Episode #426: The Better of 1H22 – Zeihan, Grantham, Zelman, Bloomstran, Ilmanen, Arnold, Baker, Grice, Valiante & Ariely

![]()

![]()

![]()

![]()

![]()

Run-Time: 46:25

Friends: John Arnold, Whitney Baker, Jeremy Grantham, Ivy Zelman, Gio Valiante, Dylan Grice, Antti Ilmanen, Chris Bloomstran, Peter Zeihan, & Dan Ariely

Abstract: At this time we’re trying again at a few of our hottest episode within the first half of 2022 overlaying a variety of subjects with some superb company. I do know it’s arduous to pay attention to each episode, so we picked some clips from our most downloaded episodes for you.

When you get pleasure from this episode, do me a favor and make sure to subscribe to the present. And if you happen to’re already subscribed, ship this episode to a buddy to allow them to be taught concerning the present.

Sponsor: Bonner Non-public Wine Partnership – Based in 2019 by Will Bonner, the Bonner Non-public Wine Partnership is a gaggle of wine lovers who come collectively to import nice, small batch wines which may in any other case get missed by massive importers. Click on right here to get 4 bottles of wine for nearly half off plus free transport.

Feedback or options? Desirous about sponsoring an episode? Electronic mail us [email protected]

Hyperlinks from the Episode:

Transcript of Episode 426:

Welcome Message: Welcome to the “Meb Faber Present,” the place the main focus is on serving to you develop and protect your wealth. Be a part of us as we focus on the craft of investing and uncover new and worthwhile concepts, all that will help you develop wealthier and wiser. Higher investing begins right here.

Disclaimer: Meb Faber is the co-founder and chief funding officer at Cambria Funding Administration. On account of business laws, he won’t focus on any of Cambria’s funds on this podcast. All opinions expressed by podcast individuals are solely their very own opinions and don’t mirror the opinion of Cambria Funding Administration or its associates. For extra info, go to cambriainvestments.com.

Sponsor Message: There’s a loopy stat down in Argentina. They’ve vineyards up at 9,000 toes, nearly remarkable for winemaking. But they make world-class like 90-point wine there, however they’re additionally inconceivable to get within the U.S. These wines come from deep inside the Andes mountains made by the identical households for over 200 years.

The tales I’ve heard from our pals over at Bonner Non-public Wine Partnership, man, it’s a surprise how they even get these items down from the mountains. Heck, one of many founders nearly died simply looking for these distant vineyards. Evidently, these wines are particular. I wouldn’t be telling you about them if I didn’t love them myself. They style unbelievable. You understand, it’s a Blackberry, darkish cherry, leather-based smoke. Nice with a steak.

Head on over to bonnerprivatewines.com/meb. No inflated costs. You’re getting top-quality wine for about half the value. That’s proper, my listeners will get $60 off this unbelievable assortment of wine and complimentary transport. And the way does a bonus bottle wine sound? You’ll get a complimentary bottle of small-batch restricted manufacturing wine from the partnership cellar. That’s 4 bottles for the value of three, simply go to bonnerprivatewines.com/meb.

Meb: Welcome listeners. At this time’s a really particular episode. We’re trying again at a few of our hottest episodes within the first half of 2022, overlaying a variety of subjects with some superb company. I do know it’s arduous to pay attention to each episode, so we picked some clips from our most downloaded episodes for you.

When you get pleasure from this episode, do me a favor, and make sure to subscribe to the present. When you’ve already subscribed, ship this episode to a buddy to allow them to be taught all concerning the “Meb Faber Present.”

To kick issues off, we’re going to start out with legendary pure gasoline dealer and billionaire philanthropist, John Arnold. When John left Enron and began his personal hedge fund, he discovered himself on the opposite aspect of a fund supervisor who was overexposed. I requested him about that have, and later why he determined to wind down his fund to turn out to be one of the vital prolific philanthropist on the earth at the moment.

John: Yeah, I’d seen loads, 17 years of buying and selling. One of many issues I’d incessantly see is {that a} dealer would are available in, have some success, and simply begin buying and selling too large. And after a few years of success, he will get vital threat capital from his firm or his fund, and simply ended up in positions that had been too large. And nearly, doubtless, that individual would find yourself blowing up.

So this occurred with Brian Hunter, who in 2004, 2005 had superb years. He was at a hedge fund that was actually a hedge fund, doing quite a lot of convertible bond ARB and a number of the extra conventional hedge funds, methods, arbitrage methods. They weren’t identified for understanding and managing power threat. And I feel administration began to see the numbers that he was placing up and gave him extra rope with out actually understanding the danger he was taking.

And so he ended up very, very deep ready that dependent upon having a hurricane, this exogenous occasion of a hurricane coming and actually, considerably impacting Gulf of Mexico manufacturing. And the entire market was sort of in opposition to him on this. He had constructed it as much as such dimension. After which because the summer season begins to tick via, and it’s a gradual hurricane season, the … began to decay.

And in some unspecified time in the future, his administration got here in and mentioned, “No extra. The truth is, you bought to lower place.” Seems, he wasn’t lowering the place. He might have even been including to it. After which they get to some extent the place they’re clearing companies steps in and says, “Place is just too large. You bought to get out of it.”

And so he calls me up one weekend after I’m in New York, getting engaged, get the decision and says, “Do you need to purchase my e book?” And I had a notion about what the scale of it was. I had been a counterparty to him on lots of the trades typically as a market maker. I had a number of the different aspect of the place however the entire market had the opposite aspect of the place. He simply sort of advised his folklore that it was centaurs versus emirate. It actually wasn’t. It was Emirates versus everyone. I had a bit of it. All people had a bit of it.

