This can be a visitor contribution by Stratosphere.io

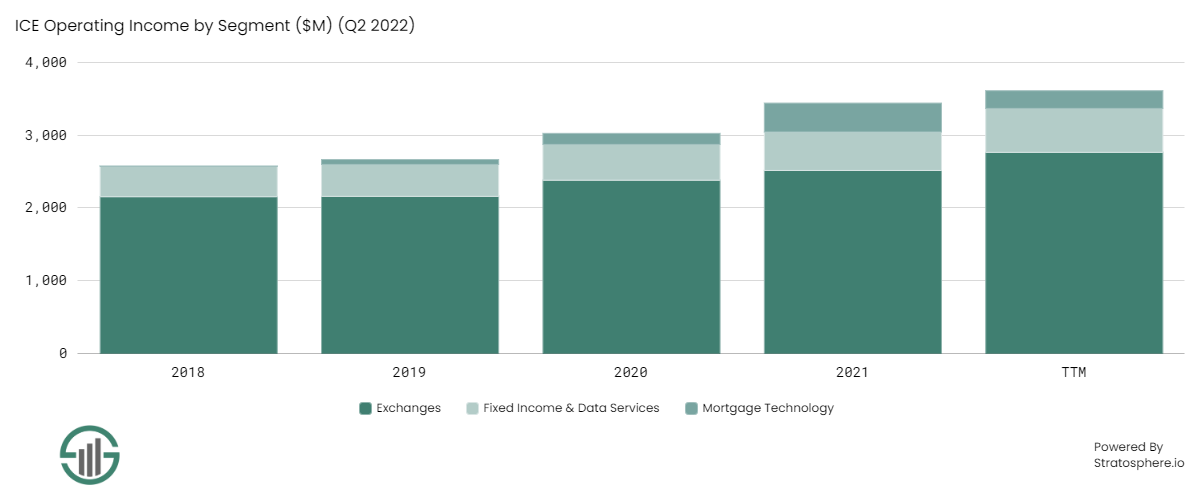

Intercontinental Change (ICE) serves the monetary markets as a market infrastructure, information companies, and know-how options supplier. The corporate operates three most important segments or product teams:

- Exchanges

- Fastened Revenue & Information Providers

- Mortgage Know-how

Exchanges are ICE’s regulated marketplaces the place itemizing, buying and selling, and clearing of spinoff contracts, monetary securities (together with commodities, rates of interest, international alternate, and shares), and ETFs can happen. ICE operates 13 of those regulated exchanges (together with the New York Inventory Change) and 6 clearing homes all over the world.

The Fastened Revenue & Information Providers section contains digitized instruments for mounted revenue asset execution and clearing, in addition to information and analytics. The Mortgage Know-how Phase focuses on digitizing the principally analog mortgage origination and shutting processes within the US. The section additionally gives information and analytics.

Funding Thesis

- ICE possesses among the strongest community results of any enterprise on the planet. Its monetary merchandise / contracts and exchanges develop stronger as extra quantity pours into these areas. That is so as a result of all events concerned (consumers, sellers, and market makers) profit from liquidity, value transparency, and execution pace.

- ICE is well-known for proudly owning the most important inventory alternate on the planet — the New York Inventory Change. Nevertheless, ICE largely creates worth by extracting and promoting information from property just like the NYSE and its many different monetary merchandise. In lots of respects, ICE is a know-how firm with a concentrate on information.

- ICE additionally doesn’t derive a lot of its progress from the well-known equities and choices buying and selling on the NYSE. Nevertheless, the corporate has been in a position to train nice pricing energy in its different monetary and alternate merchandise, particularly power contracts and its mounted revenue, equities, and mortgage information and analytics options. These ought to stay progress drivers going ahead.

- ICE’s largest threat revolves round regulation. Whereas a latest SEC ruling relating to non-public vs. public information transparency was dismissed by the US appeals court docket, regulation will probably stay a headwind. ICE’s sale of personal / proprietary alternate and glued revenue information might disproportionately profit its paying prospects, affecting smaller buyers. We imagine regulators might be watching ICE’s actions intently, and this will likely discourage the corporate from exercising its pricing energy to its full potential.

