JHVEPhoto

Funding Thesis: I fee Digital Arts as a Maintain presently.

In a earlier article again in February, I made the argument that Digital Arts (NASDAQ:EA) has the capability for additional upside going ahead on the idea of sturdy reserving progress and inspiring efficiency for the EA Sports activities FC gaming title.

Since then, we’ve seen the inventory admire by almost 9%:

TradingView.com

The aim of this text is to evaluate whether or not Digital Arts has the capability to proceed seeing progress from right here – taking current efficiency into consideration.

Efficiency

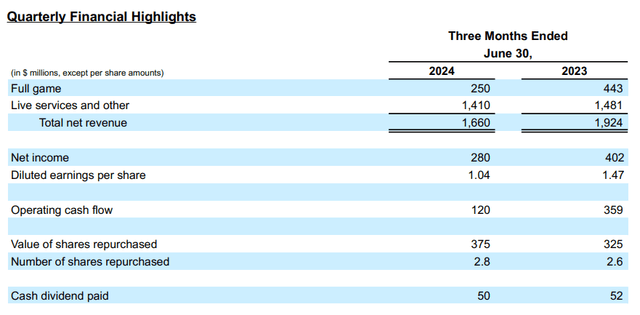

When Q1 FY25 outcomes for Digital Arts (as launched on July 30, 2024), we are able to see that whole internet income got here in at $1.660 billion for the quarter, which was down from that of $1.924 billion within the prior 12 months quarter.

Digital Arts: Q1 FY25 Earnings Launch

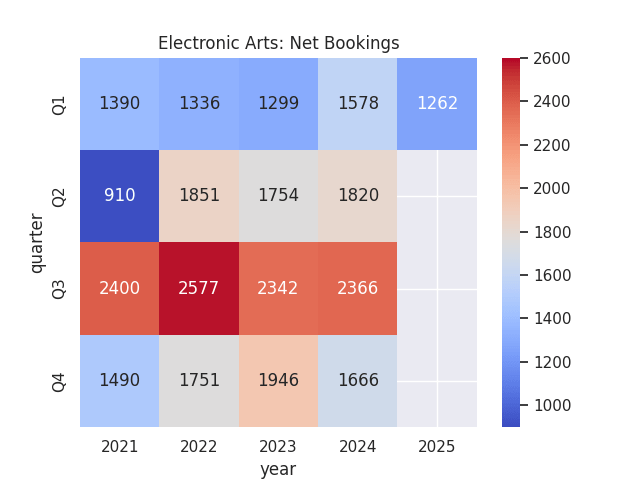

Nevertheless, it is usually notable that internet bookings for the quarter got here in at $1.262 billion – which exceeded prior steering of $1.250 billion on the greater finish of the vary, which was primarily pushed by sturdy efficiency throughout Madden NFL 24, FC On-line and FC Cell.

As well as, EA SPORTS FC noticed important traction all through Q1, in important half as a result of publicity garnered by the Euro 2024 competitors – which in accordance with the corporate attracted “tens of thousands and thousands” of latest followers and drove greater engagement for the gaming title.

When taking a broader take a look at internet bookings, we are able to see that the newest quarter of bookings at $1.262 billion (whereas having overwhelmed analyst steering) nonetheless stays beneath the $1.578 billion in internet bookings achieved within the prior 12 months quarter.

Web reserving figures (in $ thousands and thousands) sourced from historic Digital Arts quarterly reviews (Q1 FY21 to Q1 FY25). Heatmap generated by creator utilizing Python’s seaborn library.

Efficiency throughout the gaming business extra broadly has seen downward strain on the entire, with the business having reportedly seen as many layoffs within the first 5 months of 2024 as for the entire earlier 12 months. Particularly, it’s reported that with getting old console {hardware} and ongoing financial considerations on the a part of clients – PS5 and Xbox demand has seen a considerable decline this 12 months – and this has had a adverse knock-on affect for internet bookings as an entire.

From a stability sheet standpoint, we are able to see that the corporate’s fast ratio (calculated as money and money equivalents plus internet receivables throughout whole present liabilities) stays above 1 – indicating that Digital Arts has adequate liquid property to service its present liabilities.

| Mar 2024 | Jun 2024 | |

| Money and money equivalents | 2900 | 2400 |

| Receivables, internet | 565 | 433 |

| Complete present liabilities | 3090 | 2468 |

| Fast ratio | 1.12 | 1.15 |

Supply: Figures sourced from Digital Arts Q1 FY25 Earnings Launch. Fast ratio calculated by creator.

