Teka77

Today, we are back to comment on E.ON (OTCPK:EONGY) following the Q4 results. As a reminder, E.ON is a Germany-based energy player with core operating activities divided into three segments: Energy Networks, Energy Infrastructure Solutions, and Energy Retail (Fig 1). Since our last update, E.ON Is On Track To Achieve Its 2027 Objectives, the company decided to:

- Accelerate the energy transition investment pace with additional billions of investments;

- Successfully issued €1.8 billion of bonds and started pre-funding for 2025;

- Reshape the Board for the next growth phase.

Fig 1

E.ON’s three core segments

Source: E.ON FY 2023 Results presentation

In 2023, we moved E.ON to a neutral rating. Indeed, the CEO reported the following in the H1 analysis call: “What is desired by Governments is one thing; what the company can finance is something else.”

It is essential to review our last message:

With a regulatory-based remuneration system (RAB), there are rumors that the German government is willing to increase the cost of debt and equity for new investments. This positive sign goes in the right direction; however, this should also be performed for maintenance and existing CAPEX. This will provide the proper visibility for the E.ON rating upgrade.

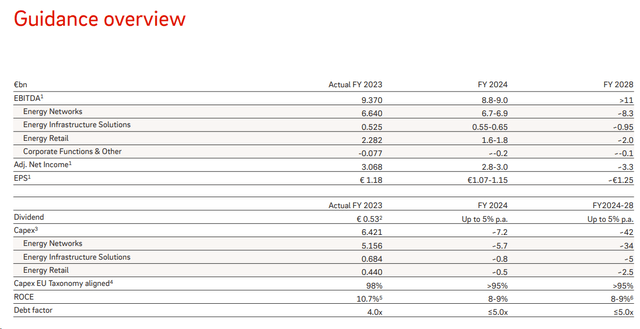

E.ON significantly raised its CAPEX (which means a higher Regulated Asset Base), which means a potentially higher valuation. Still, the German regulator has not yet upgraded the allowed returns remuneration for E.ON’s existing assets. Despite that, the company reached our target price of €12.5 per share, and considering the new outlook (Fig 2), it is time to price in a new phase.

Fig 2

E.ON outlook

Earnings Results and Supportive Guidance

Looking at the 2023 results, E.ON delivered sales and EBITDA of €93.68 and €9.37 billion, respectively. This was above its upgraded EBITDA FY23 outlook set between €8.6 and €8.8 billion. However, the company’s updated guidance, which was provided on 13 March, was positively received. The CEO delivered a message of growth with the possibility of value creation on CAPEX. Here at the Lab, we should report that there were positive expectations for the event, but the company managed to over-deliver. E.ON not only upgraded its 2028 outlook but also its 2024 guidance. In detail, the company guided for the following:

- In 2024, EBITDA is forecasted at a group level of €8.8-9.0 billion. This is 4% above the E.ON collected consensus. Net income was also 6% better than anticipated;

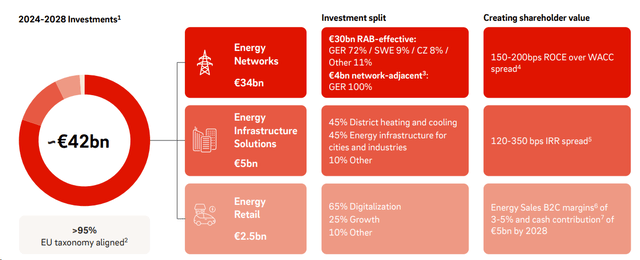

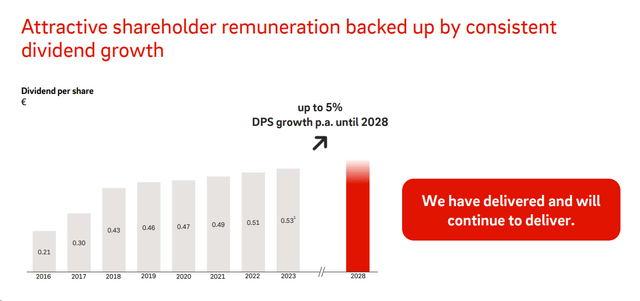

- For the medium-term outlook, we should report a significant step-up in the investment program. In total, the company previously estimated a CAPEX of €33 billion, while there is now an indication for €42 billion (Fig 3). This is estimated to have a better expected ROCE between 8-9% compared to a previous forecast of 7-8%. For this reason, the company sees a 2028 group core EBITDA above €11 billion. This is 12% above the VARA consensus and 16% above the VARA net income level. DPS growth expectations were unchanged (Fig 4).

