Journey Ink/DigitalVision through Getty Photos

Those that observe my work intently know that I’m an enormous fan of the midstream/pipeline area. The businesses on this area have quite a lot of benefits. Despite the fact that it’s pricey for them to develop, they obtain regular and dependable money flows. They really are money cows, and most of the gamers on this market commerce at low multiples. Despite the fact that it is not my favourite participant out there, one of many companies that I discover most attention-grabbing right here is Enterprise Merchandise Companions (NYSE:EPD). Again in Might of this yr, I reaffirmed my ‘purchase’ ranking for the inventory, mentioning that development and the low buying and selling a number of of the enterprise would probably propel shares greater.

Since then, shares have generated a return for buyers of solely 0.4%. That falls wanting the two.1% improve seen by the S&P 500 over the identical window of time. However given the time that has handed, I figured it will make sense to take a look at the corporate as soon as once more. And what I discovered makes me really feel much more assured in my long-term outlook for the agency. Given the totality of the image, I do imagine that preserving the corporate rated a strong ‘purchase’ is sensible at this time limit.

The image retains getting higher

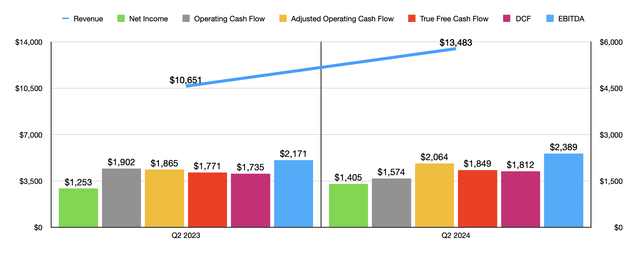

In my final article on Enterprise Merchandise Companions, buyers had been solely aware of information protecting by means of the primary quarter of the 2024 fiscal yr. However now that we’re three months out from that, outcomes now prolong by means of the second quarter. By virtually each measure that issues, Enterprise Merchandise Companions is doing a unbelievable job on a year-over-year foundation. For starters, income for the newest quarter totaled $13.48 billion. That is a rise of 26.6% in comparison with the $10.65 billion reported one yr earlier.

Writer – SEC EDGAR Information

This improve in gross sales was pushed by power throughout three of the 4 segments that the corporate has. Its NGL Pipelines & Companies phase, for example, reported a soar in gross sales from $3.69 billion to $4.27 billion. Its Crude Oil Pipelines & Companies phase additionally jumped properly, with gross sales increasing from $4.30 billion to $5.89 billion. And the corporate additionally noticed an increase in its Petrochemical & Refined Merchandise Companies phase from $1.88 billion to $2.72 billion. All mixed, greater gross sales volumes added $2.1 billion to the corporate’s income, whereas greater common gross sales costs contributed $814 million. The image would have been even higher had it not been for the weak point from the Pure Gasoline Pipelines & Companies phase. Income dropped from $775 million to $612 million. This drop was pushed by a $204 million hit due to decrease common gross sales costs of pure fuel. All of those aforementioned adjustments on a year-over-year foundation had been on the advertising aspect of the equation. However the firm additionally does present midstream providers. Income right here rose by $104 million, pushed largely by a $40 million enchancment in pure fuel pipeline property income.

With income rising, earnings for the corporate additionally expanded. Web revenue jumped from $1.25 billion to $1.41 billion. This is not to say that each profitability metric improved. Working money circulation is the oddball out, dropping from $1.90 billion to $1.57 billion. But when we modify for adjustments in working capital, we get a rise from $1.87 billion to $2.06 billion. One factor that I prefer to measure on this area is what I seek advice from as ‘true free money circulation.’ That is adjusted working money circulation, minus sustaining or upkeep capital expenditures, any most popular distributions, and sure non-controlling pursuits. 12 months over yr, this metric expanded from $1.77 billion to $1.85 billion. The same improve could be seen when DCF, or distributable money circulation. It grew from $1.74 billion to $1.81 billion. And eventually, EBITDA for the enterprise jumped from $2.17 billion to $2.39 billion.

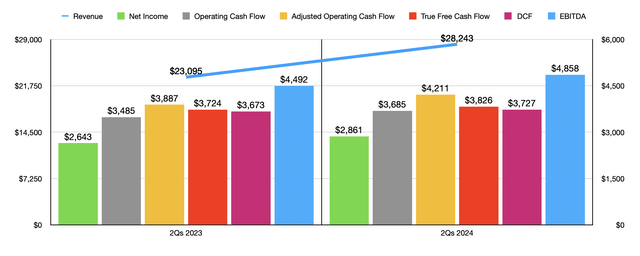

Writer – SEC EDGAR Information

Within the chart above, you possibly can see monetary outcomes for the primary half of 2024 relative to the primary half of 2023. This robust development on a year-over-year foundation exhibits that the second quarter by itself was not a one-time blip on the radar. The corporate is seeing significant growth in virtually each respect. However the huge query is what this implies for the remainder of the yr. We do not actually have any detailed steering. But when we assume that the second-half of this yr seems like the primary half did, we might anticipate adjusted working money circulation of $8.80 billion, true free money circulation of $7.79 billion, DCF of $7.71 billion, and EBITDA of $10.08 billion.