And that weekend, he has to indicate me the place as a result of I’m bidding on it. And I used to be flabbergasted by the scale of it and that his administration would let him get right into a place with a place dimension like that. And I gave him a worth that ended up being I feel the best worth given the place issues traded that Monday every time the market opened up, and it had been shocked. His clearing companies ended up taking up the place and liquidating it. After which the market actually simply evaporated. That turned the pure gasoline story that led to quite a lot of regulatory oversight and quite a lot of complications for me in the long run.

Meb: So your curiosity began to shift from this kind of section of your life with the fund and every little thing you’ve accomplished as much as this time. I imply, there’s an overlap, it feels like, too. You began being fascinated about another areas earlier than the fund shut down nevertheless it appeared like a glide path. What was kind of just like the crystallizing choice that the Arnold Ventures sort of like path would turn out to be this actually the subsequent chapter in your life? Or was there one was it kind of like one month at a time, one yr at a time, that is sort of the place you’ve arrived, the place on the time was like, “You understand what. That is what we’re going to do?” You sat down along with your spouse and mentioned, “Let’s chat about this.”

John: I had at all times been fascinated about philanthropy within the nonprofit sector. I had began writing checks, perhaps after I was 25 or so, getting concerned within the constitution faculties in Houston, acquired on the board of certainly one of KIPP Houston. And so I simply sort of began going to a number of the schooling reform conferences and excited about this from a systems-level considering. And I used to be on this. We began a basis, very passive and simply put a bunch of cash right into a basis, had one or two workers, and we’d write some checks fairly passively. My spouse on the time, we had met in 2006, acquired married in 2007, she labored a few extra years, determined to retire from her profession as an M&A lawyer, after which helped begin a EMP Firm in Houston. She determined to go full-time on the inspiration.

And I might go over there to the inspiration’s workplace after working at Centaurus and go spend an hour or two they’re within the afternoon. I feel a few issues turned clear, one was that, if you happen to’re not 100% centered on the markets, it’s arduous to be worthwhile on it. It’s extremely aggressive area. And so, as soon as my thoughts began to float, and I wasn’t 100% in there, I wasn’t dreaming about it at night time, I wasn’t excited about it within the bathe within the morning, I wasn’t not speaking about it with pals at night time, then it turned tougher to achieve success.

The second was that I turned extra intellectually within the nonprofit area than I used to be in buying and selling power. So by 2012, it was time for me to shut up Centaurus. I used to be simply drained. And I had this factor, I had this basis. I needed to go spend a while with it and attempt to determine issues out. And one factor led to a different I used to be like, “Okay, I’ve this factor I can go do.” And that was essential. I’ve seen lots of people within the business who acquired drained, acquired exhausted, give up, after which they looked for what subsequent. And so they might by no means discover one thing that was intellectually stimulating to them. And that turned very irritating. However I had this.

And so, with my spouse, we put our full-time efforts into, on the time, the Laura and John Arnold Basis, which has turn out to be our ventures in making an attempt to construct this actually impactful basis. We work on problems with public coverage viewing coverage as a extra sustainable, extra structural, extra scalable options, work on a number of the most endemic issues that society faces, work in areas like legal justice, well being care, public finance, schooling, analysis integrity, and making an attempt to determine what works, what doesn’t with social applications. And that’s how I’ve spent each day since 2012.

Meb: Subsequent up is Whitney Baker. Whitney is the founding father of Totem Macro, an rising markets macro consultancy in hedge fund advisory boutique, and beforehand labored at fame retailers like Bridgewater and Soros. Once we spoke in early January, she mentioned, “We’re beginning to expertise a secular and cyclical regime change that individuals weren’t adjusting to,” and why she believed the U.S. was in a once-in-a-generation bubble. Let’s pay attention in to see what she needed to say.

Whitney” Not each cycle is a bubble. Clearly, generally you simply find yourself with a credit score cycle that then inflow once they tighten and also you get a traditional kind of backyard selection recession. The U.S. ones have been bubble. U.S. exceptionalism was a bubble within the 20s a bubble within the 90s and a bubble at the moment. And what’s attention-grabbing is that they at all times comply with the identical sort of even like inside breads, indicators and issues like that. Like, what occurred in 1928 was the Fed was mountaineering aggressively, commodities collapsed as a result of they kind of sniffed out that world development and inflation can be impacted by this. After which mainly second half ’28 via starting of ’29, it was solely the factor of the day successfully, radio and stuff like that, that was getting any flows and doing something.

They had been the one… it was like, once more, 5 shares doing every little thing. It’s nearly just like the final vestige of the bubble mentality since you’re like, “Oh, man, I actually really feel like I should purchase the dip however I’m unsure I need to have one thing that’s going to be damaging free money move until 2048. So perhaps I’ll simply purchase Amazon or no matter.” Similar sort of factor goes on. After which in the end, it’s the entire kind of vary of these bubble belongings and people flows that unwind.

My large concern right here, after I take into consideration secularly, the outlook and I’m not essentially speaking about EM right here, however we now have had an insane improve in metrics of U.S. wealth, as a ratio of GDP, as a ratio of disposable family revenue, something like that. It’s like six to seven instances. It’s by no means been anyplace remotely near this. And it’s gone up by about one and a half phrases of GDP within the final couple of years. Now, belongings are simply issues which are tied to future money flows. Money flows are tied to the financial system and earnings or spending of some variety. And so what you’ve got right here is that this enormous disconnect between asset valuations and the money flows that may assist them.

