Zuberka

Introduction

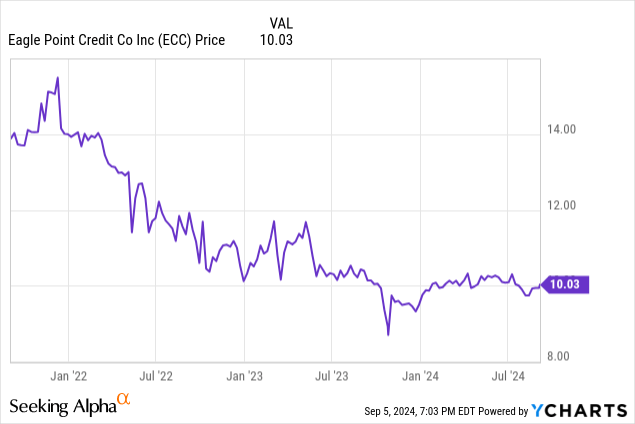

Because it has been some time since I mentioned Eagle Level Credit score (NYSE:ECC) and its perpetual most popular shares, I needed to control the corporate’s potential to proceed to cowl the popular dividend funds. The yield on the popular shares has elevated to eight.7% and I nonetheless assume this provides danger/reward ratio.

The earnings reported by ECC stay robust

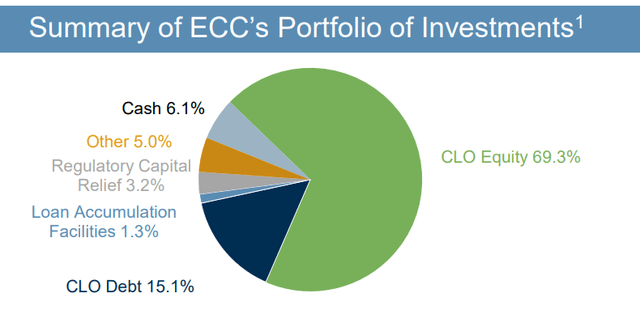

In Eagle Level Credit score’s case, the vast majority of the portfolio consists of CLO Fairness. These investments are on the backside of the CLO meals chain and solely obtained the ‘leftovers’ by way of revenue. Solely in any case funds on the CLO Debt securities have been coated, the CLO Fairness will obtain a payout. After all these increased danger securities include the next reward because the CLO Fairness investments are likely to have a return of round and even over 20% as of late.

ECC Investor Relations

Given the upper danger component in CLO Fairness versus CLO debt, it’s vital to maintain observe of the default fee of the CLO issuers, as it is vitally unlikely CLO Fairness will get well something within the occasion of a default. However because the 12-month trailing default fee was simply 0.92% on the finish of June (a lower from the year-end 2023 default fee), and that in fact is a really manageable share that might simply be absorbed by the incoming money flows from the performing securities.

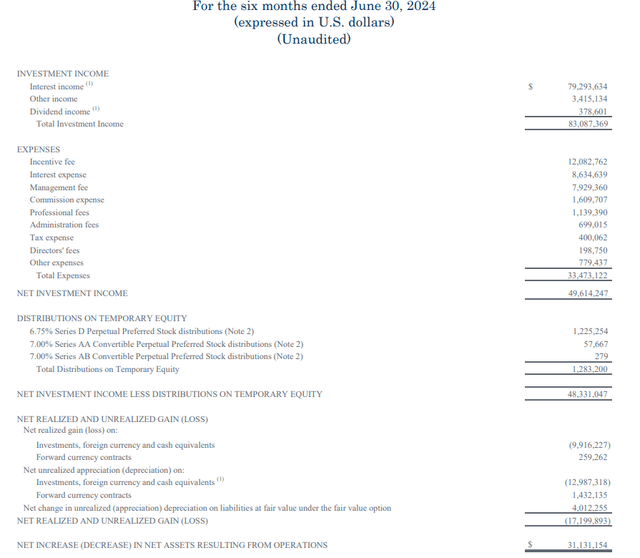

As proven beneath, Eagle Level Credit score generated a complete funding revenue of $83.1M within the first half of this yr. In the meantime, the entire bills got here in at $33.5M (and this consists of the curiosity funds in addition to the dividend funds on the time period most popular inventory) leading to a internet funding revenue of $49.6M.

ECC Investor Relations

As proven above, the $1.22M in most popular dividend funds on the Sequence D most popular inventory, leading to a internet funding revenue of $48.3M after the distributions.

The revenue assertion above tells us two issues. To start with, the payout ratio of the Sequence D most popular dividends versus the web funding revenue is lower than 3%. That’s nice. Secondly, it additionally exhibits that the corporate might cowl nearly $100M per yr in defaults earlier than reporting a internet loss. So whereas CLO Fairness is riskier than CLO debt, in ECC’s case the upper CLO revenue is greater than ample to cowl the influence of the potential defaults.

The revenue assertion additionally exhibits there was a realized lack of $9.9M on investments, which signifies that the web funding revenue minus realized losses was roughly $38.4M. Divided over 97.8M shares, this ends in a results of roughly $0.39/share. I’m not together with unrealized losses right here, as these losses both A) do materialize and find yourself within the class of realized losses or B) don’t materialize, and the market worth trades nearer to par worth nearer to the maturity date of the securities. So primarily based on the present outcomes and default fee, the popular dividends are very effectively coated.

