Klaus Vedfelt/DigitalVision through Getty Pictures

Primary Thesis / Background

The aim of this text is to judge the broader rising markets fairness market, with a selected have a look at the iShares MSCI Rising Markets ETF (NYSEARCA:NYSEARCA:EEM). It is a broad, passive ETF, with an goal “to trace the funding outcomes of an index composed of large- and mid-capitalization rising market equities”.

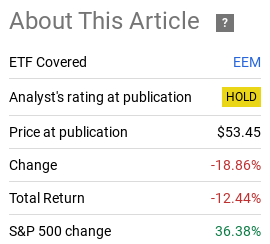

I cowl US markets, non-US developed markets predominately, however I additionally take into account rising markets when the time is ripe. This consists of by way of the usage of automobiles comparable to EEM, though I’ve typically been postpone by the sector (and this fund) for some time. The truth is, my final assessment had a cautious outlook on the long run prospects of EEM and I used to be confirmed proper in hindsight:

Fund Efficiency (In search of Alpha)

Nonetheless, this was a very long time in the past and issues do change, so I wished to take one other have a look at EEM to see if I ought to change my score going ahead.

After assessment, I do see a pair potential catalysts for rising markets as a complete. However to me these are overshadowed by the dangers dealing with this thematic thought. Additional, I proceed to see worth in large-cap US shares, so the concept of shifting positioning to favor a fund like EEM appears misplaced in the meanwhile. As such, I’m conserving the “maintain” score in place and can clarify why in higher element beneath.

Curiosity Charges A Tailwind? Possibly Not

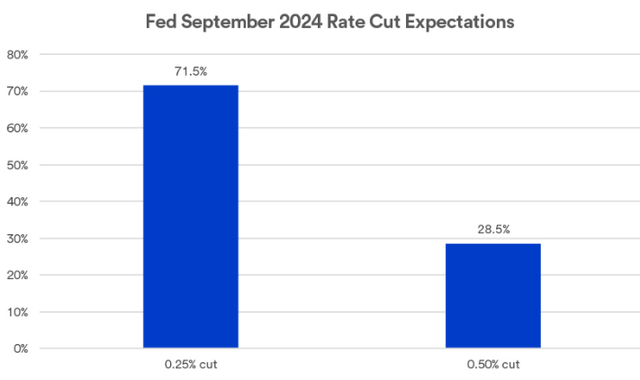

One issue that’s driving the markets – right here and overseas – is the US central financial institution. The Fed has been affected person on conserving charges regular however the time the market has been ready (impatiently) for might lastly be right here. That’s the starting of a Fed price reduce cycle within the US, with a rising probability of a .50 foundation level reduce coming within the subsequent few weeks:

Upcoming Fed Assembly Expectations (CME Group)

In fact, readers might surprise why this belongs on this article. In spite of everything, EEM holds rising market equities, so who cares in regards to the US Federal Reserve?

The reply lies in the truth that many rising market international locations (and corporations) are closely depending on what is going on state-side. Typically we hear that rising rates of interest within the US are collectively unhealthy for rising markets. That’s as a result of a lot of their debt is priced in USD – in order the USD rises the price of servicing that debt in native foreign money goes up. This challenges social spending and monetary flexibility in these rising economies and might usually be a major headwind.

So one may suppose that declining charges right here would now be a tailwind. Type of is smart, does not it? Whereas it might be on the floor, I’ve my issues. One is the explanation why charges are going to say no within the US. It’s due to worries of excessive authorities spending, declining inflation, and a possible recession in 2025. The catch right here is that if the US does enter right into a recession, that might hit rising markets notably onerous.

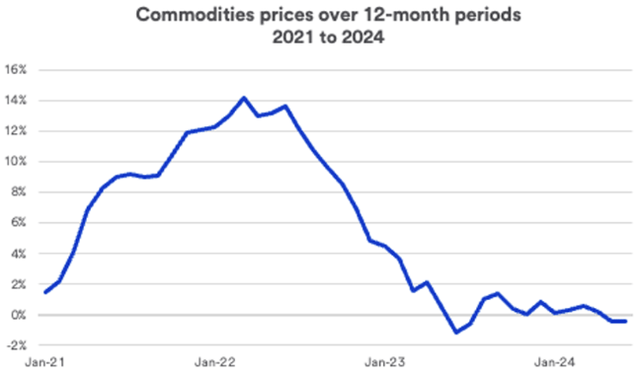

That is very true of countries (lots of them EM in areas like Latin America, the Center East, and Asia) that depend on exporting items like commodities. The truth is, in accordance with a report by the World Financial institution, roughly two-thirds of the rising market and creating economies “closely depend on commodities for export, fiscal income, and financial exercise”.

