metamorworks

A Quick Take On Edgio

Edgio (NASDAQ:EGIO) reported its Q3 2022 financial results on November 9, 2022, missing revenue and EPS estimates.

The firm provides content delivery and other edge application technologies to businesses globally.

I’m on Hold for EGIO until we see management organically growing the newly combined entity while making meaningful progress toward operating breakeven.

Edgio Overview

Tempe, Arizona-based Edgio was founded as Limelight Networks in 2001 to provide distributed computing and connectivity solutions for application developers and video media companies worldwide.

In June 2022, the company completed the acquisition of Yahoo’s Edgecast in an all-stock deal valued at approximately $300 million.

The firm is headed by Chief Executive Officer Bob Lyons, who was previously CEO at Alert Logic and before that Operating Partner at Welsh, Carson, Anderson & Stowe.

The company’s primary offerings include:

Edgio AppOps

Edgio Delivery

Edgio Streaming

Management says the firm delivers 20% of global internet traffic for websites and video applications.

Edgio’s Market And Competition

Per a 2019 market research report, the content delivery market is forecast to grow to over $22 billion by 2024, a CAGR of 12.3% from 2019 to 2024.

Important reasons for this growth trajectory include ‘an increasing demand for enhanced video content, latency-free online gaming experience, and enhance QoE and QoS.’

North America is expected to be the largest market for CDN services.

According to a 2018 report, the Domain Name Service market is expected to reach $500 million by 2024, representing a CAGR of 13% from 2018 to 2024.

Major competitive vendors that provide CDN services include:

Akamai

Amazon AWS

Microsoft

Fastly

Cloudflare

Additional smaller startup companies focused on specific verticals

Edgio’s Recent Financial Performance

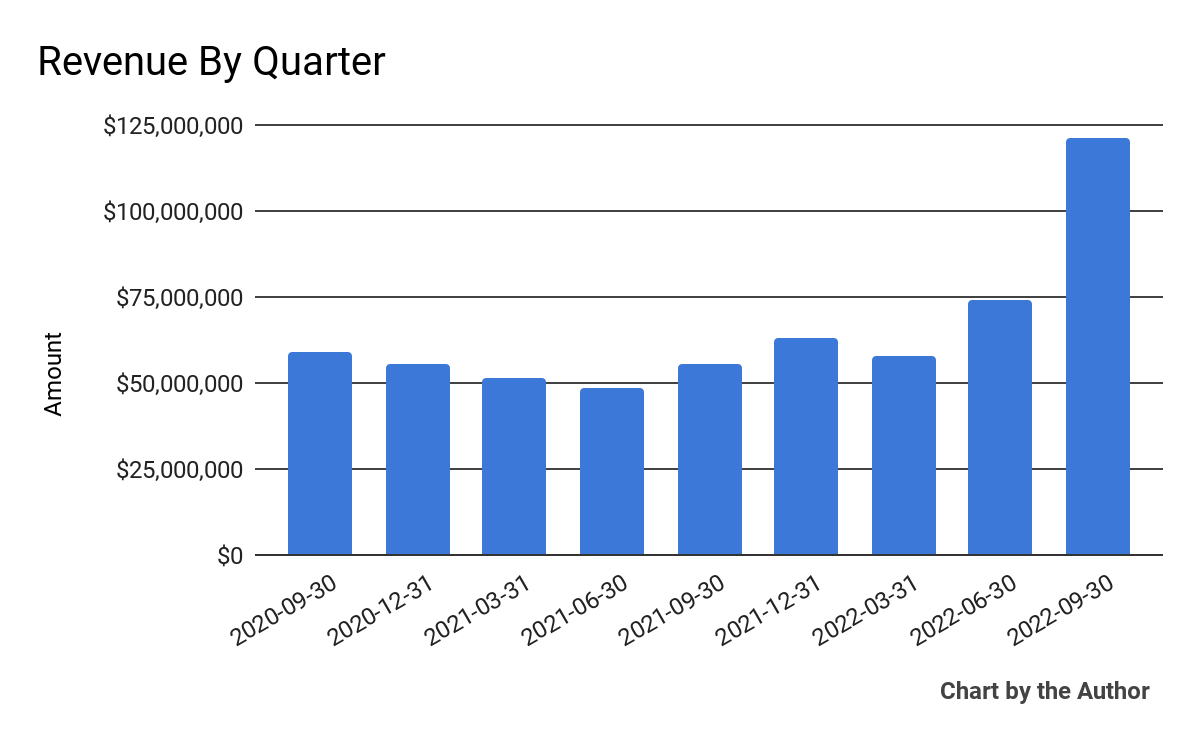

Total revenue by quarter has risen sharply in the two most recent quarters, likely due to the acquisition of Edgecast:

9 Quarter Total Revenue (Financial Modeling Prep)

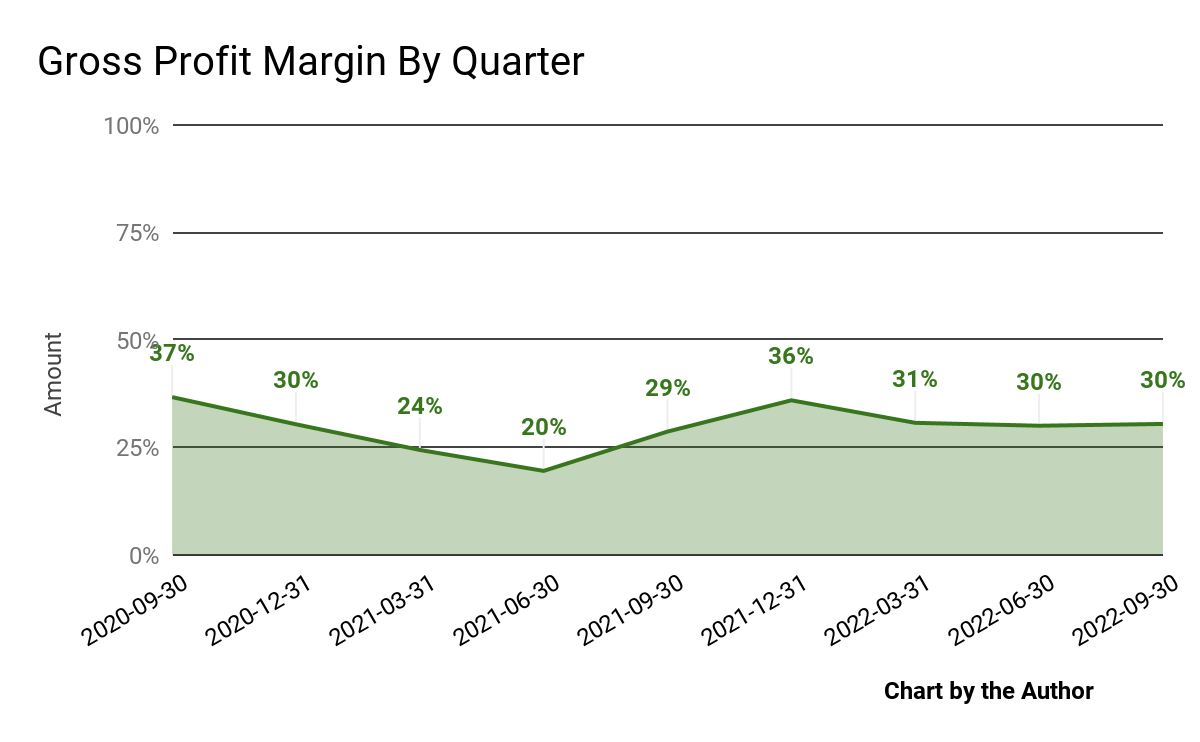

Gross profit margin by quarter has trended higher in recent quarters:

9 Quarter Gross Profit (Financial Modeling Prep)

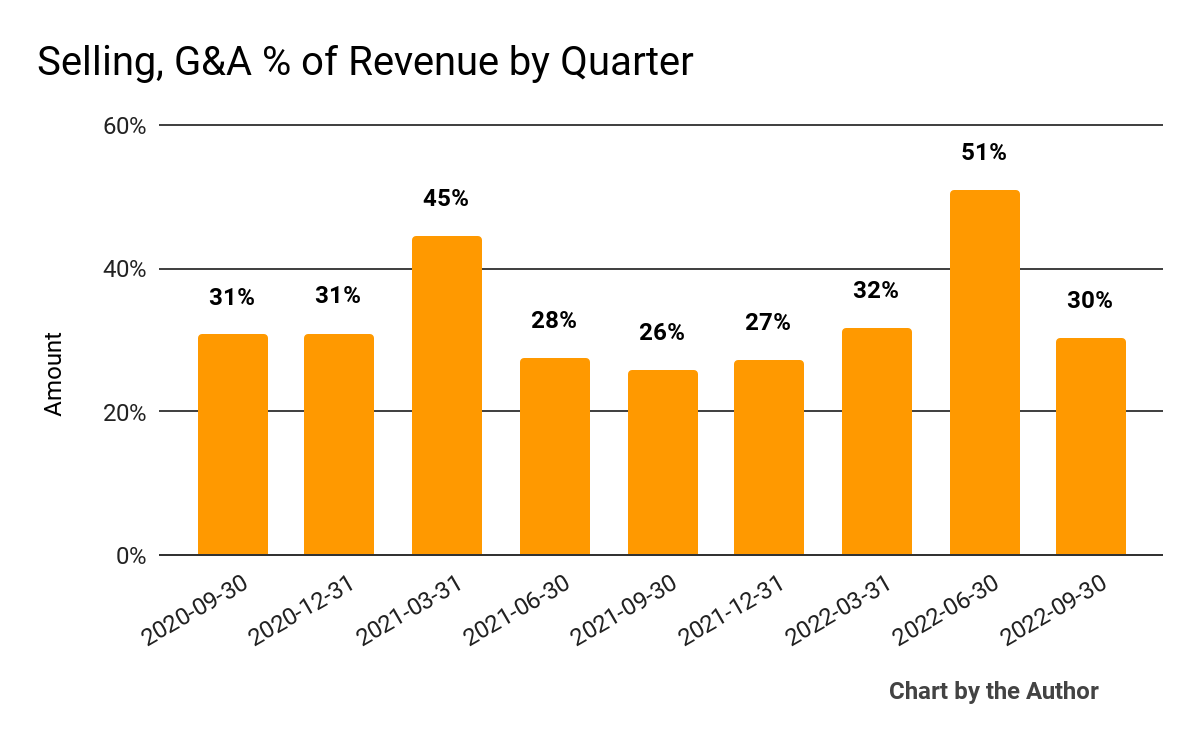

Selling, G&A expenses as a percentage of total revenue by quarter have fluctuated according to the following chart:

