Marco VDM

Those who follow my analyses know that the sectors I focus on the most are climate transition and renewable energy. In my endeavor to cover actions in these sectors as extensively as possible, I came across Emeren Group (NYSE:SOL), a company with a troubled past but, in my opinion, a promising future. It was formerly a giant in the OEM production of photovoltaic panels that had to change its business model over time to avoid bankruptcy. Six years after the storm that hit the company in 2017-18, I believe there are now prerequisites for a good investment.

My investment thesis is based on two main elements:

- Margins are improving significantly due to strategic choices that are proving correct.

- There are important catalysts related to the environmental policies of the geographic markets the company has decided to focus more on in the past two years.

Given this fundamental improvement, I believe the valuation is still very attractive. Emeren (formerly known as ReneSola) remains a risky investment, but even considering these risks – which I address in the last paragraph of the analysis – I believe it’s appropriate to start my coverage with a BUY rating.

A Pivot in the Business Model

Until 2017, the primary business of Emeren Group was the OEM production of photovoltaic panels. With over $1.5 billion in revenue at its peak expansion, it was considered one of the most important solar panel manufacturing companies in the world.

However, this branch of the company also became heavily indebted over time. The stock price began to plummet due to bankruptcy fears, until then Chairman and CEO Xianshou Li offered to buy the manufacturing business. This transaction eliminated $452 million of Emeren’s debt, which was then still called ReneSola, as well as $217 million in intercompany payables that ReneSola owed to the ReneSola Singapore division.

The deal with its former CEO allowed the company to survive but with completely different numbers, relying solely on the design and construction of photovoltaic systems business. A capital-light business, the company focused mainly on decentralized systems in China and the US.

In recent years, ReneSola – renamed Emeren in February 2023 – continued to improve its competitive position in its new business segment. Specifically, it chose to sell most of its photovoltaic assets in China and focus on three guidelines:

- Shift more focus to the European market, which offers a good mix of favorable policies and high margins.

- Become an Independent Power Producer, realized in late 2022 with the acquisition of the 50 MW Branston plant, which already has a 4-year PPA in place.

- Be one of the first companies in Europe to emphasize energy storage projects, a decision that yielded significant contracts in Italy and Poland.

Simultaneously, the company is trying to cut as much of the ECP branch as possible, where margins are nearly non-existent, and continue reducing exposure to the Chinese market.

Financials

Below is a table with some of the most important financial data related to Emeren, all following the sale of the manufacturing division.

| Dec 2018 | Dec 2019 | Dec 2020 | Dec 2021 | Dec 2022 | TTM | |

| Revenue | 96.9 | 119.1 | 73.5 | 79.7 | 61.3 | 96.3 |

| Gross profit | 28.1 | 34.2 | 16.7 | 31.4 | 15.3 | 24.8 |

| Operating Income | 15.2 | 9.5 | -7.3 | 13.3 | -2.5 | 2 |

| EBITDA | 23.6 | 17.3 | 0 | 20.1 | 4.4 | 12.9 |

| Net income | 1.8 | -8.8 | 2.8 | 6.9 | -4.7 | 5.4 |

| Cash & Equivalents | 6.8 | 24.3 | 40.6 | 254.1 | 107.1 | 60.5 |

| Total Debt | 176.1 | 121.3 | 115.6 | 57.9 | 70.5 | 61.3 |

| Net debt issued (repaid) | 55.5 | -63.3 | -11.3 | -51.8 | -17 | -17 |

As can be seen, revenues decreased between 2018 and 2022 due to a series of asset sales aimed at repaying debt. It seems Emeren learned its lesson: balance matters. In 5 years, the company managed to repay 65% of its total debts and has now finally started to grow again.

For FY 2023, as reiterated in the latest earnings call, management expects revenue in the lower-end of the $154-174M range. This represents at least a 59.91% increase in revenue compared to 2022, maintaining a gross profit margin of 35-40% due to high energy prices in Europe. Even looking at the coming years, management expects a gross profit of 27-30%.

The company now appears to be consistently profitable and much less indebted than before. There are the prerequisites to grow both the top-line and bottom-line, and the guidelines the management is relying on seem right to push revenue and net income upwards.

Valuation

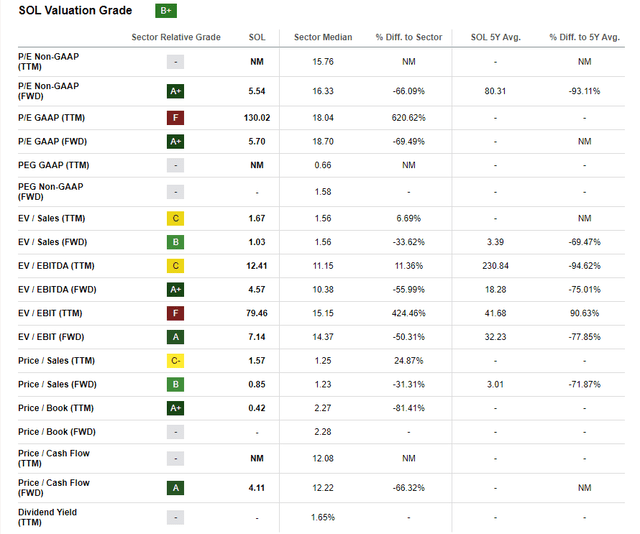

The very attractive valuation of the company is the first element on which I based my bullish rating. Below are the main data on the valuation of Emeren Group, always taken from Seeking Alpha.