So why does this matter? Effectively as a result of the previous few years this has been a headwind for commodity-rich nations as costs (on common) have been on the decline:

Basket of Commodities (Common Worth) (US Financial institution)

The purpose I’m attempting to convey right here is that there are issues are international financial exercise and the long run demand for a lot of commodities. Maybe objects like gold and silver might be properly as recessionary hedges, however exporting nations wish to provide the world with objects like oil, cooper, espresso beans, and a myriad of different commodities that depend on financial growth and progress. To see the costs come down on these assets presents uncertainty for buyers and particularly for rising market firms and governments.

This ties again to the potential Fed price cuts. Whereas decrease charges within the US could also be a profit for international and rising market companies, the explanations behind why cuts are wanted stability that out as a possible optimistic catalyst. This is the reason I do not purchase the “decrease charges are good for funds like EEM” and stay cautious on my ahead outlook.

China Stays In The Cross-hairs

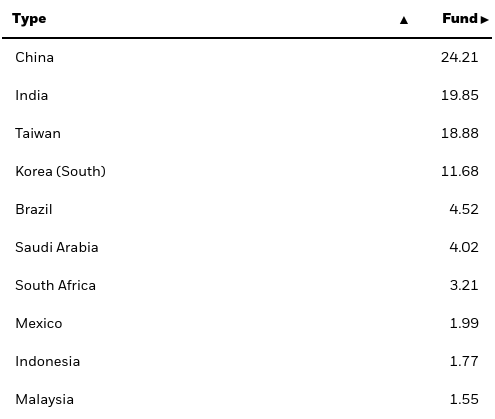

One more reason for my impartial outlook on EEM has to do with the fund’s obese allocation to Chinese language equities. With nearly one-quarter of complete belongings invested on this single nation, buyers in EEM will wish to be bullish on China earlier than shopping for this explicit product:

EEM Geographic Breakdown (iShares)

Broadly talking, I’ve issues over China’s financial restoration and geo-political tensions are usually not going away. The truth is, they might be worsening, which places pressure on my ahead outlook.

For instance, the EU introduced tariffs on imports of Chinese language electrical automobiles earlier this month. Thankfully, (for buyers) the tariffs weren’t as excessive as have been beforehand being thought-about, clocking in 9%, down from a proposed price of almost 21%, in accordance with a press launch from the European Fee.

So there may be some excellent news that cooler heads prevailed a bit, however I do not suppose the commerce battle is wherever close to over. In response to the EU’s transfer, Canada can also be contemplating an identical measure. And, in fact, the US has already put in place steep tariffs on Chinese language election automobiles.

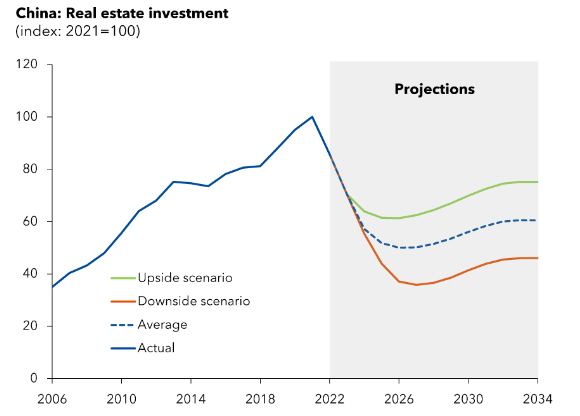

The online end result from all that is that China has some diplomacy issues. After I couple that with the continued housing disaster in that nation that has buyers rattled, I’m reluctant to get behind investing on this territory. For perspective, take into account that even the extra optimistic eventualities nonetheless present Chinese language residential property funding properly off their prior ranges:

Chinese language Actual Property Funding (By Yr) (IMF)

To emphasise this level, this actuality has left huge builders (suppose Evergrande and Nation Backyard as examples) on the brink financially. It has stalled funding on this sector and clouded future funding returns. After I see this ongoing backdrop and an increase in geo-political tensions with key buying and selling companions just like the US and EU, I can not get bullish on a fund like EEM that has a lot Chinese language publicity.

