JHVEPhoto

So far, 2023 is turning out to be a great year for the market. As of this writing, the S&P 500 is up about 15%. But one of the companies that is performing best in this space is pharmaceutical giant Eli Lilly and Company (NYSE:LLY). So far this year, units are up 27.7%, or nearly double what the broader market has seen. This is a massive upside for a company that today has a market capitalization of $435 billion. Normally, it becomes difficult for firms of this size to post such strong growth that can justify meaningful share price appreciation. This is especially true outside of the technology sector. However, investors seem to be incredibly optimistic about the firm’s prospects moving forward, thanks in large part to recent progress provided by management regarding some of its diabetes and obesity medications. If all goes according to plan, the company could stand to benefit rather significantly over the next few years. Of course, there are certain risks here that investors should be aware of. But so long as none of those risks derail the picture, I would argue that further upside for the stock is not out of the question.

A play on diabetes and weight loss

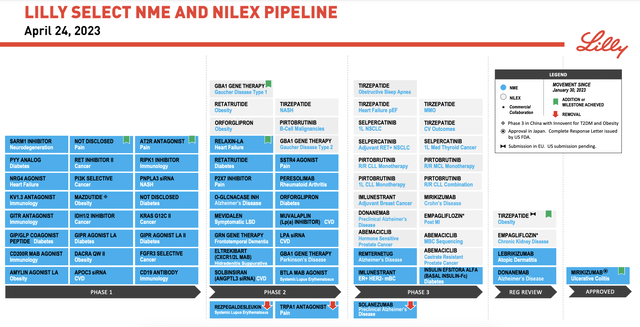

A lot of the optimism centered around Eli Lilly and Company involves some of the drugs that the company has developed or is in the process of developing in order to treat diabetes and obesity. The most notable at this point that has come about recently is Mounjaro, which is more commonly known as Tirzepatide. Originally developed to treat diabetes, it became clear very quickly that the drug had significant promise in a number of areas. In one of the most recent updates regarding the drug, the company announced that, in the second global Phase 3 clinical trial that the company conducted for the drug, users of the treatment who were overweight and who suffered from type 2 diabetes lost up to 15.7%, or 34.4 pounds, of their body weight thanks to the drug. Some of the greatest weight loss effects were seen in those who were obese but did not have diabetes. The drug has also undergone testing for other conditions such as obstructive sleep apnea, heart failure with preserved ejection fraction, and nonalcoholic steatohepatitis.

