Updated on July 25th, 2023 by Bob Ciura

At Sure Dividend, we advocate long-term investing in high-quality dividend stocks.

This is because there’s a swath of evidence to suggest that dividend stocks outperform. More specifically, dividend growth stocks outperform.

There is no better example of this than the Dividend Aristocrats – a group of elite dividend stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

We created a full list of all 67 Dividend Aristocrats, along with important financial metrics such as dividend yields and price-to-earnings ratios. You can download a free copy by clicking on the link below:

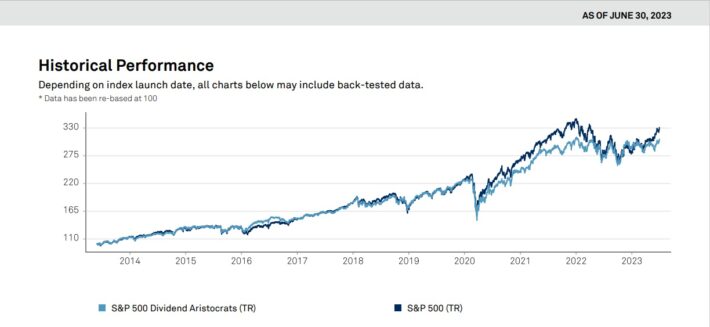

The long-term performance of the Dividend Aristocrats is shown in the following graph.

Source: S&P Fact Sheet

The Dividend Aristocrats have performed very well in the past 10 years, delivering 11.99% total annual returns.

While the Dividend Aristocrats provide one piece of evidence, there are many other reasons why dividend stocks – and particularly dividend growth stocks – are our favorite asset class for long-term wealth building.

This article will provide a detailed summary of why dividend stocks make better investments than ‘just growth’ stocks that don’t pay dividends. We’ll also show you why dividend growth stocks allow you to harness the best of both dividend stocks and growth stocks, and why we prefer them over either of the alternatives.

The Performance of Dividend Stocks

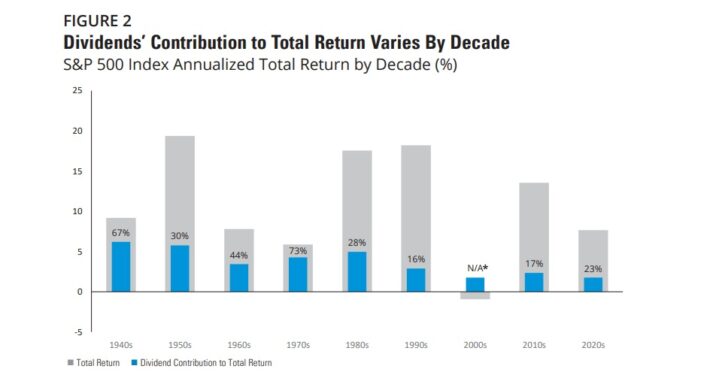

Dividends have historically been a strong contributor to the long-term total returns of the broad S&P 500 index – which includes both dividend-paying stocks and non-dividend-paying stocks.

Between 1930 and 2021, the contribution from dividends to the S&P 500’s total return was 40%. The following image shows how the figure has varied over time.

Source: Hartford Funds – The Power Of Dividends

It follows that dividend-paying stocks should have strong performance on an individual basis when compared to stocks that do not pay dividends.

Dividend stocks have outperformed non-dividend-payers while also delivering higher risk-adjusted returns as measured by the Sharpe Ratio.

Clearly, there is significant evidence to support the long-term outperformance of dividend-paying stocks. The following section will discuss the fundamental reasons why these securities tend to beat the market.

Why Dividend Stocks Outperform

In our view, there are three main reasons why dividend stocks outperform non-dividend stocks:

Reason 1: A company that pays dividends must have underlying operations that actually support that dividend. Said another way, dividend-paying securities must have earnings and cash flow to distribute to shareholders – or else their dividend payments would not be possible. This means that dividend stocks exclude the riskiest securities: ‘pre-earnings’ startups and businesses experiencing bankruptcy or other financial distress.

Reason 2: Dividend-paying companies have less internal cash flow available to fund organic growth opportunities, meaning that corporate management must focus on only the best growth opportunities. Having such a laser-sharp focus on the efficiency of capital allocation has a high probability of improving a company’s performance over time.

Reason 3: Dividend payments imply that a company’s management is willing to transfer money from their control to their shareholders’ control. In other words, it means that the company is shareholder-friendly, a characteristic that likely impacts other behavior at the C-suite level.

Along with these business-level characteristics, there are other reasons why we like dividend stocks.

First, from the perspective of the portfolio manager, dividend stocks are highly preferred because they generate a constant stream of cash that can be deployed into new investment opportunities.

This dividend income stream is far more constant than stock prices are, which means investors have the ability to buy more stocks when stock prices are low. The stability of dividend payments also has a ‘smoothing’ effect on long-term portfolio performance.

Dividend stocks also avoid the main problem with growth stocks: valuation risk. In our view, there are two major risks that investors should aim to avoid in the stock market:

- The risk that the business you are buying is a dud.

- The risk that you are overpaying for the business.