Expense Ratio Off-Placing

My subsequent subject is a fast – however essential – one. It has to do with EEM in isolation and nothing in regards to the funding case for rising market equities. Moderately, this issues the expense buyers are paying for this explicit fund. As a comparatively passive ETF, an expense ratio of .70% simply appears excessive to me on the floor:

Expense Ratio (EEM) (iShares)

Personally, that is fairly excessive for many ETFs throughout the funding spectrum and makes me query why iShares has it this elevated.

However the excellent news is buyers have loads of decisions on the market. Common rising markets from different huge names like Vanguard and Charles Schwab provide related publicity for a fraction of the annual price:

SCHE Expense Ratio (Charles Schwab) VWO Expense Ratio (Vanguard)

In fact these funds are usually not similar, however they do maintain lots of the identical high holdings (usually very shut by way of proportion) and the nation publicity can also be very related. So it stands to motive that even when one was bullish on rising markets in the meanwhile, EEM in all probability is not the neatest solution to play that concept.

India, Brazil Not Costly, However Not Low-cost Both

By this assessment I’ve actually been pretty pessimistic. I do not see EEM as a purchase proper now and I stand by that decision. However I additionally do not suppose it’s truthful to have it as an outright “promote” both. There are a few causes for that.

One, EEM has carried out very poorly over the previous few years and might be due for a turnaround. Whereas I do not personally see that enjoying out, tides do flip and the time to go brief or sell-off this fund have in all probability handed. The disconnect between EEM and the S&P 500, for an instance, tells me {that a} narrowing of the efficiency hole is actually within the playing cards. So I do not suppose it pays too be overly bearish right here.

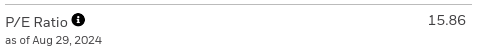

Second, a lot is remodeled the valuation hole between rising markets and the developed world. And that rings true immediately. For these in search of “worth”, which might be plenty of us given how frothy the S&P 500 and NASDAQ 100 look, the a fund like EEM might have some advantage:

EEM’s Present P/E Ratio (iShares)

This presents a stark low cost to the S&P 500 – which is the most typical benchmark – and will curiosity some buyers who might in any other case not have been .

However how “low cost” is reasonable actually? As I discussed earlier than China makes up chunk of this ETF, however it’s not at all the opposite nation represented. Different nations, comparable to Taiwan, India, South Korea, and Brazil are within the combine and value appreciable thought.

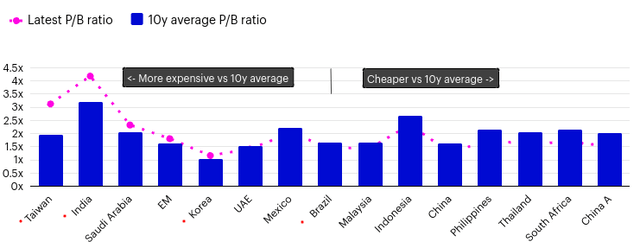

However there’s the rub. Whereas these nations might seem low cost in comparison with their developed market friends, they’re truly buying and selling (on common) at valuations above their personal historic common. That may be a key issue to bear in mind:

Present Valuations (By Nation) (S&P International)

I deliver this up as a phrase of warning. We have to take into account greater than only a nation’s relative valuation to the US. We also needs to take into account its personal buying and selling historical past in isolation to offer a fuller image on how possible additional positive aspects are. Within the examples given above, I might await a greater alternative to current itself.

Backside-line

EEM has been a loser long-term and I do not see a a lot brighter future forward. There are many dangers for US buyers when branching abroad and a fund heavy with China publicity will not be on my radar for now. After I add within the combine that nations like India and Taiwan are buying and selling at elevated valuations relative to their very own historical past and {that a} fund like EEM is sort of costly to personal, I’m put-off from upgrading my view for now. Subsequently, I’m conserving the “maintain” outlook in place and urge my followers to be very selective with any potential positions at the moment.