And when you consider a inventory, let’s say it’s buying and selling on 30 instances earnings, whether or not earnings develop 10%, subsequent yr, like they grew 10% final yr or no matter, while you’re simply buying and selling at such an costly a number of, the earnings themselves will not be actually the factor that turns into attribution-only what drives the inventory volatility. It’s modifications in that a number of that drive far more of what’s happening. So, anyway, in the end, you get this on wind. And when the bubbles pop, I feel this time round, my important concern right here is there’s going to be quite a lot of wealth destruction.

After I take into consideration how they’re going to gradual this inflation drawback down, usually, like, let’s return to 2006, 2007, what they did was raised charges. There’s an enormous credit score growth ongoing globally, however particularly within the developed world. And so they raised charges after which worth begin to fall. So home costs begin to fall credit score rolls over and this entire borrowing cycle ends. And that’s how usually mountaineering brings concerning the finish of the cycle and disinflation. This time round, this isn’t a credit-driven factor. That is like a number of cash being printed, a number of checks being mailed to folks, $2.7 trillion of that are sitting there on spent within the extra financial savings that everyone talks about within the U.S.

And so there’s quite a lot of dry powder to go. This hasn’t been pushed by credit score. This hasn’t been pushed by cash and financial. Fiscal goes to be greater via the cycle than we’ve been used to. And it’s very troublesome given the polarization for any sort of fiscal retrenchment. And so it’s arduous for me to see how via the conventional channels of like reasonable price hikes, we truly get a significant slowdown right here, aside from via wealth destruction, and that recoupling of giant asset values with the financial system, and, subsequently, issues just like the market cap to GDP, or family wealth to GDP, these types of crude reads, kind of return to one thing extra regular.

And it’s via that channel that you just truly get a discount in spending, and so forth and so forth. As a result of if something, credit score is accelerating. and I feel that’s pure since you’re getting such an enormous funding growth. So, there’s a response that’s happening now to the primary spherical of inflationary issues, which is perpetuating the inflation, which is clearly the labor market, and wage positive aspects, and the CapEx growth that’s happening. All of that simply extra demand for items and labor proper now, extra spending energy for labor. And it solely truly will get disinflationary in a while. In order that’s actually beginning to are available in now, and it’s offsetting any fiscal drag individuals are speaking about, plus you’ve acquired this dry powder problem.

So anyway, from you globally as buyers and likewise simply as society, how we navigate the challenges of coping with the shifting inflation and rate of interest paradigm secular change there, enormous debt ranges, belongings which are extraordinarily costly and possibly not providing you first rate ahead returns within the U.S., specifically, how does that entire factor play out in a benign manner? It’s very arduous to see.

Meb: Quickly after Russia invaded Ukraine, we spoke with legendary investor and co-founder of GMO, Jeremy Grantham. Jeremy touched on rising meals costs, the connection between inflation and PEs, and even shared some unfiltered ideas on the Fed.

Jeremy: The UN Meals Index is again to these highs of 2011. And Ukraine shouldn’t be a bystander. Ukraine is a part of the nice breadbasket of Europe. It’s the place wheat comes from into the export market. So if you happen to’re an Egyptian, half your imported wheat comes from the Ukraine. That is solely related. And also you add collectively the change within the climate. Not less than within the Arab Spring, folks weren’t obsessing about floods, droughts, and better temperatures, however that has turn out to be painfully extra apparent within the final 10 years. And it’s making agriculture very troublesome.

Meb: What do you assume this analogue as we glance again, is that this a slight early ’70s vibe? Is there one other interval that feels just like you, whether or not it’s within the U.S. or globally or anyplace that’s an identical market setup that we now have at the moment?

Jeremy: Each system is so difficult, they’re at all times totally different. However I feel the final 20 years has been fully totally different. Certainly, I wrote a quarterly letter in 2017 saying I couldn’t discover something that wasn’t totally different. The 4 most harmful phrases in investing weren’t, “This time is totally different.” However actually, the 5 most harmful phrases had been, “this time is rarely totally different.” As a result of every now and then, issues completely change. And so they modified within the early twenty first century. And we went to a regime of company paradise the place PEs weren’t simply greater than the earlier 60 years. They averaged 60% greater. Revenue margins weren’t simply greater, however they common near 40% greater.

So, earnings as a proportion of GDP went up a number of factors, and wages as a proportion of GDP fell a number of factors. So these are profound variations. And so they had been accompanied by the bottom rates of interest within the historical past of man, which declined… Nicely, they declined for 50 years, however they declined the complete twenty first century. And the availability of debt rose extra quickly than in all probability another 20-year interval exterior of main conflict. So every little thing had modified. I feel what will occur is that it’s altering again. We’re going again in some ways, to the twentieth century. Inflation has been a non-issue on this Goldilocks space for 22 years. I’m proud to say I wrote 20 years of quarterly letters, and I by no means featured inflation. It was fully boring and out of my curiosity zone.

And within the twentieth century within the 70s, ’80s, and ’90s, as funding managers, in fact, you may not ignore inflation, I feel inflation is at all times going to be a part of the dialogue as soon as once more. It’s not at all times going to be 7% or 17%. It’s going to ebb and move. However it is going to at all times be thought of. Once more, the final 20 years, we forgot about them. And PEs depend upon two issues revenue margins, and inflation. Revenue margins are excessive, inflation is low, you’ve got a really excessive PE. You return to the ’70s, you’ve got excessive inflation, low-profit margins, you promote at seven instances depressed earnings. After which in 2000, you promote it 35 instances peak earnings.