- The corporate takes a contrarian, “blue ocean” strategy to M&A and innovation. The corporate is presently targeted on modernizing the US residential mortgage business from finish to finish. It did so by buying a number of massive firms and aggressively integrating them. ICE’s future progress alternatives are thus principally unpredictable, however doubtlessly extremely rewarding.

Key Firm Metrics

A set of metrics always stored up-to-date on Stratosphere.io for ICE:

Aggressive Benefits

The King of Community Results

ICE spurs and advantages from highly effective community results. In our opinion, ICE’s exchanges and clearinghouses (and the info / analytics that circulate from them) maintain one of many strongest examples of the “community impact” on the planet.

Exchanges permit consumers and sellers to “alternate” items and companies (monetary property on this case). Clearinghouses are additionally concerned in these “purchase” and “promote” transactions, albeit after the transactions have been executed.

Clearinghouses work to verify transactions on an alternate settle and clear in the way in which the customer and the vendor of every transaction achieved the end result they have been on the lookout for. In different phrases, a clearinghouse will guarantee the vendor can switch over the bought property and the customer can obtain the funds implied by the sale.

The position of exchanges and the clearinghouses that primarily energy them are necessary to inventory markets, and arguably extra necessary for derivatives markets, like futures, the place leverage is usually used. Clearinghouses work to make sure these markets are secure and all transactions are settled absolutely on the finish of every buying and selling day.

Exchanges and the underlying clearinghouses profit from having extra transactors on them. An alternate is simply as “good” because the pace, effectivity, accuracy, and degree of liquidity with which merchants, buyers, and establishments can function at. Every of those have an effect on the diploma of bid-ask spreads, pace of execution, and the general degree of liquidity (gross greenback quantity).

Due to this fact, smaller exchanges are successfully crowded out ultimately. Typically talking, investing, buying and selling, market making, capital elevating, and monetary threat administration all profit from excessive ranges of liquidity, pace of execution, and skinny bid-ask spreads. Market makers make more cash on high-volume exchanges whereas buyers and merchants profit from slim bid-ask spreads the place one of the best costs and execution of trades will be achieved.

So, these events will naturally gravitate to massive exchanges over time, just like how essentially the most highly effective social media networks are usually those which have essentially the most customers. Extra customers = much more customers over time.

The ICE-owned NYSE is the most important inventory market alternate on the planet, having over $25 trillion in listings (the second largest is the NASDAQ alternate at round $17 trillion). As we speak, the NYSE has 70% of the S&P 500 and 77% of the Dow Jones listings on its alternate. In 2021, 3 of the 4 largest IPOs have been listed on the NYSE, testifying to the attractiveness of enormous and liquid exchanges.

Nevertheless, the NYSE is just one piece of the ICE puzzle. Earlier than the NYSE acquisition in 2013, ICE primarily targeted on eliminating the inefficiencies in power and different derivatives markets.

The corporate owns and operates extremely liquid contracts and derivatives, equivalent to WTI and Brent crude oil, 60 international alternate contracts, a number of agricultural futures (i.e., espresso, cocoa, cotton, sugar, UK feed wheat, canola, and frozen concentrated orange juice), amongst many extra for companies and different establishments to handle monetary threat and set costs.

The recognition of those ICE merchandise has grown so excessive that now, as an example, 80% of world crude oil of varied grades is traded with Brent crude oil contracts as the value reference for these grades.

The huge quantity of varied events utilizing the NYSE alternate and different ICE merchandise enhance the collective expertise buying and selling ICE or ICE-hosted merchandise on its exchanges, which advantages the corporate by transaction and itemizing charges.

These highly effective community results are mixed with robust economies of scale and low capital necessities on the a part of ICE. On high of those limitations, exchanges and clearinghouses are extremely regulated, making it extremely unlikely that rising or new exchanges might uproot such a big conglomerate of exchanges and clearinghouses like ICE.

World-Class Integrator

In a single interview of Jeff Sprecher, the Founder & CEO of ICE, he had talked about that his strategy to M&A is as follows: ICE both pays up for fast-growing firms in secular development markets that assist its prospects remedy an issue that legacy firms didn’t deal with, or it acquires out-of-favour, mature companies that may very well be rotated and do considerably higher below the ICE umbrella.

