NanoStockk/iStock via Getty Images

Introduction

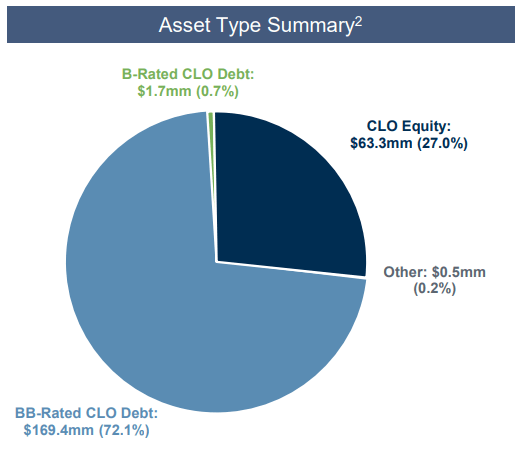

Eagle Point Income (NYSE:EIC) is an investment company focusing on CLO debt, and as explained in a previous article, Steven Bavaria is an authority on this sector and I would strongly recommend you to read some of his older articles. This October 2022 article is perhaps 18 months old, but still explains very well how you should look at CLO debt. I have a long position in EIC’s common shares, but I have a much larger position in the 2026 term preferred shares (NYSE:EICA) where the yield to maturity is quite appealing given the additional layer of safety.

A very robust Q4 result sets the tone

Unfortunately EIC didn’t release the detailed Q4 results. However, by comparing the FY 2023 results with the 9M 2023 report, we’re able to figure out the Q4 performance.

EIC Investor Relations

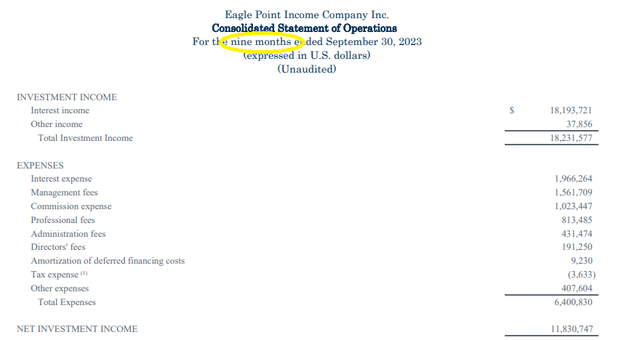

As you can see below, Eagle Point Income reported a total investment income of $26.75M and a net investment income of $17.4M for the entire financial year 2023.

EIC Investor Relations

This compares to a net investment income of $11.83M as of the end of the third quarter, which means the NII in the final quarter of the year was a very impressive $5.55M. Considering the average share count during the fourth quarter was 10.26M shares, the underlying earnings were 0.54 per share on the net investment income level.

EIC Investor Relations

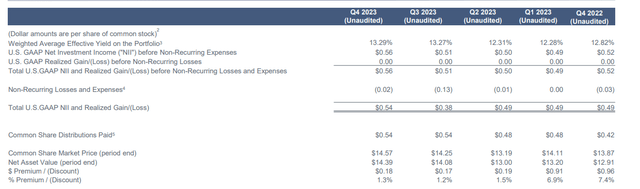

That’s also backed by the summarized quarterly overview provided by Eagle Point where you can see the total NII and realized gains before non-recurring items was $0.56/share and $0.54 after including the non-recurring items.

EIC Investor Relations

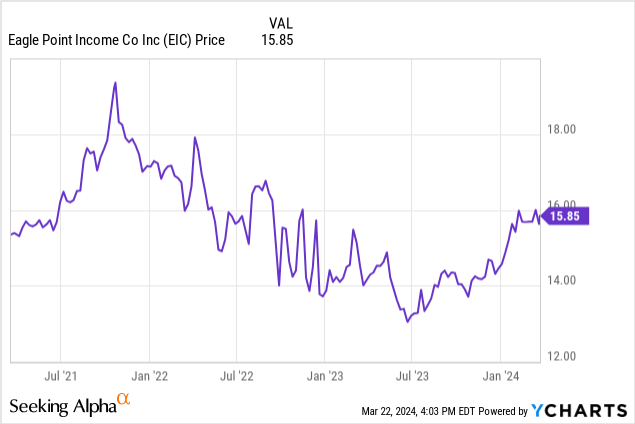

The common shares are still trading at a (small) premium to the NAV as of the end of 2023 and it shouldn’t be a surprise to see the company continued to issue new shares. At the end of 2023, there were just under 11 million shares outstanding which means EIC issued just more than 1 million shares during the final quarter of 2023.

