Whether or not it’s refining your corporation mannequin, mastering new applied sciences, or discovering methods to capitalize on the subsequent market surge, Inman Join New York will put together you to take daring steps ahead. The Subsequent Chapter is about to start. Be a part of it. Be a part of us and 1000’s of actual property leaders Jan. 22-24, 2025.

This story was up to date after publishing with an up to date remark from Douglas Elliman and feedback from Matt and Heather Altman.

Amidst management upheaval on the East Coast, Douglas Elliman’s Western Area can also be underneath fireplace for alleged kickbacks and preferential therapy towards the Altman Brothers Workforce in two LA Superior Courtroom lawsuits filed in October.

The lawsuits have surfaced as all eyes have been on Elliman after former CEO Howard Lorber’s abrupt retirement final week, which was adopted up by the surprising termination of brokerage President and CEO Scott Durkin.

Now Stephen Kotler who leads Elliman’s Western brokerage operations can also be being positioned underneath scrutiny in a pair of authorized actions, The Actual Deal reported on Thursday.

In a lawsuit filed by former Newport Seaside workplace Government Supervisor of Gross sales Christina Carrillo, the previous supervisor, who resigned earlier in October, alleged that credit had not been reported on closing statements so as to inflate the commissions of sure brokers. Carrillo additionally calls out the Altman Brothers Workforce, alleging that the group acquired purchasers from different brokers’ and brokers’ energetic listings.

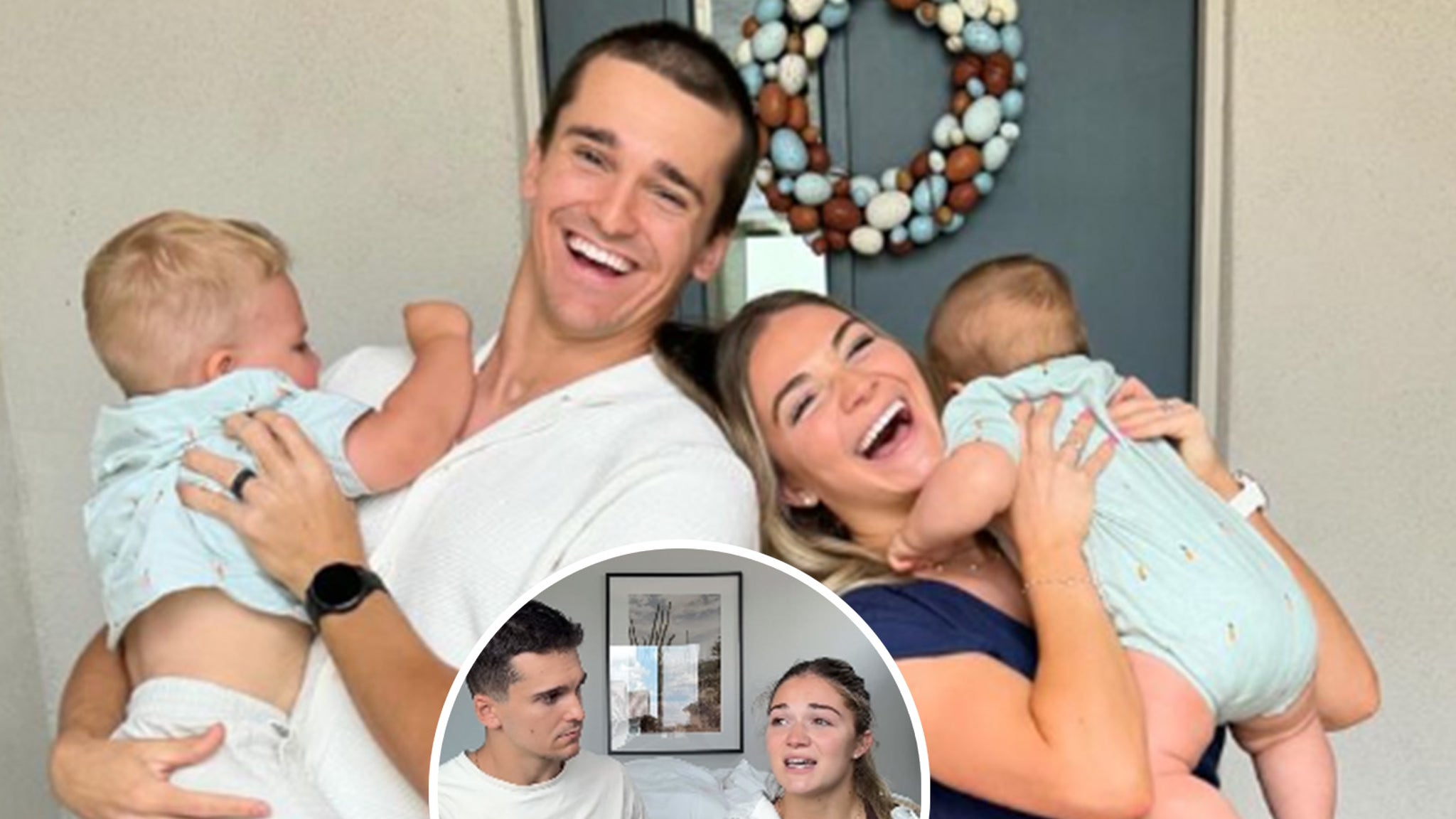

Josh Altman, Matt Altman and Heather Altman haven’t been named as defendants in both lawsuit.

