sankai

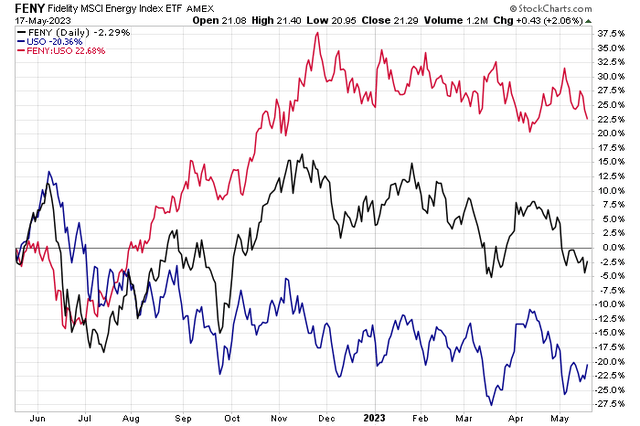

It has been nearly a year since oil prices peaked near $120 per barrel. Since that climax in June 2022, Energy sector equities are firmly lower. On a year-on-year basis, the Fidelity MSCI Energy Index ETF (NYSEARCA:FENY) is down marginally. Compared to the price of oil (using The United States Oil Fund (USO) as a proxy), oil and gas stocks have performed decently in the last 52 weeks. Since December, though, investors have shunned the cyclical-value sector.

I see FENY as a hold today as oil prices hold the $70 level despite a higher dollar. Also, the ETF’s price-to-earnings ratio is modest with strong free cash flow among constituents of the fund. The downside is a clear trend reversal that is taking shape.

Oil Stocks Fading Last 6 Months

Stockcharts.com

According to the issuer, FENY seeks to provide investment returns that correspond, before fees and expenses, generally to the performance of the MSCI USA IMI Energy Index. Investing at least 80% of assets in securities included in the fund’s underlying index. The fund’s underlying index represents the performance of the energy sector in the U.S. equity market.

FENY is one of the most inexpensive Energy sector funds you will find. Its net annual expense ratio is just 0.08% and the fund houses a respectable $1.4 billion in assets under management. With its inception some 10 years ago, it has a solid track record of following its index. What’s more, the median 30-day bid/ask spread is just 5 basis points while 90-day mean volume is slightly more than 750,000 shares. Income investors will like the portfolio’s 3.8% yield – more than twice that of the S&P 500. I like it’s exposure to all market cap sizes and very low cost.

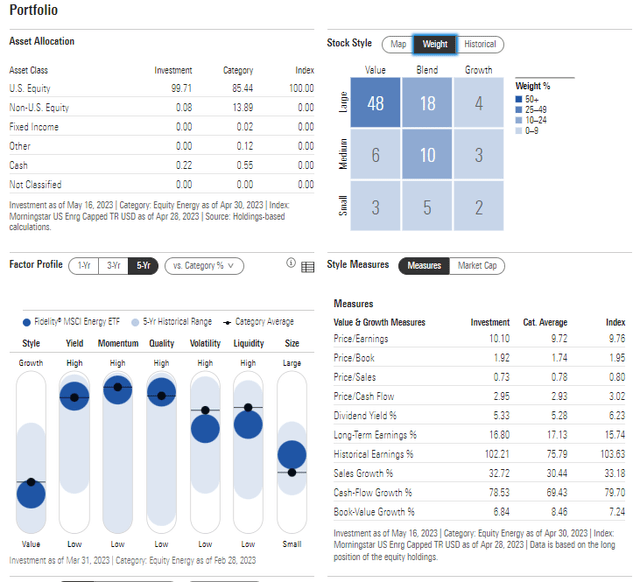

A 4-star gold-rated ETF by Morningstar, the ETF’s allocation plots in the upper-left portion of the Style Box. With that large-cap value tilt, expect FENY to perform well amid rising interest rates and expectations of better economic growth at large. The fund’s low 10.1 P/E and ample cash flow growth are appealing while its yield, momentum, and earnings quality factor metrics are high.

