US President Donald Trump

| Picture Credit score:

Eduardo Munoz

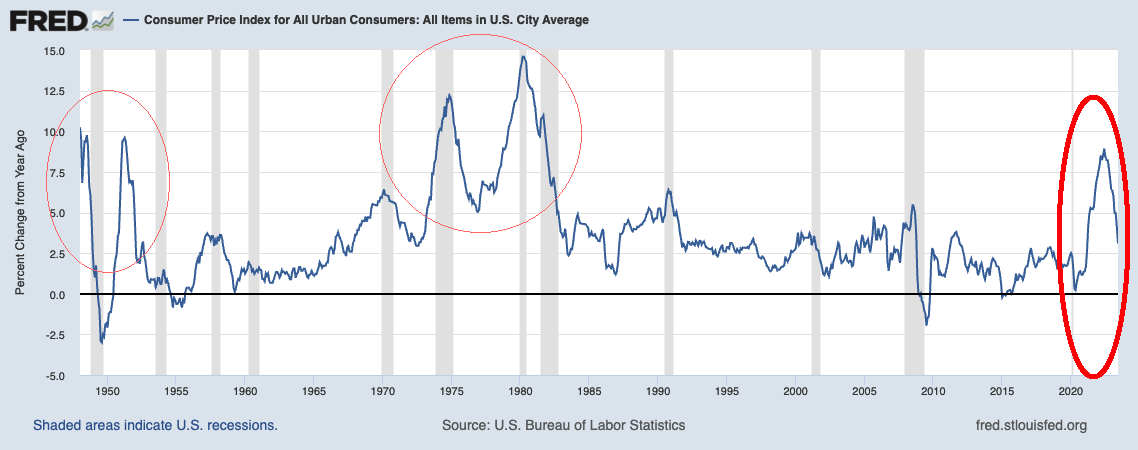

Was US President Donald Trump’s U-turn to escalate the commerce warfare final Friday by threatening excessive tariffs on the EU and iPhone maker Apple, in per week when US 30-year treasury yields hit their highest ranges since 2007, only a co-incidence? For, in the event you return a couple of weeks in the past, to early April, he made the same U-turn to pause the reciprocal tariffs for 90 days within the very week the US 10-year bond yields had their largest one week spike (50 bps) since 2001.

At the moment, bond market veteran Jim Bianco posted on X highlighting the irresistible power of the bond market by quoting James Carville (Invoice Clinton’s political advisor) who had stated, “I used to assume that if there was reincarnation, I wished to return again because the president or the pope or as a .400 baseball hitter. However now I want to come again because the bond market. You possibly can intimidate everyone.”

In spite of everything, when sovereign bond yields spike, all finance prices improve and have to regulate accordingly — the danger free price will increase, the rates of interest of debtors (authorities and personal) improve and monetary deficit as proportion of GDP, too, will increase given the upper rates of interest upon the bloated leverage of governments in developed economies just like the US and Japan. All of those have implications for equities/valuations as nicely though they could take time to play out.

Thus, with the spike final week Trump was placed on discover once more by the bond vigilantes. The issue for him is it’s now changing into a frequent incidence — first in early January this 12 months, then in April and now once more!

Double discuss

In latest weeks, there was what one can time period as double discuss or deceptive contradictory indicators on financial agenda of the Trump administration. From begin of Trump 2.0 until mid-April and particularly throughout days of deep correction in markets following reciprocal tariffs, Treasury Secretary Scott Bessent was out pushing throughout strongly that the US economic system wanted a ‘detox’ from extreme authorities spending.

The bond market cherished this and long- time period treasury bond yields have been falling till early April when some surprising and unorderly winding of positions brought on the yields to spike once more (whereas there have been views that this was probably due to China promoting US bonds in retaliation to US tariffs, the ultimate verdict in this isn’t but out).

Nonetheless, in latest weeks, with the administration working arduous to move ‘The One Large Lovely Invoice’ focussed on tax cuts which may also improve the debt ceiling, bond traders appear to be getting spooked once more. Particularly when that is occurring within the backdrop of the US rankings downgrade.

Final week, Bessent stated the US would take care of debt by guaranteeing the economic system grows quicker than the rise in debt. This implies he isn’t searching for ‘detox’ in economic system, however for it to develop quicker.

It is a full about shift of their agenda. The essential factor to notice right here is that, it now seems that Trump could possibly be able of ‘damned in the event you do it and damned in the event you don’t’.

Escalating tariff wars is inflicting concern that China or different nations might retaliate by promoting treasury bonds sending yields greater, whereas de-escalation in tariff wars, mixed with improve in debt ceiling, is inflicting issues that economic system will overheat and inflation will spike up, ensuing within the present bond tantrum.

So whereas Trump’s tariff warfare escalation final Friday could have its roots in an try to chill bond yields by focusing on eurozone and never the three largest holders of US treasury bonds — Japan, the UK and China — the danger is rising that his administration could lose management of the narrative if the flip flops proceed.

Japanese bonds

Including stress now are bond tantrums enjoying out in Japan. The Japanese 30 12 months bond yields too spiked final week and at highest ranges on document. With it comes stress on the Japan authorities (largest holder of US treasuries) and personal traders to rethink their US Treasury investments.

As it’s, a falling $ and falling US bonds (US yields spike) is a double whammy for the worth of their US bonds. That is now mixed with their home bond market rout making Japanese bonds extra engaging. Therefore, in keeping with some macro consultants, there’s a danger of comparable sort of volatility brought on by the Yen carrytrade unwinding that occurred in August final 12 months.

Fairness markets

All above components mixed now pose a robust hurdle for US and world fairness markets. The robust restoration in Dow Jones, S&P 500 and Nasdaq Composite from the lows of April is more likely to reverse from right here if bond yields proceed to inch up. It could be price noting that final Thursday at round 1 PM New York Time, the US indices posted a pointy intra-day reversal to the draw back when an public sale for $16 billion price of latest 20-yr Treasury Bonds witnessed weak demand, and the yields spiked.

Indian bond markets replicate an oasis of calm amidst these tantrums. The danger for home fairness traders, nonetheless, could stem from how FPIs react now.

In the meantime, gold would possibly proceed to seek out takers as uncertainty reigns.

Revealed on Could 24, 2025