Every of ICE’s three most important segments as we speak have been outlined by ground-breaking M&A transactions accomplished over the previous decade.

Exchanges has the NYSE, which had been bought for $11 billion in 2013. The earlier subsection contains all the advantages from this acquisition.

Fastened Revenue & Information Analytics was outlined by the acquisitions of IDC — a number one supplier on the time for mounted revenue pricing, information, and analytics — and BofAML’s Index enterprise — the second largest mounted revenue platform on the planet. These two acquisitions bolstered ICE’s mounted revenue choices, increasing the variety of merchandise and the info & analytics capabilities. With these acquisitions, ICE continues to electronify the mounted revenue workflow and assist within the adoption of passive mounted revenue funds all over the world. As we speak, the section produces value evaluations on round 3 million mounted revenue securities with reference information on over 33 million securities. The size is huge.

Lastly, ICE has been targeted on enhancing the US residential mortgage workflow, which continues to be extremely inefficient and vulnerable to fostering errors at many factors within the full workflow as we speak. ICE acquired MERSCorp (main database of US mortgages), then Simplifile so as to add to the digital community it has been constructing, then Ellie Mae to get its fingers on a mortgage origination community. With these three acquisitions, ICE can now absolutely concentrate on digitizing the whole mortgage workflow.

Integrating these bought and internally generated property resulted in scaling & price benefits for ICE and its shoppers, nonetheless, the majority of the worth from these acts over time has largely been the extraction of knowledge and analytics.

For its mounted revenue prospects, ICE is ready to present highly effective reference information, pricing & valuation, and buying and selling and portfolio analytics. These capabilities not solely present recurring income to ICE, however its prospects profit from being higher in a position to perceive the merchandise of their portfolios and enhancing their workflows. This probably wouldn’t have been attainable had ICE not digitized mounted revenue buying and selling execution and CDS clearing.

On the mortgage entrance, ICE provides origination and shutting applied sciences for US residential mortgages. With out these choices, ICE would probably not have developed the info and analytics capabilities that it now provides to originators and different stakeholders within the US residential mortgage market.

For instance, ICE gives real-time developments of virtually 50% of the US residential mortgage market and a Information-as-a-Service (“DaaS”) providing for lenders to research their very own information and origination data. With these choices, prospects profit from price and time financial savings on the front-end (originating and shutting mortgages) whereas additionally acquiring suggestions from the very community they use to assist make higher selections.

ICE is a world-class integrator of varied area of interest monetary companies suppliers. Maybe ICE’s biggest benefit is utilizing the swaths of knowledge that circulate by its exchanges and networks to assist shoppers make higher monetary selections and handle threat. This improves ICE’s prospects’ suggestions loop. By doing this, ICE retains its prospects shut each by way of transactions and its information & analytics choices.

ICE’s efforts on this entrance have paid off tremendously effectively. Whereas the recurring income base of the corporate was merely 9% in 2011, recurring revenues now make up about 50% of ICE’s revenues as of 2021.

Pricing Energy

ICE holds robust pricing energy in some domains, whereas in others it’s on the mercy of robust competitors and regulatory stress. The buying and selling of money equities and fairness choices on the NYSE — which ICE is broadly recognized for — is the world which suffers from the latter.

The NYSE division of ICE’s Exchanges section competes primarily in opposition to the NASDAQ alternate, in addition to loads of others within the US, Canada, and the remainder of the world. Moreover, whereas the NYSE advantages from the immense quantity of liquidity that flows by its alternate, there may be nothing stopping listed firms from itemizing on different exchanges to achieve entry to extra liquidity. Whereas the exchanges business has been largely consolidated, the competitors from the remaining gamers stays fierce. The result’s declining pricing, which ICE has skilled with its money equities and fairness choices buying and selling capabilities.

Whereas the transaction-based revenues from NYSE buying and selling usually are not a serious progress driver for ICE, the info and analytics which might be derived from the alternate are. To satisfy regulatory and compliance necessities, alternate prospects should provide their purchasers and relevant regulators with correct information associated to property and their pricing. There’s little room for error, so the NYSE- and ICE-derived information for equities / choices and glued revenue securities, respectively, is often the primary place prospects look to acquire one of the best information.

It goes with out saying that these information and analytics options are a gradual natural progress driver for ICE within the type of excessive retention, constant new enterprise, and naturally, pricing energy (through will increase).

