ipopba/iStock through Getty Pictures

By Matt Wagner

If historical past is any information, worth’s new run could be getting began.

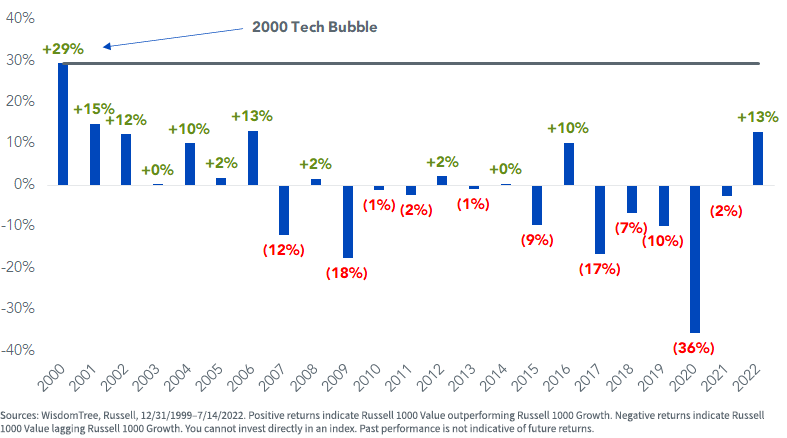

After the bursting of the tech bubble in 2000, worth went on a stretch of seven consecutive years of outperformance. That was adopted by progress management for 11 of the final 15 years.

By means of the primary half of the 12 months, worth is on tempo for its finest efficiency relative to progress since earlier than the Monetary Disaster.

Russell 1000 Worth vs. Russell 1000 Development

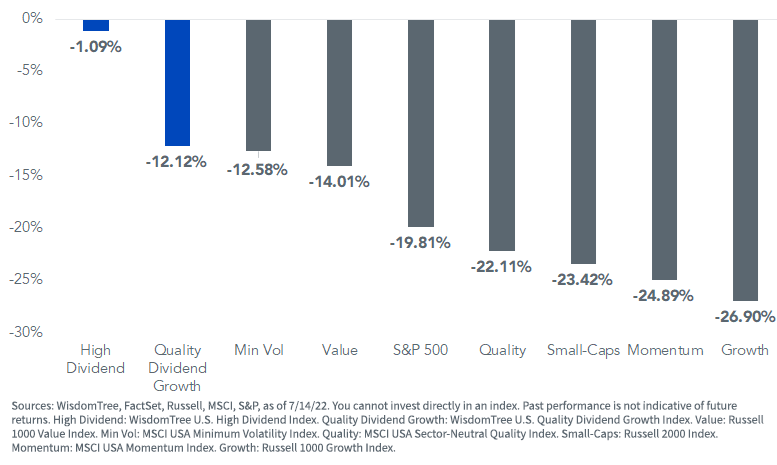

Dividends as a measure of worth—and particularly, excessive dividends—have had a fair stronger six-month run.

12 months-to-Date Index Efficiency

Historically, investing through dividends is a extra defensive method to worth—extra over-weight in Shopper Staples and Utilities and fewer depending on the extra cyclical Financials sector (which more and more makes use of extra discretionary share buybacks for payouts).

This 12 months, excessive dividends have additionally had the tailwind of being over-weight in Power, the one optimistic S&P 500 sector for the 12 months.

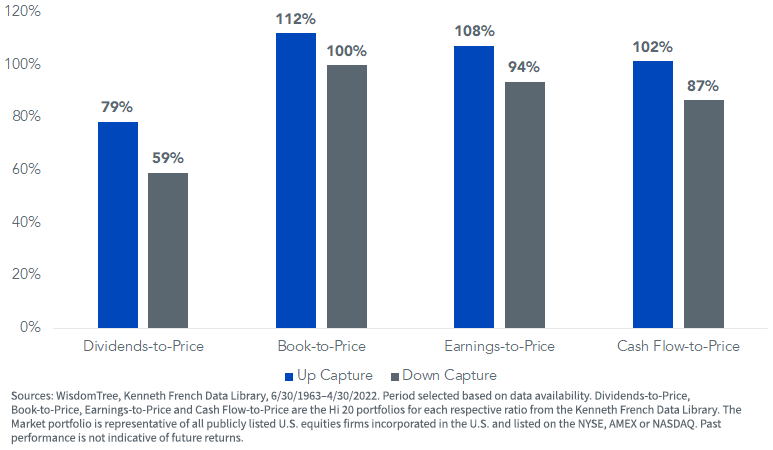

This “defensive worth” nature of excessive dividends may be seen from the down-capture ratio of simply 59% for a worth portfolio sorted by dividend yield. A portfolio sorted on book-to-price (probably the most conventional tutorial measure of worth) has a down-capture fee of 100%.