Eli Lilly and Company

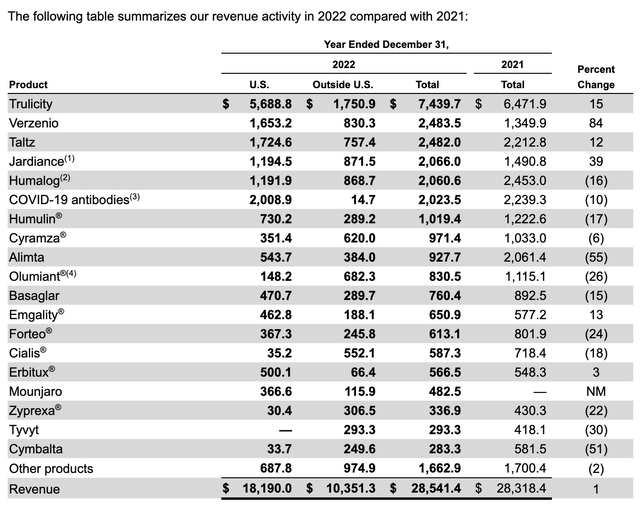

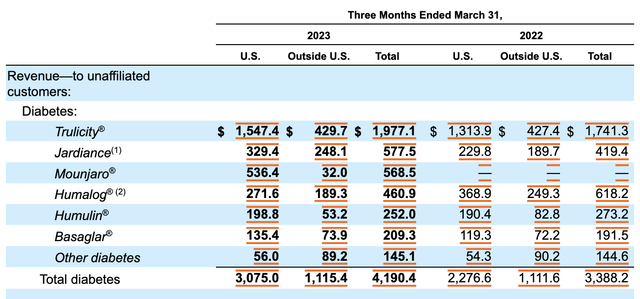

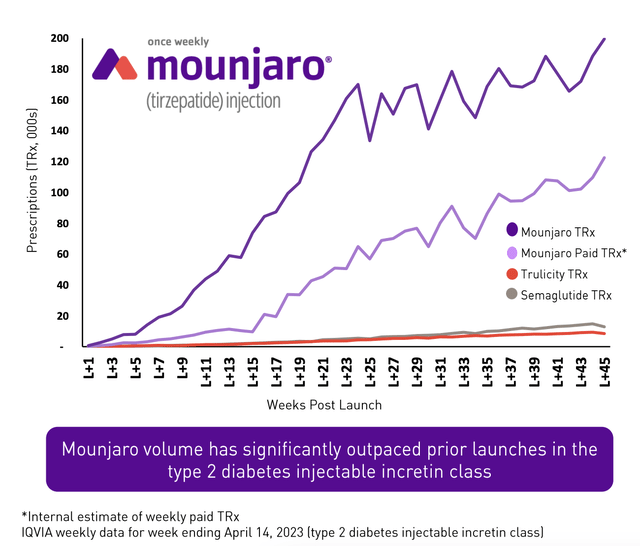

Management was able to start selling Mounjaro last year. And already, the drug is proving to be one of the most successful in the history of medicine. In the short time that it was available for sale in 2022, it generated revenue of $482.5 million. That translated to only 1.7% of the company’s overall sales last year. In the first quarter of this year, sales ballooned to $568.5 million, which works out to 8.2% of overall revenue for the enterprise. Analysts have had high hopes for this drug. Some have even gone so far as to estimate that, at its peak, that drug could be responsible for $25 billion a year of revenue. That would make it the ‘biggest drug ever’ according to analysts at UBS Group (UBS).

Eli Lilly and Company

Eli Lilly and Company

Of course, that picture could very well change. On June 26th of this year, news broke that patients in a Phase 2 clinical trial for another one of the companies drugs, called Retatrutide, reported a mean weight reduction of up to roughly 58 pounds, corresponding to 24% of their body weight. This was over a span of 48 weeks compared to the 72 weeks seen by Tirzepatide. What’s really exciting is that, even at the end of that window of time, the company asserted that those losing weight had not seen their losses plateau. So the ultimate end result could be even more impressive. Just like with some of its other drugs, there could be other positive side effects associated with Retatrutide. For instance, management stated that in 9 out of 10 cases where those running the test also suffered from non-alcoholic fatty liver disease, there appeared to be a ‘normalization of liver fat’ during the test. Considering that this is a condition that affects as many as 24% of Americans, that alone could be a boon for the enterprise. Of course, the sample size here was quite small at only 98 patients. So further testing is definitely needed.

Eli Lilly and Company

These news items came only days after Eli Lilly and Company announced that a Phase 2 trial for its once-daily obesity therapy, called Orforglipron, also offered some really interesting results. This oral treatment is more palatable to those who don’t want an injection. And the company found that it resulted in up to 14.7% weight loss for those who took it compared to the 2.3% weight loss experienced by those in the placebo group. In the image above, you can see some other medications in the pipeline, some of which are focused on diabetes, while others are focused on other conditions. The company isn’t only focusing on its own developments. It is also working to snatch up attractive opportunities then it comes across.

On June 29th, for instance, shares of Sigilon Therapeutics (SGTX) shot up from only $3.93 to $21.15 after news broke that Eli Lilly and Company agreed to acquire it in exchange for $14.95 per share, plus a non-tradeable contingent value right that will entitle shareholders of the company to receive up to an additional $111.64 per share in cash, depending on how things go. Sigilon had previously partnered up with Eli Lilly and Company to develop cell therapies for the treatment of type one diabetes.

Those who follow Eli Lilly and Company closely we all know that the company has a long history focusing on the treatment of diabetes. In fact, of its largest revenue generators, six are related in some way, shape, or form, to diabetes or weight loss. This includes Trulicity, which is used for type 2 diabetes and is the company’s largest source of revenue. Last year, sales from it totaled $7.44 billion. All told last year, 48.5% of the company’s revenue came from treatments for diabetes and weight loss. Of course, the company does have other sources of revenue as well. The most significant in terms of revenue would be Verzenio, which is used for advanced or metastatic breast cancer treatment. The company also offers medications for things like autoimmune disorders and, for a time, a sizable source of revenue involving COVID-19 antibodies.