Alternatives Forward

- ICE’s largest progress driver as we speak is its efforts within the digitization of the US residential mortgage market. Administration of ICE sees a $10 billion complete addressable market on this area based on ICE’s 2022 Investor Overview presentation. As of 2021, ICE Mortgage Know-how has captured round $1.4 billion of those yearly revenues. Over the subsequent decade, ICE believes it might probably obtain 8-10% annual progress charges on this section, carving out a big chunk of the market. This might be a big contributor to ICE’s progress profile, which might assist offset the stale progress stemming from equities and choices buying and selling. Though the NYSE is an unbelievable asset, it has been a drag on the monetary efficiency of the enterprise, largely because of the secular decline in listed firms for the previous few many years, aggressive and regulatory stress on equities / choices pricing, and the variability in volumes from 12 months to 12 months.

- Vitality buying and selling has contributed considerably to ICE’s Exchanges income progress and will proceed to do all through the forthcoming decade and past.The three most important causes for this are the rising complexity all over the world’s power transition, globalization of pure fuel, and the requirement for carbon value transparency in power markets. Collectively, these are driving the demand for buying and selling, hedging, and threat administration in / with / of power contracts. The merchandise which might be affected by the three components above have grown at a 23% annual common return between 2016 and 2021.

- The monetary companies and information & analytics choices throughout the business are extremely fragmented and ripe for consolidation.This has a number of benefits for an organization as robust as ICE on the M&A and innovation fronts. ICE tends to enhance companies as soon as built-in inside it, usually bolting them onto different choices throughout the ICE umbrella to create synergized merchandise. This typically ends in price and effectivity benefits for purchasers, which helps with regulatory approvals of those transactions. As such, we expect ICE will proceed to train optionality with its information & analytics choices, persevering with the diversification away from transaction-based revenues (primarily in Exchanges). With any further money, ICE will return money to shareholders through dividends and share repurchases. Regardless of progress in Exchanges being pretty low, the section operates at excessive working margins (~40% as a proportion of income earlier than rebates in comparison with margins between 25-30% within the different two segments). The section will function a dependable money cow for the corporate to train optionality and reinvest into mounted revenue and mortgage information & analytics, and no matter comes past that.

