ismagilov

One thing that is evident about recessions: they spark a shakeup in the markets, enabling well-run companies to showcase their strength while others that were merely riding more favorable economic times shrivel. With markets hovering at year-to-date highs, it’s time to be choosy in stock-picking and review our entire portfolios for potential blowups.

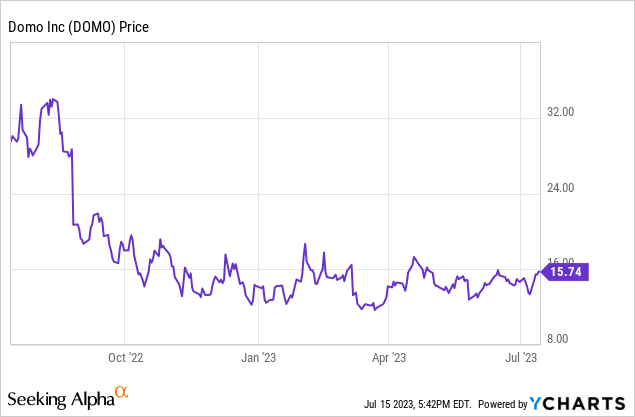

Domo (NASDAQ:DOMO), in particular, is a software company whose fortunes have shifted substantially in the post-pandemic era. This business intelligence software company is starting to crumble under the weight of both a softer buying climate as well as stiffer competition from its many rivals. Year to date, Domo’s ~12% gain has trailed behind the S&P 500 and substantially behind most enterprise software peers – and I fear that underperformance is set to continue.

I am revising my previously neutral stance on Domo to bearish. I’m not confident that this company has enough fundamental catalysts to lift it back into the stock market’s good graces. Despite its small scale, Domo’s swift fall to single-digit revenue growth (and negative billings growth) is an early indicator that this may not be a software company that can scale toward greater heights.

Here are the core red flags, in my view, that this stock faces:

- Dramatically slower billings growth rates. BI is a “nice to have,” but not a “must have.” In this environment where IT budgets are being cut, Domo implementations and deal closings are likely to get delayed, and in this time of weakness larger players like Tableau/Salesforce (CRM) and Microsoft PowerBI (MSFT) which are packaged as part of other “mission critical” software products may prevail.

- Incredibly challenging competitive landscape. And unfortunately, business intelligence software is among the most crowded arenas of enterprise software. At one time, many companies were still new to BI and choosing among vendors in a relatively greenfield landscape, but now the major players like Tableau or Microsoft PowerBI are already very commonly installed.

- Though free cash flow positive, Domo has limited resources with less than $100 million of balance sheet cash. An unexpected downturn in new deals or a sharp decline in renewals may put Domo into a pinch if it is forced to raise additional capital. Equity capital will be dilutive for Domo in this market as its stock sits well below pandemic-era highs, and debt capital will come at a huge interest cost that Domo may not be able to handle.

I only view one “upside risk” to Domo, and that’s if the company gets bought – which is not unlikely with the company’s valuation hovering around half a billion dollars. Modest valuation, in fact, is one of Domo’s only draws. At current share prices near $16, Domo trades at a market cap of $562.1 million. After netting off the $66.0 million of cash and $109.8 million of debt on Domo’s most recent balance sheet, the company’s resulting enterprise value is $605.9 million.

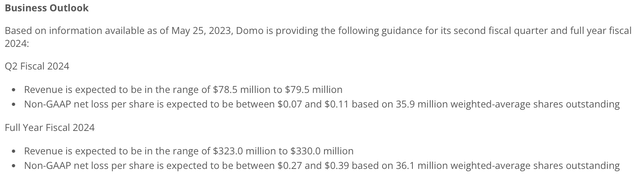

For the current fiscal year, Domo has guided to $323-$330 million in revenue, representing just 5-7% y/y growth.

Domo outlook (Domo Q1 earnings release)

This puts Domo’s valuation at 1.9x EV/FY24 revenue – a cheap valuation that reflects the company’s poor growth prospects and the possibility that Domo runs out of capital.

In my view, Domo has become a weakened value trap – steer clear here and get out of the stock while it’s still up on the year.