FENY: Large-Cap Value, Strong Free Cash Flow Growth

Morningstar

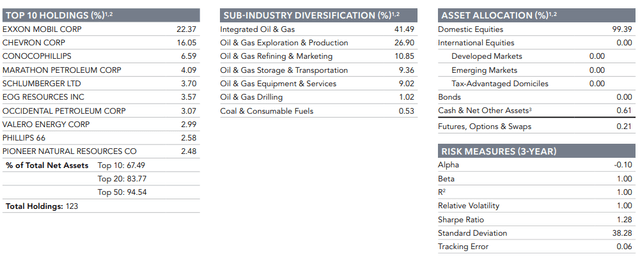

It is important to recognize that Exxon Mobil (XOM) and Chevron (CVX) comprise more than 28% of the portfolio, so it is concentrated. The major integrateds sum to more than 40% of the fund in this US-focused energy ETF.

FENY: Some SMID Exposure, But Primarily Large-Cap

Fidelity

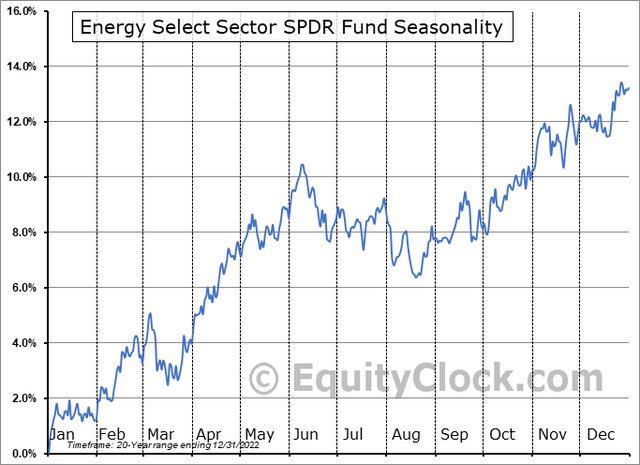

Seasonally, the Energy sector (as measured by the Energy Select Sector SPDR ETF (XLE) due to its earlier inception versus FENY), tends to peak in early June, according to Equity Clock. Shares typically decline into mid-August before staging a year-end rally. So, now may not be the ideal time to place bullish wagers on this cyclical niche.

Energy Sector Stocks: Bearish Seasonal Trends Starting In June

Equity Clock

The Technical Take

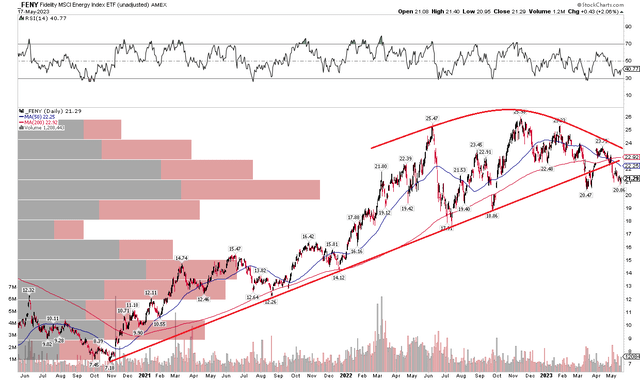

While I like the valuation of energy equities, the chart of FENY is concerning. Notice in the graph below that a bullish to bearish reversal appears underway. After making a minor new high in Q4 last year, a bearish trendline break in the past two months helps confirm a trend inflection. The 200-day moving average will likely turn negatively sloped in the weeks ahead.

Near-term, investors should monitor how the fund performs on an approach of the March low just above $20. While I do not see a definitive support zone, I would like to see FENY rally back above the recent rebound high near $24 to help negate the bearish reversal.

FENY: Bullish to Bearish Reversal, Trendline Break

Stockcharts.com

The Bottom Line

I am a hold on the Energy sector and FENY right now. I like the valuation and how oil prices are hanging in there despite macroeconomic jitters, but price action in the ETF is lackluster at best currently.