Growth stocks are, by definition, growing at a fast rate. Investors are usually willing to pay a premium valuation multiple as a result, which means that any temporary disappointment from the company in question could result in rapid valuation contraction (and negative returns).

For dividend stocks, this is not often a problem. There are usually many dividend stocks trading at reasonable valuations, allowing price-conscious investors to buy great businesses at fair prices.

To conclude, ‘dividend stocks’ make better investments than ‘growth stocks,’ at least in our view. There is another side to the story; here’s the counter-argument to dividend stocks versus growth stocks.

There is an alternative to these two options that combines the best of both worlds – dividend growth stocks. We make our case for why dividend growth stocks are our favorite asset class below.

The Case For Dividend Growth Stocks

Dividend growth stocks are companies that pay dividends and grow their dividends at a steady pace, combining the dividend payments of ‘plain’ dividend stocks with the growth of ‘plain’ growth stocks.

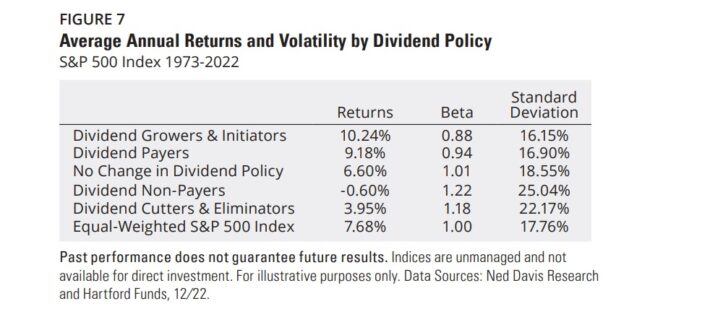

A wide body of research suggests that dividend growth stocks tend to outperform the broader stock market. In research performed by Ned Davis and Hartford Funds, it was found that dividend growers and initiators delivered total returns of 10.24% per year from 1973 through 2022, better than the equal-weighted S&P 500’s performance of 7.68% per year.

Interestingly, the dividend growers and initiators analyzed in this study generated outperformance with less volatility – a rarity and a contradiction to what modern academic financial theory tells us.

A summary of this research can be found below.

Source: Hartford Funds – The Power Of Dividends

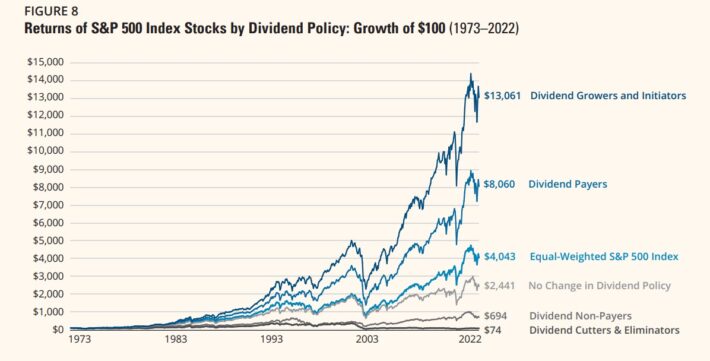

Outperformance of 2.56% annually might not seem like a game-changer, but it certainly is thanks to the wonder that is compound interest.

Using data from the same piece of research, investors who chose to invest exclusively in dividend growers and initiators were capable of turning $100 into $13,061. During the same time period, the S&P 500 index turned $100 into $4,043.

Source: Hartford Funds – The Power Of Dividends

Stocks that did not pay dividends could not match the performance of all types of dividend payers, turning $100 into $694 from 1973-2022. Dividend cutters and eliminators fared even worse, turning $100 into just $74–meaning these stocks actually lost money.

Clearly, dividend growth stocks have the power to generate excellent investment returns. Aside from performance, there are other reasons why we like investing in dividend growth stocks.

First of all, dividend growth stocks are an excellent option for retirees and other income-focused investors because they allow you to generate rising income over time without contributing any more money to your investment portfolio. This simulates the salary increases that non-retirees (usually) experience year-in and year-out.

Secondly, most dividend growth stocks are stable, well-established businesses with easy-to-understand business models. Notable examples include Johnson & Johnson (JNJ), Wal-Mart (WMT), and McDonald’s (MCD). The stability of these companies allow investors to have considerable peace of mind while owning fractional interests in these companies.

Lastly, dividend growth stocks are here for the long run. When you buy shares of a company that has raised its dividend each and every year for multiple decades, you know that its business model will stand the test of time. When recessions come (as we know they will), owning dividend growth stocks will allow us to stay the course while uncertainty and volatility increase.

Final Thoughts

While dividend stocks and growth stocks both have their merits, we far prefer dividend stocks for the reasons discussed in this article.

The great thing about debating the pros and cons of dividend growth stocks is that you don’t necessarily need to choose. Dividend growth stocks offer the benefits of both dividend stocks and growth stocks, while also having a track record of long-term outperformance.

Related: The Pros and Cons of Dividend Investing.

If you’re interested in finding individual dividend growth stocks suitable for long-term investment, the following databases (along with the previously-mentioned Dividend Aristocrats list) are fantastic resources:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].

.png)