Up to date on Could twenty fourth, 2022 by Bob Ciura

The “Canines of the Dow” investing technique is a quite simple method for traders to attain diversification and revenue of their portfolios whereas remaining within the sphere of extra conservative blue chip shares.

The technique consists of investing within the 10 highest yielding shares within the Dow Jones Industrial Common, an index of 30 giant cap U.S. shares.

Massive-cap shares symbolize companies with market caps above $10 billion. There are tons of of large-cap shares to select from. With this in thoughts, now we have compiled a listing of over 400 large-cap shares within the S&P 500 Index, with market caps of $10 billion or extra.

You may obtain your free copy of the large-cap shares listing, together with related monetary metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the hyperlink under:

The “Canines of the Dow” technique produces above common revenue and concentrates on shares that sometimes commerce at decrease valuations relative to the remainder of the DJIA. Provided that the DJIA represents a few of the largest firms on the earth, its “canines” are sometimes firms with robust observe data which have hit non permanent issues.

For worth traders trying to buy good companies which might be at present out of favor, this can be a nice and easy technique.

To implement this technique, merely take the sum of money it’s a must to make investments after which divide it equally among the many 10 highest yielding shares within the DJIA. Maintain these shares for an entire 12 months after which on the finish of 12 months, have a look at the 30 Dow shares once more and resort them by dividend yield from highest to lowest.

Rebalance and reallocate your capital accordingly and repeat the method. Along with the simplicity and concentrate on high quality, worth, and revenue that this technique generates, it additionally improves self-discipline by stopping extreme emotion-driven buying and selling.

It additionally encourages traders to reap the tax advantages from holding positions for at the least one 12 months earlier than promoting, thereby being taxed on the long-term capital positive factors tax charge as a substitute of the short-term charge.

The 2022 Canines of the Dow

The listing of the 2022 Canines of the Dow is under, together with the present dividend yield of the top-ten yielding DJIA shares. Click on on an organization’s title to leap on to evaluation on that firm.

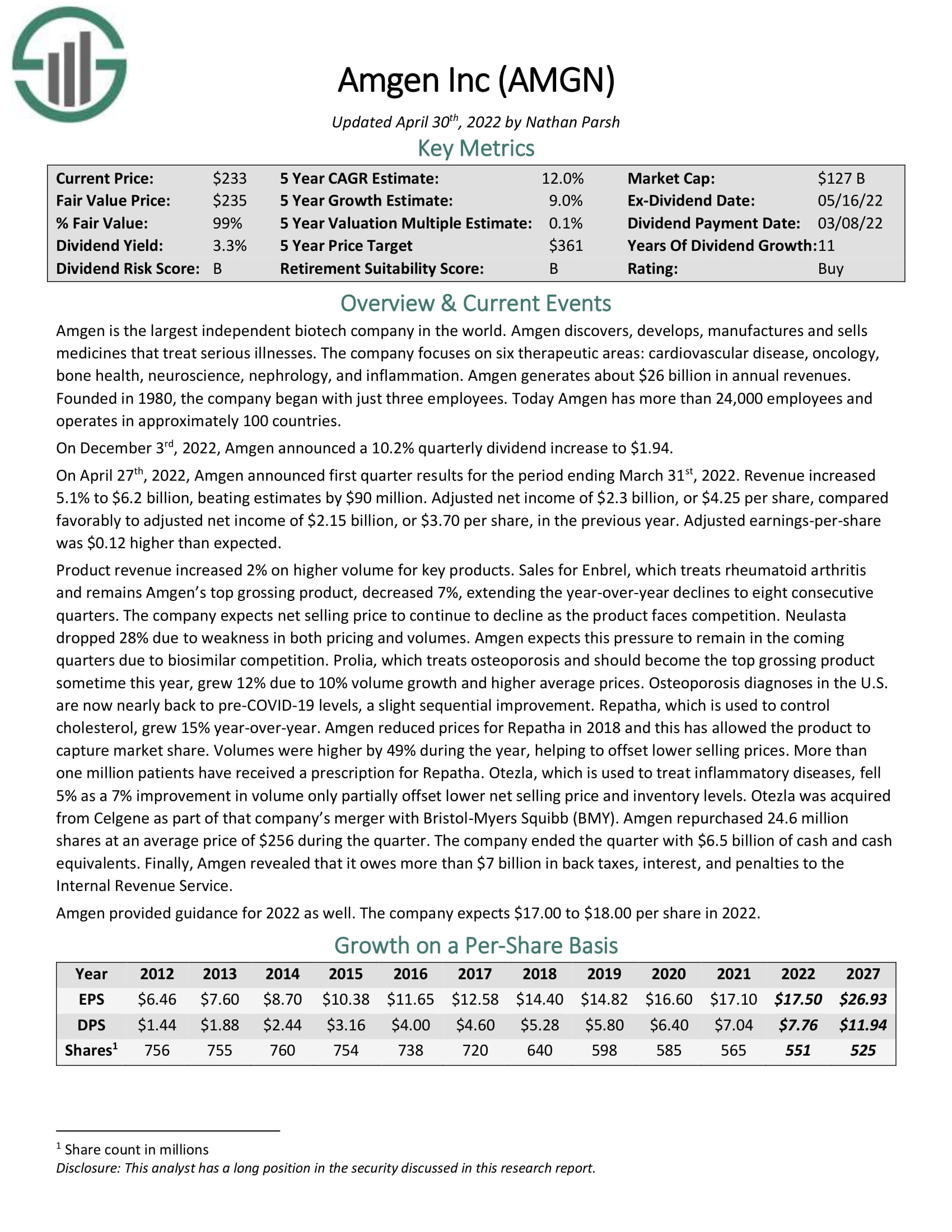

Canine of the Dow #10: Amgen Inc. (AMGN)

Amgen is the most important impartial biotech firm on the earth. Amgen discovers, develops, manufactures and sells medicines that deal with severe sicknesses. The corporate focuses on six therapeutic areas: heart problems, oncology, bone well being, neuroscience, nephrology, and irritation. Amgen generates about $26 billion in annual revenues.

On December third, 2022, Amgen introduced a ten.2% quarterly dividend enhance to $1.94. On April twenty seventh, 2022, Amgen introduced first quarter outcomes. Income elevated 5.1% to $6.2 billion, beating estimates by $90 million. Adjusted internet revenue of $2.3 billion, or $4.25 per share, in contrast favorably to adjusted internet revenue of $2.15 billion, or $3.70 per share, within the earlier 12 months. Adjusted earnings-per-share was $0.12 greater than anticipated.

Product income elevated 2% on greater quantity for key merchandise.

Supply: Investor Presentation

Gross sales for Enbrel, which treats rheumatoid arthritis and stays Amgen’s prime grossing product, decreased 7%, extending the year-over-year declines to eight consecutive quarters. The corporate expects internet promoting value to proceed to say no because the product faces competitors.

Prolia, which treats osteoporosis and will turn out to be the highest grossing product someday this 12 months, grew 12% as a result of 10% quantity progress and better common costs. Osteoporosis diagnoses within the U.S. at the moment are almost again to pre-COVID-19 ranges, a slight sequential enchancment.