That is double counting of the worst selection. And we now have been promoting at peak PE of peak revenue margins just lately. That isn’t some extent that you just need to bounce off if you happen to had the selection. You need to begin a portfolio in 1974. PE is seven instances, revenue margins are about as little as they get. Paradise, how will you lose cash? You do not need to start out on the reverse the place we had been a yr in the past.

Meb: I posted on that subject this previous yr. And it’s in all probability the primary angriest responses I acquired on Twitter. And I mentioned, “Look, this isn’t even my work. I imply, you’ll be able to have a look at Robert Nah, you’ll be able to have a look at GMO, one million different folks have talked about this. It’s very simple to see within the knowledge.” However you guys have a lovely chart. I feel it even goes again to that 100 years or so however overlaying a predicted PE based mostly on the inputs you mentioned. And there’s actually excessive correlation. However there’s two intervals that basically stick out, , now and 2000.

Jeremy: I’m certain that you just say 100 years, however, in fact, 1925 yr is abruptly, nearly 100 years. But it surely tracked 1929 fantastically, and the ’30s with native years, and the 50’s recovering. And the one factor I acquired materially flawed, as you say, is 2000. In 2000, revenue margins and inflation predicted the very best PE in historical past. And we had the very best PE in historical past. Solely it wasn’t 25, it was 35. But it surely went 40% greater. And for 2 years, that was probably the one actually loopy psychology ever, as a result of it took good situations, after which inflated these, if you happen to would, by 40%. And now, beginning simply after we spoke a yr in the past, the factor diverged once more. It was fantastically heading in the right direction once we spoke, after which a month or two later inflation began to rise quickly. And the PEs as a substitute of taking place went up. And I can say with a transparent conscience, nothing like that has ever occurred since 1925.

When PE goes from zero to 1, 2, 3, 4, 5, 6, 7, the market crashes. You’ll be able to clarify the PE of December thirty first. You’re going to clarify it by saying, not that it’s 7% inflation, however that it’s good inflation, it’s 1.9 unstable. Not 7% and unstable. That has at all times been a bane on PEs, however not this time. This time the world 100% believed that the Fed was proper when it mentioned it was non permanent, which is exceptional given the Feds report of getting nothing proper. I discover it bewildering that the world would imagine them. However they do.

Meb: Because the housing market begins look shaky and mortgage charges have shot up, it’s enjoyable to return and take heed to Ivy Zelman, certainly one of, if not, the skilled on the housing market. She defined why she thought the housing market had gone fully bonkers on the time.

Ivy: Nicely, I feel that the demographics are actually the inspiration of our cycle name. And so, we lean closely on that. And Dennis McGill is our in-house demographer. And that’s a fairly sobering outlook proper now, simply based mostly on what’s taking place with the general trajectory for each not solely family development, however inhabitants development, which has been on a downward trajectory. And we had family development on this prior decade hit the bottom ever on report, and inhabitants development second-lowest on report behind the Nineteen Thirties. And the outlook is even bleaker for this decade it had. After which while you have a look at what the drivers are for development proper now, the housing market is euphoric. And you’ve got insatiable demand. And also you even have vital governor’s on getting begins within the floor and getting houses accomplished with provide chain bottleneck.

So, it has allowed for substantial dwelling worth inflation. And I feel individuals are both giddy or scared shitless. You’ve acquired quite a lot of dynamics that make it extremely complicated, however what we’re seeing is that native major patrons actually spiked throughout COVID. So the pandemic took a market that had been on an upward trajectory, particularly the entry-level as a result of builders acquired a memo that lastly they had been listening, like, if you happen to construct it, they may come. When you exit to the French, the secondary, no matter you need to name it tertiary markets, however they weren’t prepared to as a result of there was actually a decent mortgage market. So we analyze the mortgage market and recognizing each side, each silo of it, the builders had been reluctant to construct additional out, rightfully so after they acquired so burned.

And so they had been being very cautious on how a lot land publicity they needed. So, in 2015, D.R. Horton, main homebuilder within the U.S., they create a product known as Categorical Properties, and so they went out to the exurbs. And so they began offering houses that had been within the 100 plus, and their business adopted go well with. And so actually 2016 was the trough within the homeownership price. And that’s one thing we’re clearly watching. And that homeownership price has continued to proceed on an upward trajectory and now, hovering at about 65% and possibly transferring greater. However the major purchaser due to the extent of buyers which are available in the market, has peaked out on the finish of 2020. 2021’s first quarter peeking out after a considerable spike, as COVID created a big flight from city to suburban to exurb with folks needing security and more room, and so they had been profiting from actually free cash, because of the Fed.

We additionally noticed large stimulus that gave folks incremental financial savings that in any other case they wouldn’t have additionally. They weren’t spending cash within the preliminary shutdown. So the housing markets gone bonkers, simply fully bonkers.

Meb: Later within the dialog, she talked concerning the threat of rising mortgage charges, which we’ve seen shoot greater because the episode.

