Shares moved broadly greater on Monday as Wall Avenue tried to rebound from a dropping week.

The Dow Jones Industrial Common gained 328 factors, or 1%. The S&P 500 and Nasdaq Composite rose 1.5% and 1.9%, respectively.

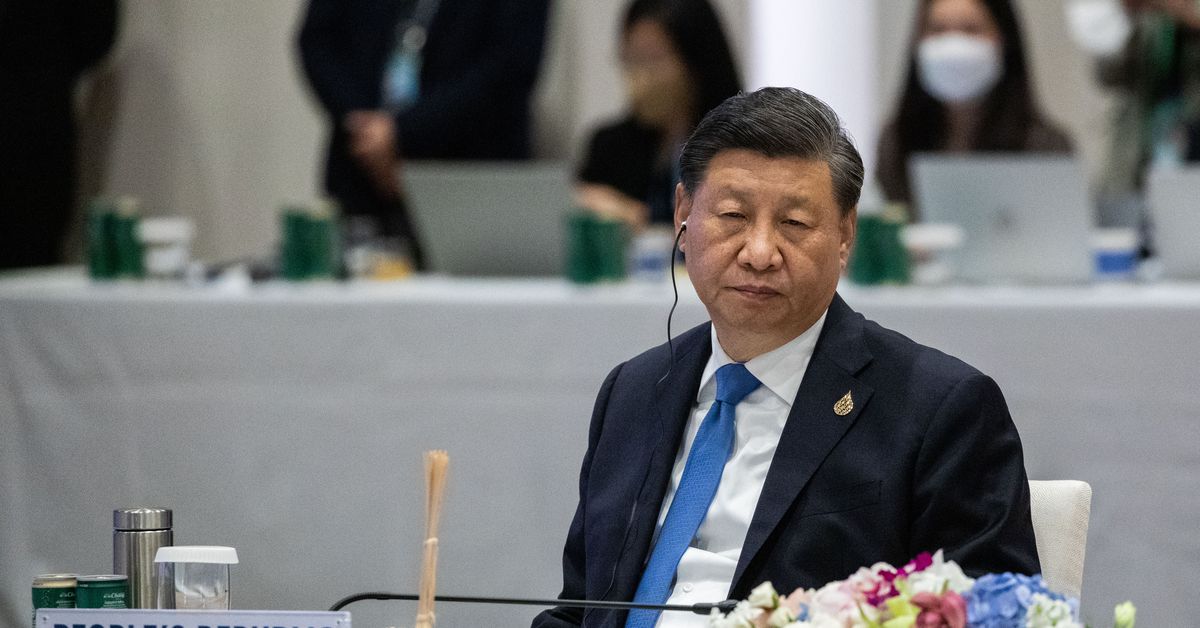

Sentiment bought a lift on after Beijing rolled again some Covid-related restrictions. In the meantime, The Wall Avenue Journal reported that Chinese language regulators are wrapping up their investigations into ride-hailing large Didi — doubtlessly signaling that the nation’s crackdown on its tech sector could also be coming to an finish.

Abroad, shares rose greater than 1% in China and over 2% in Hong Kong. Shares of Didi jumped greater than 50%.

“Since these lows close to 3,800 within the S&P 500 there was actual progress: China is reopening and hopefully the financial system shall be near working at near-full capability inside a month. That may add a big tail-wind to the worldwide financial system, and maybe most significantly, ease provide chain stress,” Tom Essaye of the Sevens Report stated in a word.

Tech shares rose within the U.S., with Apple gaining greater than 1%. Shares of Amazon rose 2% following a 20-for-1 inventory cut up.

Elsewhere, photo voltaic shares moved greater after the Biden administration moved to droop tariffs on photo voltaic panel merchandise from 4 international locations.

Financial institution shares additionally gained floor, with JPMorgan and Citibank including greater than 1% every, as rates of interest rose. The ten-year U.S. Treasury yield climbed again above 3%.

Monday’s motion adopted one other disappointing week for traders as the most important averages suffered modest losses. The blue-chip Dow fell 0.9% for its ninth adverse week in 10, whereas the S&P 500 and the Nasdaq Composite misplaced 1.2% and 1%, respectively, final week for his or her eighth dropping week in 9.

Buyers have been grappling with fears that the central financial institution may increase rates of interest too quick and an excessive amount of, inflicting a recession. Latest statements from the policy-setting Fed members point out that 50 foundation level — or a half-percentage-point — price will increase are seemingly on the June and July conferences.

The U.S. financial system added 390,000 jobs in Could, which got here in higher than anticipated regardless of fears of an financial slowdown and amid the roaring tempo of inflation.

“In our view, final week’s financial information confirmed the US financial system remaining resilient,” John Stoltzfus, chief funding strategist at Oppenheimer, stated in a word to shoppers.

Some traders imagine the robust hiring information could possibly be clearing the best way for the Fed to stay aggressive.

“For now, the market sees a Federal Reserve attempting to navigate a painful and bumpy street, but looking for a gentle exit,” stated Quincy Krosby, chief fairness strategist at LPL Monetary. “And the market finds itself between desirous to imagine within the rallies however not believing that the Fed can negotiate a gentle touchdown.”

Buyers shall be centered on the patron worth index studying for Could, which is slated for Friday morning launch. The important thing inflation gauge is anticipated to be simply barely cooler than April, which could possibly be interpreted by some as a affirmation that inflation has peaked.

The inventory market has had a risky yr with the most important averages pulling again double digits from their file highs. The S&P 500 is off by 14.7% from its all-time excessive reached in January. The fairness benchmark briefly dipped into bear market territory final month.