Solskin

Introduction & Funding Thesis

I final wrote about Doximity (NYSE:DOCS) in April, the place I rated the inventory a “maintain.” Though I said that the inventory has a possible upside of not less than 29% from its ranges again then, I believed that buyers could be weary till the administration might reignite the expansion story. Since then, the inventory has climbed 45% because it reported a powerful Q1 FY25 earnings report, the place income and Adjusted EBITDA grew 17% and 41% YoY, respectively, beating estimates.

Concurrently, the administration additionally raised their income and earnings steering for your entire FY25. Throughout the quarter, the corporate noticed a 16% improve in buyer depend, contributing $500K+ in Subscription Income and the administration sounded significantly bullish on the tempo of their product innovation, which ought to assist them seize higher market share.

Whereas the administration maintained its cautious tone on the general state of the economic system, the place it continues to see year-over-year declines in Internet Retention Price, I want to level out that the metric has stabilized on a sequential foundation. Whereas a projection of a 9% YoY development fee in income isn’t technically a “development” stage, it could have marked a backside. Subsequently, assessing each the “good” and the “dangerous”, I consider that buyers can provoke a small place within the firm, making it a “purchase”.

The nice: Income development pushed by 16% improve in $500K+ prospects, Resonating Product Innovation, Increasing margins

Doximity reported its Q1 FY25 earnings, the place income grew 17% YoY to $126.7M beating estimates, which was pushed by a 16% improve in buyer depend, contributing not less than $500K in subscription income on a trailing twelve-month foundation. In the meantime, their prime 20 shoppers, which encompass subtle pharmaceutical producers, additionally grew on the quickest fee, up 21% on a trailing twelve-month foundation. That is indicating that the mixture of their product innovation and “land and develop” technique is beginning to bear fruit, as distinctive energetic customers on the platform grew by double digits, thus deepening adoption of their options.

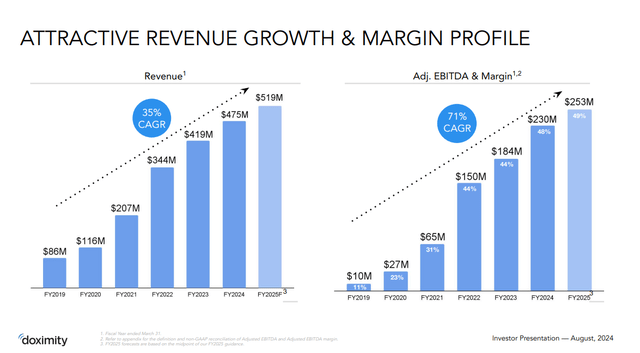

Q1 FY25 Earnings Slides: Income and Earnings development

When it comes to their product innovation, Doximity noticed a file 590,000 distinctive energetic prescribers leverage their genAI telehealth, messaging, and scheduling instruments to enhance affected person expertise and supply higher care, whereas utilization of their AI-powered customized information feed additionally set new information. In the meantime, the Doximity GPT utility has additionally seen a deep adoption by medical doctors, with over 1.5M letter requests or prompts, as medical doctors look to streamline their administrative duties. Throughout the earnings name, the administration shared the next excerpt that demonstrates how Doximity GPT is enabling medical doctors to be extra environment friendly.

“The American Medical Affiliation estimates that medical doctors spend 12 hours every week on prior authorization paperwork. So chopping that point in half is a considerable enchancment. Dr. Tariq went on to say that Doximity GPT is “lastly a device I can use to battle again.”

Lastly, Doximity has rolled out its new shopper portal to 30% of their shoppers, which consists of three key options that embrace day by day updates, gross sales knowledge, and actionable suggestions, enabling their prospects to have full transparency and actionability of their best-performing content material and successfully measure ROI. To date, the shoppers have been strongly resonating with the portal, as they can confidently consider their packages and allocate spending accordingly to maximise ROI.

Shifting gears to profitability, Doximity generated an Adjusted EBITDA of $65.9M, which grew 41% YoY, with a margin of 52%, which is 900 foundation factors increased than the earlier yr. The margin expanded as non-GAAP working bills contracted over 2% YoY, indicating a excessive degree of operational effectivity. In the meantime, the corporate’s success in driving increased spend per buyer, particularly by rising their $500K+ buyer cohort, additionally performed a pivotal position in unlocking working leverage.

The dangerous: Administration nonetheless cautious in regards to the macroeconomic panorama, Internet Retention Price declined on a year-over-year foundation.