Ivy: Within the housing, particularly, as a result of the first purchaser, while you have a look at not a lot absolute re-mortgage charges, how a lot is the month-to-month cost for an entry-level purchaser shopping for a median-priced dwelling? How a lot would it not value them at the moment versus a yr in the past? And it’s up over 30%. And that’s now incorporating the rise in mortgage charges that we’ve seen. So when the Fed is pulling again on MBS purchases, they’re additionally tightening. And on account of that, mortgage charges are rising. And one of many backlash is that the Fed, their coverage might be felt is if you happen to’re not transferring from California to a lower-cost state, you’re in all probability locked in. Seventy p.c of house owners in america are locked in, not at 4 under 4. And greater than half are locked in under 3.75.

And also you begin to take a look at what can be the bread and butter in america and also you say, okay, nicely, these folks aren’t giving up that low price, as a result of typical mortgage jumbo mores will not be transferable. So I feel which may begin to dampen the, once more, major exercise, however can the investor exercise offset that? And that’s what we’re seeing proper now.

Meb: When you’re a fan of the present, “Billions,” you’ll love this episode, Wendy Rhodes character was based mostly on our visitor, Gio Valiante, who was a efficiency coach for Point72 and Steve Cohen, and is now the efficiency coach for the Buffalo Payments, and a number of the high golfers on the PGA Tour. Hearken to Gio share the best single statistic he’s ever heard of in sports activities and the commonalities between Steve Cohen and Tiger Woods.

Gio: I’ve a statistic I pulled up for you that this actually issues to anybody who desires to be good at one thing, From 2002 until 2005, Tiger Woods had 1,540 putts from three toes in. He missed three of them. So while you actually take into consideration this, 1,540 instances, over the course of three years, Tiger had a putt inside three toes. Now, that is in wind, in rain, in good greens, left to proper, proper to left, uphill to downhill, 1,500 instances, he solely missed three of them. Are you able to think about the kind of self-discipline, rigor, dedication to course of required? Like, that’s the biggest single statistic I’ve ever learn in sport. Individuals don’t know how arduous it’s. There’s nothing that Tiger did that was… That’s the inform how good he’s.

You need to hear how good Steve Cohen is? Right here’s how good Steve Cohen is. I requested his spouse, I mentioned, “I’ve a fast query, what number of days off does your husband take?” And I hadn’t identified Steve for that lengthy however she mentioned 4 days off from the time that she’d identified him. So if you happen to go 40 years, 250 buying and selling days known as 10,000 days simply common, 10,000 days Steve Cohen took off 4. You understand why? He was within the hospital. And as quickly as he wakened from surgical procedure, he had them arrange displays because the story goes. In different phrases, Tiger Woods reveals up each day for his craft. Steve Cohen reveals up each day for his craft. The everydayness, displaying up and being current within the second for what you’re doing actually issues.

And so while you inform me about this, buy-side sell-side, and having a course of and a dedication to a course of, you need to see, nicely, who lives on the tail finish of the curve? Individuals hold displaying up. Tiger Woods, 1,540 putts from three toes, missed three of them. That’s an insanely arduous factor to do. 10,000 buying and selling days for a man who doesn’t want the cash missed 4 of them as a result of he was within the hospital. That’s an unbelievable… I like that sort of dedication a lot. And I can provide you instance, instance, and guess who these individuals are? All of them occupy the tail finish of the curve in a expertise. It’s not IQ factors. It’s these issues nevertheless it’s additionally the everydayness of displaying up for the job.

Meb: Thus far in 2022, we’ve seen a brutal yr for the 60/40 portfolio. Again in April, we spoke with Dylan Grice, co-founder of Calderwood Capital and the writer of the “Widespread Delusions” publication, and he touched on the necessity for buyers to be really diversified past simply shares and bonds.

Dylan: To have a steady portfolio return requires a really, very well-diversified portfolio. And I feel that the factor that individuals perhaps don’t normally perceive about diversification is that it’s arduous. It’s actually arduous to construct a diversified portfolio. It’s not a trivial factor to do. As a result of if you happen to’re actually trying to diversification, if you happen to’re actually in search of diversified return streams, what you’re truly seeing is you need your return streams to be essentially totally different from each other, which implies that you’re doing issues that are essentially totally different from the principle one, which is equities, which implies that, nicely, if you happen to’re essentially totally different, you’re essentially contrarian. So if you wish to construct a basic diversified portfolio, you must be contrarian.

We’ve talked already concerning the issues with 60/40, the issues with the loss of life of length with rates of interest being zero, with anticipated returns being very low. Everybody’s conscious of that. There are many articles you examine how individuals are coping with it. What are folks utilizing as a substitute of 40? What are folks utilizing as a substitute of bonds? And it appears as if what they’re doing is that they’re doing personal fairness, or they’re doing extra actual property, all proper, or they’re doing extra enterprise.

Meb: As you simply described like half the pension funds within the U.S. over the previous 4 years the place you see this, and so they’re similar to, “You understand what? Rates of interest are decrease, or we’re making an attempt to determine how one can proceed to get these 8% return. So, we’re simply upping the dial on personal fairness and VC, which God bless them if that’s what they’re going to do however that creates a complete host of challenges in my thoughts.”

Dylan: I agree. I feel two very, very apparent ones. The primary is that it was actually a wise factor to be doing that 40 years in the past, or 30 years in the past. It’s not apparent that it’s such a wise factor to be doing it at the moment, when all the large personal fairness founders are multibillionaires, and so they’re all promoting out. The second factor is, once more, diversification, what sort of diversification are you truly getting? And if you happen to put personal fairness right into a public fairness portfolio, you’re not diversified. There’s a number of good causes so that you can put money into personal fairness. Perhaps that’s your talent set. Perhaps that’s the world that you just perceive. Perhaps you’ve got some experience there. There’s nothing flawed with investing in personal fairness. However don’t child your self into considering that you just’re constructing a diversified portfolio.

