How would you feel if you saw the following headline:

“Gas stations to be saddled with major new tax on gasoline”

Perhaps you might suspect that motorists will ultimately pay the higher gas tax.

OK, so tell me how you feel reading this Bloomberg headline:

This might sound good to many Bloomberg readers. Big banks keep taking risks, which leads to government bailouts. Sounds good to require them to pay for cleaning up the mess. But on closer inspection, is this any different from the gasoline tax?

In its May proposal, the FDIC said that the extra fees, known as a special assessment, would be collected at an annual rate of about 12.5 basis points over the eight periods. The proposed formula was based on criteria, including the amount of a bank’s deposits that are uninsured.

Fee is a more polite term for tax. FDIC fees are a tax on bank deposits. In my view, bank customers will eventually end up bearing most of the cost of FDIC fees.

As in so many other cases, “who pays” is not a useful way of thinking about taxes. In the end, all taxes are paid by people. And it’s very difficult to estimate the incidence of a tax, the proportion paid by people in different income categories, especially in the long run (which is what matters.).

It is much more useful to think about the impact of taxes on incentives. Our deposit insurance system bails out the depositors of risky banks and then puts a tax on safer banks to pay for those bailouts. How would you expect that system to impact bank behavior?

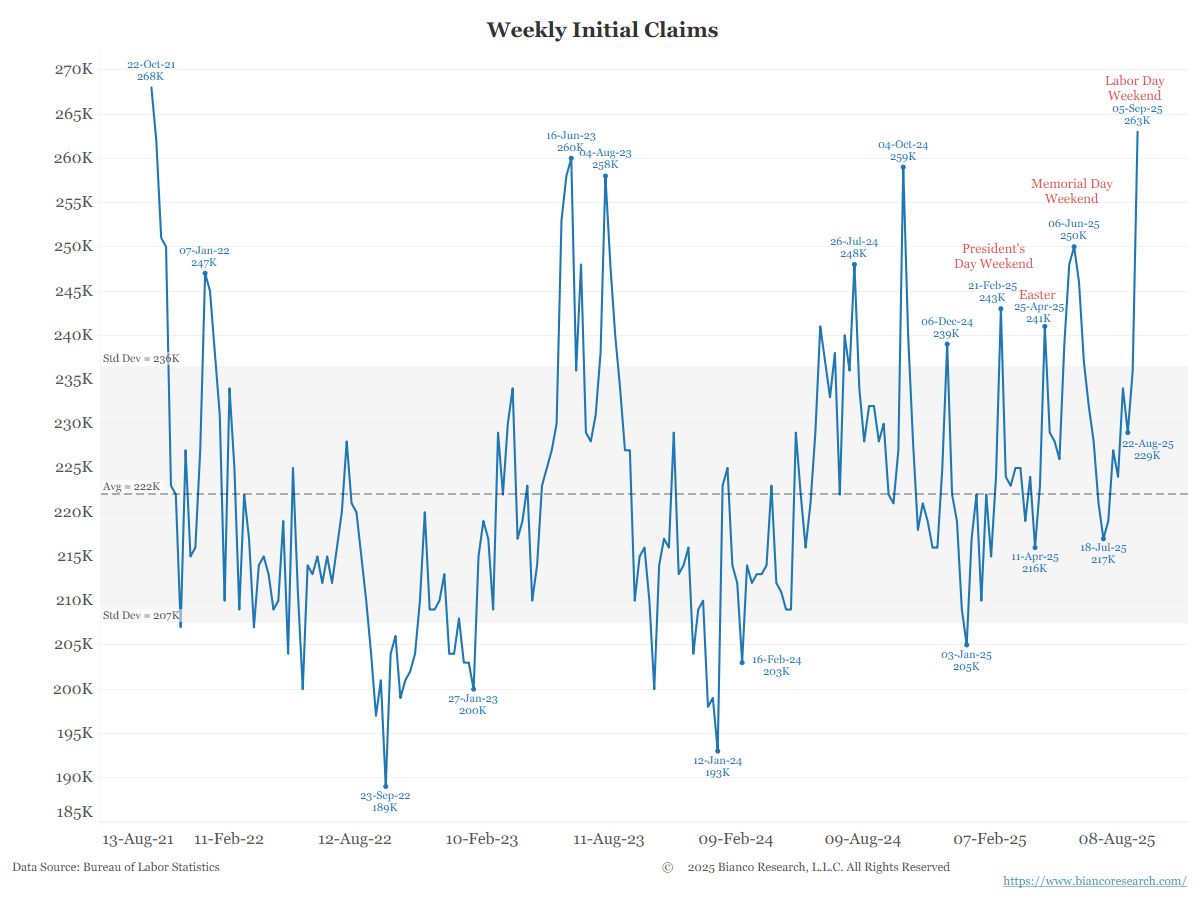

PS. Check out Alex Tabarrok’s new post for a visual presentation of the impact of taxes on behavior.