Amgen repurchased 24.6 million shares at a median value of $256 in the course of the quarter. The corporate ended the quarter with $6.5 billion of money and money equivalents. Lastly, Amgen offered steering for 2022 as effectively. The corporate expects $17.00 to $18.00 per share in 2022.

Click on right here to obtain our most up-to-date Positive Evaluation report on Amgen (preview of web page 1 of three proven under):

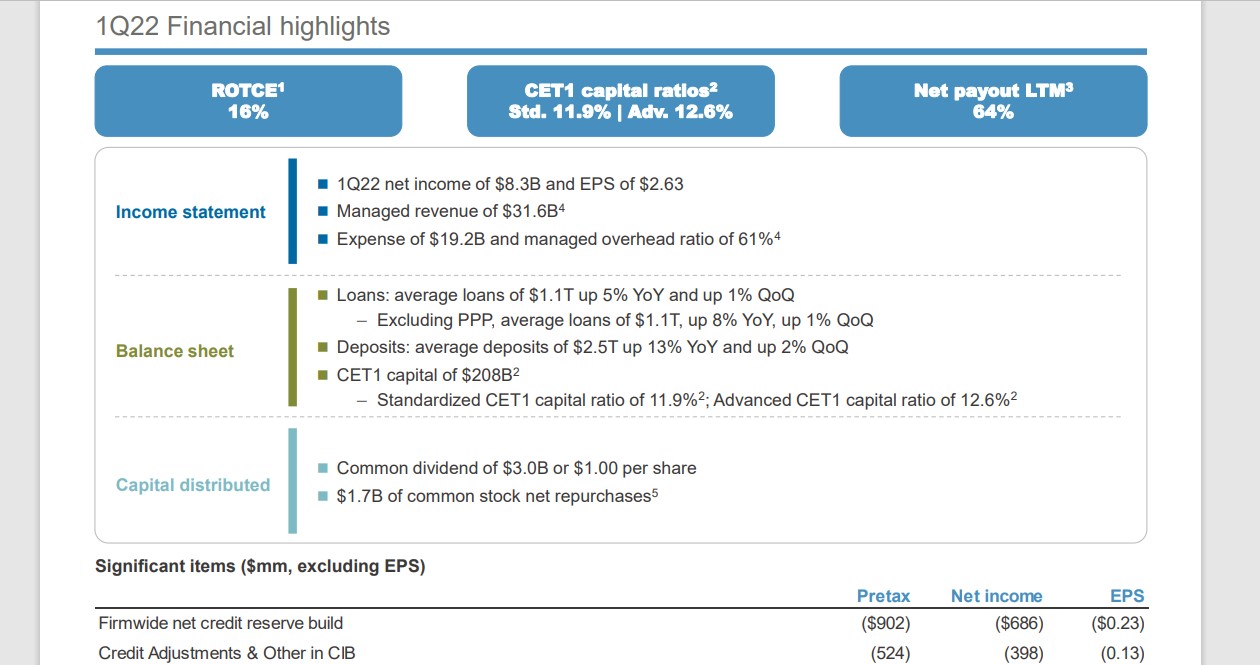

Canine of the Dow #9: JPMorgan Chase (JPM)

JPMorgan was based in 1799 as one of many first industrial banks within the U.S. Since then, it has merged or acquired greater than 1,200 totally different establishments, creating a worldwide banking behemoth with about $124 billion in annual income. JPMorgan competes in each main section of economic providers, together with client banking, industrial banking, house lending, bank cards, asset administration and funding banking.

JPMorgan Chase reported first quarter earnings on April thirteenth, 2022, and outcomes had been considerably combined, with income coming in forward of expectations, whereas earnings missed the mark.

Supply: Investor Presentation

Earnings-per-share got here to $2.63 in Q1, which was seven cents lower than anticipated. As well as, earnings declined from $3.33 in This fall of 2021, and from $4.50 in Q1 of 2021. Complete income was down 5% year-over-year to $30.7 billion, however did beat expectations by $170 million. Provisions for credit score losses had been $1.46 billion, versus a good thing about $1.29 billion in This fall, and a good thing about $4.16 billion within the year-ago interval.

Complete loans ended the interval at $1.07 trillion, basically flat with the prior quarter. Complete deposits had been $2.56 trillion, up from $2.46 trillion as the corporate continues to take deposits with out lending them. We see the loan-to-deposit ratio close to 40% as a transparent signal of administration’s warning into the following few quarters.

Administration authorized a brand new buyback authorization of $30 billion, beginning on Could 1st, 2022. On the present share value, such a buyback would retire about 8% of the corporate’s excellent shares.

Click on right here to obtain our most up-to-date Positive Evaluation report on JPM (preview of web page 1 of three proven under):