And once more, perhaps you don’t desire a variety. You simply need pure fairness, you need leveraged fairness. Once more, that’s high-quality. However if you happen to genuinely need diversification, if you’d like some safety in opposition to the very actual chance that the occasion of the final 40 years is over the subsequent 40 years are going to look totally different, you’re going to should mainly let go of all of that stuff that labored so nicely over the past 40 years and embrace issues that are far much less typical. That is our searching floor. These extremely unconventional, extremely unfamiliar asset courses are, I feel, the place you’re very, very engaging return profiles. And extra importantly, very, very various return streams like cryptocurrency arbitrage, reinsurance litigation, commerce, finance, artificial credit score and correlation, mortgage derivatives, none of these items actually correlate with broader monetary situations. And so, even in this sort of loopy inflated world, you’ll be able to nonetheless completely construct a diversified portfolio with good steady returns, that’s going to be strong. And I feel it’s going to be the cockroach.

Meb: And certainly one of my favourite all-time episodes, I speak with AQR’s Antti Ilmanen concerning the problem buyers face as many years of tailwinds are turning into headwinds. He talked concerning the significance of humility, and the necessity to keep away from return chasing.

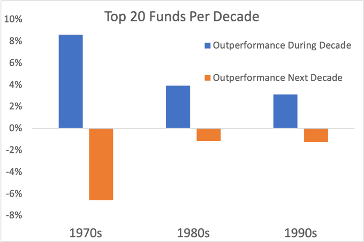

Antti: You’ve acquired to assume, what are you able to forecast and what’s only a random consequence. That’s one other manner I’m considering of the Serenity Prayer, having the knowledge to know the distinction. So, if uncovered, you get an enormous valuation improve for already costly belongings. Sorry, shit occurs. And also you simply acquired to simply accept that forecasting is troublesome. We aren’t saying that these items are helpful for one-year market timing or one thing like that however they’re nonetheless about the most effective we now have for considering of 10 years forward, anticipated returns. And while you get this occasional dictate who has breached, issues get even richer, you’re going to get the unhealthy consequence. If folks after that assume, let’s simply ignore that sort of recommendation, that’s one thing that has labored traditionally, very badly. That’s an X 10 yr returns are negatively associated.

So you might be getting the signal of a minimum of with what we’re speaking about, on common, you are inclined to get it proper with these valuations. You get a number of forecast errors, however on common, you are inclined to get it proper. So we’ve acquired that historical past on our aspect. However nonetheless, humility is essential right here. This final forecast was from… And it’s not simple to reuse these items, nevertheless it’s the most effective we now have.

Meb: Yeah, I imply, you truly… I’ve that highlighted within the e book. You’re speaking about humility, and I used to be saying that’s so essential. There’s a quote that I simply love this previous yr I can’t get out of my head is about speaking, like, “You don’t need to make your concept your identification.” And so, , you’re over right here, you and I, or another person shopping for maintain shares, or even when it’s… Shares are costly. Like, the fact of likelihood and stats is like these items can go both manner, and also you be taught to embrace and settle for the market. So that you nearly acquired to be a comic. I say you bought to be half historian, half comic to essentially get it. However you mentioned like investing with serenity shouldn’t be solely about calmly accepting low returns. It’s about investing thoughtfully, determining one of the best ways to succeed in your objectives. We have to take advantage of when markets supply the least.

Whereas on this journey, buyers ought to focus extra on the method than the end result. That’s attention-grabbing, as a result of it’s simple to say however arduous to do. Most buyers, even those that say they give attention to course of, and never outcomes, I really feel like they try this on the purchase choice, and so they nearly by no means do it on the promote choice. And I don’t know if you happen to’ve skilled that. instance I at all times give, as I say, folks that undergo this course of, say, “All proper, right here’s my course of, specializing in the outcomes. Do you underperform after a yr or two, you’re fired?” Or if it’s not an lively supervisor, if it’s an asset class, no matter, ETF, on the flip aspect, folks say, “All proper, you underperform greater than my expectations, you’re fired.” However nobody in historical past, and you’ll inform me if it’s occurred to you has ever mentioned to you, “You understand what, Meb? You understand what, Antti? You guys did manner higher than anticipated, I’ve to fireside you. I’m sorry.” Have you ever ever heard that? As a result of I’ve by no means heard that.

Antti: Yeah, there’s extraordinarily uncommon instances however there may be some conditions the place folks kind of go together with it. But it surely’s one percentile factor the place that occurs. And, yeah, I feel it’s comprehensible. However on the similar time, the identical folks know that there’s a tendency for, if something, like three to five-year imply reverse on the wage, and nonetheless individuals are doing it. Such as you mentioned, I feel discretionary selections will are inclined to have this return chasing/capitulation tendency. Cliff has acquired this beautiful quote, “Individuals act like momentum buyers at reversal horizons.” And that’s simply so unhealthy on your wealth. However all of us do it if we don’t systematize issues. Yeah.

Meb: One of many challenges… Like, there have been loads of instances in historical past the place say shares are costly, and greenback nice. There’s been instances when bonds might not look nice. This appears to be, and also you guys have touched on this earlier than, a uncommon second when each U.S. shares and U.S. bonds look fairly pungent. And I’m simply speaking about usually final couple years, fairly pungent collectively on the similar time. And then you definitely speak about, like, how does this resolve as a result of, like, most individuals the way in which they remedy this drawback traditionally is you diversify. You go to shares and bonds, 60/40. However not often is it sort of, like, have we seen this many instances in historical past the place they each simply look sort of gross?

