RHJ

Last week, I published “Cameco: Uranium Market Hype Clashes With Weakening Fundamentals,” which detailed my bearish outlook for the uranium sector and the giant Cameco (CCJ). Many uranium market investors do not understand the market’s supply elasticity. A slight increase in uranium production associated with the recent rally likely pushes uranium back into a glut, reversing all or most of its recent gains.

In this article, I’d like to focus on the US uranium stock Energy Fuels (NYSE:UUUU), which remains extremely popular with “U-Bulls.” I will not restate all of my macroeconomic views regarding uranium, so please look to the previous set of articles for that information. However, to summarize, with uranium over $90/lbs, output from North America, primarily from Cameco’s Canadian operation, will likely put uranium back into a glut this year.

For the most part, uranium demand is fixed, only rising or falling slowly (1-2% per year) with the small global changes in nuclear facilities. However, uranium as a mineral is highly abundant, and for decades, North American uranium miners have been waiting on the sidelines to ramp up production once it becomes profitable. The amount of US production capacity alone is tremendous compared to demand, making the risk of a glut greater than that of a shortage. Consider that the recent uranium rally was driven by a shortage created by the shutdown of Cameco’s Canadian mine, which was restarted last year and is now starting to bring significant supplies back onto the market, with production expected to increase by ~12% this year, and demand only rising at a CAGR of ~3.5%.

Thus, as the fundamental laws of economics hold, it is unsurprising that uranium prices are now crashing. See below:

Uranium Price (TradingEconomics.com)

At the end of last year, uranium was one of the favorites in the energy sector. Around December, I became skeptical of the rally and turned bearish in early January, right around the market peak.

Of course, Cameco is only a tiny component of the total speculative activity around uranium mining stocks. In the US, a great deal of focus is on the most prominent US uranium mining company, Energy Fuels, which is also working on developing strategic metal facilities. Interestingly, most analysts are bullish on Energy Fuels despite its terrible performance record. With that in mind, I believe it is an ideal time to take a closer look at the stock.

Uranium is Up, So Show Me The Money

I have a history with Energy Fuels. In 2019, I was very bullish on UUUU, believing it would rally as the Trump administration began efforts to improve US uranium mining capacity, potentially granting UUUU government benefits. It was worth $2.04 then, eventually rising by over 4X, though it is currently 200% higher than when I was bullish. That said, I downgraded UUUU to a “hold” later, then turned bearish in November of 2021, which was, almost to the day, UUUU’s highest price point this decade at $10.76. It has been down 43% since then.

There is a degree of luck with that. However, I argue that, compared to other markets, the uranium market has much less market efficiency. Uranium is driven by its weird economics, so institutional analysts avoid it. Additionally, most publicaly traded uranium miners, not called Cameco, are relatively small and highly volatile due to their lack of profitability. Indeed, as I noted in my recent Cameco article, I feel retail investor sentiment is deliberately skewed in the market by some to raise prices to sell equities and raise cash to offset these firm’s chronic losses.

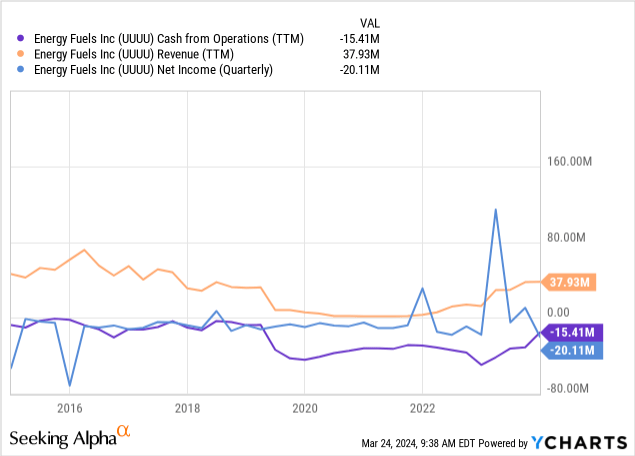

While I would not relate that point to UUUU specifically, it is worth pointing out that it does not make money. Energy Fuels consistently has negative operating cash flow and had almost no revenue from 2019 to mid-2023, as most of its facilities were shut down due to low uranium prices. See below:

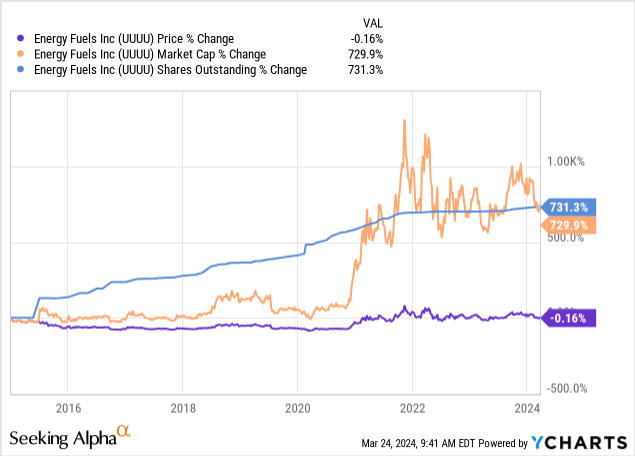

To offset chronic losses, Energy Fuels must consistently dilute equity. Since 2015, Energy Fuel’s market capitalization has risen by ~730% to over $1B. Its stock price is unchanged, as its market value has only increased due to equity dilution. Historically, UUUU dilutes the most as its stock price rises, taking advantage of a higher valuation to raise cash. See below:

Luckily, UUUU has only performed minor dilutions recently following its small equity rally last year. Of course, with its market capitalization so high, Energy Fuels must only sell a small amount of stock to raise sufficient cash to offset its negative operating cash flows. Its operating cash flows have also improved over the past year with increased production at higher uranium prices.

That said, it remains unprofitable. Energy Fuels does not publish its breakeven, but it is likely around $90/lb, as is typical with North American miners. Energy Fuels has waited for prices to get closer to this level and ramped up output at many of its mines toward the end of last year.

Of course, we have the economic issue of inelastic demand and highly elastic supply. A slight increase in supply is enough to create a significant glut, as uranium demand will not rise should prices slip. The vast majority of global uranium comes from central Asia, which has lower costs. Arguably, central Asia produces just below the needed level to sustain demand. However, if prices rise enough, the potential North American supplies are far too high, creating the cycle we’ve seen in uranium prices since the 2000s.

To me, it is unlikely uranium remains above $80, as that is likely to price where Cameco will allow its Canadian mine to operate, which is large enough to maintain global demand. Without government regulation that stops all foreign uranium, tariffs, or subsidies, I do not think there is a feasible economic situation where Energy Fuels can profitably sell uranium until either central Asia runs out or demand rises significantly, which is highly unlikely in the next decade.

Banning Russian uranium should not impact the US market for raw uranium. Russia does not export raw uranium; it exports enriched uranium mined in Kazakhstan. Banning Russian-enriched uranium would undoubtedly cause a shortage of enriched uranium that spurs the development of US uranium refineries. However, the enriched uranium market is not the raw market, as uranium enrichment is well over 99% of the actual uranium fuel cost, with raw uranium being inconsequential. Speculation on this point may cause UUUU and others to rise, but it should not impact raw uranium prices.

The Bottom Line

Overall, I remain bearish on Energy Fuels. I argue that the recent rally in uranium prices is a net negative for the company. Paradoxically, because high uranium prices fueled speculation surrounding mining profitability, Energy Fuels has restarted many of its mines. That choice appeared reasonable months ago when uranium was over $100/lb. Still, now that it’s falling, I suspect that Energy Fuels will see higher costs due to ramping production but limited revenue improvement, causing its losses to widen.

Some argue that Energy Fuels makes a few million dollars per year from other minerals such as Vanadium. However, a few million dollars is nothing for a company valued at $1B. Indeed, even if uranium mining were profitable, I do not think Energy Fuels has sufficient capacity to earn a significant and steady profit, given its revenue has never been much over $70M.

A very small number of analysts predict that Energy Fuels will see its revenue rise to $200M to $400M by 2025-2030, but that would require uranium remaining well over $90/lbs, which seems unlikely given its economics. The company is involved in an Australian REE project to develop a mine that will funnel to Energy Fuel’s mill. However, the expected payoff of this investment remains unknown and likely lower than many speculators hope.

Thus, I believe the UUUU rally is not founded on fundamentals, but instead hopeful speculation that largely overlooks uranium’s abundance of standby supplies. I would not short UUUU because it is subject to too much retail investor speculation that could cause it to rally. Energy Fuels also has over $200M in working capital, mainly cash, since its equity dilutions.

So, the company should not have liquidity concerns in the foreseeable future. Without a massive change to the US nuclear infrastructure (requiring significant government attention), I do not believe Energy Fuels will deliver consistent profits comparable to its market capitalization.