CoffeeAndMilk

Back in February, I wrote a bullish article on e.l.f. Beauty, Inc. (NYSE:ELF), saying it was momentum stock in a market lacking momentum and that momentum investors should climb aboard. Since then, the stock is up over 40%. Let’s take a closer look at the name.

Company Profile

As a quick reminder, ELF sells beauty and skincare products under its e.l.f. Cosmetics, e.l.f. SKIN, Well People, and Keys Soulcare brands. The company is a fast-follower that caters to younger, female consumers and sells its products at much cheaper prices than prestige cosmetic brands.

Its products are typically found in the mass beauty channel, with Walmart (WMT) and Target (TGT) its largest retail channels. The company relies heavily on influencers to promote its products and tends to forego traditional TV and print advertising.

Post Earnings Surge

ELF shares were on an upward trend following my initial article and got a further boost following its fiscal Q4 earnings. The stock surged 22.5% the session after its report included a big earnings beat and upwardly revised guidance.

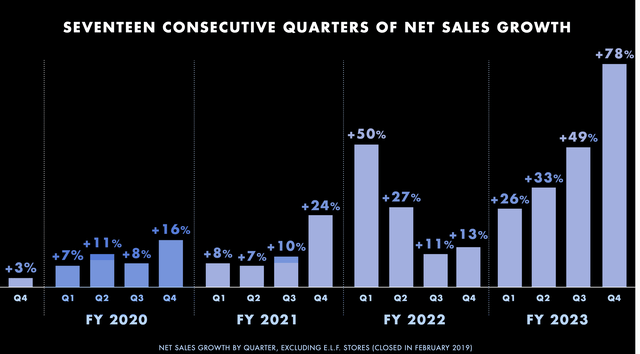

Fiscal Q4 quarterly sales soared 78% to $187.4 million, easily topping the analyst consensus of $156.1 million. Adjusted EPS, meanwhile, jumped from 13 cents a year ago to 42 cents, which was more than double the 20-cent analyst estimate.

Company Presentation

Increasing distribution was one area I discussed as a potential opportunity for ELF. In the spring, the company gained shelf space with TGT, WMT, CVS (CVS) and Shoppers Drug Mart. The company also announced that it will gain shelf space in the fall with Ulta Beauty (ULTA), Walgreens (WBA), and CVS.

Management said its average shelf space at its three largest customers still trails some other large brands. It said it has 12 feet in Target, 8 feet in Ulta Beauty and 7 feet in Walmart. That compares to 20 feet for some legacy brands.

The company’s product velocity and strong sell-through is certainly helping its cause in gaining more shelf space. ELF said it grew its business at ULTA by 70% in fiscal 2023 without any shelf space gain. Meanwhile, it said it grew its market share by 270 basis points to be the #3 mass cosmetic brand in the U.S.

Helping drive this velocity is product innovation and expansion, another area I discussed in my original article. ELF is a fast follower, so it looks to quickly make similar copies of much more expensive popular products from prestige brands. At the same time, it’s been able to place these new products into different franchises, helping grow the categories out.

On its fiscal Q4 call, CEO Tarang Amin said:

“We have a unique ability to deliver Holy Grails, taking inspiration from our community and the best products in prestige and bringing them to the market at extraordinary value. Our innovation has built category leadership over time. e.l.f. now has the #1 or #2 position across 16 segments of the color cosmetics category. Collectively, these segments make up over 75% of e.l.f. Cosmetics sales. We delivered the strongest sales growth and share gains in each of these segments in fiscal ’23. Our innovation approach is to build growing and sustaining product franchises instead of one-and-done launches. Our 4 largest franchises, Camo, Putty, Halo Glow and Power Grip, have all grown year after year. As we launch new innovation within each franchise, the entire franchise grows. We believe this is a source of competitive advantage as we’re not dependent on proliferating SKUs to anniversary prior year launches.”