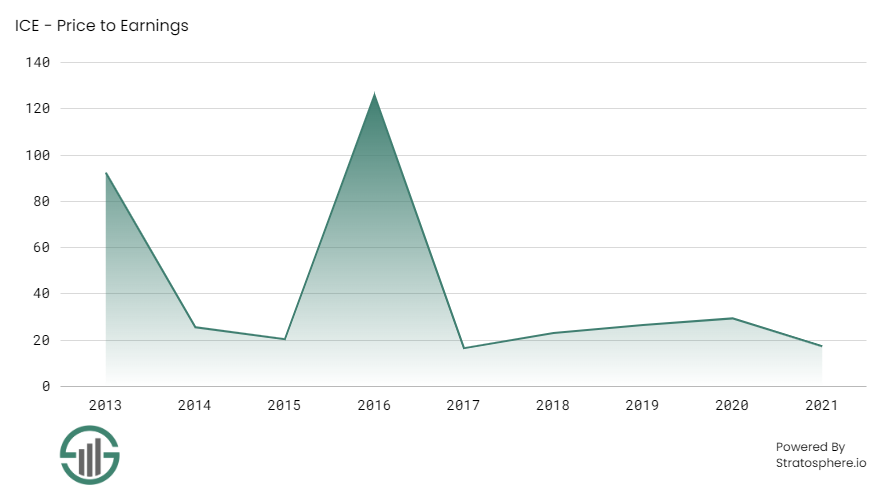

Valuation & Anticipated Returns

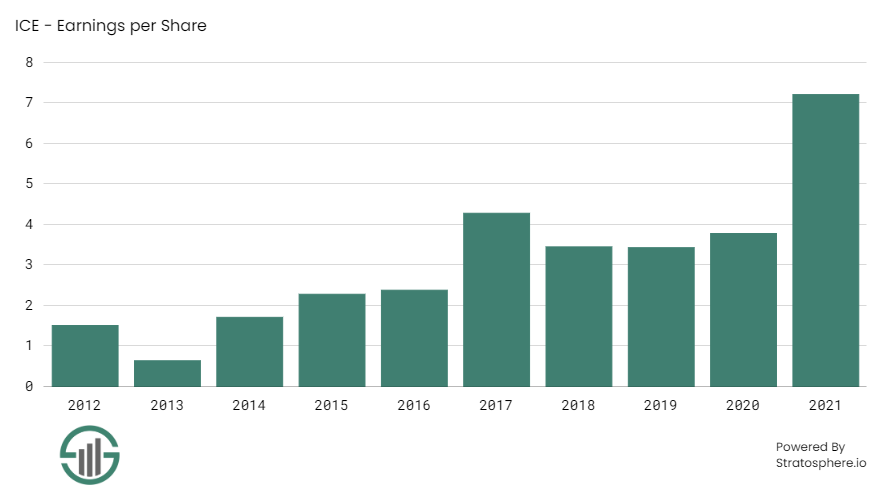

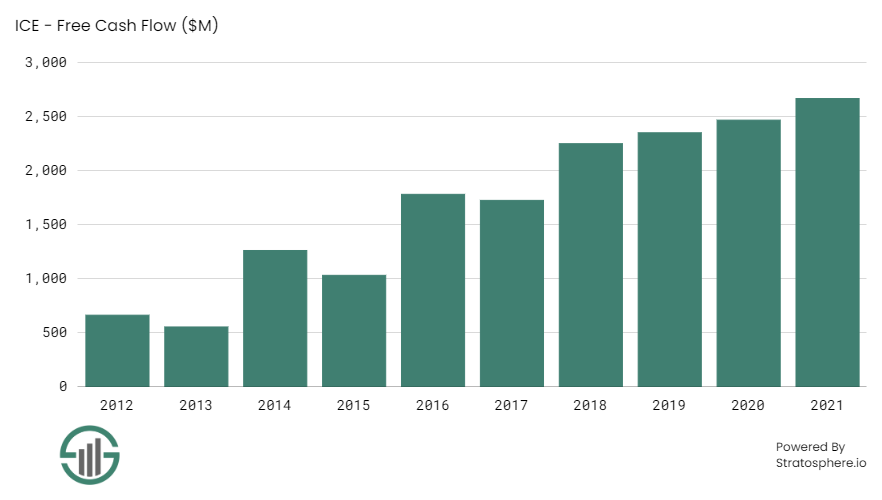

ICE’s present price-to-earnings (“P/E”) ratio based mostly on the consensus anticipated 2022 EPS determine ($5.36 / share) is roughly 19.5. This P/E ratio is roughly in keeping with the valuation ICE traded at since 2017. The corporate trades equally on a price-to-free-cash-flow foundation. We imagine this valuation is aligned with a high-quality firm equivalent to ICE, which not solely considers the expansion avenues of the enterprise, but additionally the cyclicality / seasonality related to its transaction-based companies. These companies nonetheless make up about half of the corporate’s complete revenues. The valuation charts under will be discovered on ICE’s Monetary Abstract tab on Stratosphere.io:

As ICE’s income combine shifts in direction of a better quantity of recurring income sources stemming from its information and analytics choices, we imagine there’s a case for the ahead P/E a number of to extend modestly to 22.5 over the subsequent 5 years. Over this five-year interval, the modest a number of enlargement alone might yield shareholders annual returns of three.0%. Ought to the corporate train even better optionality than is predicted now with the info and analytics choices in its three segments, the P/E ratio might broaden even additional. However, if ICE can’t broaden its recurring income base as rapidly or easily as anticipated, it’s attainable that the P/E a number of contracts modestly to 17.5.

In any case, ICE is a high-quality firm that ought to have the ability to develop organically at a excessive single-digit fee. We imagine the corporate can proceed to develop revenues at 6% per 12 months over the subsequent 5 years; on this case we assume margins don’t contract or broaden as the corporate faces counteracting forces between scaled economies benefiting margins whereas continued investments in innovation and acquisitions stress margins and offset the advantages.

