yoh4nn/E+ via Getty Images

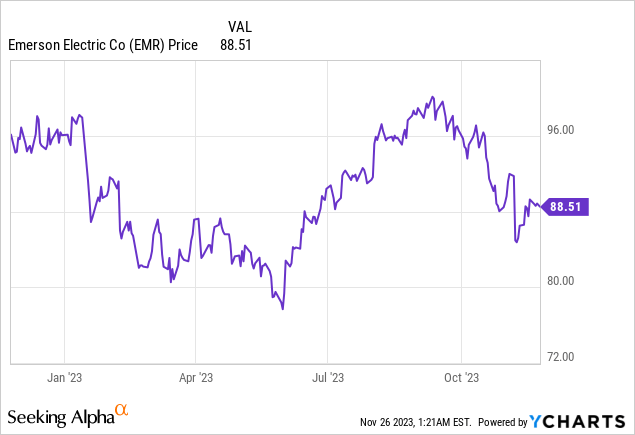

Emerson Electric (NYSE:EMR) reported earnings on November 7 for their fiscal year ending September 30, announcing adjusted EPS of $4.44, a 22% increase over fiscal 2022. Net sales were $15.2B for the year, generating $2.36B in free cash flow. The fiscal year saw many milestones as the company continues to transition to a pure-play industrial automation company. Shares are down 7.9% since the beginning of the year due in part to concerns that the company overpaid for their acquisition of National Instruments and a stake in Aspen Technology. Shares trade at a ~19x multiple of 2024 free cash flow guidance recently provided by the company, which may provide investors with a reasonable entry point if the company can execute on their transformational plans.

Transitions – Buying

Emerson completed their contentious acquisition of National Instruments for $60 per share on October 11, a 25% premium on the $48 that was offered in May of 2022. The deal came after National Instruments implemented a poison pill strategy in January. While National Instruments shareholders benefited from the negotiations, the increased price may have negated most of the value Emerson stood to gain from the transaction.

Emerson paid $8.2B in equity value for National Instruments, equaling 4.9x National Instrument’s 2022 sales of $1.66B. The valuation looked even worse on a free cash flow basis, as National Instruments’ cash flow generation had been falling in recent years. Excluding 2022 as an anomaly, the 5-year average free cash flow generation between 2017 and 2021 was still only $166MM, which would be a price to free cash flow of over 49x. Emerson believes they can realize $165MM in synergies from the transaction by the end of year five, but it will come at the cost of an additional $155MM in expenses. R&D efficiency has been called out as one area of opportunity, as National Instruments spent ~20% of revenue on R&D. For comparison, Fortive (FTV) spends 6.9% of revenue on R&D.

| Year | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

| CFO (millions) | $42.96 | $143.5 | $180.8 | $224.4 | $274.6 | $224.4 |

| FCF (millions) | -$5.2 | $102.5 | $131.1 | $163.5 | $239.9 | 194.2 |

Although the price of the acquisition may be questionable, the strategic fit makes sense. The heritage National Instruments business had 68% gross profit margins versus 46% for Emerson and annual sales are expected to grow at a rate of 2-3% faster than Emerson. Further, the technology is highly complementary to Emerson’s measurement and control technology portfolio.

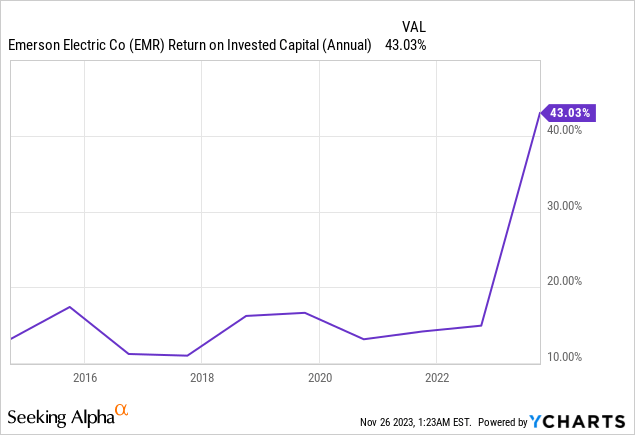

Similarly, Emerson appears to have overpaid to acquire a 55% stake in Aspen Technology (AZPN) in 2022. Aspen Technology has a market cap of $11.8B, but Emerson paid $6B and contributed their Open Systems International business, which they paid $1.6B for in 2020, and Geological Simulation Software business in 2022. Aspen Technology generated $292MM in free cash flow for their latest fiscal year ending on June 30, 2023, of which $160.6MM is attributable to Emerson. Aspen Technology is targeting free cash flow in excess of $360MM for fiscal year 2024, which would put Emerson’s cut at ~$200MM and would equate to an acquisition price of well over 30x free cash flow. Aspen Technology had 64.2% gross profit margins in fiscal 2023 and the process optimization software is in a position to see growth in the coming years, but it is hard to justify the valuation. Emerson’s return on invested capital has hovered in the teens in recent years, but will likely be closer to 10% in 2024 given the large amount of goodwill from these two transactions – the most recent value is artificially high due to the Climate Technologies transaction.

Transactions – Selling

Emerson paid for their recent acquisitions in part with profits from the sale of two of their businesses. InSinkErator was sold to Whirlpool (WHR) for $3B in October of last year. The business is expected to deliver $100MM in free cash flow to Whirlpool, so Emerson appears to have obtained a good price for the business.