E.ON’s superior growth should be supported by a CAPEX step-up. In detail, the company decided to accelerate its investment by approximately 30% as it seeks to move forward with the energy transition value proposition. As a reminder, Europe is aiming for climate neutrality by 2050. This means expanding electricity grids, growth supported by renewable connections, and a more efficient network (with grid reinforcement and grid replacement).

Post Q4 results and following the company’s new estimates, here at the Lab, we decided to upgrade our 2024 EBITDA by 3% and 2025-28E EBITDA by 7-8%. We are below the company’s estimates, but we believe we should price higher earnings expectations in the network business. This is supported by an upgraded CAPEX plan and higher RAB returns. In addition, unlike E.ON’s previous strategic plan, the company’s expected EBITDA growth should translate into earnings per share growth. With a lower revenue generation amid lower energy prices, we forecast approximately €80 billion in sales. Our EBITDA reached €8.9 billion (mid of E.ON guidance). Our FCF is at €1.29 billion, and we consider a CAPEX of €7.2 billion. The dividend was left at €0.55 per share, so we applied no changes in our forward estimates. On the bottom line, considering a net income level of €2.89 billion, our EPS reached €1.11.

Fig 3

E.ON new CAPEX guidance

Fig 4

E.ON’s DPS evolution

Valuation

In summary, we raised our target price from €12.5 to €13.87 based on higher earnings estimates. With our financials, E.ON trades at a P/E of 11.3x. Looking at the peers, Snam is 12.6x, Enagás trades at 12.4x (following a 43% dividend cut), and Terna is above 15x. Looking at the yield, we should report a lower dividend income projection. However, as opposed to Enagás, E.ON projects a DPS of 5% per year until 2028 (Fig 4). Therefore, we prefer a company such as E.ON with a clear trajectory in earnings and dividend visibility. Indeed, going to the valuation, using a peer average P/E target of 12.5x with an EPS of €1.11, we derive a stock price of €13.87 per share. Therefore, we moved our rating to a buy status.

Risks

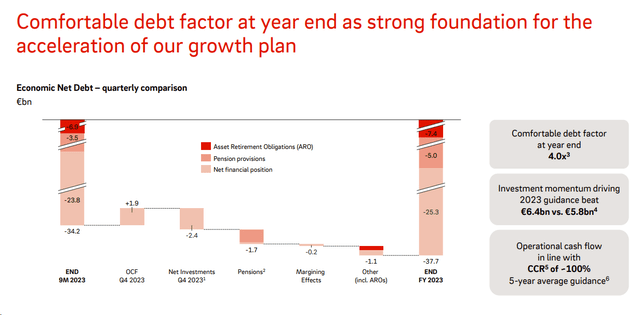

Downside risks include lower growth CAPEX with lower allowed returns. We might also assume a deterioration of the operating environment for energy retail markets. We should always consider regulatory risks and higher interest rates. Indeed, the company has almost €37.7 billion in net debt with a ratio in relation to EBITDA of 4x (Fig 5).

Fig 5

E.ON’s net debt evolution

Conclusion

The company offers solid exposure to electricity distribution, where our team sees increasing CAPEX growth driven by renewable energy transition and network efficiency. E.ON, as well as Snam, remains one of our favored European companies in the network sector. Balance sheet capacity has been created with higher expected remuneration. In our view, a dividend of 4.4% also offers a little downside protection. EON’s guidance for 2024 and 2028 is significantly above consensus expectations. We believe rates likely peaked in 2023, so we moved our rating to a buy for the above reasons.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.