EQT Exeter has bought the primary part of The Hub at London Groveport, an industrial park within the Columbus suburb of Lockbourne, Ohio, in addition to a 6.7-acre trailer parking zone, in Higher Columbus, Ohio. A three way partnership between Xebec and Heitman bought the belongings with help from JLL.

The Hub’s Section One contains 1,590,495 sq. ft throughout 4 industrial buildings that debuted in 2021. Two extra amenities are anticipated to return on-line throughout Section Two.

The portfolio features a cross-dock facility measuring roughly 1 million sq. ft and three rear-load properties totaling 531,495 sq. ft.

All 4 buildings have 32-foot clear heights and a complete of 277 dock-high doorways and 10 grade-level doorways, whereas truck courts’ depth ranges between 60 and 130 ft. The portfolio was 91 p.c leased on the time of sale, Amazon being one of many two tenants on the roster.

READ ALSO: Industrial Deal Quantity Down, Costs Excessive

Carrying the addresses 6201 and 6322 Collings Drive, in addition to 1260 and 1302 London Groveport Street, The Hub is 10 miles southeast of downtown Columbus. Rickenbacker Worldwide Airport—one of many world’s largest cargo-dedicated airports, dealing with month-to-month greater than 30 million kilos—operates 3 miles away.

The JLL staff representing the vendor included Senior Managing Director John Huguenard, President Jody Thornton, Managing Director Ed Halaburt and Director William McCormack.

EQT Exeter expands close to airports

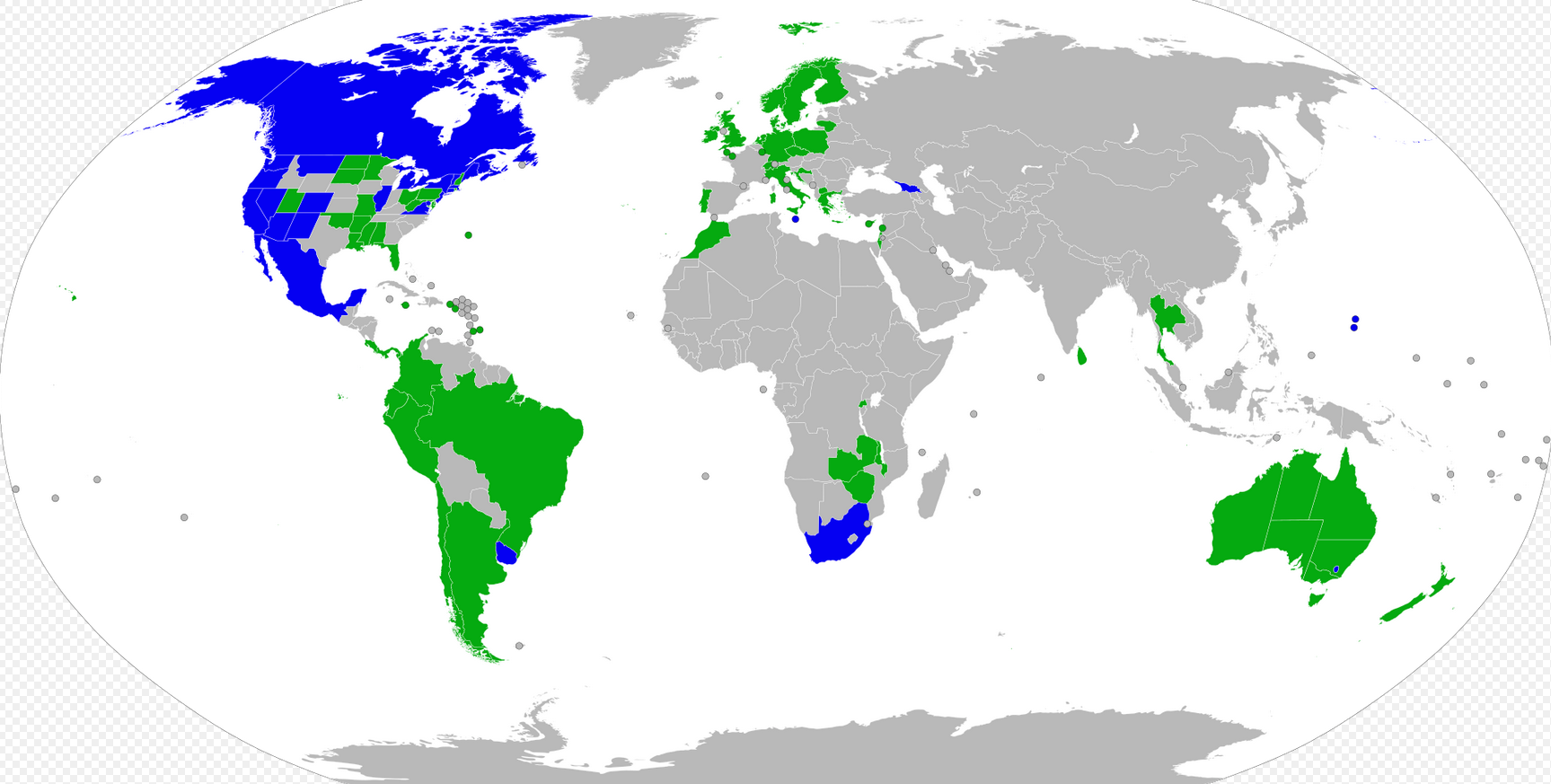

As of October, EQT Exeter had greater than $30 billion in world fairness below administration. Throughout the globe, the corporate owns and operates north of two,000 belongings spanning greater than 375 million sq. ft—and it retains increasing its industrial portfolio.

Simply this week, EQT Exeter paid $143.2 million in an all-cash transaction for the Phoenix Gateway Portfolio. Hyperlink Logistics bought the six industrial buildings encompassing 860,200 sq. ft, additionally situated in an airport submarket.

Regardless of sizable pipeline, Columbus’ industrial emptiness stays steady

The commercial funding quantity in Higher Columbus reached $571 million year-to-date as of August, based on a CommercialEdge report. Belongings traded for $82 per sq. foot, under the nationwide common of $132 per sq. foot.

In one of many metro’s bigger transactions W.P. Carey acquired Rickenbacker Change at Industrial Level’s Constructing 2, a 1.2 million-square-foot speculative industrial facility. VanTrust Actual Property bought the asset for $94.1 million.

Higher Columbus’ emptiness charge clocked in at 4.6 p.c in August, the report goes on to point out. The Discovery Metropolis had the third-lowest charge within the U.S., overshadowed solely by Charlotte, N.C. (4.0 p.c), and Bridgeport, Conn. (4.2 p.c).

One consider Higher Columbus’ rise in emptiness might be attributed to its industrial pipeline. As of August, the metro had 8.7 million sq. ft of commercial area underway—representing 2.8 p.c of inventory, forward of the nationwide common of 1.9 p.c, the identical supply reveals.