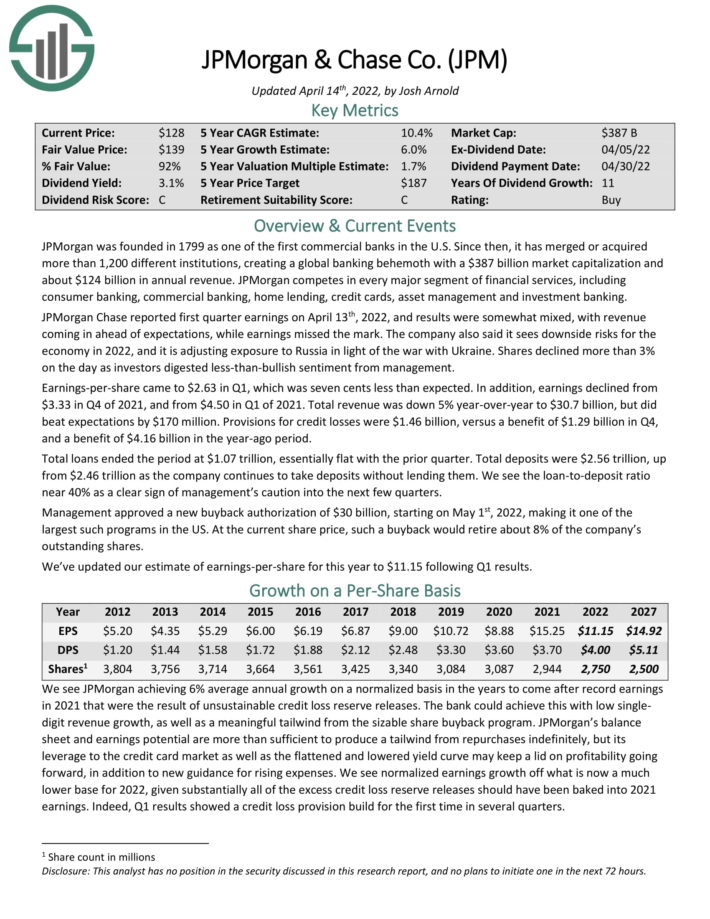

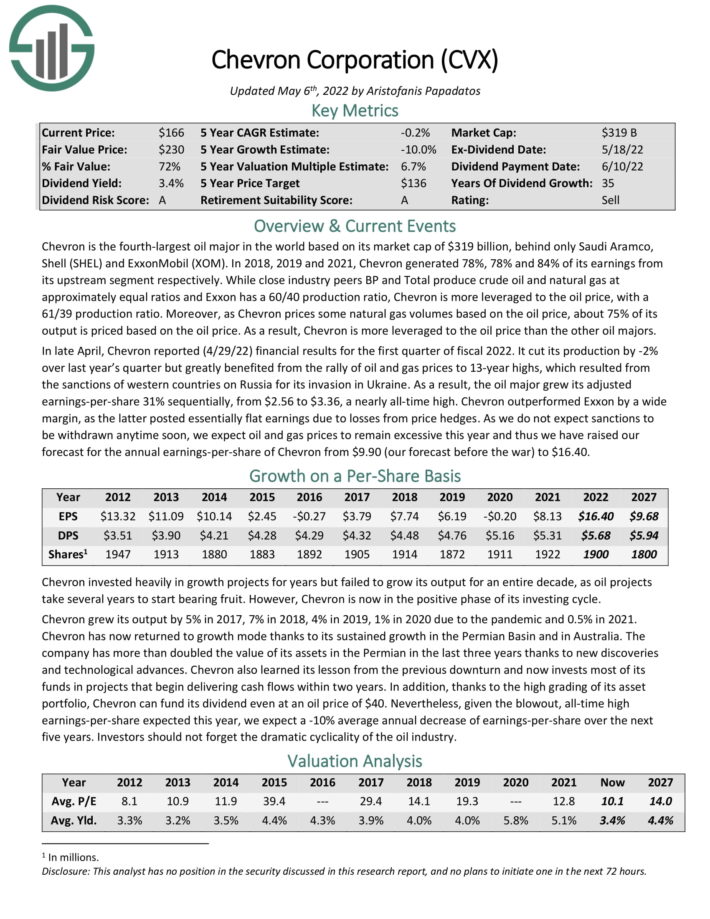

Canine of the Dow #8: Chevron Company (CVX)

Chevron is the third–largest oil main on the earth. In 2021, Chevron generated 84% of its earnings from its upstream section.

The corporate has elevated its dividend for over 40 consecutive years.

Supply: Investor Presentation

In late April, Chevron reported (4/29/22) monetary outcomes for the primary quarter of fiscal 2022. It lower its manufacturing by -2% over final 12 months’s quarter however enormously benefited from the rally of oil and gasoline costs to 13-year highs, which resulted from the sanctions of western international locations on Russia for its invasion in Ukraine. In consequence, the oil main grew its adjusted earnings-per-share 31% sequentially, from $2.56 to $3.36, an almost all-time excessive.

As we don’t anticipate sanctions to be withdrawn anytime quickly, we anticipate oil and gasoline costs to stay extreme this 12 months and thus now we have raised our forecast for the annual earnings-per-share of Chevron from $9.90 (our forecast earlier than the battle) to $16.40.

Click on right here to obtain our most up-to-date Positive Evaluation report on CVX (preview of web page 1 of three proven under):

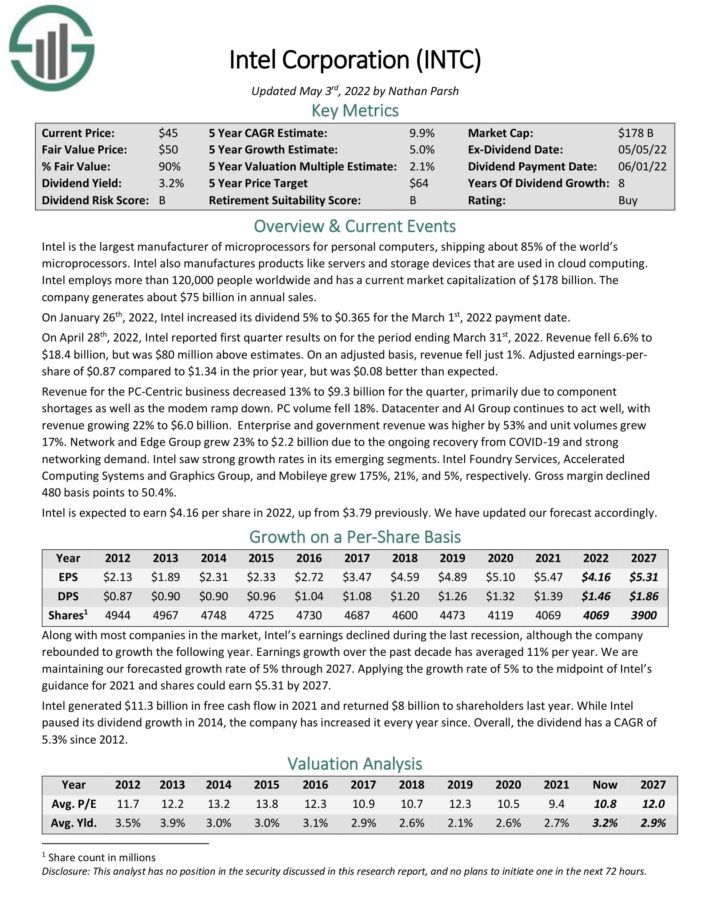

Canine of the Dow #7: Cisco Techniques (CSCO)

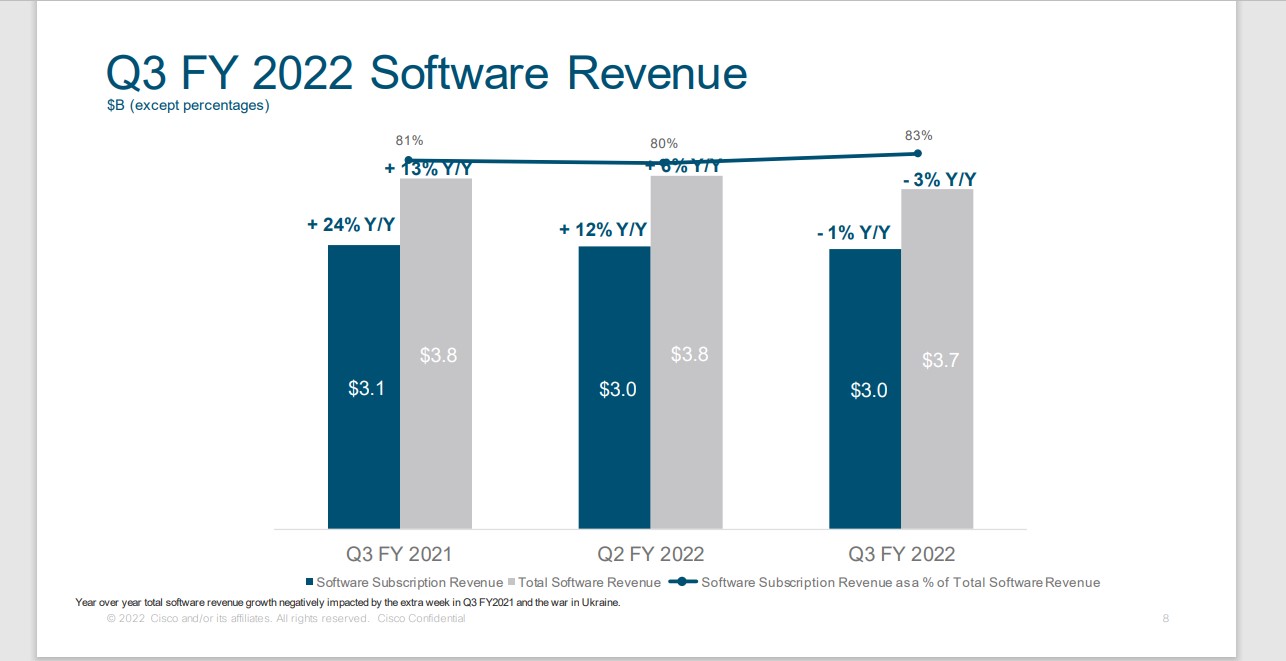

Cisco Techniques is the worldwide chief in excessive efficiency laptop networking programs. The corporate’s routers and switches permit networks world wide to attach to one another via the web. Cisco additionally presents knowledge middle, cloud, and safety merchandise.Cisco and generates about $51 billion in annual revenues. On February sixteenth, 2022, Cisco introduced a 2.7% dividend enhance within the quarterly cost to $0.38 per share.

