This article is an on-site version of our Europe Express newsletter. Sign up here to get the newsletter sent straight to your inbox every weekday and Saturday morning

Good morning. The EU is to impose curbs on imports of Chinese green technologies, according to a draft of the commission’s Net Zero Industry Act to be unveiled today and seen by my brilliant colleagues.

And Netherlands prime minister Mark Rutte took a battering yesterday in provincial elections won by an upstart farmers’ protest movement. His ruling coalition lost a quarter of its seats in the Dutch senate, according to an exit poll.

Today, our ECB whisperer parses the dilemma in Frankfurt as the bank tries to decide on interest rates in the middle of a market meltdown. And our Paris bureau chief picks through the rubbish piling up on the pavements ahead of the parliamentary showdown on pension reform.

Stick or twist?

Who would be a central banker? Having clearly signalled plans to raise interest rates by half a percentage point, the European Central Bank is now being urged by former executives to do less because of turmoil in financial markets after a US bank failure, writes Martin Arnold.

Context: The ECB’s governing council meets today to decide how much to raise borrowing costs to tackle high inflation. Financial markets are gyrating wildly after Silicon Valley Bank collapsed in the US and shares of Credit Suisse and other European banks have fallen on worries the crisis could spread, complicating the ECB’s task.

Two of its former board members have said policymakers should scale back their planned rate hike to a quarter point, or postpone it altogether, until the scale of the problems in the banking system are clearer.

“I think what happened today is a bit of a game-changer,” Vítor Constâncio, former ECB vice-president, told the FT, referring to the share price falls of European banks yesterday. “The contagion to other European banks is worrying and they should be careful.”

“I think stepping down to a quarter-point move and saying they are likely to do more is justified,” said Constâncio, now an economics professor at the University of Navarra. “What is already in the public domain is enough to explain such a move and they don’t need other reasons.”

The worry for the ECB is that raising borrowing costs as planned could be unwise if this week’s wobbles in the banking system become a full-blown crisis, especially as rising rates were a major factor in the collapse of SVB.

“The financial contagion is equivalent to some form of tightening of monetary conditions,” said Lorenzo Bini Smaghi, another former ECB executive who now chairs French bank Société Générale.

“Sticking to the 50 points increase, as if nothing happened, means implementing a tougher stance than previously thought,” he told German newspaper Börsen-Zeitung. “This could be risky and add further instability. Postponing for one month or doing only 25 points would not be a problem.”

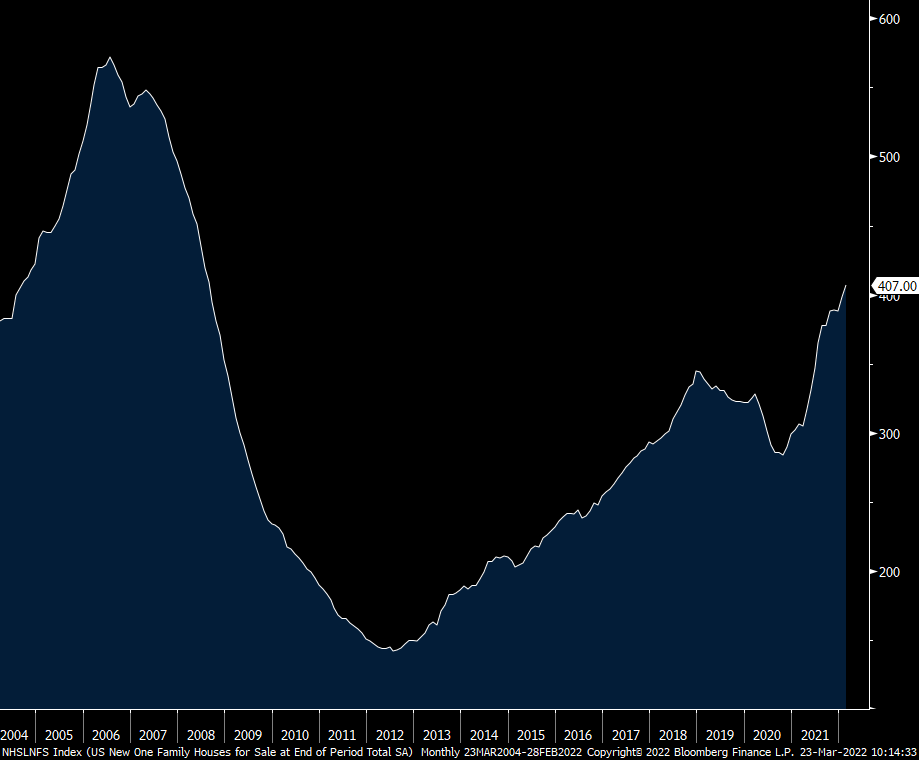

Chart du jour: Territorial dispute

In Germany, Spain, Italy, Portugal and Romania, more people think the war in Ukraine should end as soon as possible — even if that means ceding territory to Russia — than think Kyiv should fight as long as necessary to liberate all its land, according to a survey by the European Council on Foreign Relations.

Reform, trashed

Emmanuel Macron’s plan to raise the retirement age by two years to 64 was never going to be popular, but the French president may have underestimated just how stinky things would get, writes Leila Abboud.

The sidewalks of Paris have filled up with more than 7,000 tonnes of garbage in the past week because the rubbish collectors have gone on strike. Protesters have flung bags of trash on the doorstep of the headquarters of Macron’s Renaissance party.

Here’s hoping they don’t do the same thing in parliament today when lawmakers are expected to vote on the pension reform draft law.

No one really knows whether Macron has enough support to pass his flagship reform. It is yet another sign of how his political hand has been weakened since his party lost legislative elections last June, leaving its centrist alliance about 40 votes short of what is needed to pass laws.

Aides were counting and recounting potential votes in the Élysée yesterday, but political veterans admit that wily lawmakers will always find a way to be mysteriously absent from the hemicycle if necessary. Abstaining or skipping a vote on raising the retirement reform, which is opposed by three-quarters of the public, is a far more comfortable position for an MP than having to answer for it in their district.

If he does not have the votes, Macron can resort to passing the law by decree, in effect over-ruling lawmakers under the 49.3 clause in the French constitution. But using 49.3 has a cost: it allows opposition lawmakers to call a no-confidence vote and potentially bring down the government.

Triggering the 49.3 will also surely prompt Macron’s critics to say something is as rotten in the French Republic as all those piles of rubbish.

What to watch today

-

EU environment ministers meet in Brussels.

-

EU top diplomat Josep Borrell in Albania for accession talks.

Now read these

Recommended newsletters for you

Britain after Brexit — Keep up to date with the latest developments as the UK economy adjusts to life outside the EU. Sign up here

Trade Secrets — A must-read on the changing face of international trade and globalisation. Sign up here

Are you enjoying Europe Express? Sign up here to have it delivered straight to your inbox every workday at 7am CET and on Saturdays at noon CET. Do tell us what you think, we love to hear from you: [email protected]. Keep up with the latest European stories @FT Europe