GOCMEN

Thesis

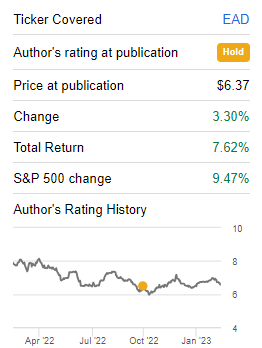

The Allspring Income Opportunities Fund (NYSE:EAD) is a fixed income closed-end fund. The vehicle focuses on leveraged loans, with a sleeve for high yield debt. Since our last article on the fund, EAD is continuing to performing, being up more than 7% on a total return basis:

Performance (Author)

Having a leveraged loan composition, the fund has a low beta of 1.38, which translates into a less volatile performance. Floating rate assets have proven to be the best choice in the past year, with the move up in dividend yield thanks to higher rates helping overall returns.

We think we are still in a bear market that is far from over. We have witnessed in the past months another bear market rally that will fizzle out at some point yet again. High beta asset classes have been all the rage, with certain names in the speculative Tech space returning over 30% this year. When investors reduce risk, they should always look at the high beta names in their portfolios first. Those are the names that will sell off the hardest in the next downturn, and those are the names that should be cut. EAD is on the lower beta side, and we have seen the discount to NAV widen out a lot already. We continue to be on Hold for this name.

Analytics

AUM: $0.39 billion.

Sharpe Ratio: 0.13 (3Y).

Std. Deviation: 15 (3Y).

Yield: 9%.

Premium/Discount to NAV: -7%.

Z-Stat: -0.12.

Leverage Ratio: 30%

Performance

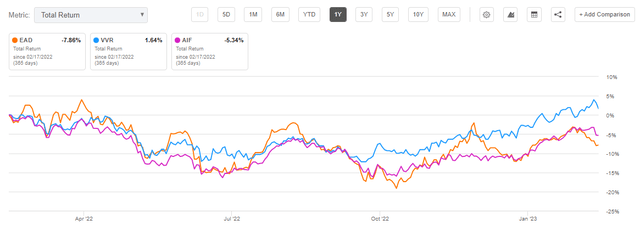

The fund traces closely the Apollo Tactical Income Fund (AIF) but underperformed in the past year when compared to Invesco Senior Income Trust (VVR):

Total Return (Seeking Alpha)

For much of the past year the CEF has traced quite closely the golden standards in the leveraged loan CEF world. To note that EAD’s premium to NAV exhibits very significant swings, which are accountable for the periods of heightened volatility we see in the fund’s total return.

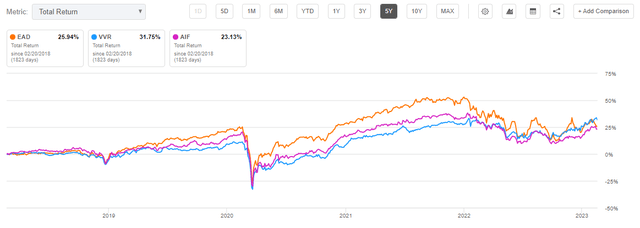

On a 5-year basis the CEF has a very good total return, very much comparable with its cohort:

Total Return (Seeking Alpha)

We are of the opinion that longer timeframes bring out the alpha capabilities of a manager, and their ability to invest in good credits. When a fund employs leverage, it is critical that the chosen portfolio does well because leverage only magnifies returns. If the fund fundamentally is not doing well, then leverage is just going to magnify that performance. Leverage on its own does not magically create positive returns.

A CEF manager often trades in and out of credits a lot, and tends to pick certain sectors and names that they think are undervalued. On a longer time frame basis one can see from the total return generated if the strategy is successful or not.

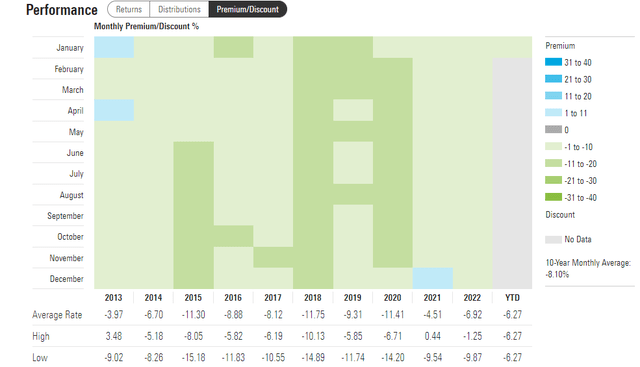

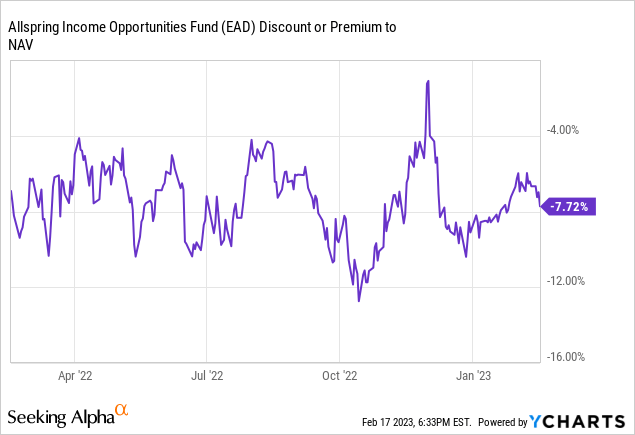

Premium/Discount to NAV

The fund continues to trade at a discount to NAV, although there has been some volatility in that figure recently:

Premium/Discount to NAV (Morningstar)

We are now moving towards the wide of the range for the fund, which has been around a -10% discount to NAV historically. There is a high beta here as well to market risk-on / risk-off environments:

We can see moves of 8% here between the October lows and December highs, moves which are very significant. These sort of premium compressions can represent almost a year’s worth of dividend income. Expect more of the same – during the next leg down in the market the fund is going to move again towards a substantial discount to NAV.

At some point during the next leg down in this market the discount to NAV is going to -12% again. That will be a very nice buy entry point. The natural state for this fund is with a -5% discount, so investors should get a nice boost on the leg up.

Conclusion

EAD is a fixed income closed end fund. The vehicle focuses on leveraged loans, but does contain a high yield bond sleeve. The CEF has a low beta figure, meaning it is well set-up versus the more aggressive CEFs for another market downturn. The fund has continued to perform in line with AIF and VVR, although its discount to NAV has been fairly volatile. We believe at this stage in the market cycle investors should prune high beta CEFs out of their portfolios and focus on names that are well set up for higher rates and have low beta figures. We are on Hold for EAD.