Antti: No. So, once more, each of them have been first or second percentile. So simply on the tail finish of their richness lately. And by the way in which, once more, if something, then drifting to even attain a stage of CIO, which meant that this contrarian forecasts had been simply getting issues flawed lately. As U.S.A., it’s uncommon for that to occur collectively. And that makes me really feel much more assured that gravity goes to hit us. I say, “I don’t know the way it’s going to materialize.” I exploit this terminology, gradual ache or fasting.

Sluggish ache is that issues keep costly. And we don’t have any extra of these tailwinds behind us. After which we’re clipping non-existent coupons and dividends. And that ain’t enjoyable. After which the opposite chance is that you just get the quick paying issues low cost. And I feel we could be getting each of, , now we’re getting a number of the quick pay this yr. However I don’t assume we’re going to get that a lot quicker, and that’s going to unravel the issue. I don’t assume we’re going from this tiny ranges to historic averages. If we get midway there, I’m already shocked. That requires a really large bear market to occur. So I feel we’ll get some quick ache however nonetheless find yourself with that gradual ache drawback with us.

Meb: Now, this visitor is somebody you don’t need to audit your funding letters and analysis reviews if you happen to aren’t in your A-game. Chris Bloomstran is a basic worth investor and CIO of Semper Augustus Investments. I talked with Chris about a number of the shenanigans and charlatans we’re seeing these days and why it’s essential to him to name these issues out to guard retail buyers in every single place.

Chris: I remorse at some stage being on Twitter, however the place is the place I’ve knocked heads with of us or 100% solely, the place I feel the retail investor is simply getting shellacked and abused. If Goldman Sachs desires to go fleece a hedge fund, everyone in that world are large boys and massive women and know what you’re getting and know what you’re shopping for. You’re professionals and also you’re educated to ferret out the great, the unhealthy and the evil. However while you’re fleecing the retail platforms like Robin Hood on the time of their IPO, I might by no means have commented on Kathy had she not put up a Tesla report a yr in the past with a $3,000 inventory worth goal, which was riddled with inconsistencies and impossibilities about a number of the enterprise traces they’d be. And I occur to know a little bit bit about insurance coverage and auto insurance coverage, specifically, to counsel that they had been going to be the quantity two or quantity three underwriter in Otto inside a five-year time frame was insane.

After which to now come out within the final fall, after which extra just lately, a few weeks in the past to counsel you’re going to make 40% a yr after which what’s now 50% a yr, might, to make use of authorized phrases, might or might be criminally negligent. You’re simply selling. And I discover the habits appalling. We noticed quite a lot of examples like that within the late ’90s. We haven’t seen it till this newest iteration. And so, I’ve merely tried to lift consciousness and lots of people will like me for it, however it’s what it’s.

Meb: And certainly one of our most downloaded episodes ever already, geopolitical skilled, Peter Zeihan talks concerning the implications of rising meals costs across the globe.

Peter: The Chinese language stopped phosphate exports late final yr, and so they had been the world’s largest exporter. The Russians largely stopped potash exports within the first month of the conflict, as a result of most of their export factors undergo the Black Sea, which is a warzone. And the ships are having bother getting insurance coverage indemnification. So the ships simply gained’t go there. Or in the event that they do go there, they should get a sovereign indemnification from one other nation. The third sort of fertilizer is nitrogen-based, the Russians had been the most important exporter of the parts for that. And the Europeans have stopped producing nitrogen fertilizer, as a result of pure gasoline costs in Europe are actually seven instances what they’re in america. And it’s not economically viable.

So even when all of this magically went away at the moment, we have already got had too many months of interruptions to the availability system. And it’s already too late for the planting and harvest years of 2022. So we all know already from what has been planted or not, and what has been fertilized or not that we’re going to have a worldwide meals scarcity that’s going to start within the fourth quarter of this yr. We solely, for instance, have two months, roughly, of worldwide wheat storage. Half of that’s in China. And the Chinese language storage system sucks and it’s in all probability all rotted similar to it has been each time they’ve tried to construct a grain reserve earlier than. So, we’re going to chew via our backup in a short time when it turns into obvious that the harvest season this yr simply isn’t going to be that nice.

Changing or augmenting fertilizer manufacturing shouldn’t be one thing you do in a season. Phosphate and nitrogen infrastructure for the processing the creation takes a minimal of two years. Three years might be extra reasonable. And for a potash mine to be introduced on-line, you’re speaking a decade. It’s simply not one thing that we’re able to fixing anytime quickly. And that is simply disruption from one a part of the world. One of many actually darkish issues about agriculture is that the availability chain system is so built-in with every little thing else that in case you have a failure at any level within the course of, you instantly get an agricultural disaster. You probably have a monetary scarcity, farmers aren’t capable of finance their seed and their inputs. You probably have a producing disaster, they lose entry to gear. You probably have given power disaster, they will’t gas the gear, they will’t make issues like pesticides. You probably have an industrial commodities scarcity, fertilizer is faraway from the equation.

It doesn’t matter the place it occurs, it doesn’t matter what the dimensions is, you pull that thread out, and it pulls loads else out with it. And meaning some farmers in some components of the world merely can’t produce what we anticipate. We have now exceeded the carrying capability of the world if it delocalizes. There is no such thing as a manner within the best-case situation that we get out of this with out dropping a billion folks.

