omersukrugoksu

The iShares MSCI Poland Capped ETF (NYSEARCA:EPOL) might seem a benign approach to put money into a developed japanese European financial system, however ETF buyers have to take care. Massive components of the portfolio are uncovered to authorized dangers, and there’s a respectable threat associated to refinery product margins related to additional macroeconomic softening. That is in all probability not the perfect approach to get publicity in japanese Europe, and is not actually the profile that ETF buyers could be keen on, we might assume.

Breaking Down EPOL

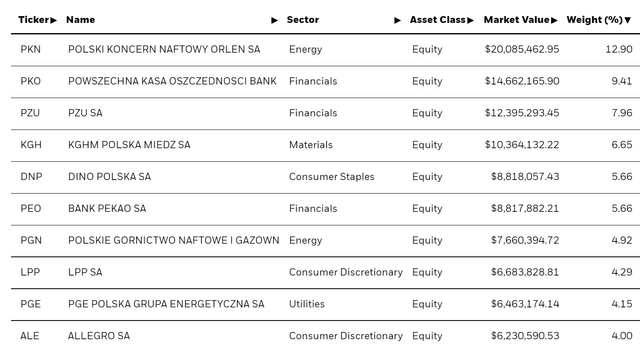

The primary 20% of the allocations already present a lot dialogue.

EPOL Holdings (iShares.com)

The primary is ORLEN (OTC:PSKOF), which is primarily a refinery. Whereas refiners are in a structurally respectable place, we do acknowledge that the sector would possibly face some volatility associated to macro. Being a world market, oil is already being affected by the scenario with China in APAC, and run-cuts are occurring at refineries as margins there fall. Whereas regionality issues a good bit for refiners, particularly now that prime logistic prices have fragmented markets a bit, petrochem might see a flip. Sure, concurrently falling crude is a pleasant backstop however macro, the place we might be prepared for unfavorable company developments quickly, is likely to be the subsequent leg of margin and quantity decline for the corporate.

There’s not an excessive amount of flawed with ORLEN, apart from the potential for some volatility. The larger issues include the financials. PKO (OTCPK:PSZKY), Poland’s largest lender with 80% retail enterprise. The problems going through a number of polish retail banks focuses on the usage of Wibor to cost loans, the place a authorized case is being introduced towards them on the premise that because of illiquidity in long-term interbank mortgage markets the banks are overcharging retail debtors on their cash. This has turn out to be extra poignant because of a very troublesome inflationary stress on Polish households and an aggressive charge mountaineering coverage coming. Additionally, as Polish banks, very similar to elsewhere, are nonetheless not elevating financial savings charges and creating fairly sturdy spreads. With numerous financials in EPOL, the potential enlargement of this authorized publicity is one thing buyers ought to have in mind.

Conclusions

Whether or not significantly seemingly or not, these authorized dangers is likely to be some that ETF buyers wish to keep away from. Nonetheless, we should always level out that there’s some reward for it. The ETF has a reasonably large earnings yield of round 18% because of the extremely compressed PEs within the portfolio. That is partly because of a quite heavy monetary publicity, the place retail banks typically commerce fairly cheaply taking ING (ING) for example, and likewise the quite idiosyncratic dangers that is likely to be confronted by Polish banks over this lawsuit. Nonetheless, this isn’t our favourite approach to get publicity to Poland. We might flag Asseco Poland (OTCPK:ASOZF), a quite low a number of, excessive progress tech consulting and software program holding firm with yield round 4% that follows healthily its double digit income progress.

Whereas we do not usually do macroeconomic opinions, we do sometimes on our market service right here on Searching for Alpha, The Worth Lab. We deal with long-only worth concepts, the place we attempt to discover worldwide mispriced equities and goal a portfolio yield of about 4%. We have accomplished rather well for ourselves over the past 5 years, however it took getting our fingers soiled in worldwide markets. If you’re a value-investor, critical about defending your wealth, us on the Worth Lab is likely to be of inspiration. Give our no-strings-attached free trial a attempt to see if it is for you.