9 Quarter Selling, G&A % Of Revenue (Financial Modeling Prep)

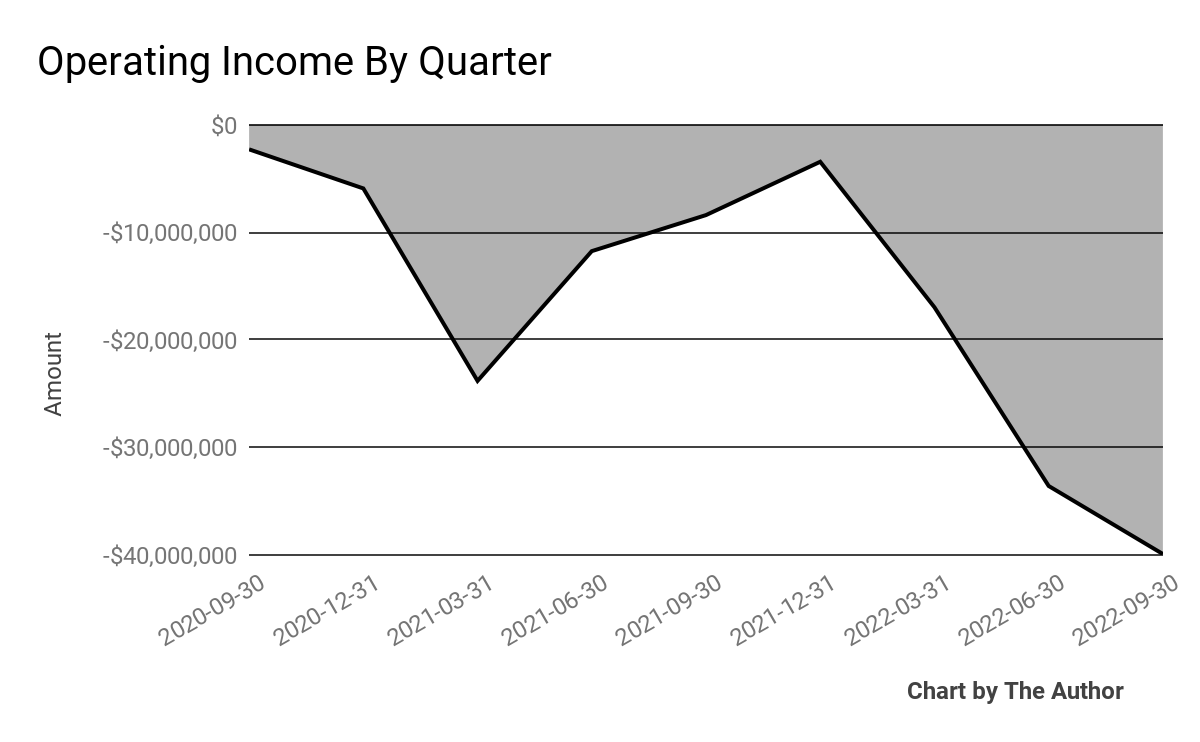

Operating losses by quarter have worsened sharply in recent quarters:

9 Quarter Operating Income (Financial Modeling Prep)

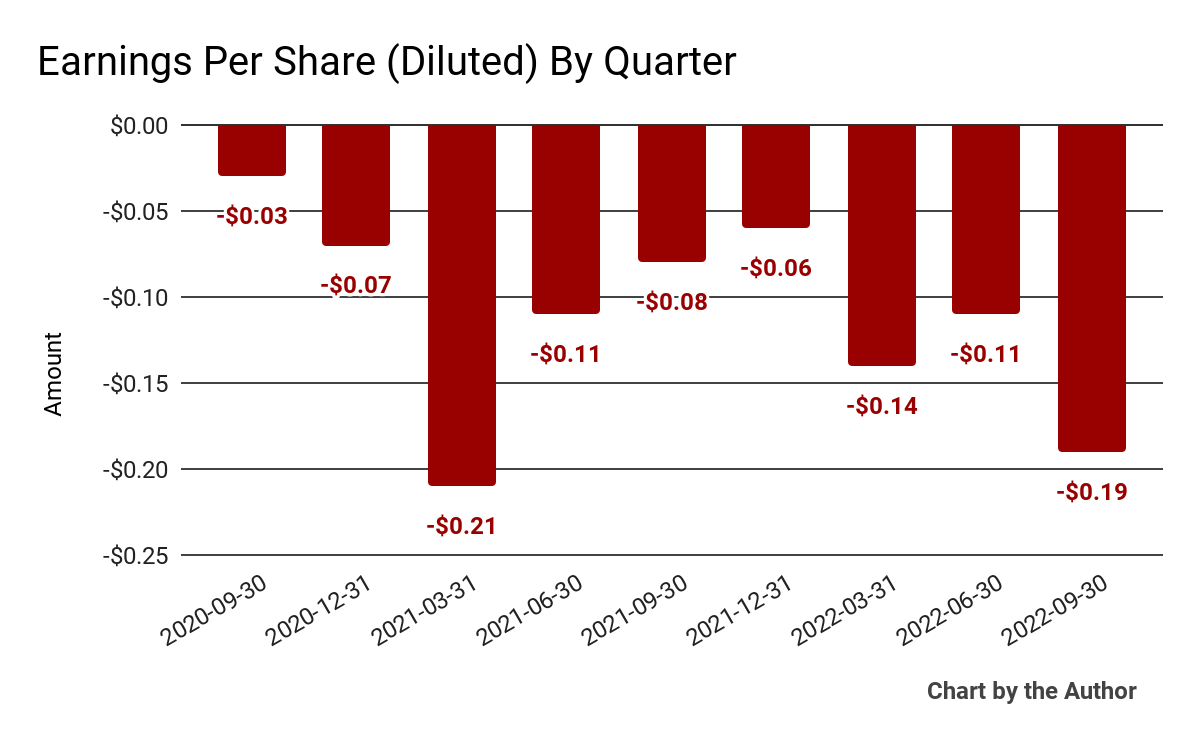

Earnings per share (Diluted) have also worsened further into negative territory recently, as the chart shows below:

9 Quarter Earnings Per Share (Financial Modeling Prep)

(All data in the above charts is GAAP)

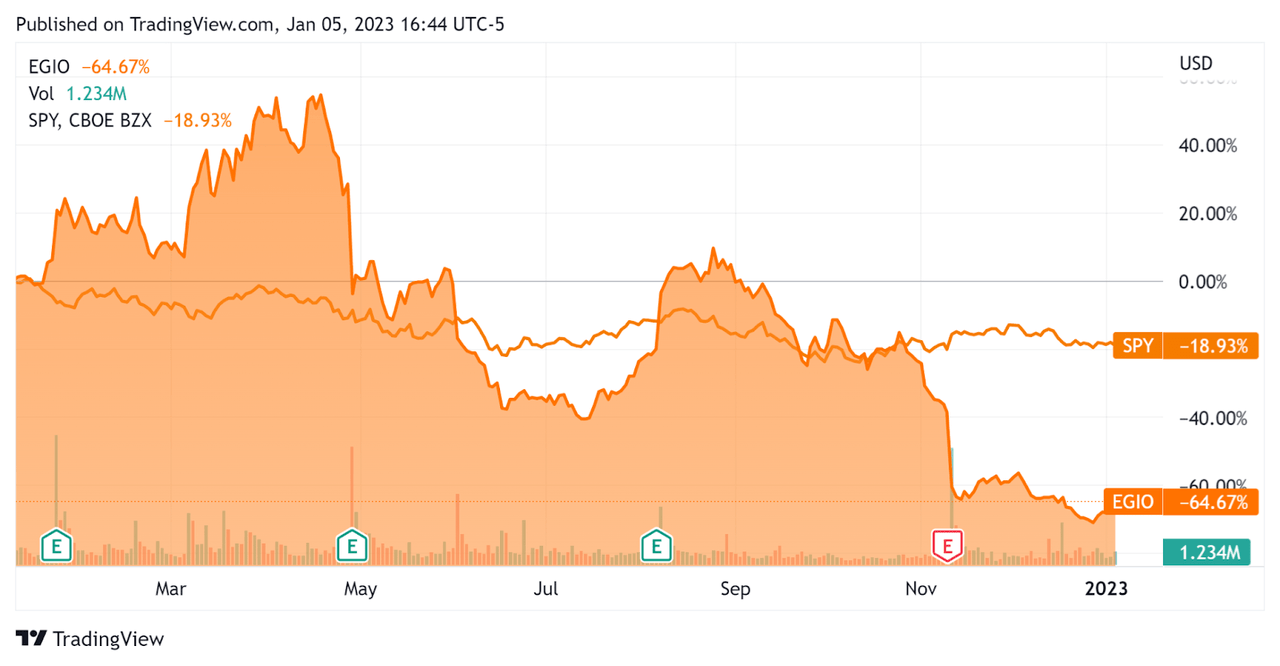

In the past 12 months, EGIO’s stock price has fallen 64.7% vs. the U.S. S&P 500 index’s drop of around 19%, as the chart below indicates:

52-Week Stock Price Comparison (Seeking Alpha)

Valuation And Other Metrics For Edgio

Below is a table of relevant capitalization and valuation figures for the company:

Measure [TTM] | Amount |

Enterprise Value / Sales | 1.0 |

Enterprise Value / EBITDA | -11.6 |

Revenue Growth Rate | 50.5% |

Net Income Margin | -26.4% |

GAAP EBITDA % | -8.8% |

Market Capitalization | $248,175,200 |

Enterprise Value | $324,634,280 |

Operating Cash Flow | -$33,733,000 |

Earnings Per Share (Fully Diluted) | -$0.50 |

(Source – Financial Modeling Prep)

The Rule of 40 is a software industry rule of thumb that says that as long as the combined revenue growth rate and EBITDA percentage rate equal or exceed 40%, the firm is on an acceptable growth/EBITDA trajectory.