Q1 download

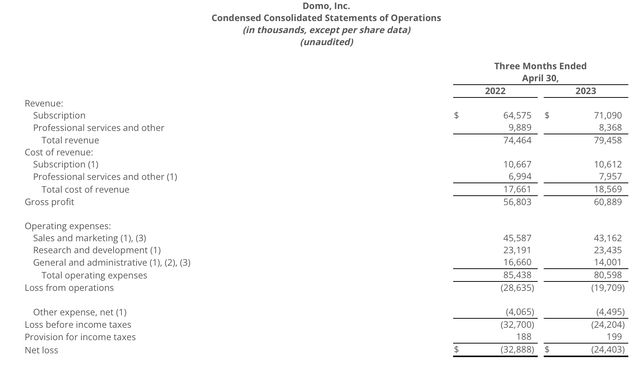

Let’s now go through Domo’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Domo Q1 results (Domo Q1 earnings release)

Domo’s revenue in Q1 grew only 7% y/y to $79.5 million, in line with Wall Street’s expectations of $78.9 million (+6% y/y). The company’s -15% y/y decline in professional services revenue, which is a benefit to gross margins as it’s performed at barely above cost, is nevertheless a signal of weak implementations and new deal activity.

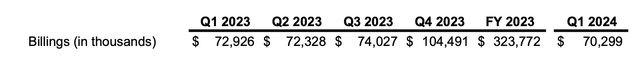

Billings is perhaps the more punishing metric this quarter: Q1 billings of $70.3 million declined -4% y/y; and was also $9 million lower on a nominal basis versus revenue.

Domo billings (Domo Q1 earnings release)

This indicates a rare circumstance for an enterprise software company in which Domo is draining its deferred revenue balances – in other words, the company is recognizing revenue at a faster pace than new deals are being brought in. This is one of the most telling signs of impending deceleration in growth.

The company acknowledges weaker performance and is trying many things to reverse recent trends, including an update to its pricing strategy to offer Domo on a consumption basis – which may appeal to smaller clients with more limited budgets and can’t afford its more expensive subscription plans. Per CEO Josh James’ remarks on the Q1 earnings call:

What’s going to bring us back to growth is a relentless focus on our customers, and a motivated and aligned sales team. I also think there’s a lot of potential upside in how we price and go to market, which I will also talk about today […]

We entered this year with much more stability in our sales force than we had last year, and I feel even more confident after Q1. I’ve been spending a lot of time with our sales force, and I can tell you that they are incredibly motivated to go execute against the targets we have all outlined, and that includes customers of all sizes. We’ve aligned the sales force very closely to how we were structured when we were executing consistently well in fiscal year ’21 and ’22.

In Q1, we had just 5 sales reps leave the company in what is a seasonally high rep attrition quarter. We think it reflects a committed sales force. We also have a much tighter alignment between marketing and sales. The top of the funnel continues to grow. And although deals are taking longer in this environment, our pipeline is building.

And then finally, I think we have upside in how we price and go to market with our products. We’ve been increasing our ability to provide access to Domo on a consumption pricing basis because we believe this will remove many of the barriers to adoption and better align our pricing to the value delivered to our customers. This allows us to offer our seat licenses to our customers for free.”

The company notes promising traction with early upsells from customers switching to a consumption-based model to take advantage of premium Domo features, but we have not yet seen a material uptick in the company’s revenue or billings just yet.

From a profitability standpoint, Domo’s pro forma operating margins improved slightly to -2% this quarter, up three points from -5% in the year-ago Q1. This was driven in part by the company’s more favorable mix of subscription versus professional services revenue, as well as a one-point boost in subscription gross margins to 86%.

Still, with limited growth prospects ahead (unless Domo’s consumption-based pricing strategy can yield a return to double-digit revenue growth), it’s unclear whether Domo will ever achieve the economies of scale needed to produce meaningful profits.

Key takeaways

With negative billings and a drawdown on deferred revenue balances, Domo has become a “show me” story. Its cheap valuation reflects the market’s sentiment that a recovery path is unlikely. Domo’s relatively small stature may invite a potential buyer, but the possibility of an acquisition takeout is not enticing enough to keep me invested in DOMO stock.