On Could 18th, 2022, Cisco reported earnings outcomes for the third quarter of fiscal 12 months 2022. Income grew 0.3% to $12.8 billion. Adjusted earnings-per-share of $0.87 in contrast grew 4.8%.

Supply: Investor Presentation

Safe Agile Networks, previously often known as Infrastructure, grew 4% whereas Finish-to-Finish Safety, previously often known as Safety, improved by 7%. Web for the Future was up 6% and Optimized Software Experiences was greater 8%. Collaboration was as soon as once more the lone section to say no, as income decreased 7%.

By area, the Americas grew 5% whereas Europe/Center East/Africa and Asia-Pacific/Japan/China had been each decrease by 6%. Complete gross margins contracted 60 foundation factors to 63.3%. Deferred income grew 7% to $22.3 billion. Cisco repurchased 5 million shares at a median value of $54.20 in the course of the quarter. The corporate remaining share repurchase authorization is $17.6 billion, or almost 10% of the present market cap.

Cisco provided a revised outlook for fiscal 12 months 2022 as effectively, with the corporate now anticipating income progress of two% to three%, down from 5.5% to six.5% and 5% to 7% beforehand. Adjusted earnings-per-share is now anticipated in a variety of $3.29 to $3.37, in comparison with $3.41 to $3.46 and $3.38 to $3.45 beforehand. On the midpoint, this could be a 3.4% enchancment from the prior 12 months.

Click on right here to obtain our most up-to-date Positive Evaluation report on Cisco (preview of web page 1 of three proven under):

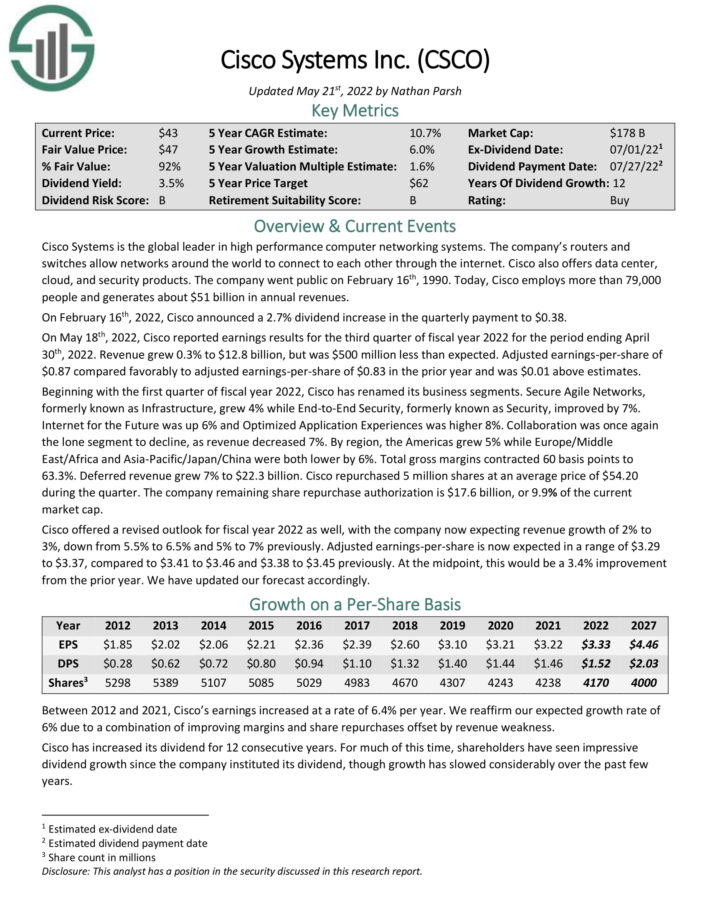

Canine of the Dow #6: Intel Company (INTC)

Intel is the most important producer of microprocessors for private computer systems, delivery about 85% of the world’s microprocessors. Intel additionally manufactures merchandise like servers and storage units which might be utilized in cloud computing. Intel generates about $75 billion in annual gross sales.

On January twenty sixth, 2022, Intel elevated its dividend 5% to $0.365 for the March 1st, 2022 cost date. On April twenty eighth, 2022, Intel reported first quarter outcomes. Income fell 6.6% to $18.4 billion, however was $80 million above estimates. On an adjusted foundation, income fell simply 1%. Adjusted earnings-per-share of $0.87 in comparison with $1.34 within the prior 12 months, however was $0.08 higher than anticipated.

Income for the PC-Centric enterprise decreased 13% to $9.3 billion for the quarter, primarily as a result of element shortages in addition to the modem ramp down. PC quantity fell 18%.

Datacenter and AI Group continues to behave effectively, with income rising 22% to $6.0 billion. Enterprise and authorities income was greater by 53% and unit volumes grew 17%. Community and Edge Group grew 23% to $2.2 billion as a result of ongoing restoration from COVID-19 and powerful networking demand.

Intel noticed robust progress charges in its rising segments. Intel Foundry Providers, Accelerated Computing Techniques and Graphics Group, and Mobileye grew 175%, 21%, and 5%, respectively. Gross margin declined 480 foundation factors to 50.4%.

Click on right here to obtain our most up-to-date Positive Evaluation report on Intel (preview of web page 1 of three proven under):

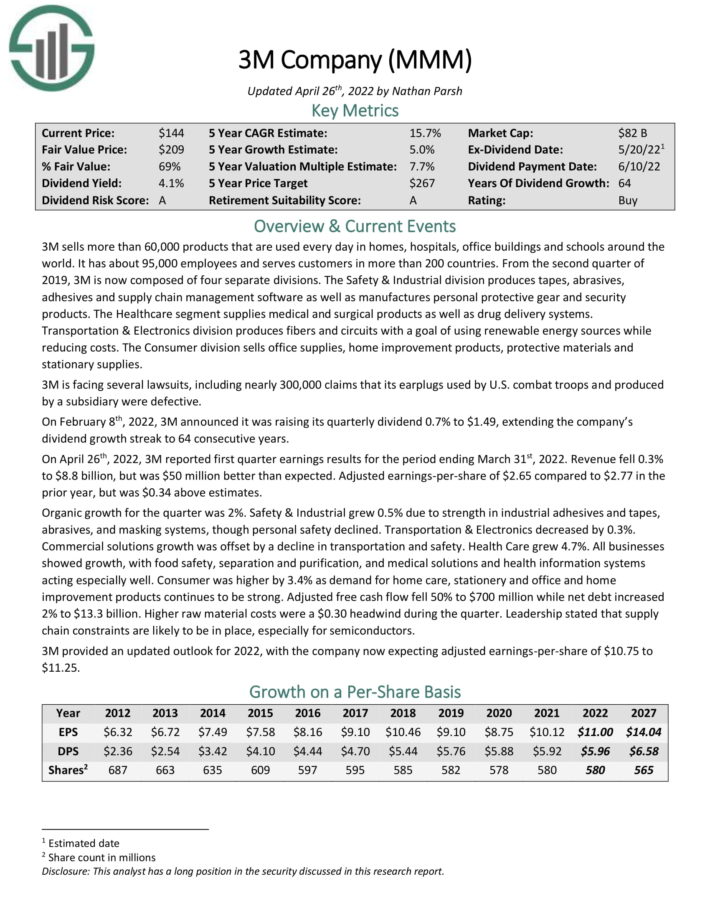

Canine of the Dow #5: 3M Firm (MMM)

