AntonioSolano/iStock via Getty Images

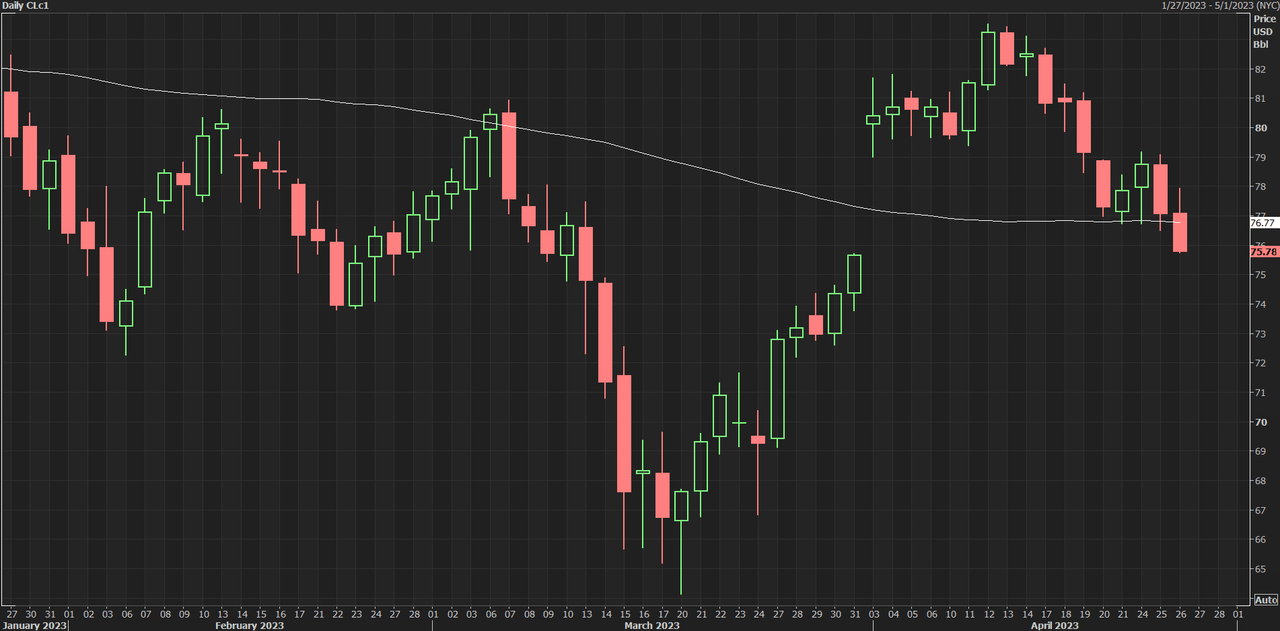

With a further decline in Wednesday’s intraday action, oil prices (CL1:COM) have erased the gains posted earlier in April and fallen below a key technical barrier. The slide has weighed on ETFs tied to the commodity.

Oil declined 2% in Wednesday’s trading, falling to the $76 per barrel range and dropping below its 100-day moving average. With the latest slide, oil is now down 9.3% since reaching a multi-month high on April 12.

Meanwhile, the popular broad-spectrum Energy Select Sector SPDR Fund (NYSEARCA:XLE), with its $38.46B assets under management, had dropped along with its key commodity. XLE has found itself lower by 1% on Wednesday and down roughly 5% since its April trading high.

Outside of XLE, other energy-focused funds have also eased gains posted earlier in April. Here is a list of some of the most high-profile examples:

- US Brent Oil (NYSEARCA:BNO) -9.1%.

- US Oil Fund (NYSEARCA:USO) -8.3%.

- US Oil Equipment & Services iShares ETF (IEZ) -6.3%.

- S&P Oil & Gas Eqpt & Services SPDR (XES) -6.1%.

- Vaneck Oil Services ETF (NYSEARCA:OIH) -6%.

See below a chart outlining oil’s recent slide. In related news, the American Petroleum Institute reportedly showed a draw of 6.1M barrels of oil in U.S. commercial stockpiles for the week ending April 21.