rarrarorro/iStock via Getty Images

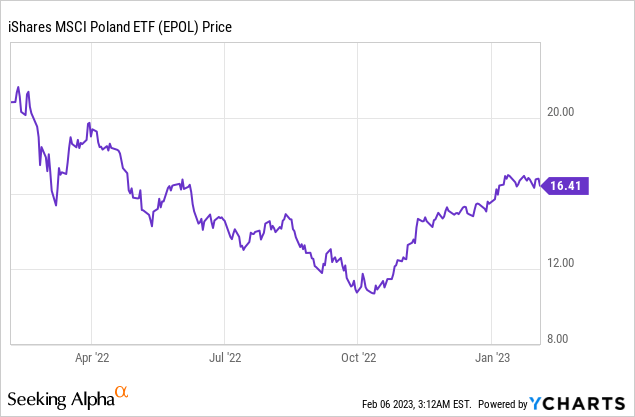

With an economic slowdown well underway in Poland and Q4 GDP set to normalize lower as the one-off inventory tailwind in Q3 normalizes, Polish equities and, by extension, the iShares MSCI Poland Capped ETF (NYSEARCA:EPOL) could underperform in the coming months. The fund retains an outsized financials (mainly banking) exposure at >40%, leaving it exposed to a two-pronged headwind – loosening monetary policy and slowing loan growth. The current central bank (National Bank of Poland or ‘NBP’) view seems to be that a pending economic slowdown will be sufficient to anchor inflationary expectations, allowing for a reversal of monetary tightening. If inflation data continues to support this view, key holdings PKO Bank (OTCPK:PSZKY) and Bank Pekao (OTCPK:BKPKF) have likely seen a peak in their net interest margins (‘NIMs’). This leaves the banks with limited insulation against a lending slowdown (alongside GDP), as well as emerging risks such as an extension of mortgage payment holidays into 2024.

The consumer side of the portfolio (note consumer discretionary is the third largest weighting) also looks poised to underperform alongside the overall economic weakness, with discretionary-driven consumer names like Allegro (OTCPK:ALEGF) already signaling a slowdown for Q4 2022. Net, I remain in ‘wait and see’ mode on EPOL.

Fund Overview – A Low-Cost, Highly Concentrated Play on Polish Equities

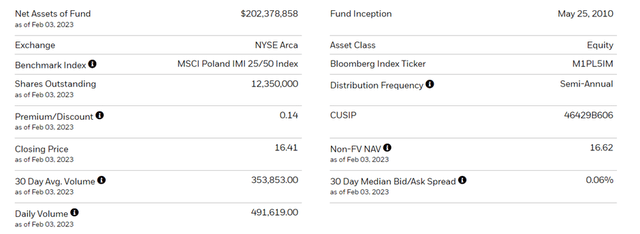

With $202m in net assets and an expense ratio of 0.58%, the iShares MSCI Poland ETF offers US investors a relatively low-cost vehicle to gain exposure to Polish equities. The ETF tracks the price and yield performance of the MSCI Poland IMI 25/50 Index (before fees), spanning large, mid, and small-cap segments of the Polish market and covering ~99% of the free float-adjusted market cap. An overview of the key facts is per the graphic below:

iShares

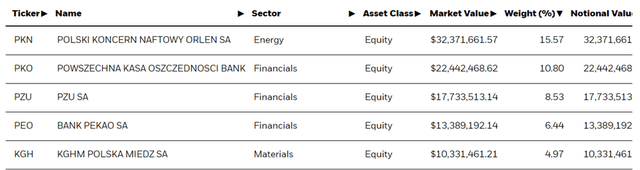

The EPOL portfolio comprises 34 stocks at the time of writing, with its top holding, PKN Orlen (OTC:PSKOF), a Polish oil refiner and petrol retailer, comprising 15.6% of the portfolio. The second-largest holding is leading Polish bank PKO Bank Polski at 10.8%, followed by Polish insurance leader PZU SA (OTCPK:PZAKY) and Bank Pekao (Poland’s second-largest bank) at 8.5% and 6.4%, respectively. The fund allocation remains as concentrated as ever, with the largest ten holdings representing >67% of the portfolio.