Total, we’ve seen that whereas internet reserving progress got here in forward of expectations – downward strain has remained as in comparison with the earlier 12 months.

My Perspective and Trying Ahead

By way of prospects for Digital Arts going ahead, I take the view that internet bookings as an entire must see a big restoration to that of prior 12 months ranges for the inventory to see sustained upside from right here.

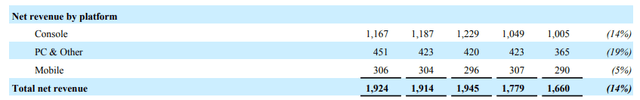

For this to occur, I take the view that we might want to see a big rebound in console demand from right here. Now we have seen that whereas console internet income fell by 14% from Q1 FY24 to Q1 FY25, this section nonetheless accounted for over 60% of whole income in the newest quarter.

Digital Arts: Q1 FY25 Earnings Launch

With that being stated, the rumoured arrival of the PS5 Professional earlier than the tip of this 12 months may point out that clients have been ready for the discharge of this console to improve – and at such time we may see a big uptick in internet bookings throughout well-liked gaming titles. Along with sturdy efficiency by EA SPORTS FC, a record-breaking launch of the EA SPORTS Faculty Soccer 25 title may assist propel internet reserving progress in subsequent quarters – and we’ve additionally seen that internet bookings in Q2 and Q3 have historically been greater than that of the remainder of the 12 months.

By way of potential valuation, I had beforehand made the argument that continued progress in earnings may push the inventory again to the $140-150 vary, which might put the worth again to highs final seen in 2021 when gaming demand was excessive throughout pandemic restrictions. With the inventory now buying and selling at simply above $148 – value has reached my beforehand anticipated vary.

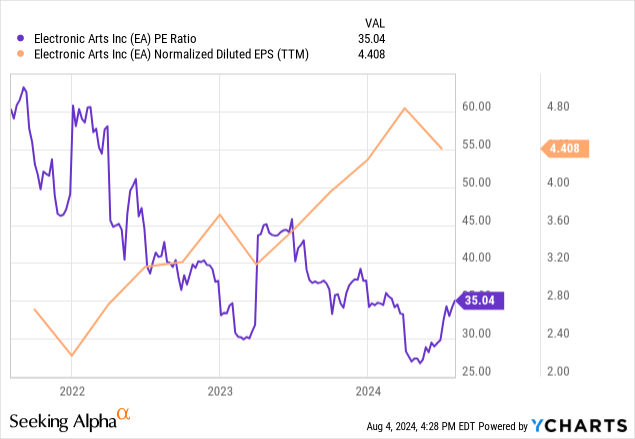

Again in February, the P/E ratio was buying and selling at 34.74x and we’ve since seen a slight enhance to 35.04x. Whereas EPS (normalized diluted) has elevated from $3.978 to $4.408 over the identical interval – we are actually seeing that earnings progress has been plateauing – in step with the dip that we’ve been seeing in internet bookings relative to that of final 12 months.

ycharts.com

With a P/E ratio of 35.04x and EPS of $4.408, this might yield a value of $154.45 (35.04 * 4.408 = 154.45). Given a value of $148 and likewise taking into consideration the truth that earnings progress is beginning to plateau – I take the view that the inventory is buying and selling inside its honest worth vary presently.

Dangers

By way of potential dangers for Digital Arts going ahead, the primary one in my opinion is the chance that console gross sales will proceed to see downward strain from right here. This may very well be the case if we see delays to the discharge of the PS5 Professional, or if certainly demand for the console seems to be weaker than anticipated.

I see this as a danger within the sense that weaker console gross sales can be prone to result in decrease gaming title demand. As such, I shall be paying important consideration going ahead as to whether 1) console gross sales begin to see progress as soon as once more and eventual uptake of the PS5 Professional is in step with expectations, and a couple of) Digital Arts continues to see sturdy demand for its current and upcoming gaming titles.

Conclusion

To conclude, Digital Arts has seen internet bookings for this quarter exceed expectations, however internet bookings and income nonetheless stay decrease than that of the earlier 12 months. As well as, I estimate that the inventory is pretty valued at current. On this regard, I fee Digital Arts as a Maintain presently.