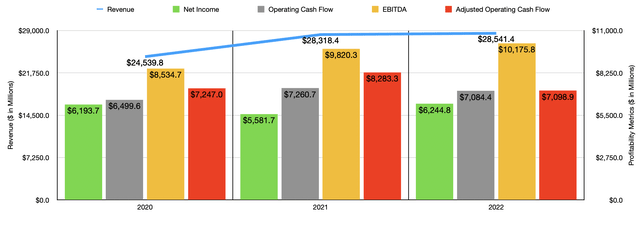

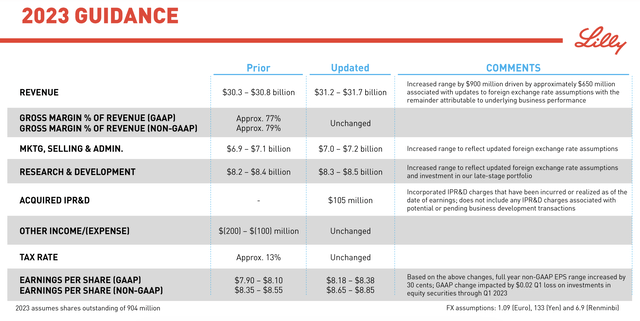

Author – SEC EDGAR Data

With diabetes and weight loss as its main source of revenue, the company has built for itself and its investors a rather large operation. From 2020 through 2022, sales for the company grew from $24.54 billion to $28.54 billion. Net income expanded from $6.19 billion to $6.24 billion. As you can see in the chart above, other profitability metrics also generally improved. It is worth noting that some of the volatility in results is almost certainly thanks to COVID-19. For a time, the company generated significant amounts of revenue on this front. But those days do seem to be gone. In the first quarter of this year, for instance, it generated no revenue from COVID-19 antibodies. That compares to the $1.92 billion generated the same quarter last year. According to management, revenue for 2023 should range between $31.2 billion and $31.7 billion, while mid-point earnings per share guidance calls for net income to be around $7.48 billion. The bottom line, especially, is impressive, since it implies a year-over-year growth rate compared to 2022’s profits amounting to 19.8%.

Eli Lilly and Company

If Eli Lilly and Company can continue to come out with successful drugs to address obesity, the end result for shareholders could be incredibly positive. In the US alone, obesity rates have tripled since 1975. 42.4% of adults in the country currently have it. In 2022 alone, over 5 million prescriptions were written in order to address the obesity epidemic. That’s up significantly from only 230,000 in 2019. Data from 2019 suggested that, each year, obesity here at home results in $173 billion in medical costs. Globally, an estimated 650 million people are clinically obese. Given the fact that obesity also results in other health effects such as an increased risk of heart attack and stroke, early death by cardiovascular disease, and more, there is a lot of money to be made addressing it.

One source that I looked at indicated that the obesity drug market should be worth $54 billion by 2030. But other sources have indicated that the weight loss market as a whole could be worth as much as $200 billion annually by 2030. For the most part, I see this as excellent news for Eli Lilly and Company. But it’s also important to keep in mind that there are some risks here. The most significant that I can think of is a potential cannibalization of its existing offerings. If the company comes out with obesity and diabetes drugs that render its other offerings obsolete and that may even result in a permanent reduction in said health conditions, the company could be missing out on long term revenue in exchange for a short-term surge in sales. I don’t think that the probability of this is terribly high. After all, the firm already has multiple successful drugs that treat the same kind of condition. And on top of that, a continuously growing global population that is moving more and more people every year into the middle class is bound to result in new customers as time goes on.

Takeaway

All things considered, I must say that I am quite impressed by all of the recent developments regarding obesity and diabetes treatment. The fact of the matter is that Eli Lilly and Company is doing really well and the upside for investors in the long run very likely will be enough to justify further appreciation in the company’s stock price. Given these factors, I have no problem rating the company a ‘buy’ at this time.