iShares

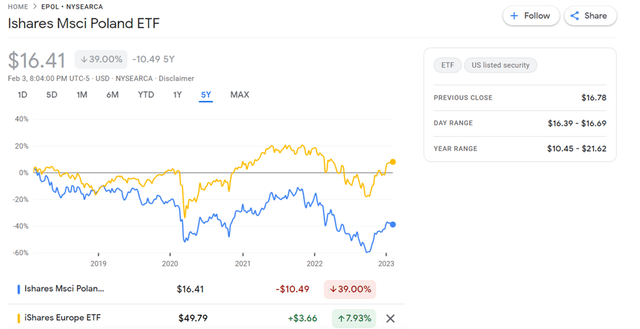

On a YTD basis, the ETF has returned 4.5% but has depreciated in value by 36.4% since its inception in 2010. The dismal 2022 performance didn’t help at -24.5% and -24.6% in NAV and market price terms, respectively. Relative to the US-listed iShares Europe ETF (IEV), the fund has underperformed on one- and five-year timelines, as well as since inception. The distribution (paid on a semi-annual basis) yield at 2.6% isn’t appealing either, given the fund’s concentration in financials and energy, two sectors that typically offer good payouts. Also worth noting is that the yield is quoted on a trailing basis; names exposed to the O&G cycle, like top-holding Orlen and to a reversal in monetary tightening (banks like PKO and Bank Pekao) could see their payouts normalize lower.

Google Finance

Headwinds from Monetary Easing and Unfavorable Policies

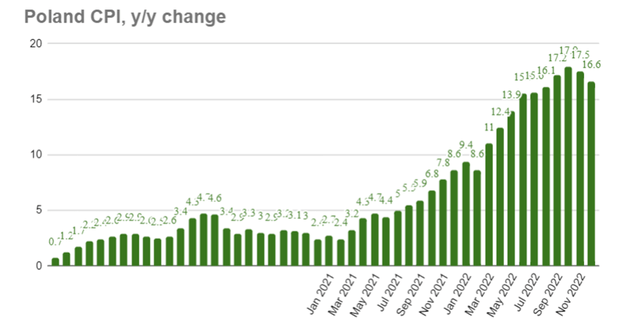

Following a long stretch of accelerating inflationary pressures, the November inflation report marked the first deceleration in Polish headline inflation in a while at +17.5% YoY (down from +17.9% YoY prior). This was followed by another round of deceleration to +16.6% YoY in December. Signs of a fading inflationary impulse (mainly household energy and fuel prices) will come as a welcome relief and, combined with a pending economic slowdown, should be sufficient to anchor wage and price growth expectations into 2023/2024. Commentary from the NBP seems to support this view, and thus, I expect the current monetary tightening cycle is coming to an end.

BNE

In tandem, EPOL’s exposure to major banks means it could underperform – key holding PKO Bank has already guided to peak NIMs post-Q4, with slowing loan demand (tracking the broader economy) likely to drive more earnings downside ahead. Further, recent news reports have suggested a potential extension to mortgage payment holidays, presenting further downside to the earnings trajectory. Alternatively, the additional PLN2bn FWK (i.e., the Polish borrowers’ support fund) contribution from the banks that the government had initially called for could still be on the cards. All in all, the near-term setup for the banking sector isn’t great, and given EPOL’s concentration here, the fund could lag behind its Europe/emerging Europe peers as a result.

Slowing GDP to Drive More Consumer Weakness

All signs point to 2023 being a year of slowing consumer-led growth. Polish consumer confidence hasn’t recovered since COVID, and with private consumption contracting 0.7% QoQ (and slowing to +0.9% YoY) in Q3 in the face of continued inflationary pressures, the outlook for EPOL’s consumer discretionary holdings (its third largest sector allocation) isn’t great. In line with the bearish view, blue-chip consumer discretionary names like Allegro (EPOL’s biggest consumer holding) have further trimmed guidance in anticipation of a further slowdown into 2023 as well. EPOL under indexes to staples vs. discretionary, so even if food retailers remain resilient and lower-income consumer demand gains support from the ~20% minimum wage hike, the fund will see a limited benefit.

Heading into an Economic Slowdown

Poland has generally sustained low to mid-single-digits % growth in recent years, but 2023 could undershoot as an economic slowdown takes hold. With the Q4 GDP print likely to show a QoQ deceleration as inventory benefits wind down and consumption and investment levels also falter, the setup for EPOL isn’t compelling.

The ETF holds a concentrated portfolio, with >40% exposure to financials (banks primarily), so investors will want to keep a close eye on the pace of monetary easing from here. With recent inflation data points showing a slowdown, the path to a reversal of the interest rate hikes over the last year is clearer, which will weigh on the NIMs of key holdings like PKO and Bank Pekao. Also concerning is the pace of loan demand growth in an economic slowdown, as well as the risk of an extended mortgage payment holiday and increased FWK contribution requirements. Alongside its heavy consumer discretionary (vs. staples) exposure heading into a growth slowdown and relatively low distribution yield (~2.6%), I would hold off on EPOL pending signs of an economic upturn.