Scott Olson

Shares of Domino’s Pizza (NYSE:DPZ) have fallen about 15% from their highs in recent weeks, with a decidedly mixed quarter not helping sentiment. While the recently announced Uber Eats partnership may boost growth next year, sales momentum has slowed. Since I recommended buying shares last October, the stock has risen about 6%. Given mixed results and rising bond yields, I view shares as less attractive today and would be looking to rotate out of the position.

Seeking Alpha

In the company’s third quarter, Domino’s earned $4.18 in GAAP EPS, up 50% from last year, though there were $0.98 of favorable one-time items, which also played a role in its $0.89 beat vs consensus. Revenue was $1.03 billion, and it fell 4% from last year. However, there are many moving pieces that complicate the comparisons.

Domino’s primarily franchises out its brand, but there are some company-owned stores. Those stores obviously drive more revenue that DPZ reports than those it franchises. During the quarter, it refranchised 114 stores, reducing the revenue contribution they generate. That is why revenue from US-owned stores fell by $36 even as store-owned comps rose. On a true system-wide basis adjusting for these factors, there was modest real revenue growth.

Franchise royalties rose 8% to $138 million in the US, aided by a growing store count and new contracts. Foreign franchise fees similarly rose about 9% to $73 billion. Supply chain revenue fell a bit under 6% to $618 million. While volumes were a bit softer, pricing has also fallen, which is a positive for the business. Last year, food prices had been rising substantially, particularly dairy, which was weighing on margins as those increases could not be passed quickly enough on to customers. DPZ’s price basket fell by 1.7% from last year. On an absolute level, food prices are high, but things have gotten better.

As a consequence of this, gross margins expanded by 310bp to 38.8%, recapturing last year’s lost margin. Operating margins were up 190bp to 18.4%. This was strong, but not as strong as gross margins as Domino’s had higher advertising and G&A cost. Domino’s was a bit slow to raise prices last year to avoid undermining its brand’s value proposition, but it has been catching up all year. Prices were up 3.2% in the US last quarter, which when considering that food prices fell 1.7% is a meaningful outperformance.

Thanks to much more attractive pricing, franchisees’ profits have improved. According to management, the average franchised store generates $155k in EBITDA, which is up from $150k last quarter, and $139k from last year. This is an important metric to watch because DPZ’s growth is dependent on continuing to open new stores. To do so, potential franchisees need to believe the economics of having a Domino’s is attractive, particularly as financing costs have risen. Increasing EBITDA per store will help DPZ re-accelerate store growth.

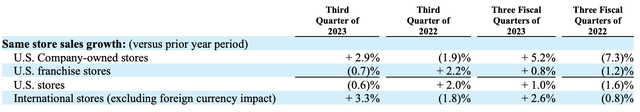

That said, after falling behind input inflation last year, there are signs Domino’s may have gone too far on pricing and is now reducing consumer demand for its pizzas. The company is now seeing a meaningful slowdown in sales. Overseas, international same-store sales growth was 3.3%, but in the US, same-store sales growth was -0.6%. While the US has led the world economy out of COVID, inflation has sapped consumers’ savings, so it is a concern that the declines were are seeing in the US will begin to be followed by other major markets.

Domino’s Pizza

There are interesting signs that US consumers are getting more price-sensitive. Notably, there has been a shift away from delivery and toward carryout, as a way to avoid fees. Carryout was up 1.9% while delivery sales fell 2.3%. That decline in delivery follows a 7.5% drop last year whereas carryout is up over 21% from two years ago. With its Uber Eats partnership launching nationwide by the start of 2024, Domino’s is hoping that this can reinvigorate its delivery sales. While management has argued carryout is complimentary to delivery, the fact sales have been going in the opposite direction points to at least some cannibalization.

While pricing was up 3.2% in Q3, management expects pricing to be up less than 1% in Q4 as it tests several promotions. Most interestingly, it is pushing an “Emergency Pizza” program, which is a “buy one get one” promotion where you can get a second pizza anytime over the next thirty days. These actions point to a customer that is growing more price-sensitive as excess savings have been largely tapped out, forcing more consumers to make trade-offs in how they spend their disposable income.

The company’s targeted growth formula has been 5-7% net store growth and 4-8% retail sales growth. After this quarter, management expects store growth to be below 5% as it has had some closures and only added 135 stores ex-Russia. With retail sales up 4.9% ex-Russia, it is poised to be a bit below the midpoint on its retail sales growth. Given solid store EBITDA performance, I am optimistic we can see some acceleration next year in store count growth, but with consumers stretched and a risk other developed markets follow the US into slower growth, getting same-store sales to accelerate will be difficult. Additionally, pricing actions may lead DPZ to give back some of the margin it has regained this year.

Last October, I thought DPZ could generate about $500 million in free cash flow as margins recover. It is on track to get close to this level. So far this year, it has generated $363 million in free cash flow, up from $280 million last year. Excluding working capital, DPZ has $356 million in free cash flow this year from $330 million last year. It should end the year around $475 million, coming up a bit short of $500 million due to slower store count growth. Even as it has faced sales challenges, DPZ remains an asset-light, highly cash-generative business thanks to the recurring nature of its franchise and licensing fees. Thanks to this cash flow, it has reduced its share count by about 2% over the past year, repurchasing $90 million in stock last quarter.

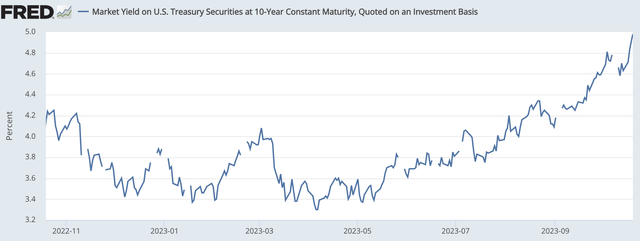

That is a business model that merits a premium valuation. Shares today offer a ~4% free cash flow yield, not too dissimilar from last year when I viewed shares as a buy. However, over the past year, the 10-year treasury has increased from just over 4% to nearly 5%. With the risk-free rate of return so much higher, a 4% free cash flow yield from a business is simply not as compelling as it once was. This is especially true for a business that may see some margin pressure as it is forced to give back some pricing in the face of weak same-store sales.

St. Louis Federal Reserve

With this premium free cash flow valuation and growth that is running below the company’s medium-term targets, I think shares have arguably performed better than they should have over the past year, even as their gain has lagged the S&P 500’s increase. While I think the recurring revenue of a franchise model is attractive, Domino’s has the same valuation as a year ago despite slower growth and higher bond yields, which makes shares less appealing. I would recommend selling shares and rotating into other franchise models with better growth prospects, like Hilton (HLT).