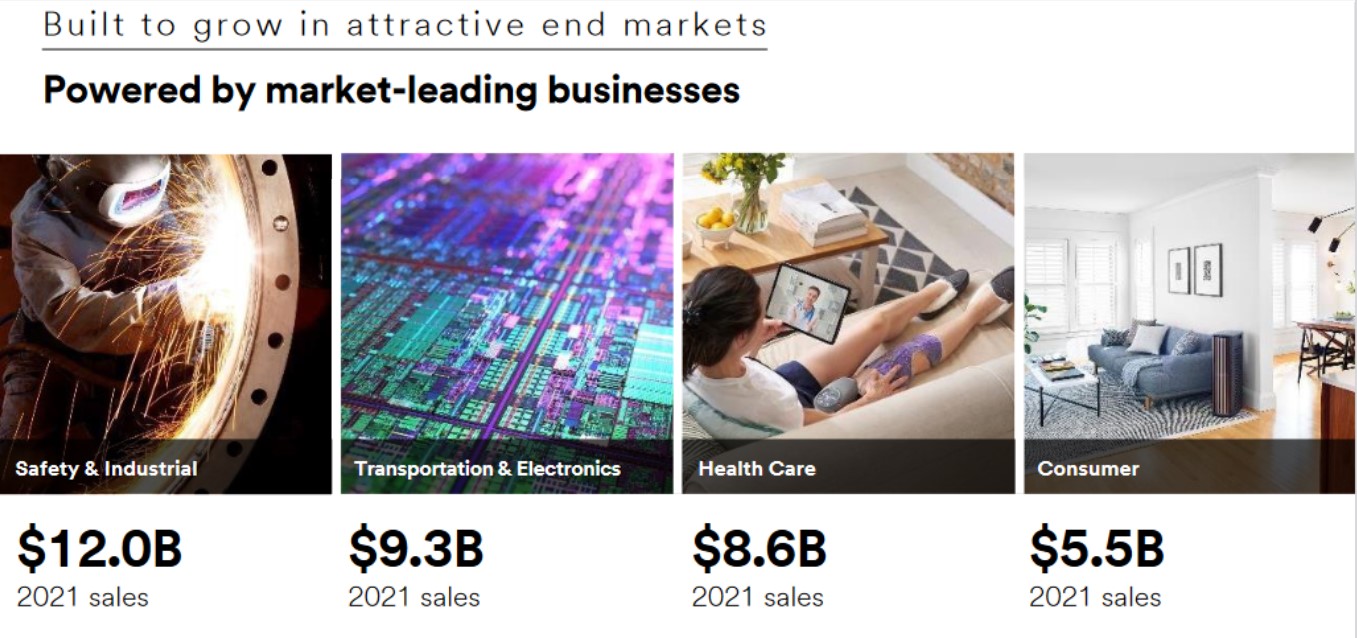

3M sells greater than 60,000 merchandise which might be used daily in properties, hospitals, workplace buildings and colleges across the world. It has about 95,000 staff and serves prospects in additional than 200 international locations.

Supply: Investor Presentation

3M is now composed of 4 separate divisions. The Security & Industrial division produces tapes, abrasives, adhesives and provide chain administration software program in addition to manufactures private protecting gear and safety merchandise.

The Healthcare section provides medical and surgical merchandise in addition to drug supply programs. Transportation & Digitals division produces fibers and circuits with a objective of utilizing renewable power sources whereas lowering prices. The Shopper division sells workplace provides, house enchancment merchandise, protecting supplies and stationary provides.

On April twenty sixth, 2022, 3M reported first quarter earnings outcomes for the interval ending March thirty first, 2022. Income fell 0.3% to $8.8 billion, however was $50 million higher than anticipated. Adjusted earnings-per-share of $2.65 in comparison with $2.77 within the prior 12 months, however was $0.34 above estimates. Natural progress for the quarter was 2%.

Security & Industrial grew 0.5% as a result of energy in industrial adhesives and tapes, abrasives, and masking programs, although private security declined. Transportation & Electronics decreased by 0.3%. Industrial options progress was offset by a decline in transportation and security. Well being Care grew 4.7%. Shopper was greater by 3.4% as demand for house care, stationery and workplace and residential enchancment merchandise continues to be robust.

3M offered an up to date outlook for 2022, with the corporate now anticipating adjusted earnings-per-share of $10.75 to $11.25.

Click on right here to obtain our most up-to-date Positive Evaluation report on 3M (preview of web page 1 of three proven under):

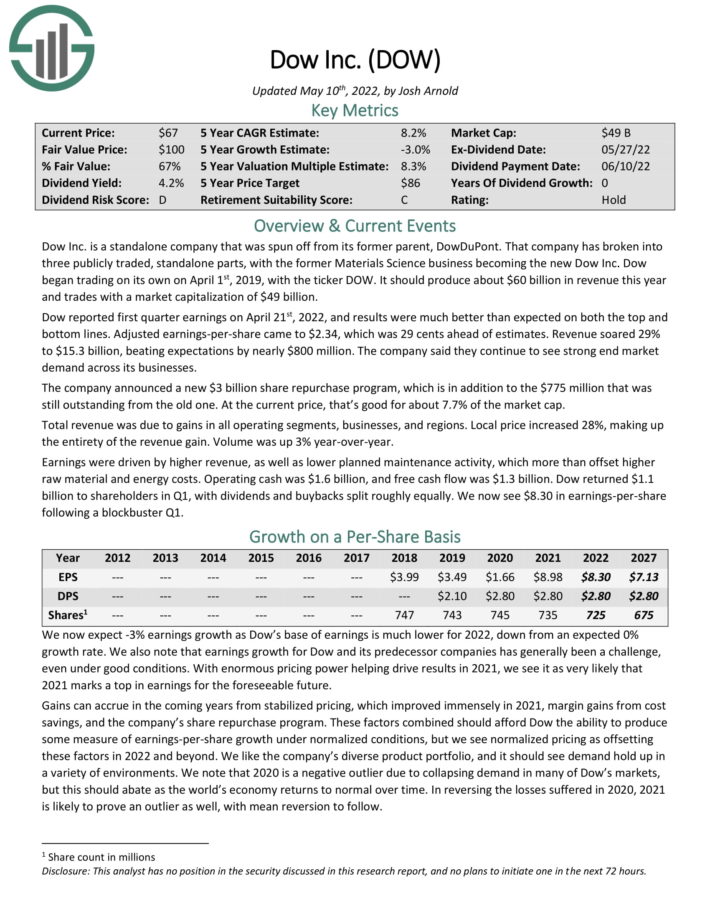

Canine of the Dow #4: Dow Inc. (DOW)

Dow Inc. is a standalone firm that was spun off from its former guardian, DowDuPont. That firm has damaged into three publicly traded, standalone elements, with the previous Supplies Science enterprise turning into the brand new Dow Inc. Dow ought to produce about $60 billion in income this 12 months.