Seeking Alpha

The forward P/E of 5.70 is based on the management’s estimates for FY 2023 confirmed in the latest earnings call, and there is no reason to think things could get worse in the coming years. The same goes for the price/EBITDA ratio.

One of the most enticing valuation elements is the price/book ratio of 0.42: thanks to meticulous debt reduction, today’s market capitalization is literally less than what would be obtained by selling all Emeren assets and repaying all debts.

Combining the multiples related to profitability, growth prospects, and the extremely value-territory price/book ratio, I believe that Emeren’s valuation is significantly low compared to the fundamentals and future prospects of the company. This could be due to the management’s need to regain the trust of financial markets after what happened in 2017.

Two catalysts are in sight

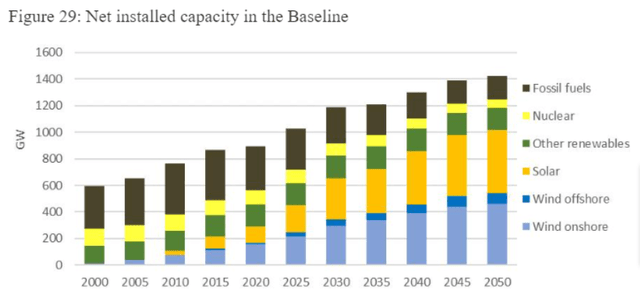

The fact that Emeren’s financial data is improving quarter by quarter is directly related to the strategic choices we discussed. The European Union shows very attractive fundamentals for renewable companies: the EU is heavily investing in the sector, margins are high due to the high energy price, and it recently raised its renewable production targets for 2030.

By raising the renewable targets, the EU automatically had to adjust its focus on energy storage. Both are two big positives for Emeren shares.

1. Expansion of Key European Market

Emeren made it very clear in all its latest earnings calls: for the past two years, the European Union is the key market the company wants to invest in. Entering Australia is also being evaluated, but essentially, the EU will receive most of the management’s attention.

Recently, the European Union revised its targets for renewable energy production by 2030. The target was revised from 32% to 42.50%, in an initiative called RePowerEU aimed at reducing energy dependence from non-EU countries. As noted from the official document accompanying the announcement, a substantial increase in both wind and photovoltaic energy capacity is expected.

Europa.eu

2. Strong Entry into the World of Energy Storage

Emeren entered the world of energy storage two years ago, but the first revenues effectively arrived this year. The company operates in Italy and Poland, which management sees as the two main European markets in terms of energy storage over the next few years. Margins in this business line have been 35-40% so far, and both Italy and Poland have good news on the way.

Italy doubled its energy storage capacity in H1 2023 and announced a plan to produce even 65% of the national energy demand from renewable sources by 2030. Being historically one of the main importers of Russian natural gas, Italy needs to accelerate its energy transition to renewables.

Poland recently inaugurated the largest energy storage facility in Europe and is still far behind in achieving its renewable targets. Currently, over 79% of national energy comes from fossil sources, almost all from coal-fired plants. Now the nation intends to reach 32-50% production from renewable sources by 2030, and to achieve this, it will have to move quickly.

Conclusions and Final Thoughts

The transition from ReneSola to Emeren is not just a matter of name: the company has truly changed in recent years. A very complex restructuring, which saw a debt-laden OEM producer of international level become a capital-light company, sniping opportunities in markets where it sees opportunities to obtain high margins and growth rates.

So far, the company’s valuation seems still influenced by strong skepticism, but at the same time, management has proven capable of successfully guiding the company through its major transition phase. With the opportunities offered by the growth of renewables in Europe, combined with Emeren’s very attractive valuation at this time, I believe there is great potential to see the stock grow in the coming years.

Risks to Consider

Being a very small company with a troubled history, it’s important to also consider the risks of buying Emeren shares:

- The company is exposed to the trend of energy prices in Europe, which in recent years has been highly volatile and could prove lower in 2024 than management expectations;

- In the past, Emeren missed several times its revenue or net income target on quarterly data, so management promises should be taken with a grain of salt;

- Emeren could suffer an increase in competition in Europe, since many other companies are now looking at the opportunities offered by the new EU plans for 2030.

Despite all this, I still believe there is a basis for a positive rating and that the risks are less than the potential increase in the value of the share in the coming years.