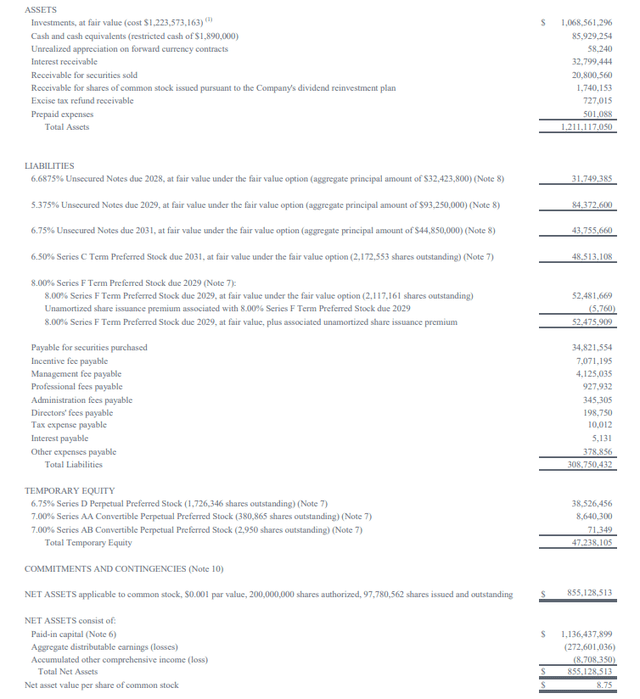

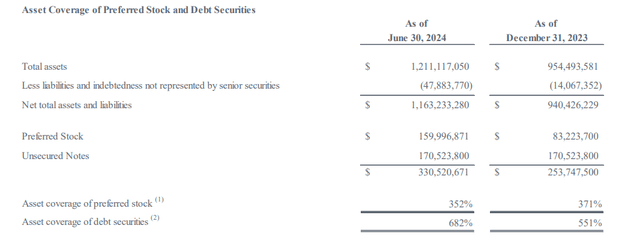

The asset protection ratio stays wonderful as effectively. As you may see beneath, there are 1.73M most popular shares excellent (excluding the time period most popular shares that are included within the liabilities phase and aren’t counted as fairness), leading to most popular fairness of $47M to which the $855M in widespread fairness ranks junior.

ECC Investor Relations

And due to the strong steadiness sheet, the corporate additionally handsomely meets the minimal 200% most popular inventory asset protection ratio, with a complete protection ratio of 352% as of the top of June.

ECC Investor Relations

So from each the dividend protection perspective and the asset protection ratio perspective, I’m not apprehensive about ECC’s cost commitments.

Including period to my portfolio utilizing the perpetual most popular shares

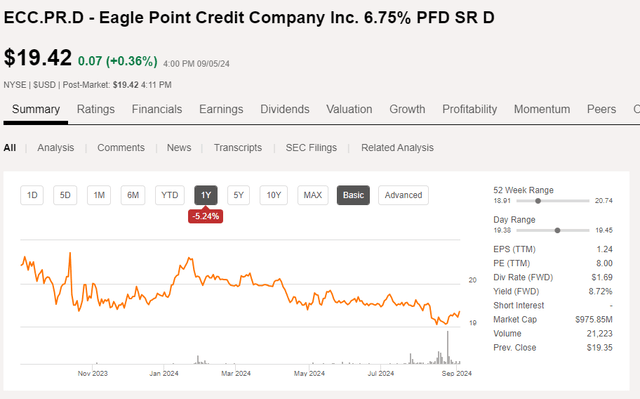

Whereas Eagle Level Credit score has a number of problems with time period most popular shares and child bonds excellent, I grew to become more and more intrigued by the perpetual most popular shares, buying and selling with (NYSE:ECC.PR.D) as ticker image. The Sequence D most popular shares are presently buying and selling at $19.42 (proven beneath) which suggests the present yield is roughly 8.7%. As these are perpetual most popular shares with out a agency maturity date, it’s fairly ineffective to calculate a yield to name (which might be the higher metric to make use of for the time period most popular shares). As 6.75% is a fairly low value of capital for Eagle Level Credit score, I’m not relying on these most popular shares being retired anytime quickly.

In search of Alpha

These most popular shares pay an annual distribution of $1.6875 per share, payable in month-to-month tranches of simply over $0.14 monthly.

Funding thesis

I presently have a small lengthy place in ECC’s most popular shares Sequence D as I like the chance/reward ratio and because the perpetual nature of those most popular securities provides period to my portfolio. I could add a few of the different most popular or debt securities to my portfolio. In the meantime, the widespread shares seem fairly fascinating in addition to the present quarterly distribution of $0.48/share (paid month-to-month) is decently coated whereas the yield on the widespread shares is roughly 19%. However whereas the distribution fee on the widespread items is interesting, let’s not overlook the inventory is buying and selling at a premium of just about 15% to its NAV however Eagle Level continues to promote widespread inventory on the open market on the identical premium.