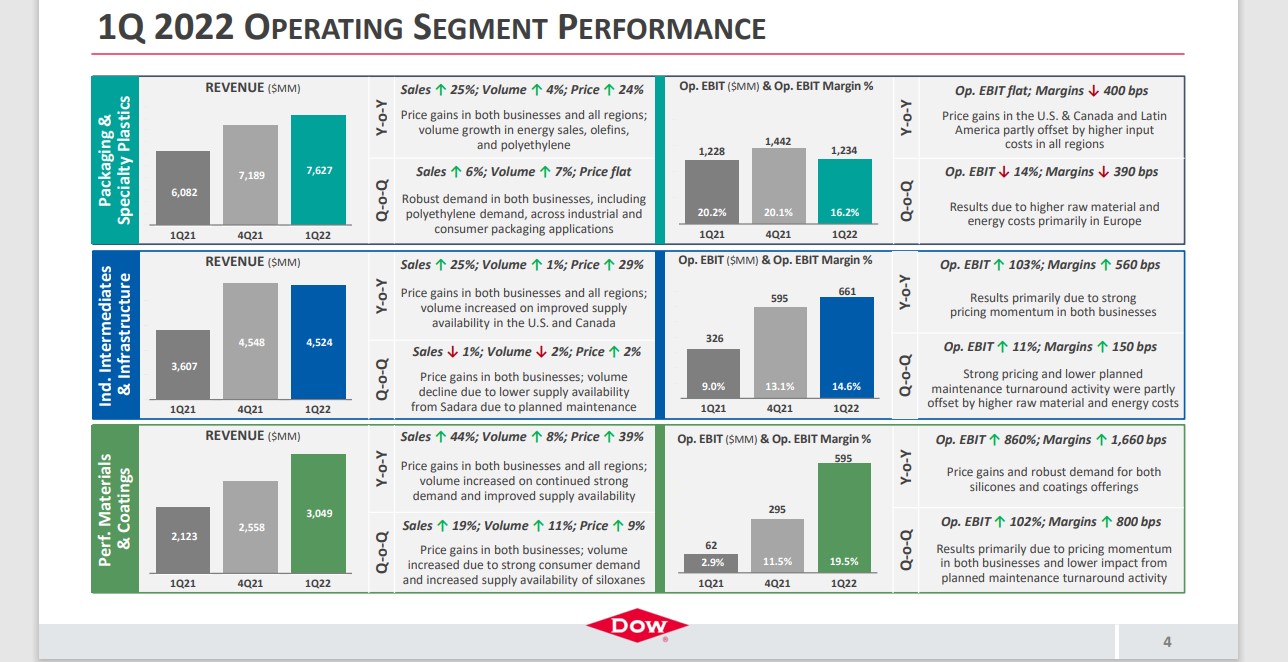

Dow reported first quarter earnings on April twenty first, 2022, and outcomes had been a lot better than anticipated on each the highest and backside traces. Adjusted earnings-per-share got here to $2.34, which was 29 cents forward of estimates. Income soared 29% to $15.3 billion, beating expectations by almost $800 million. The corporate mentioned they proceed to see robust finish market demand throughout its companies.

The corporate introduced a brand new $3 billion share repurchase program, which is along with the $775 million that was nonetheless excellent from the outdated one. On the present value, that’s good for over 7% of the market cap.

Income progress was as a result of positive factors in all working segments, companies, and areas.

Supply: Investor Presentation

Native value elevated 28%, making up the whole thing of the income achieve. Quantity was up 3% year-over-year. Earnings had been pushed by greater income, in addition to decrease deliberate upkeep exercise, which greater than offset greater uncooked materials and power prices.

Working money was $1.6 billion, and free money stream was $1.3 billion. Dow returned $1.1 billion to shareholders in Q1, with dividends and buybacks cut up roughly equally. We now see $8.30 in earnings-per-share following a blockbuster Q1.

The corporate’s product portfolio just isn’t solely its aggressive benefit, but in addition ought to carry out effectively sufficient throughout downturns to maintain the corporate worthwhile. We see the corporate’s targeted efforts on high-growth areas reminiscent of client care, packaging, and infrastructure, in addition to its very lengthy working historical past as a element of the previous firm, and its model, as aggressive benefits.

Click on right here to obtain our most up-to-date Positive Evaluation report on Dow (preview of web page 1 of three proven under):

Canine of the Dow #3: Walgreens Boots Alliance (WBA)

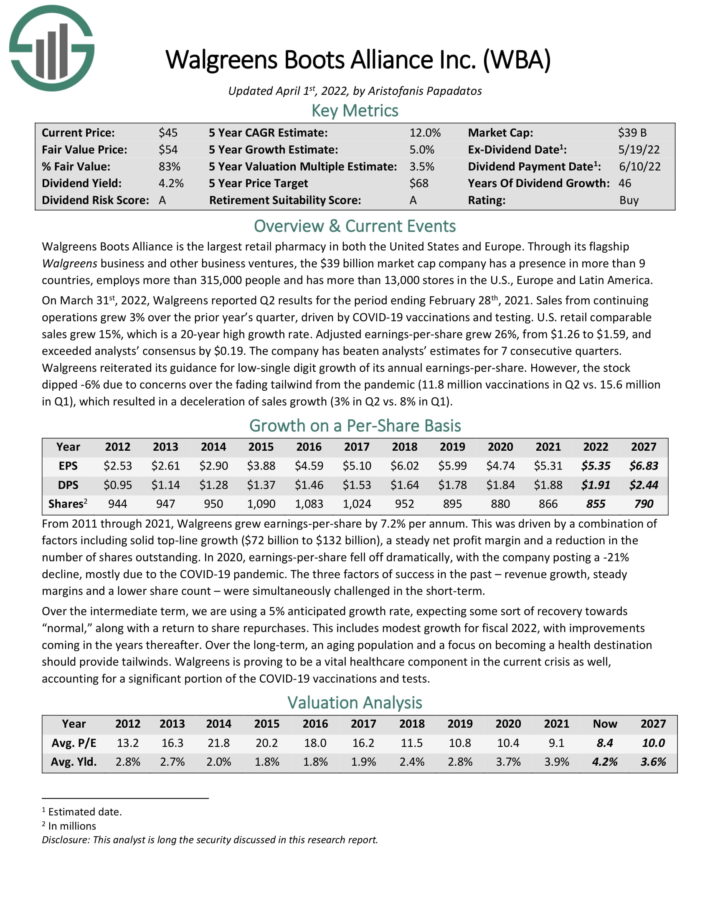

Walgreens Boots Alliance is the most important retail pharmacy in each the USA and Europe. By means of its flagship Walgreens enterprise and different business ventures, the firm employs extra than 325,000 individuals and has greater than 13,000 shops.

