Hispanolistic

Dear readers/followers,

I’ve recently covered a number of residential REITs that are on my watchlist, these include AvalonBay (AVB), Essex Property (ESS), Camden Property (CPT), BSR REIT (HOM.U:CA) and Mid-America Apartment Communities (MAA). Today I found a new REIT which shares a lot of characteristics with the ones above. After analyzing it, I decided to add it to my watchlist. In this article I want to present my analysis so that you can decide whether to add it to yours too.

Overview

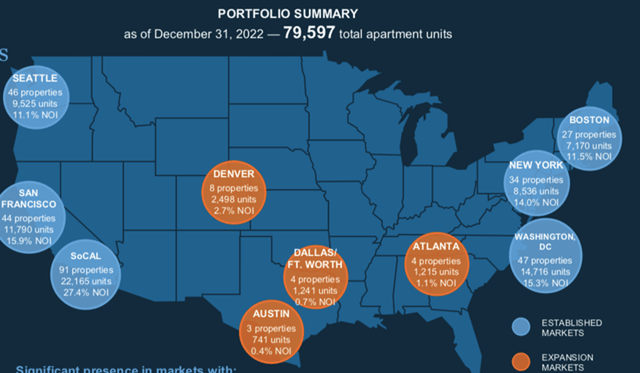

Equity Residential (NYSE:EQR) is an apartment REIT which owns and operates 308 communities with almost 80,000 apartments, primarily located on both coast of the US. Currently 95% of NOI is generated in established legacy markets on both coasts with the remainder in higher growth markets such as Texas, Georgia and Colorado. The company aims to expand their exposure to these growing markets to 20% of total NOI. The geographical exposure as well as the plans to expand to the Sunbelt region make this REIT very similar to AvalonBay, which I covered in my recent article. That article discusses all the reasons why investing in legacy markets could deliver higher returns than the overcrowded Sunbelt market so I encourage you to check it out to get a feel for the market. Here I will only focus on information relevant to EQR so that we can compare it to AvalonBay and decide if it’s worth buying.

EQR Investor Presentation

Financials

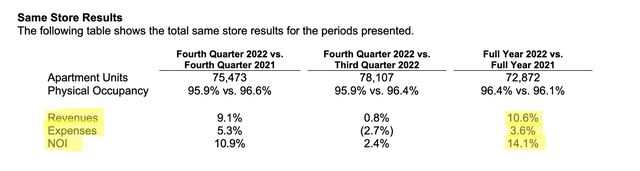

EQR’s 2022 results were pretty good as normalized FFO increased by 17.7% YoY to $3.52 per share driven by a 10.6% YoY increase in same store revenue. When revenues increase I like to check if expenses increase by the same percentage or ideally a lower one which indeed was the case for EQR as same store expenses increased by only 3.6% YoY.

EQR Financial Report

For 2023 management expects stable occupancy and slower growth of around 4.5-6% resulting in normalized FFO of $3.75 per share. For reference AvalonBay expects their FFO to grow by 6% per year.

With regards to changes in their portfolio, 2022 was a calm year for Equity Residential. They only acquired one small community with 172 units and sold three communities with 945 units. The acquisition cap rate and disposition yield stood at 3.4% and 3.5%, respectively which is below the 4% cap rate that AvalonBay got when selling their properties in 2022. The company also has an active development division, just like AVB, which generates additional value for shareholders because it allows the company to get properties at a significantly higher cap rate compared to buying on the market.

EQR doesn’t provide expected rental revenue for their new developments, so I calculated it using the weighted average rental rate on the whole portfolio of $2,956 per month and assuming NOI margin of 68% (in line with the existing portfolio). With 3,189 units under construction and total development costs of $1.4 Billion, the resulting yield on their new developments is 5.5%. This is slightly less than AvalonBay’s 5.8% but still great compared to the price that the company paid for their acquisitions in 2022.

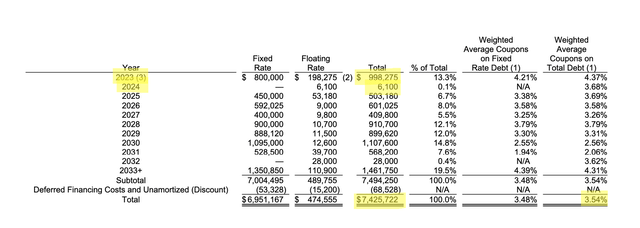

With regards to their balance sheet, Equity Residential is A- rated and has about $7.4 billion in debt, the vast majority of which is fixed rate. Their weighted average interest rate is 3.5% which is in line with AVB and nicely below 10-year treasury yields. The company has a significant debt maturity of almost a billion which it will have to refinance this year. This debt currently has an interest rate of 4.37% which is likely to increase by at least 1% when the company refinances. This will result in about a $10 Million increase in interest expense which I don’t think management included in their normalized FFO forecast for 2023. I calculate that the impact of this will be roughly a $0.03 per share decrease in FFO which is not a deal breaker by any means. The company also has substantial liquidity available through its line of credit.