Skincare, meanwhile, remains an under-penetrated area for ELF. But as I’ve noted in other articles on beauty names, skincare is often one the most stable growing beauty categories. ELF said it currently only has 1% share in this large category, so it is looking to drive innovation in the area as well.

Expanding beyond its core Gen-Z customer base and international were two other areas I mentioned as potential growth drivers. Of the demographic front, Gen Z continued to power results gain a massive 900 basis points in market share, but the company did say it picked up share among Millennial and Gen X consumers as well as Hispanic consumers.

On the international front, it continues to have a lot of white space. International revenue grew 60%, as it expands into Canada and the U.K. However, it still is only the #7 brand in these countries, as it tries to build them out. Then of course there is the rest of the world to eventually enter as well.

The macro-environment is a potential risk, but as I noted in previous articles, beauty company sales tend to perform well during tougher economic times. Given ELF’s guidance, it isn’t seeing any slowdown.

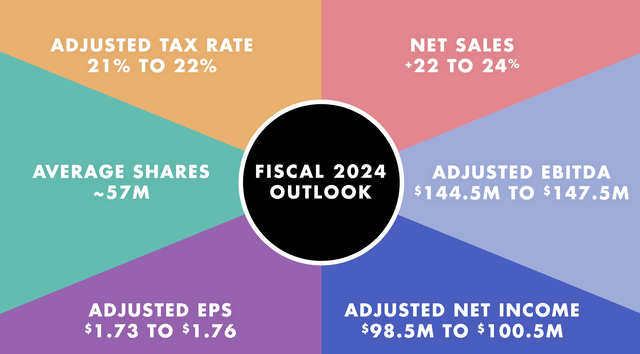

The company forecast fiscal 2024 sales to grow 22-24% to between $705-$720 million, with Q1 sales to come in well ahead of that growth rate. It guided for adjusted EBITDA of between $144.5-$147.5 million and adjusted EPS in the range of $1.73-$1.76. At the time, analysts were looking for fiscal 2024 revenue of $637.7 million and for adjusted EPS of $1.64.

Company Presentation

On its Q4 call, CFO Mandy Fields said:

“As we look out to the remainder of the year, we remain bullish on the cosmetics category and our ability to gain share. At the same time, we are mindful of macroeconomic uncertainty and potential recessionary risks. We believe our outlook appropriately balances these elements, and our approach has been consistent, serving us well as we’ve navigated a dynamic operating environment to deliver 17 consecutive quarters of net sales growth.”

Overall, that’s incredibly strong guidance that shows a company that is seeing strong demand and increased shelf space. I should also point out that the margin expansion of 470 basis points was also impressive. The company last raised prices in March 2022, so there could be some price increase upside at some point this year as well, as inflation drives up prices everywhere. That’s not currently in guidance, and could be additional upside.

Valuation

ELF stock trades around 37.8x the FY2024 (ending March) consensus EBITDA of $149.3 million and 32.7x the FY2025 consensus of $172.2 million.

It trades at a forward P/E of 58.5x the FY24 consensus of $1.80. Based on 2025 analyst estimates of $2.09, it trades at 50.4x.

Comparatively, Estee Lauder (EL) is valued at ~19.4x fiscal ’24 EBITDA (ending June). Fragrance company Inter Parfums (IPAR) has a multiple of ~19x ’23 EBITDA, while cosmetic retailer Ulta Beauty is valued at ~12x FY’24 EBITDA (ending January).

Conclusion

With e.l.f. Beauty, Inc. stock up over 40% since my initial bullish call in late February, the prudent thing would be to take some profits and hold onto the rest. The company is clearly executing great, and I think there is even some potential upside to its terrific outlook, as it should have the opportunity to raise prices a bit.

With the market re-entering bull territory, it’s not bad to hold a little bit of a momentum growth name, and ELF is certainly delivering. That said, the valuation isn’t cheap and e.l.f. Beauty, Inc. stock is up a lot since my earlier recommendation, so I’m going to take my rating to “Hold.”