theasis

I’ve highlighted Dynavax Applied sciences Company (DVAX) fairly a bit over the previous few years. The inventory has been largely vary sure over that point, regardless of the corporate persevering with to take market share in its core market and the corporate transferring in direction of profitability. Fortuitously, the inventory has been one in all my favourite and profitable “rinse, wash, and repeat” coated name trades over that point as effectively. The corporate reported second quarter outcomes in August. Subsequently, it appears an excellent time to verify again in on this rising vaccine concern. An up to date evaluation follows beneath.

In search of Alpha

Firm Overview:

Dynavax Applied sciences is headquartered in Emeryville, CA. This industrial stage biopharma’s major asset is Heplisav-B, which has grow to be the ‘better of breed’ hepatitis B vaccine since being accredited attributable to its greater effectiveness and far greater compliance (it may be delivered in two doses over a one-month interval in comparison with three doses over six months just like the earlier customary of care Entergis-B). Dynavax had an enormous burst of gross sales attributable to adjuvants utilized in a number of abroad COVID-19 vaccines, however that income stream has fully gone away now that the pandemic is over. The corporate did handle to construct up an enormous money steadiness attributable to this inflow of non-recurring funding, nonetheless. The inventory at the moment trades slightly below $11.00 a share and sports activities an approximate market cap of simply over $1.4 billion.

Second Quarter Outcomes:

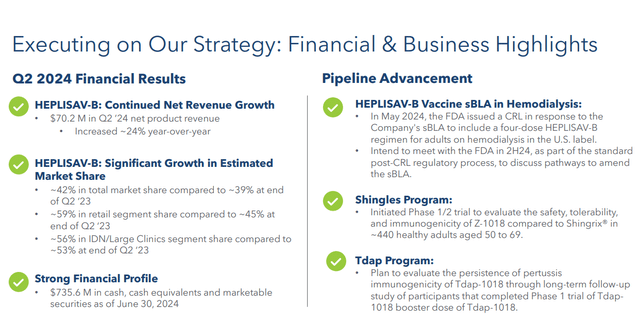

On August sixth, Dynavax posted its Q2 outcomes. They had been strong. Dynavax posted a GAAP revenue of eight cents a share, two pennies a share above expectations. Revenues rose 22.5% on a year-over-year to $73.8 million, which was barely gentle of the consensus. Heplisav-B gross sales grew 24% from the identical interval a 12 months in the past to $70.2 million and produced gross margins of roughly 80%.

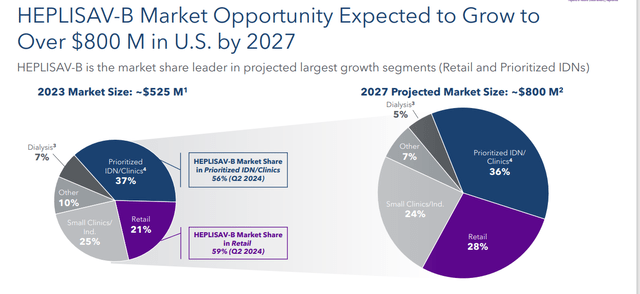

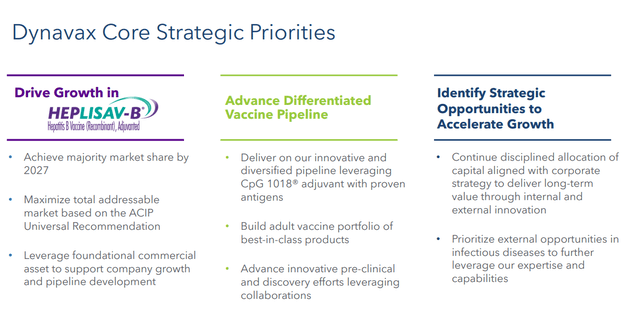

August 2024 Firm Presentation

Gross sales proceed to extend as each the dimensions of the hepatitis B vaccine market is rising and Heplisav-B’s market share additionally continues to extend. It hit 42% within the second quarter, in comparison with 39% in the identical interval a 12 months in the past. Administration has set expectations that Heplisav-B could have over half the market by 2027, and that market shall be at the least $800 million in whole. Management reiterated FY2024 Heplisav-B gross sales of between $265 million to $280 million. That is strong development over the $213.3 million of internet gross sales this vaccine supplied in FY2023.