Worth Portfolio Up/Down Seize vs. Market

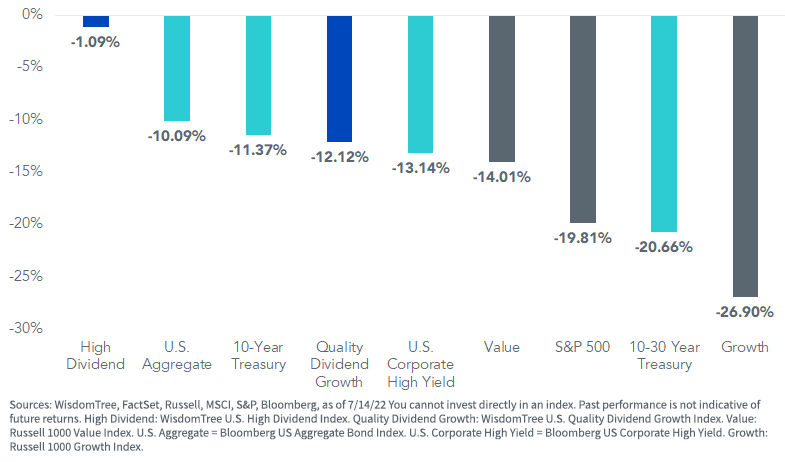

With volatility elevated, sluggish progress expectations and excessive inflation now entrenched within the collective psyche of traders, excessive dividends have been a haven not simply in comparison with equities however mounted earnings as nicely.

On account of this atmosphere of seemingly nowhere to cover for asset allocators, high-dividend ETFs have taken in a file $25 billion in property thus far this 12 months.

12 months-to-Date Index Efficiency

Avoiding Worth Traps

Utilizing dividends as a measure of worth has a key benefit over measures like earnings or e-book worth in instances of uncertainty – a dividend is an unambiguous measure of worth that’s insulated from aggressive accounting practices.

However some dividend payouts are much less secure than others.

To account for the chance of investing in dividend payers which have deteriorating prospects of with the ability to preserve or develop their dividends, WisdomTree’s dividend Indexes have a composite threat display screen to weed out potential worth traps.

Corporations that fall inside the backside decile of a composite threat rating (CRS), which consists of an equally weighted rating of the under two components, should not eligible for inclusion in our Indexes.

- High quality Issue – decided by static observations and tendencies of return on fairness (ROE), return on property (ROA), gross income over property and money flows over property. Scores are calculated inside trade teams.

- Momentum Issue – decided by shares’ risk-adjusted complete returns over historic durations (6 and 12 months).

Along with screening out the riskiest decile of corporations based mostly on the CRS, we’ve got additionally included a screening of the highest-yielding corporations (the highest 5%) that even have below-average (backside 5 deciles) threat scores. Previous to a dividend lower, market contributors will usually worth a dividend as unsustainable, inflicting share costs to drop and the yield to skyrocket.

Earlier this 12 months, we highlighted the AT&T dividend lower as a reside case research of the kind of dividend cuts our threat display screen was designed to keep away from.

Conclusion

Many of the ache in U.S. equities this 12 months has been felt by non-dividend payers relative to dividend payers. Going ahead, ought to we see materials weak point within the financial system, traders could start to deal with the protection of dividend payouts.

In this kind of sluggish (or unfavourable) progress backdrop, our composite threat screens are aimed to mitigate publicity to distressed corporations with unsustainable dividend payouts.

For extra investing insights, try our Financial & Market Outlook

Matt Wagner joined WisdomTree in Could 2017 as an Analyst on the Analysis workforce. In his present function as an Affiliate Director, he helps the creation, upkeep, and reconstitution of our indexes and actively managed ETFs. Matt began his profession at Morgan Stanley, working as an analyst in Treasury Capital Markets from 2015 to 2017 the place he centered on unsecured funding planning, execution and threat administration. Matt graduated from Boston Faculty in 2015 with a B.A. in Worldwide Research with a focus in Economics. In 2020, he earned a Certificates in Superior Valuation from NYU Stern. Matt is a holder of the Chartered Monetary Analyst designation.

Unique Put up

Editor’s Be aware: The abstract bullets for this text had been chosen by In search of Alpha editors.