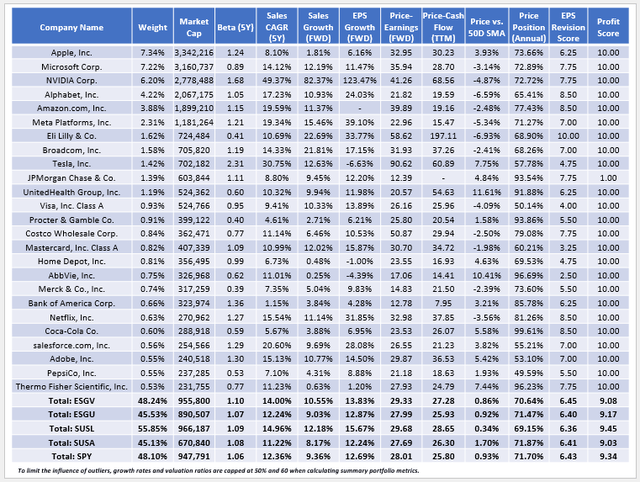

Since previous efficiency will not be indicative of future returns, it is value evaluating ESGV on the elementary degree, too. The next desk highlights chosen elementary metrics for ESGV’s high 25 holdings, totaling 48.24%. On the backside are abstract metrics for ESGU, SUSL, SUSA, and SPY.

The Sunday Investor

ESGV excludes 115 S&P 500 Index shares, however its 48.24% focus in its high 25 holdings stays the identical as SPY. Successfully, practically one thousand further small- and mid-cap shares (12.24% by weight) function an offset, which can show useful in comparison with SUSL, which has 11.77% and 11.19% allotted to Microsoft Company (MSFT) and NVIDIA Company (NVDA). It is powerful to say which Magnificent Seven shares will outperform transferring ahead, however Apple Inc. (AAPL) is the one one buying and selling above its 50-day transferring common value (+3.94%). Nvidia is 4.87% under its 50-day transferring common value however nonetheless up 128.30% YTD. When you consider the present market broadening will proceed, limiting publicity to this inventory is prudent, and that is one thing ESGV does higher than SUSL.

On valuation, ESGV trades at 29.33x ahead earnings (23.29x harmonic common), which is a couple of level greater than SPY however affordable given its increased development profile. SUSL provides extra one-year estimated earnings development (15.67% vs. 13.83%), primarily on account of Nvidia. Neither of those ETFs are clear winners basically, however SUSA has outperformed ESGV when markets declined. So it might be a barely higher defensive decide.

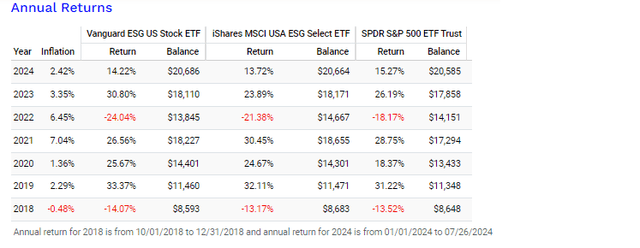

Portfolio Visualizer

As proven, SUSA beat by about 3% in 2022 but in addition confirmed its potential to outperform in 2021 (30.45% vs. 26.56%). The weird dominance of Magnificent Seven shares has made short-term efficiency charts troublesome to interpret, because it actually comes right down to how a lot publicity an ETF needed to these shares and whether or not that was the results of a superior technique or simply luck. All these funds are related, and barring any substantial returns of a inventory like Nvidia, they need to ship related outcomes transferring ahead.

Funding Suggestion

ESGV is a fairly well-diversified fund holding roughly 1,400 U.S. shares from all measurement segments. It follows product screens that eradicate firms within the fossil fuels, vice merchandise, and weapons industries. Nevertheless, its conduct screens associated to “controversies” are generally inconsistent with different ESG ranking techniques, so I doubt ESGV will align completely along with your values. Nonetheless, it might be a step in the appropriate course.

I most popular SUSL final yr, however its allocation to Nvidia has elevated by 7.40%, and it is prudent to give attention to diversification because the market broadens. Due to this fact, ESGV is a strong alternative, and I anticipate it to ship returns just like these of different whole market funds transferring ahead. Thanks for studying, and I sit up for your feedback under.