On March thirty first, 2022, Walgreens reported Q2 outcomes for the interval ending February twenty eighth, 2021. Gross sales from persevering with operations grew 3% over the prior 12 months’s quarter, pushed by COVID-19 vaccinations and testing. U.S. retail comparable gross sales grew 15%, which is a 20-year excessive progress charge. Adjusted earnings-per-share grew 26%, from $1.26 to $1.59, and exceeded analysts’ consensus by $0.19. The corporate has crushed analysts’ estimates for 7 consecutive quarters.

Walgreens reiterated its steering for low-single digit progress of its annual earnings-per-share.

Click on right here to obtain our most up-to-date Positive Evaluation report on Walgreens (preview of web page 1 of three proven under):

Canine of the Dow #2: Worldwide Enterprise Machines (IBM)

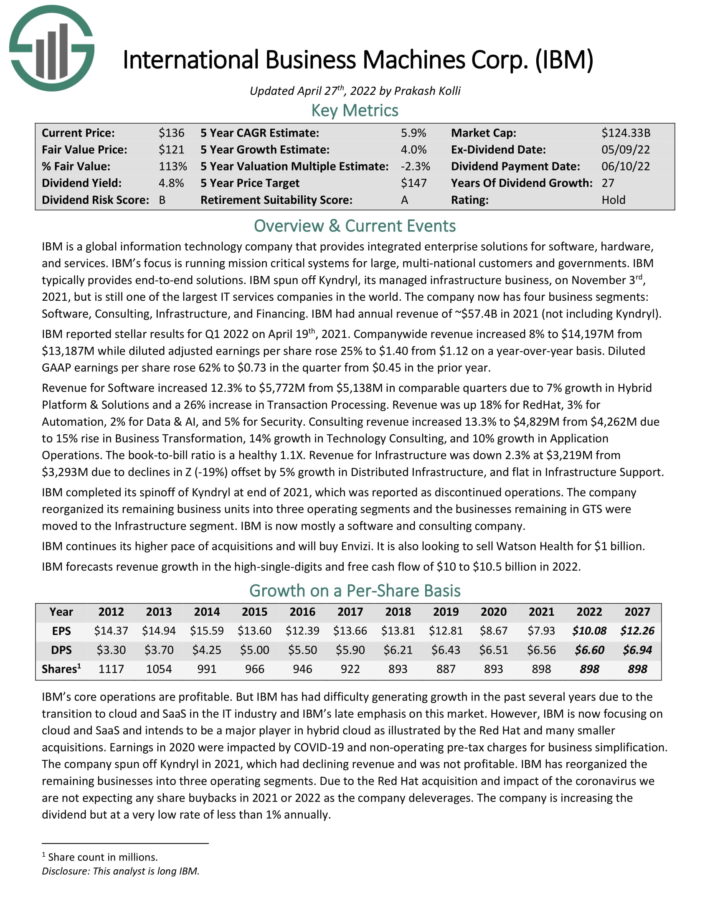

IBM is a worldwide informationrmation expertise firm that gives built-in enterprise options for software program, {hardware}, and providers. IBM’s focus is operating mission essential programs for giant, multi-nationwide prospects and governments. IBM sometimes gives end-to-end options.

The corporate now has 4 enterprise segments: Software program, Consulting, Infrastructure, and Financing. IBM had annual income of ~$57.4B in 2021 (not together with Kyndryl).

IBM reported stellar outcomes for Q1 2022 on April nineteenth, 2021. Firm-wide income elevated 8% to $14,197M from $13,187M whereas diluted adjusted earnings per share rose 25% to $1.40 from $1.12 on a year-over-year foundation. Diluted GAAP earnings per share rose 62% to $0.73 within the quarter from $0.45 within the prior 12 months.

Income for Software program elevated 12.3% to $5,772M from $5,138M in comparable quarters as a result of 7% progress in Hybrid Platform & Options and a 26% enhance in Transaction Processing. Income was up 18% for RedHat, 3% for Automation, 2% for Knowledge & AI, and 5% for Safety. Consulting income elevated 13.3% to $4,829M from $4,262M as a result of 15% rise in Enterprise Transformation, 14% progress in Know-how Consulting, and 10% progress in Software Operations.

The book-to-bill ratio is a wholesome 1.1X. Income for Infrastructure was down 2.3% at $3,219M from $3,293M as a result of declines in Z (-19%) offset by 5% progress in Distributed Infrastructure, and flat in Infrastructure Help.

Click on right here to obtain our most up-to-date Positive Evaluation report on IBM (preview of web page 1 of three proven under):

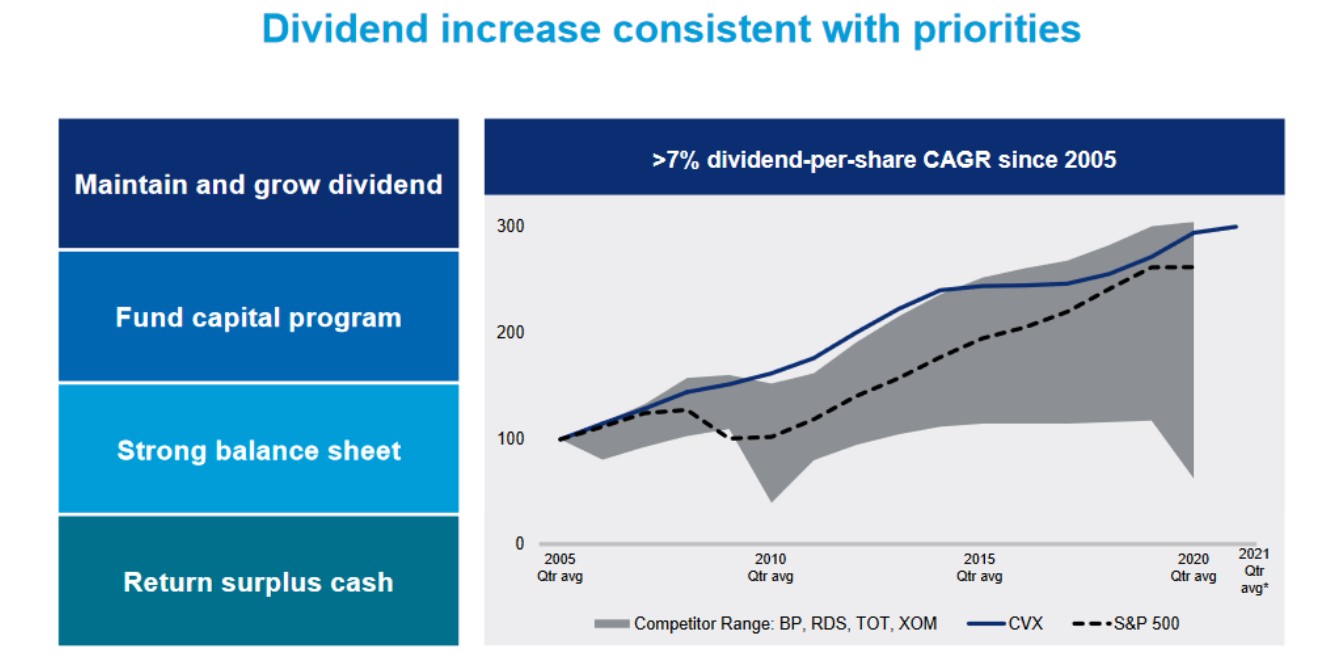

Canine of the Dow #1: Verizon Communications (VZ)