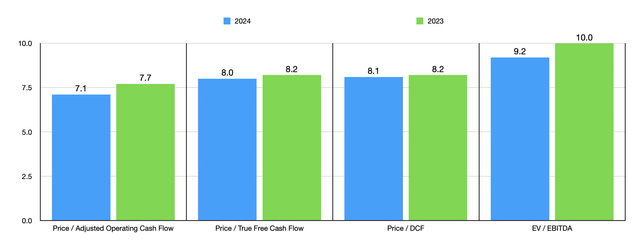

Writer – SEC EDGAR Information

With these figures, I used to be in a position to worth the corporate as proven within the chart above. Just about throughout the board, shares are attractively priced. However they don’t seem to be low cost, solely on an absolute foundation. They’re additionally close to a budget finish of the spectrum in comparison with comparable companies. Within the desk beneath, I checked out 5 such companies. On a worth to working money circulation foundation, solely one of many 5 firms that I in contrast it to ended up being cheaper than Enterprise Merchandise Companions. The identical holds true when wanting on the image by means of the lens of the EV to EBITDA a number of.

| Firm | Value / Working Money Movement | EV / EBITDA |

| Enterprise Merchandise Companions | 7.1 | 9.2 |

| TC Vitality (TRP) | 8.3 | 13.2 |

| Kinder Morgan (KMI) | 7.2 | 12.2 |

| The Williams Corporations (WMB) | 9.5 | 11.2 |

| Enbridge (ENB) | 8.7 | 12.8 |

| Vitality Switch (ET) | 5.3 | 8.6 |

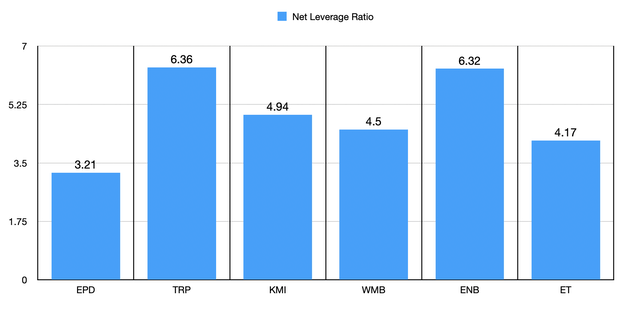

In evaluating Enterprise Merchandise Companions, there are another issues that we must be being attentive to. As an example, there are the explanation why one agency may commerce close to a budget finish of the spectrum whereas one other may commerce close to the costly finish. One such instance would contain leverage. Excessive quantities of leverage can justify a reduction, whereas low quantities can justify a premium. Effectively, within the chart beneath, you possibly can see the online leverage ratio not just for Enterprise Merchandise Companions, but in addition for a similar 5 firms I’ve in contrast it to.

Writer – SEC EDGAR Information

What I discovered was that, with a studying of three.21, Enterprise Merchandise Companions is the bottom of the group. And in reality, that is being conservative. I say this as a result of, if we use present internet debt and projected EBITDA for this yr, we might get a studying even decrease than this at 2.97. To place this in perspective, utilizing the 2023 figures, Enterprise Merchandise Companions must tackle a further $8.94 billion value of internet debt to have the identical internet leverage ratio of the following lowest of the 5 firms. That provides it an amazing quantity of wiggle room.