Nevertheless, the administration continued to keep up its cautious stance on the general macroeconomic situation, which has been negatively impacting pharma budgets. Throughout the earnings name, Anna Bryson, CFO at Doximity, outlined that they count on pharma budgets to develop roughly 5-7%, which has not modified from its earlier expectation. Nevertheless, what I discovered optimistic is that the administration sounded fairly bullish on the power of their present product portfolio and the extra insights which are being pushed by their shopper portal, which ought to assist it unlock a better pharma finances over time as they get extra snug deploying their {dollars} with Doximity earlier on within the upsell cycle. On the identical time, Doximity can be taking a measured strategy to R&D spend, which declined 4.2%, demonstrating that the administration is attempting to navigate a posh macroeconomic state of affairs, develop platform engagement, and keep their aggressive positioning all on the identical time. On that notice, Doximity is projected to develop at a a lot quicker fee of 9% in FY25 when in comparison with its quick opponents, which embrace Teladoc (NYSE:TDOC), which is anticipated to see gross sales decline by 2%, and American Properly Company (NYSE:AMWL), which is anticipated to develop by simply 1.6% together with far superior profitability.

Though Doximity is rising quicker and extra worthwhile than its quick opponents, there isn’t a doubt that income development is slowing. One of many greater areas of concern is that Internet Retention Price is constant to slip on a year-over-year foundation from 118% to 114%, which may very well be pushed by tight pharma budgets, thus placing strain on Doximity’s prime line. Up till this quarter, Doximity would report the variety of prospects in its $100,000 cohort. In my earlier submit, I identified that it was seeing a slight decline within the variety of prospects in its $100K+ cohort, and in This fall, it solely noticed a 1% YoY improve in its $100K+ cohort. Within the newest quarter, the administration has not supplied the most recent $100K+ buyer cohort quantity and as an alternative selected to offer the client depend in its $500K+ cohort (which has been growing). So, whereas Doximity is having success in driving adoption of its options within the $500K+ cohort, which has a NRR of 121%, it’s attainable that it’s seeing higher churn from the cohort that sits between $100K and $500K in subscription income, thus pushing the quantity down on a year-over-year foundation. Nevertheless, earlier than I shut this part, I want to level out that total NRR figures have stabilized on a quarter-over-quarter foundation, and matched with administration’s bullish sentiment on capturing a higher share of the pharma finances from their superior product innovation, it could be on the cusp of a turnaround.

Revisiting my valuation: A small place may be initiated.

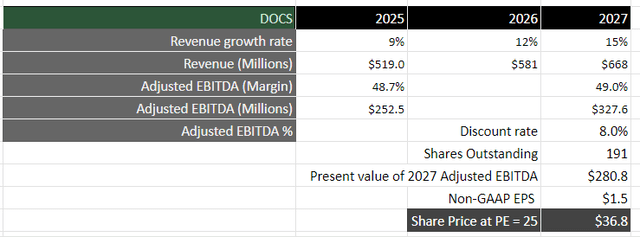

Wanting ahead, Doximity administration has raised its income steering from $512M to $519M, which might symbolize a development fee of 9% YoY. Assuming that Doximity can speed up its development again up into the low to mid teenagers over the following 2 years because it drives product innovation to land and develop throughout its buyer base, leading to increased spend per buyer, it ought to generate near $668M in income by FY27.

From a profitability standpoint, the administration additionally raised its steering for Adjusted EBITDA from $244M to $252.5M, which can symbolize a margin of 48.7%. Assuming it will probably proceed to drive the present degree of economic self-discipline over the following two years, it ought to generate near $327M in Adjusted EBITDA, which can be equal to $280M, when discounted at 8%.

Taking the S&P 500 as a proxy, the place its corporations develop their earnings on common by 8% over a 10-year interval, with a price-to-earnings ratio of 15–18, I consider it ought to commerce not less than at 1.5 instances the a number of, given the expansion fee of its earnings throughout this time period. This can lead to a PE ratio of 25, or a worth goal of $36.8, which is the place the corporate is at the moment buying and selling.

Writer’s Valuation Mannequin

My ultimate verdict and conclusions

Once I revealed my earlier submit, I had a worth goal of $29.4 for the inventory, which represented an upside of shut to twenty-eight% from its ranges again then. Since that point, the inventory is up 45%. The explanation I gave it a “maintain” was as a result of I believed that the administration needed to showcase that it might revive its development story. Whereas a 9% YoY development fee in income isn’t essentially a “development” story, it’s demonstrating indicators of a turnaround. First, it beat its income estimate by over 5%. Second, it’s seeing development in its $500K+ subscription income cohort, with buyer depend rising 16% YoY. Third, it’s seeing rising utilization and adoption of its options, with the administration sounding bullish that it will probably unlock increased pharma budgets sooner or later. Fourth, it’s seeing a decline in NRR on a year-over-year foundation, however it could be stabilizing on a sequential foundation, which may very well be proof of a turnaround. Lastly, the administration continues to stay exceptionally disciplined in relation to sustaining its operational effectivity.