August 2024 Firm Presentation

Analyst Commentary & Stability Sheet:

Since Q2 numbers hit the wires, Goldman Sachs maintained their Maintain ranking and lowered their worth goal to $15 a share from $20 beforehand. Nevertheless, JMP Securities ($29 worth goal), TD Cowen ($25 worth goal) and H.C. Wainwright ($29 worth goal) all have reissued their Purchase rankings after perusing outcomes.

Dynavax ended the quarter with $735 million of money and marketable securities on its steadiness sheet, and management expects the corporate to be free money circulation optimistic in FY2024. The corporate listed $223 million in convertible notes on the 10-Q it simply filed for the second quarter. There was minimal insider promoting of the shares in 2024 up to now (lower than $500,000 collectively).

Dynavax’s Money Dilemma:

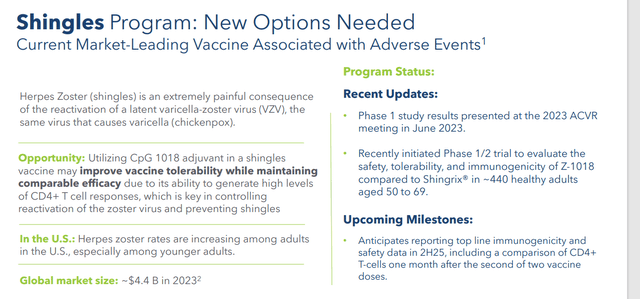

The corporate is advancing a pipeline of differentiated product candidates that leverage the identical CpG 1018® adjuvant that was utilized in a number of COVID-19 vaccines. This contains Z-1018, which is an investigational vaccine candidate that’s being developed for the prevention of shingles in adults aged 50 years and older. Dynavax simply initiated a Part 1/2 examine in June. Prime-line immunogenicity and security knowledge is anticipated out within the second half of 2025.

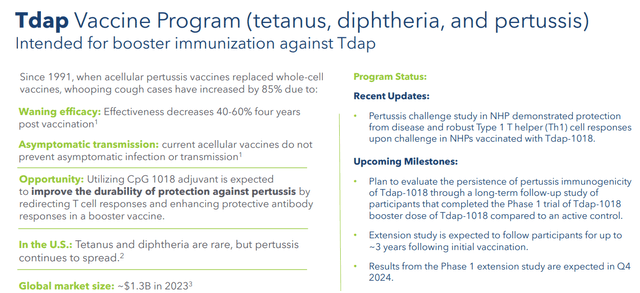

August 2024 Firm Presentation

The corporate can also be growing Tdap-1018 for energetic booster immunization towards tetanus, diphtheria, and pertussis, or Tdap. Some Part 1 examine knowledge round this candidate ought to be posted earlier than the tip of the 12 months. Lastly, Dynavax is growing a plague (rF1V) vaccine candidate that’s being absolutely funded by the Division of Protection. Some mid-stage knowledge ought to be up to date earlier than yearend. There is no such thing as a present vaccine for the plague.

August 2024 Firm Presentation

These candidates have some potential, particularly the Shingles effort. The corporate is spending $60 million to $75 million in R&D prices yearly to advance its pipeline. Dynavax would make a horny M&A candidate, buying and selling at roughly thrice revenues minus the online money on its steadiness sheet, even with an honest buyout premium. Dynavax was talked about as a logical buyout goal on a listing in February of this 12 months. The corporate could be accretive to a bigger participant in the same house.

The corporate has already reached profitability, which ought to proceed to extend within the years forward together with gross sales development. The administration at Dynavax may additionally look to buy an organization with a product accredited in the marketplace within the vaccine market or that has late-stage candidates with important potential given the money it has on its steadiness sheet. Management has hinted on the risk up to now.

August 2024 Firm Presentation

Conclusion:

Sadly, till Dynavax Applied sciences Company strikes its candidates into late-stage improvement or purchases different strategic candidates, the shares may stay vary sure and undervalued. Clearly, if DVAX is purchased out itself, that dilemma resolves itself. The excellent news is, there appears to be little draw back to the shares, and the inventory can also be buying and selling at close to the ground of a spread that has held agency for some three years now.

The choices towards the fairness often have first rate liquidity, and I’ve executed some current coated name orders so as to add to my place. It is usually an excellent degree so as to add some Dynavax Applied sciences Company shares by way of straight fairness as effectively, in my view.