Writer – SEC EDGAR Information

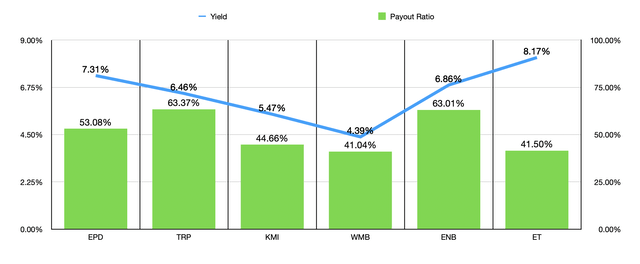

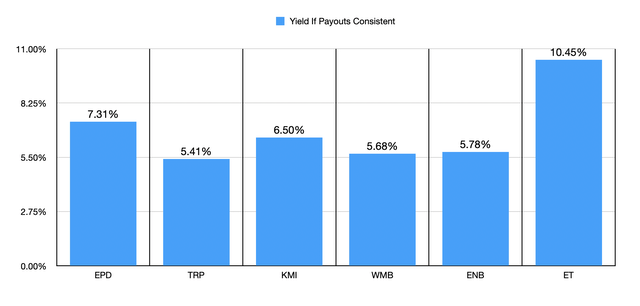

One other consideration must be the amount of money the corporate can distribute primarily based on its present spending plans. Within the chart above, you possibly can see the yield and distribution payout ratio for our candidate, in addition to for a similar 5 firms I’m evaluating it to. The distribution payout ratio is predicated on adjusted working money circulation. At current, Enterprise Merchandise Companions has the second-highest yield of the six companies. However one factor I love to do when wanting on the enterprise is to see what would occur for those who had been to alter the distribution such that the payout ratios can be constant from one agency to the following. Clearly, this depends on the idea that you may change the payout with out the share worth being impacted. But when we entertain that concept, then, because the chart beneath exhibits, Enterprise Merchandise Companions nonetheless has the second-highest yield out of the group. It is nonetheless a distant second to my very own private favourite, Vitality Switch, nevertheless it’s additionally comfortably forward of the third-place participant, Kinder Morgan.

Writer – SEC EDGAR Information

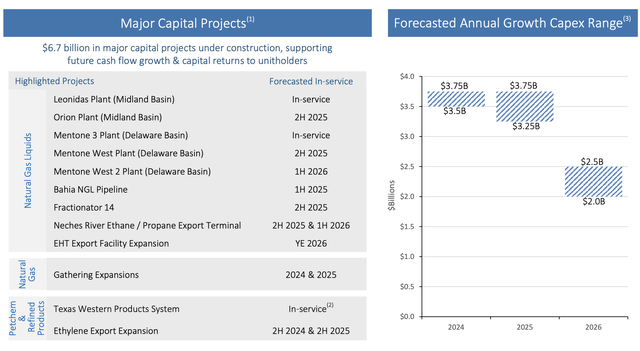

In all probability, Enterprise Merchandise Companions will proceed to not solely pay out its distribution, however to develop it. I say this as a result of the corporate has been paying consecutive distribution will increase for 26 years now. This comes at a time when administration has been profitable in preserving leverage low and has been profitable in allocating quite a lot of capital towards development initiatives. This yr alone, administration plans to spend between $3.50 billion and $3.75 billion on development oriented capital expenditures. Administration has achieved all of this whereas concurrently shopping for again inventory as effectively. In reality, within the second quarter by itself, the agency repurchased round $40 million value of items.

Enterprise Merchandise Companions

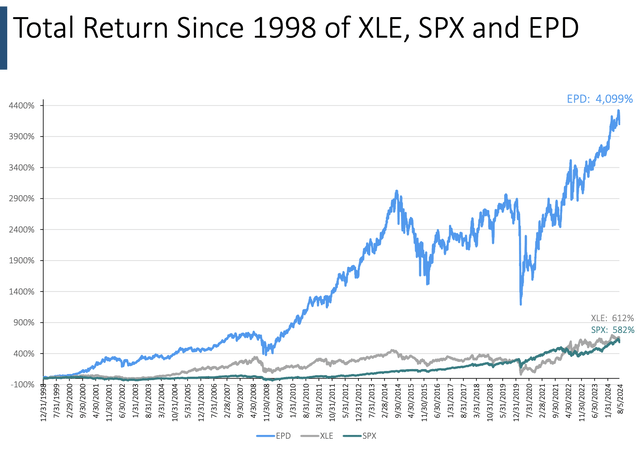

While you add into the combo the dividends the corporate has paid out, administration has efficiently returned $54.4 billion to shareholders over the past 26 years. To place that in perspective, the corporate’s market capitalization as of this writing is $62.35 billion. And shareholders have been effectively rewarded by this. In reality, the overall return achieved by the inventory from the top of 1998 by means of August fifth of this yr has been 4,099%. That dwarfs the 582% achieved by the SPX and the 612% achieved by the XLE.

Enterprise Merchandise Companions

This isn’t to say that robust development will all the time be on the desk. Administration does have plans to gradual this down finally. Or no less than that is the present plan. Subsequent yr, the corporate can even spend as a lot as $3.75 billion on development tasks. Nevertheless, that quantity may very well be as little as $3.25 billion. However for 2026, administration is forecasting spending of between $2 billion and $2.5 billion. Despite the fact that this may be disappointing to some buyers, this does imply that the corporate can have extra capital to deal with debt discount and/or direct shareholder returns.

Takeaway

Essentially talking, Enterprise Merchandise Companions is about nearly as good as you get with regards to an organization. The agency is a money cow that is rising at a pleasant clip. Leverage is decrease than what most comparable companies have. Shares are attractively priced, and the corporate is paying out a hefty quantity of capital on to shareholders. Given this mix of things, mixed with administration’s development plans, I’ve no drawback preserving the corporate rated a really strong ‘purchase’ proper now.