EQR Financial Report

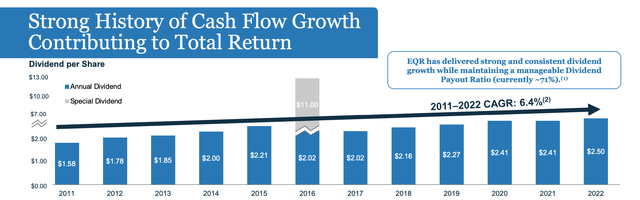

The company has a long history of returning wealth to shareholders through growing dividends. Currently the stock yields a solid 4.0% and has a payout ratio of 71%. The dividend has historically grown at a CAGR of 6.4%. Going forward I expect that it will continue to grow, likely at a rate similar to FFO growth, so 4-6% for the next few years.

EQR Investor Presentation

Valuation

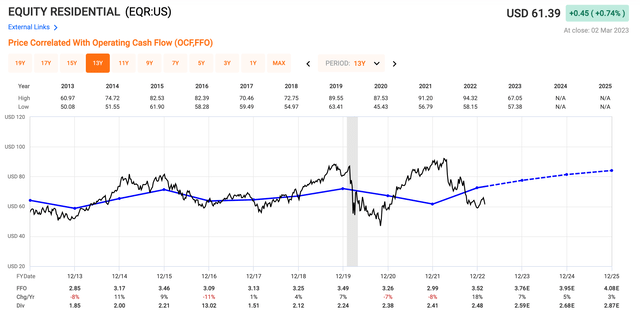

Currently the stock trades at a P/FFO multiple of 17.2x, compared to its long-term historical average of 20.6x. That’s a 20% upside if the stock price normalizes and returns to the average multiple.

Fast graphs

Relative to peers EQR trades on par with AVB and at a discount to MAA. This discount is a result of MAA’s exposure to the Sunbelt which has been preferred by the market. As such Equity Residential is trading fairly compared to peers and especially compared to AvalonBay to which it’s very similar.

| REIT | P/FFO |

| EQR | 17.2x |

| AVB | 17.2x |

| MAA | 18.7x |

If management can deliver on their FFO growth forecast, FFO could reach $4.13 per share by 2025. This would imply a PT for EQR of $85 per share.

With an annual NOI of $1.7 Billion the stock is trading at an implied cap rate of 5.5%, which once again is in line with AvalonBay and other major residential REITs. It’s worth pointing out that the 5.5% cap rate is significantly above the cap rate at which EQR managed to sell one of their properties in 2022 and on par with the yield that the company achieves on their new developments. Once again, this implies that we are buying these apartments for the price it costs to build them and that’s a great deal!

So with that said, what can we reasonably expect from EQR going forward?

- 4% dividend yield (growing at 4-6% per year)

- 5% FFO growth for the next two to three years

- 6.3% annual return from multiple expansion as the company returns to 20.6x FFO

- total return of 15.3% per year

Remember how I generate alpha:

- start with a thesis why a given industry/sector should outperform

- stay overweight in those sectors for as long as the thesis is valid

- look for companies with sound fundamentals that are either undervalued or fairly valued with exceptional growth prospects

- if a company becomes overvalued, trim the position and rotate into another stock/sector that is still undervalued

- if a company becomes increasingly undervalued and the thesis is still valid, add to the position

- generate alpha and repeat

My total return then comes from the dividend yield, EPS growth, and multiple expansion as the valuation normalizes over time. I always target a total return in excess of market returns (>8%) to generate alpha.

What things do I look for when selecting individual stocks to buy?

- strong and safe fundamentals

- good management teams with a track record of caring about shareholders

- healthy EPS growth

- well-covered dividend

- discount relative to peers and/or historical fair multiples

- other catalysts.

Verdict

I started writing this article with the understanding that Equity Residential is somewhat similar to AvalonBay, especially in their geographical exposure. After doing a deep dive into the company’s financial, the similarity is almost spooky. Not only are the two companies equally big and have identical geographical exposures. They also trade at exactly the same multiples in terms of P/FFO and implied cap rates and have nearly identical growth prospects.

In summary, EQR is just as good as AvalonBay and I rate it as a “BUY” here at $61 per share with a PT of $85 per share. Personally I will not be adding the stock to my portfolio, because it is too similar to AVB which I already hold. Exposure to both doesn’t make sense in my opinion so pick one and roll with it.