Carrillo additional alleged that when she introduced up these points to Kotler, he disregarded them. She can also be suing Kotler for sexual harassment and retaliation.

“Sufficient Christi. I’ve made hundreds of thousands from the Altman Brothers, so shut up,” the lawsuit alleges that Kotler informed Carrillo. “If different brokers and brokers get fucked over, I don’t care, so be it.”

Douglas Elliman asserted that it had by no means acquired sexual harassment complaints from Carrillo.

“Douglas Elliman by no means acquired any complaints of sexual harassment or associated misconduct involving Christina Carrillo, nor was administration conscious of any such claims,” a consultant stated in an announcement emailed to Inman.

“Had any such complaints been acquired, these complaints would have been totally investigated in line with our insurance policies and procedures, as has been the case with complaints made infrequently towards others on the Firm over time. Douglas Elliman is dedicated to fostering a office setting that’s protected, comfy and freed from sexual harassment.”

A second lawsuit filed by plaintiff Invoice Grasska, who was beforehand president of Douglas Elliman’s Portfolio Escrow, makes related allegations concerning altered closing statements.

The swimsuit, which is towards Douglas Elliman’s California brokerage and its monetary subsidiaries, Kotler, escrow officer Melinda Topete, Western Area COO William Begert and escrow officer Renee Mills, alleges that the corporate requested managers at Portfolio Escrow to “inflate a closing assertion to permit the Altmans to earn extra commissions.”

Grasska launched Portfolio Escrow in 2009 and bought it to Douglas Elliman in 2019. He’s suing for retaliation, breach of contract and defamation, in addition to different allegations. The lawsuit states that Portfolio Escrow can also be presently underneath audit by the California Division of Monetary Safety and Innovation. Grasska claimed that Elliman brokers have been incentivized to make use of Portfolio Escrow of their transactions by way of greater commissions and advertising and marketing spend will increase, with out disclosing these incentives to customers.

Carrillo declined to remark to Inman. Grasska didn’t instantly reply to Inman’s request for remark.

Douglas Elliman additionally filed its personal lawsuit towards Grasska final week, alleging that the previous Portfolio Escrow president was underneath investigation for kickbacks. The agency additionally claimed that Grasska had charged “costly meals and lavish lodge stays” on an organization bank card and created a 1031 trade known as Sienna Monetary that violated his non-compete settlement with Douglas Elliman. The corporate stated as soon as it was found that Grasska had created the 1031 trade, he was “instantly positioned on go away pending additional investigation for this and different misconduct.”

A consultant from Douglas Elliman stated that Grasska’s lawsuit was an try and distract from “his personal egregious misconduct.”

“In Douglas Elliman’s grievance towards him, we clearly set forth our claims that Grasska engaged in fraud, embezzlement of firm funds, and associated misconduct. Furthermore, the dealer referenced in our grievance as being concerned in Grasska’s fraudulent scheme involving kickbacks just isn’t the Altman Brothers or anybody on their group, and has by no means been affiliated with Douglas Elliman.”

That dealer was described in Douglas Elliman’s lawsuit as a “high-profile Los Angeles actual property dealer that’s now a star of a actuality tv present.”

Matt and Heather Altman informed Inman in an announcement despatched by way of textual content that they’re usually targets in these sorts of authorized actions as high-profile brokers.

“This occurs usually as we’re each on the high of the actual property sport and on TV,” the assertion stated. “Individuals like Invoice and Christi use our title and throw it round to catch consideration to themselves and their lawsuit that we’re not even concerned in. We’re used to it. Sadly, retailers like The Actual Deal use our names as clickbait. It’s already been confirmed. We’ve got nothing to do with any of this and it’s simply determined individuals in search of consideration. The Altman Brothers aren’t named in both lawsuit.”

The brokerage additionally alleged that it had found that Grasska created pretend invoices for providers by no means supplied at Portfolio Escrow with the assistance of an organization accountant as a workaround from paying off penalties from the IRS he had incurred by “carelessly” working his personal private transaction by way of Portfolio.

“This scheme was designed to illegally receive cash belonging to Portfolio to repay penalties assessed by the IRS,” Douglas Elliman’s grievance alleges. The brokerage additionally alleges that Grasska labored with a “actual property dealer that’s now a star of a actuality tv present” to present the dealer kickbacks in return for enterprise. Douglas Elliman is alleging that Grasska is responsible of breach of contract, civil embezzlement, fraud and negligence.

In the previous few weeks, long-time firm CEO Howard Lorber and brokerage president and CEO Scott Durkin each left Douglas Elliman. Lorber’s departure was framed as a retirement, whereas Durkin’s termination got here to mild by way of one of many firm’s SEC filings.

Nonetheless, The Wall Road Journal reported that Lorber had been pressured to go away amidst a bigger investigation into the corporate’s office tradition, largely spurred by high-profile sexual assault allegations towards two former long-time high brokers, Tal and Oren Alexander.

Get Inman’s Luxurious Lens Publication delivered proper to your inbox. A weekly deep dive into the most important information on the earth of high-end actual property delivered each Friday. Click on right here to subscribe.

E-mail Lillian Dickerson