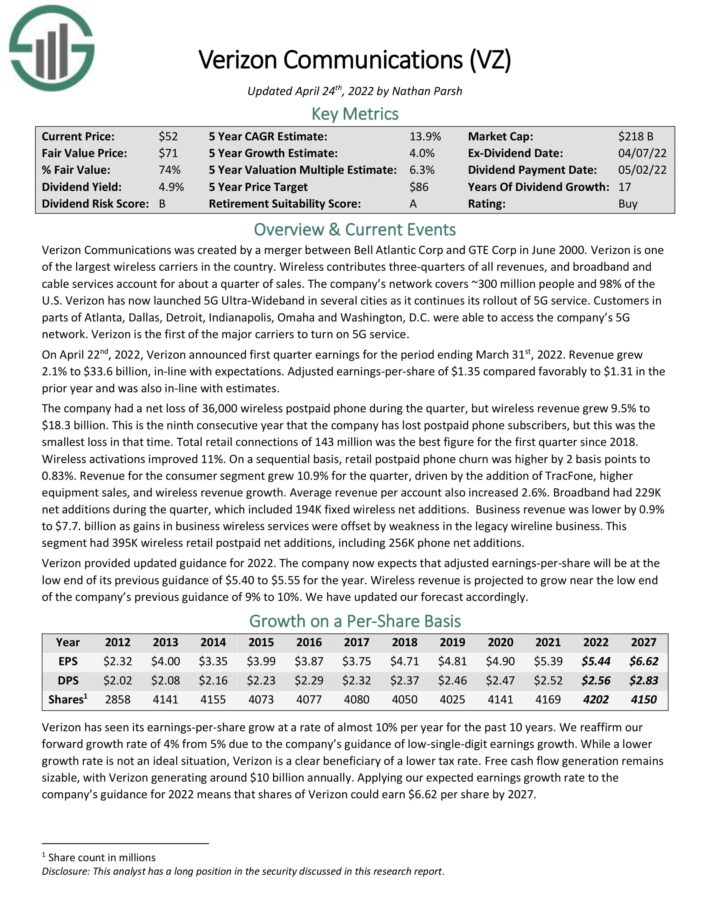

Verizon Communications was created by a merger between Bell Atlantic Corp and GTE Corp in June 2000. Verizon is without doubt one of the largest wi-fi carriers within the nation. Wi-fi contributes three-quarters of all revenues, and broadband and cable providers account for a few quarter of gross sales. The corporate’s community covers ~300 million individuals and 98% of the U.S. Verizon has now launched 5G Extremely-Wideband in a number of cities because it continues its rollout of 5G service.

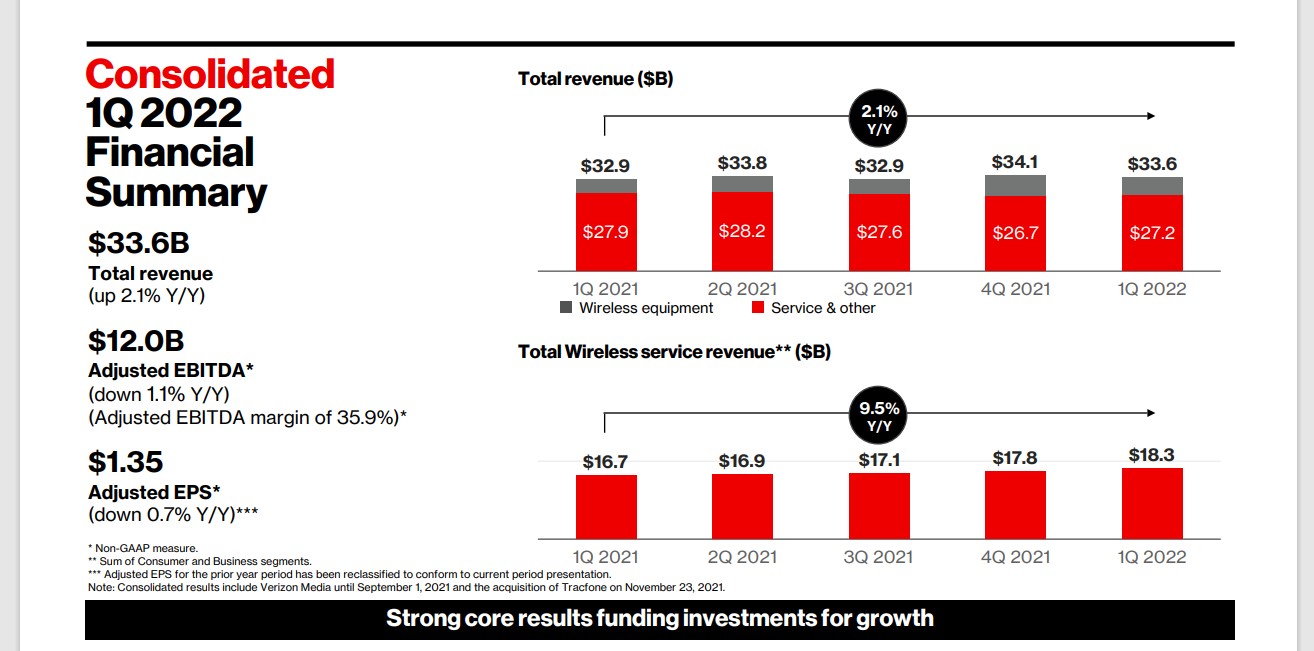

On April twenty second, 2022, Verizon introduced first quarter earnings for the interval ending March thirty first, 2022. Income grew 2.1% to $33.6 billion, in-line with expectations. Adjusted earnings-per-share of $1.35 in contrast favorably to $1.31 within the prior 12 months and was additionally in-line with estimates.

The corporate had a internet lack of 36,000 wi-fi postpaid telephone in the course of the quarter, however wi-fi income grew 9.5% to $18.3 billion. That is the ninth consecutive 12 months that the corporate has misplaced postpaid telephone subscribers, however this was the smallest loss in that point. Complete retail connections of 143 million was one of the best determine for the primary quarter since 2018.

You may see highlights of the corporate’s first-quarter efficiency within the picture under:

Supply: Investor Presentation

We anticipate annual returns of 15.3% for Verizon inventory, comprised of 4% earnings progress, the 5.2% dividend yield, and a large increase from an increasing P/E a number of.

Click on right here to obtain our most up-to-date Positive Evaluation report on Verizon (preview of web page 1 of three proven under):

Closing Ideas

Given the descriptions above, the Canines of the Dow are clearly a really various group of blue-chip shares which every take pleasure in vital aggressive benefits and prolonged histories of paying rising dividends.

In consequence, this investing technique is a superb, low-risk method for unsophisticated traders to strategy dividend progress investing.

Whereas it could not outperform the broader market yearly, it’s nearly assured to supply traders with a mix of enticing present yield with steadily rising revenue over time.

Different Dividend Lists

Worth investing is a priceless course of to mix with dividend investing. The next lists comprise many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].