Meb: Later within the episode, he shared his ideas on how the Russia/Ukraine conflict could play out.

Peter: The Russians at all times had to do that. The Russian state in its present kind is indefensible. But when they will broaden out via Ukraine to locations like Poland and Romania, they will focus their forces within the geographic entry factors to the Russian area. Their concepts, if they will ahead place like that, then the Russian state can exist longer. And I feel, general, that could be a broadly correct evaluation on the Russians’ half. So it’s not that they’re not going to cease till they’ve all of Ukraine, it’s that they’re not going to cease once they have all of Ukraine.

Ukraine is rather like step 4 of a seven-part course of that entails a normal growth. Right here’s the issue for this yr. We all know from the way in which that the Russians have failed tactically within the conflict, that in a direct confrontation between American and Russian forces, the Russian forces can be obliterated, and would go away them with just one choice, escalation to contain nuclear weapons. And so we now have to forestall that from taking place. That’s the first motive why the Biden administration, and particular, and all of the NATO international locations usually, are transport so many weapons techniques into Ukraine for the Ukrainians to make use of. We simply have to forestall something that may make American forces face off in opposition to Russian forces.

And because the Russians in the end are coming for NATO international locations, meaning we now have to attempt to kill the Russian army fully in Ukraine. And that’s now official coverage. That’s mainly what Secretary Austin mentioned a few weeks in the past. Now, the issue we’re dealing with is that america army has not had to make use of a provide chain for normal warfare because the ’70s, since Vietnam. We’ve had quick intense conflicts the place we’ve gone in opposition to non-pure pat wars. And the kind of conflict of attrition that we now discover ourselves backing in Ukraine requires a distinct kind of gear sourcing. I feel the most effective instance are the Javelin missiles, which the Ukrainians love, which had been very efficient.

We have now already given the Ukrainians 1 / 4 of our complete retailer of that weapons system. And if we function the prevailing provide chain system to max out manufacturing, we would not have sufficient to interchange that system for over two years. The stingers are even worse. We’ve already given the Ukrainians a 3rd of our stinger stockpile. We don’t actually have a manufacturing provide chain for these anymore as a result of our military doesn’t use it as a result of we now have an precise Air Pressure. We offer stingers to 3rd international locations which are combating a distinct kind of battle from the sort that we design, simply establishing a brand new provide chain for a weapon that’s mainly been decommissioned from the U.S. Military’s standpoint, that’s going to take a yr simply to get going.

So we’re trying on the major weapons techniques that we’re offering that the cabinet goes to be naked someday earlier than the top of the summer season, perhaps into the autumn. And if the Ukrainians haven’t managed to interrupt the Russian army in that timeframe, then this conflict of attrition, the Russians have extra weapons, they’ve extra tanks, they’ve extra folks, and they’ll roll over Ukraine. So in some unspecified time in the future, in in all probability let’s name it September, October, the maths of this conflict goes to vary dramatically. Both the U.S. goes to should up its sport by way of involvement and dangers that direct battle, or it turns right into a partisan conflict, the place the Ukrainians have fallen, and so they’re combating from behind enemy traces now making an attempt to savage the Russian deployments from inside. Both manner, the extent of threat goes up considerably.

Meb: In one of many more moderen episodes, I talked with behavioral economist, Dan Ariely, concerning the ache of paying and why the benefit of how we pay for issues at the moment with Apple Pay and on-line ordering encourages folks to spend extra.

Dan: On day-to-day speak concerning the psychology of cash, I convey pizza and I cost the scholars 25 cents per chunk, and what do you assume occurs?

Meb: They simply take one monumental chunk and stuff it of their mouth.

Dan: Very, very massive bites, and so they don’t get pleasure from it, and so they don’t be taught from expertise since you sit there after the primary unbelievably massive chunk you didn’t get pleasure from and also you’re so tempted to push a little bit bit extra inside. And the ache of paying is that this actually attention-grabbing factor that will get us to get pleasure from issues kind of relying on the timing of cost and the way in which we pay. So if you consider the Apple Pay and Google Pay, much less salient, we don’t pay as a lot. We don’t give it some thought as a lot. There’s a research displaying that when folks pay the electrical energy invoice with a examine, they spend much less on power. And once they transfer to computerized deduction, they begin spending extra on power. What occurs, this one minute while you write the examine, you’re pissed off, you take note of the variety of the cash, you write the examine, you inform your youngsters shut the lights, do all these items, have a look at how a lot cash you’re losing.

If it’s coming out of your checking card, you don’t concentrate. You don’t know what it’s. So this saliency of cost to the society, we’re going away from saliency. The whole lot’s computerized within the background, subscriptions and so forth. It’s not essentially nice for us. There are some issues the place it’s nice, however not at all times. Typically it’s horrible. And we want to consider it in another way. By the way in which, as soon as I attempted to get… I educate at Duke College in a really large hospital. I used to be making an attempt to persuade them to have the operating invoice on one of many tv stations in sufferers’ rooms. Each time you get lunch, it updates. Each time you’re taking Tylenol, it goes up and so forth. And I needed to see whether or not folks wouldn’t get launched out of hospital sooner once they see that. By the way in which, they wouldn’t let me run that research.

Meb: Podcast listeners, we’ll submit present notes to at the moment’s dialog at mebfaber.com/podcast. When you love the present, if you happen to hate it, shoot us suggestions at [email protected]. We like to learn the opinions. Please overview us on iTunes and subscribe to the present anyplace good podcasts are discovered. Thanks for listening, pals, and good investing.