bjdlzx

Introduction

You know how it is with oil and gas producers, right? Their profits and revenues are sort of at the mercy of the grander commodity market. They don’t really get to call the shots on pricing. However, the truly competent ones can still churn out profits across oil price cycles and build up value for their shareholders. And I believe Enerplus Corporation (NYSE:ERF) is one of those savvy operators that has shown expertise in navigating these market fluctuations. As they gear up for their quarterly earnings release, things might look a bit gloomy with a predicted sizeable drop in profits. But, in my opinion, they might still have a few tricks up their sleeve to keep shareholders smiling.

Anticipated Earnings Dip

Enerplus Corporation, an independent oil and gas exploration and production company, is headquartered in Calgary, Alberta. The company’s operations primarily center on hydrocarbon production from North Dakota’s Bakken Shale and Pennsylvania’s Marcellus Shale. Predominantly, nearly 70% of its production stems from the oil-rich Bakken formation. It’s clear that Enerplus has a production profile that leans heavily towards liquids rather than natural gas, with the former constituting 60% of its output in Q1-2023.

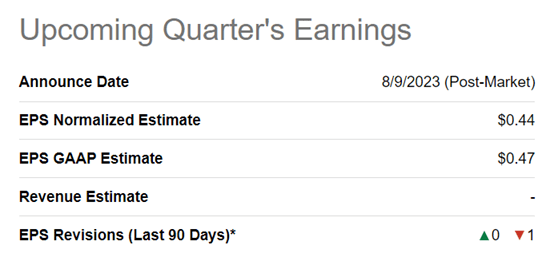

Enerplus is poised to announce its second-quarter results following the market closure on August 9. Analysts project the company will report earnings of $0.44 per share, which signifies a substantial decline of 37% from the $0.70 per share reported in Q2-2022. Although there are currently no revenue estimates available, I think the company might report a proportional decrease.

Seeking Alpha

I believe the forecasted dip in earnings makes sense in light of the company’s operations amid a lower oil and gas environment. The WTI spot oil price averaged at $74 per barrel in Q2-2023, down considerably from $109 a barrel during the same period in 2022 and slightly below the $76 in Q1-2023. The Henry Hub natural gas spot price also experienced a decrease, averaging at $2.16 per MMBtu in Q2-2023, a notable reduction from $7.48 in Q2-2022 and $2.65 in Q1-2023. Consequently, Enerplus is likely to report decreased levels of realized commodity prices as compared to the previous year’s quarter and the preceding quarter. This is primarily due to the significant YoY decrease in spot prices, which will result in a considerable plunge in the company’s earnings. The YoY decline will likely overshadow the sequential drop.

Nevertheless, a significant strength of Enerplus lies in it being a low-cost operator with a high-quality asset base. The company extracts the majority of its Bakken production from the Little Knife and FBIR regions, which are among the most cost-effective shale oil producing plays in North America. In these regions, Enerplus maintains an inventory of oil wells with an average breakeven price of $40 a barrel or lower. Consequently, at a realized oil price of $75 a barrel, the company is capable of generating substantial profits

Production Activity

In my view, Enerplus’s production will align closely with its annual goal of 93,000 to 98,000 boe per day. It’s worth noting that the company recorded production of 97,700 boe per day in Q1-2023, nearly reaching the upper limit of its guidance, and 94,100 boe per day in Q2-2022, which was closer to the lower limit. The year-over-year comparison is likely to reveal the adverse effects of the sale of Canadian properties in Q4-2022, which were yielding 6,400 boe per day (78% liquids), as well as the reduced activity in Marcellus.

Nevertheless, the second quarter was projected to be a pivotal time for drilling activity, as it would lay the groundwork for an increase in oil production in the latter half of the year. I think this aspect is worth the attention of investors, as it could establish a promising trajectory for future production and earnings. During the second quarter, the company planned to conduct extensive well completion work and bring 20 net operated wells into production in the Bakken shale region. While this may not greatly influence second quarter production, it should begin to propel the company’s oil production upward from the third and fourth quarters. Updates on the progress of North Dakota’s completions program are likely to be provided in the earnings release and during the conference call.

Cash Flow Dynamics

It’s worth noting that the extensive drilling and completion operations conducted in the second quarter could drive Enerplus’s capital expenditures higher for the period. As a reminder, the company has allocated a capital expenditure budget of $500 million to $550 million for this year, with 95% earmarked for the Bakken region. In the first quarter, it allocated $138.6 million, approximately 26% of the annual budget of $525 million (the midpoint of the guidance). However, due to the ramp-up in drilling and completion activities, the expenditure might increase in the second quarter.

This spike in capital expenditures might also negatively affect Enerplus’s free cash flows. The company reported a free cash flow (FCF) of $121.8 million in Q1-2023 and $162.9 million in Q2-2022. But with diminishing earnings, resulting in reduced cash flow from operations, and increased capital expenditures, the company’s FCF is expected to decline both year-over-year and sequentially.

Despite this, the dip could be transitory, and we might see an improvement from the second half of the year as capital expenditures stabilize and production improves. In essence, even though the free cash flows may decline, the overall outlook could be favorable.

Generating Shareholder Value

The Free Cash Flow (FCF) is an important metric for investors to track as it forms the basis of shareholder returns through dividends and buybacks. It’s worth noting that Enerplus is dedicated to returning at least 60% of its free cash flows in 2023 to shareholders in the form of dividends and buybacks. The company allocated roughly $67 million in the first quarter for dividends and buybacks, with the lion’s share channeled towards the latter. This decision stems from the management’s belief that the company’s shares are considerably undervalued and buybacks are the most effective strategy for generating shareholder value. Enerplus has successfully reduced its outstanding shares by 16% since it resumed its repurchase program in 2021, and I anticipate this trend will persist going forward.

Concurrently, Enerplus has been focusing on fortifying its balance sheet by curbing its net debt (debt minus cash). The company deserves commendation for reducing its net debt by 32% from the end of last year to just about $151 million ($203.2 million in debt minus $52.6 million in cash) at the end of Q2-2023. Should the company sustain its free cash flow generation, cash reserves are likely to increase, leading to a further decrease in net debt.

Concluding Remarks

Enerplus’s proficiency in profitable oil drilling, its ability to generate free cash flows, conduct share buybacks, and reduce debt has worked well, enabling its shares to outperform its competitors. The company’s shares have returned 3.3% this year, significantly outshining other exploration and production companies whose shares, as tracked by the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), have declined by around 7% this year. Although I believe that softness in oil prices may exert pressure on the company’s shares, I anticipate its continued outperformance in the future.