In recent years, Kohl’s Corporation (NYSE: KSS) often came under pressure from activist investors who pushed the management to make major changes to streamline operations. The department store chain is scheduled to report earnings next week – experts are of the view that sales and profit declined year-over-year in Q4.

Over the past twelve months, Kohl’s stock has experienced high fluctuation and is currently maintaining an uptrend, ahead of the earnings. The Wisconsin-headquartered specialty retailer has been paying quarterly dividends regularly for more than a decade. The current dividend yield of around 7% is well above the industry average.

Q4 Report Due

Kohl’s is preparing to report fourth-quarter results on Tuesday, March 12, at 7:00 a.m. ET. Market watchers are not very optimistic about the company’s financial performance in the final months of FY23. It is estimated that net sales and earnings declined in Q4, continuing the recent trend. The consensus estimates for revenue and net income are $5.7 billion and $1.27 per share respectively. The projected top-line number is broadly in line with the revenue generated in the prior-year quarter when earnings per share was $1.45.

There has been a slowdown in the company’s digital sales, mainly reflecting the management’s decision to discontinue online-only promotions in favor of broad-based omnichannel pricing. In 2023, a key priority was to reestablish stores as a focal point of the company’s sales strategy. Recent initiatives like the extension of the partnership with beauty retailer Sephora and the expansion of the home décor division should drive sales growth in the coming months.

Road Ahead

Despite the recent moderation in sales, the company remains committed to adding new units to the store network every quarter as it looks to regain the lost momentum, especially in the apparel and footwear segment. For the near term, the focus is on accelerating and simplifying value strategies; managing inventory and expenses with discipline; and strengthening the balance sheet.

From Kohl’s Q3 2023 earnings call:

“In 2023, we have re-established our stores as a key focal point of our strategy. This has come in the form of leadership’s time and attention, meaningful investments, and new operational processes. Our actions have included expanding our gifting assortment and repositioning it to the front of stores, simplifying our in-store signage and graphics, consolidating the customer checkout area, improving our overall merchandising while adding new categories, and empowering our stores to capitalize on opportunities to drive sales in their local markets.”

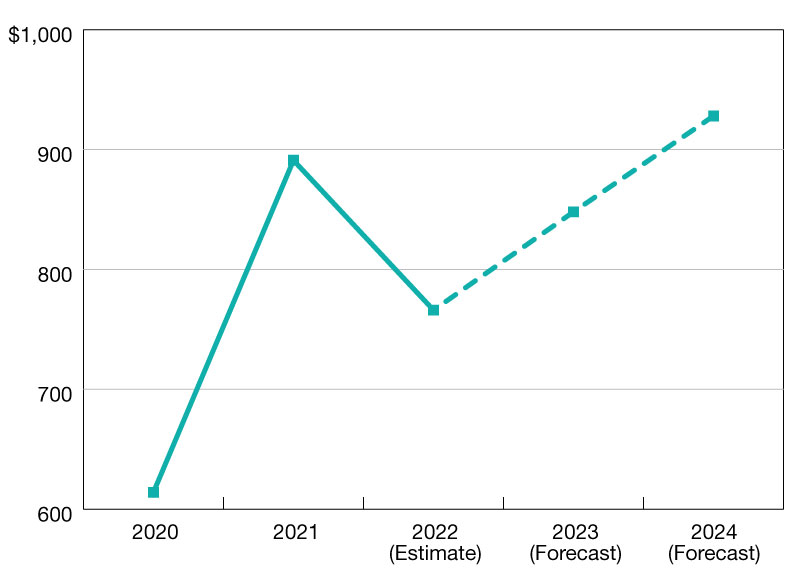

In the third quarter, net income declined sharply to $59 million or $0.53 per share, mainly reflecting a 5% drop in revenues to $3.84 billion. Comparable store sales were down 5.5% annually. For the whole of 2023, the management predicts a sales decline of 2.8-4% and earnings of $2.30 to $2.70 per share.

Investor Activism

Kohl’s management battled investor activism multiple times in the last few years and has quelled demands like replacement of board members, removal of the CEO, and sale of the company. Recently, an activist hedge fund put pressure on the management to put Kohl’s up for sale, which the company rejected.

Kohl’s stock opened Monday’s session sharply higher, paring most of the weakness it experienced last week. The shares traded up 2% in the afternoon.