EGIO’s most recent GAAP Rule of 40 calculation was 41.7% as of Q3 2022, so the firm has performed well in this regard, per the table below:

Rule of 40 – GAAP [TTM] | Calculation |

Recent Rev. Growth % | 50.5% |

GAAP EBITDA % | -8.8% |

Total | 41.7% |

(Source – Financial Modeling Prep)

Commentary On Edgio

In its last earnings call (Source – Seeking Alpha), covering Q3 2022’s results, management highlighted the double-digit growth in its pipeline in 2022, which includes ‘major global brands.’

The firm expects to generate $60 million in annualized run rate synergies and were one-third of the way toward this expectation.

Also, with its wide range of solutions, the company is focusing on improving its cross- and up-selling sales motions.

As to its financial results, total revenue rose 119% year-over-year during the first full quarter after having completed the acquisition of Edgecast.

Management did not disclose any company retention rate metrics other than to characterize them as ‘healthy.’

The firm’s Rule of 40 results have been positive, with a strong revenue result offset by a negative operating result. However, this result is a function of its M&A activity, so is less of an indicator of health in this regard.

Operating losses worsened sharply, due in part to acquisition and restructuring charges and R&D increased as a percentage of revenue.

For the balance sheet, the firm finished the quarter with $70.8 million in cash, equivalents and marketable securities and $122.4 million in total debt.

Over the trailing twelve months, free cash used was $38.8 million, of which capital expenditures accounted for $24.4 million. The company paid a hefty $26.7 million in stock-based compensation.

Looking ahead, Q4 revenue was expected to be $111.5 million at the midpoint of the range and adjusted EBITDA loss of $7 million at the midpoint.

Regarding valuation, the market is valuing EGIO at an EV/Sales multiple of around 1.0x.

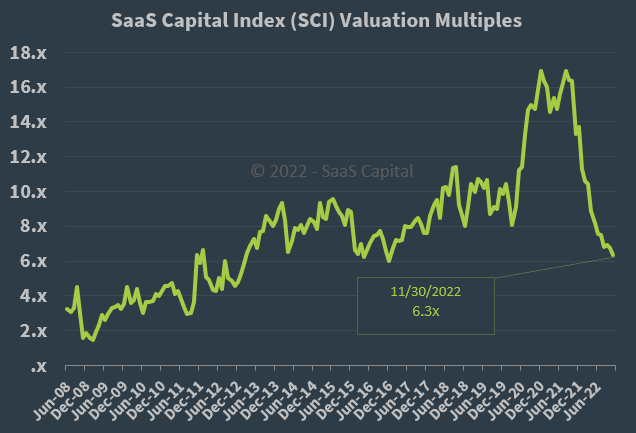

The SaaS Capital Index of publicly held SaaS software companies showed an average forward EV/Revenue multiple of around 6.3x on November 30, 2022, as the chart shows here:

SaaS Capital Index (SaaS Capital)

So, by comparison, EGIO is currently valued by the market at a significant discount to the broader SaaS Capital Index, at least as of November 30, 2022.

The primary risk to the company’s outlook is an increasingly likely macroeconomic slowdown or recession, which may produce slower sales cycles and reduce its revenue growth trajectory.

Already, the company sees increased churn ‘across a group of smaller customers,’ although management is pinning this on the inevitable nature of some churn in the Edgecast acquisition.

CapEx budgets are also becoming tighter, so the firm faces a generally tighter environment just as it is integrating the Edgecast deal.

A potential upside catalyst to the stock could include added benefits from revenue diversification from its Edgecast acquisition and a short and shallow economic slowdown.

If the macroeconomic slowdown is shallow, Edgio could be positioned as having integrated its Edgecast deal just as economic conditions are improving, possibly in the second half of 2023.

But until then, I’m on Hold for EGIO until we see management organically growing the newly combined entity while making meaningful progress toward operating breakeven.