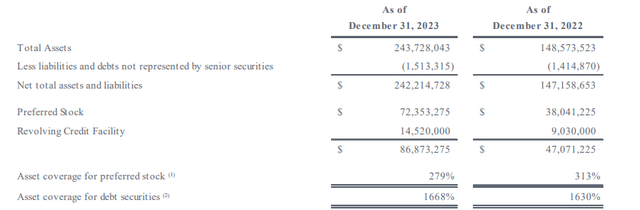

This immediately reduces my concerns about the asset coverage ratio for the term preferred shares. These asset coverage ratio has to be at least 200% at any given time and in my previous article I already mentioned that despite seeing the company issue additional preferred securities, I didn’t expect Eagle Point Income to get close to the 200% coverage ratio. This is now confirmed in the annual financial results and the asset coverage ratio as of the end of last year was approximately 279%.

EIC Investor Relations

This ratio will continue to increase. EIC disclosed it had sold an additional 1.18 million of its common shares between Jan. 1 and Feb. 21, for total net proceeds of $17.4M (net of $0.4M in commission). On a pro forma basis, assuming all other parameters remain unchanged, the asset coverage ratio for the preferred shares is slowly creeping up toward 300% again. I expect EIC to continue to issue new stock, and for every common share it issues, the preferred shares are getting safer. At the end of February, EIC’s common shares were trading at a premium of almost 6% to the NAV/share.

Eagle Point Income currently pays a monthly dividend of $0.20 on the common shares, but as interest rates on the financial markets start to decrease, I expect the monthly dividend payments to decrease as well. That’s perfectly normal considering the CLO debt traditionally has floating interest rates. Fortunately EIC still sees good opportunities in the secondary market as it deployed cash at 17% yields during the final quarter.

I’m still overweight EICA

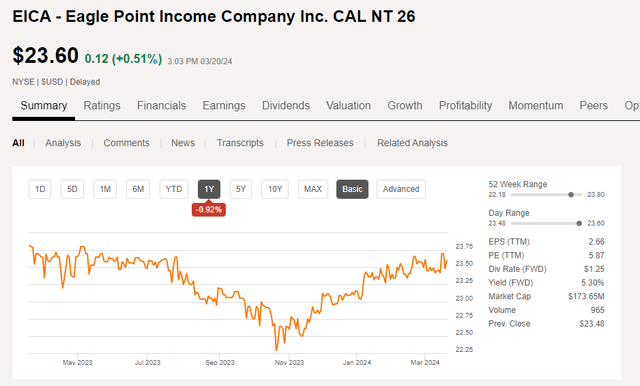

One of the largest positions in my fixed income portfolio are the 2026 preferred shares issued by Eagle Point Income. Those preferred shares have a mandatory repayment date in October 2026 and can be called from Oct. 30 this year on, and are trading with (EICA) as ticker symbol. And although they’re classified as a liability due to the mandatory call date, they’re not baby bonds, as some have erroneously suggested. That’s an important difference as interest payments and (preferred) dividend payments tend to have different tax treatments, especially for non-US investors. Just to be clear: EICA pays monthly preferred dividends which are subject to the applicable dividend taxation rules.

Seeking Alpha

The EICA security is paying the $1.25 in annualized payments per preferred share in 12 equal monthly payments of just more than $0.104 per month. These preferred shares can be called at any given moment at their principal value of $25, but what makes this issue even more attractive is the fact EIC has to redeem these preferred shares by Oct. 30, 2026. One of the main reasons why I like EICA so much is the fact that this preferred share also enjoys the benefits of the required 200% minimum asset coverage level, which adds an interesting layer of protection.

The EICA term preferred shares currently offer a pro forma yield to maturity of approximately 7.5-7.6% which I think is very appealing for a security with a remaining term of two years and seven months.

Investment thesis

I have a small long position in the common shares of Eagle Point Income but I have a pretty substantial position in the 2026 term preferred shares issued by Eagle Point. I think both the common shares as well as the preferred shares are still a “buy” although I’m a bit reluctant to pay a mid single digit premium over the current NAV of the common shares. That being said, EIC performs quite well and I think the management is making the right decision to continue to issue new shares as that will protect the balance sheet (and it makes the preferred shares safer).

I have a long position in both. The common shares are a buy on dips and the 2026 term preferred shares are a buy at the current levels.