Emerson also did well in receiving $9.7B pretax and a $2.25B face value seller note from Blackstone for 60% of their Climate Technologies business in a transaction that closed in May of this year. Climate Technologies generated ~$675MM in free cash flow in 2022, meaning Emerson was paid over 24x trailing FCF for the business. Selling two businesses that don’t align with the current business strategy for more than 20x free cash flow should be considered a positive move for shareholders.

Shareholder Returns

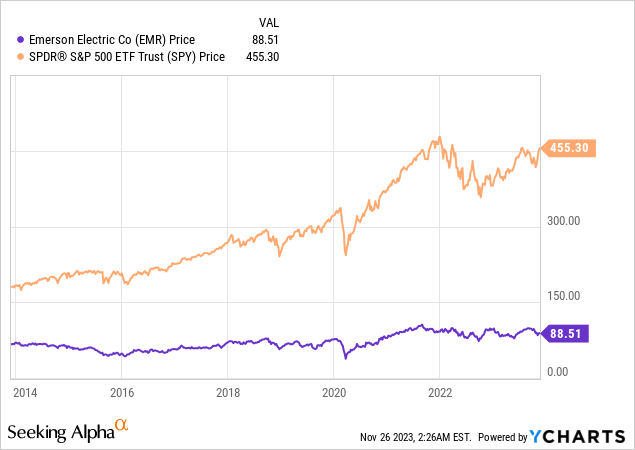

Emerson’s total shareholder returns have significantly lagged the S&P 500 over the last decade, likely one reason the D. E. Shaw group took up an activist investor campaign against the company in 2019.

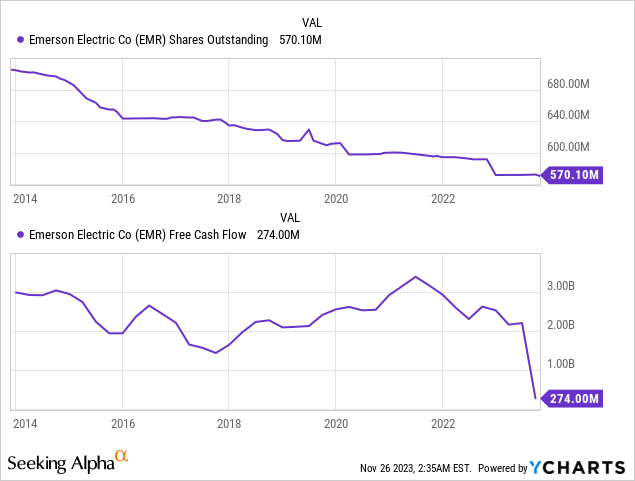

Share repurchases have played a major role in Emerson’s shareholder total returns strategy. The company has retired 19% of shares outstanding in the last decade, going from 703,964,498 shares in October of 2013 to 570.1 million shares at October 31, 2023. The company indicated that they intend to spend another $500MM on share repurchases in fiscal year 2024. The reduction in share count has helped to offset declining free cash flow generation over the same period.

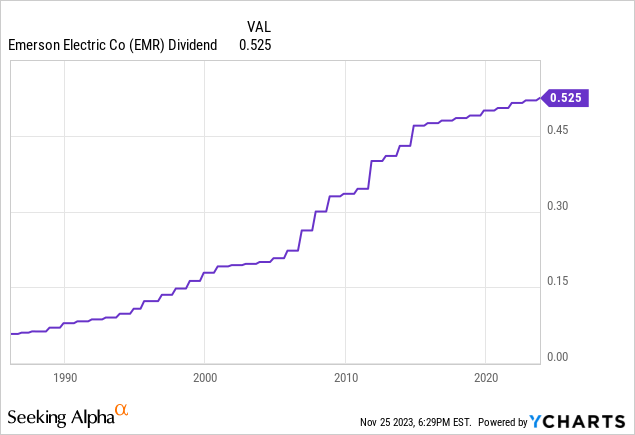

The company’s forward dividend yield of 2.37% and anemic dividend growth of 2.5% per year over the last decade have not helped shareholders. Emerson increased their quarterly dividend by half a cent to $0.525 per share, marking 67 consecutive years the company has increased their payout. The dividend will consume ~$1.2B in cash next year and the company is projecting fiscal 2024 free cash flow of $2.6-$2.7B, putting Emerson in good position to increase dividend payouts at a faster rate in the future in my view.

To Buy or Not?

I applaud Emerson’s decision to divest non-core businesses at attractive valuations and I agree in principle to reinvesting the proceeds into higher margin, complementary businesses. However, the company appears to have been overly aggressive in their valuation of National Instruments and the stake in Aspen Technology. The lack of price discipline in M&A is concerning, particularly when the company has made over 20 acquisitions in the last seven years.

That being said, Emerson is putting together a stable of brands that generate good margins and should benefit from secular growth in industrial automation. The company provided 2024 free cash flow guidance of $2.6 to $2.7B, which would equate to a share price of less than < 20x 2024 free cash flow. There is ample opportunity for share value growth after a lost decade, and I initiated a small position recently when shares traded under $85 based on my belief that the company is primed to return to growth. I will be keeping a close eye on cash flow generation and will adjust my share position based on Emerson’s ability to execute on their growth plan.