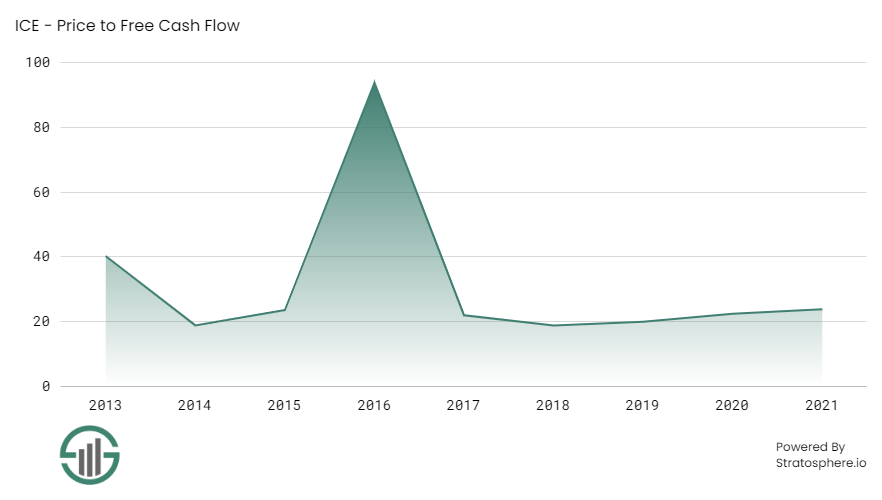

Based mostly on the dividend protection ratio with both free money circulate or internet earnings because the denominator, ICE’s dividends are adequately lined by money flows and earnings. The dividend payout ratio utilizing free money circulate didn’t exceed 32.0% since 2013 and the dividend payout ratio utilizing internet earnings didn’t exceed 32.1% since 2013. The EPS and free money circulate charts under will be additionally discovered on ICE’s Monetary Abstract tab on Stratosphere.io:

Between 2013 and 2021, the dividend per share elevated from $0.13 to $1.32 at a CAGR of 33.6%. Between 2017 and 2021, the dividend per share elevated from $0.80 to $1.32, a CAGR of 13.3%. Going ahead, we imagine the dividend per share will improve roughly in keeping with the expansion in EPS. Due to this fact, we expect EPS and dividends ought to improve at a fee of ~6% yearly by 2027.

Based mostly on all of the components above and a present dividend yield of virtually 1.5%, it seems ICE is poised to ship compounded annual common returns of 10.5% over the subsequent 5 years.

Dangers

Transaction-Based mostly Revenues

Whereas ICE’s recurring income base has considerably elevated over the past 10 years, as we speak there may be nonetheless a 50/50 break up between recurring and transactional revenues.

The failure to proceed exercising optionality with information and analytics within the monetary companies area or the lack to efficiently combine and / or find significant targets might impede ICE’s potential to proceed increasing its choices on this area.

Moreover, regulation is probably going essentially the most extreme threat to ICE’s ambitions within the information and analytics area as we speak.

In late 2020, the SEC authorised new guidelines that took goal on the exchanges. The exchanges promote proprietary information to alternate prospects that’s a lot quicker and extra dependable than the general public information out there. The priority from regulators is that this fosters a two-tier market as necessary data is withheld from the general public.

The US appeals court docket initially allowed the SEC to proceed with its ambitions to alter the way in which alternate information is made out there to prospects and the general public.

Nevertheless, in July 2022, the appeals court docket dismissed the order after it deemed a clause that acted in opposition to the Securities Change Act.

Whereas this order was dismissed, we imagine this threat to exchanges will all the time stay, and should resurface. This may occasionally additionally put a damper on ICE’s potential to train pricing energy in a method that will as soon as once more appeal to the eyes of regulators.

Aggressive M&A Strategy

ICE depends on aggressive M&A practices to gas its progress. Up to now, ICE has been recognized to chop prices aggressively with newly built-in goal firms in addition to pay massive sums for these firms with the expectation that the eventual synergies will considerably outweigh any threat on the acquisition value.

For instance, after the acquisition of the NYSE, ICE noticed a possibility to slash a majority of the bills that the NYSE had. Whereas this acquisition has labored out effectively, it’s attainable that with future acquisitions, necessary human sources are minimize that have an effect on operations, too many bills are minimize that might have an effect on progress, and / or the synergies that have been first recognized take longer to be or might by no means be realized.

The mitigating issue right here is that Jeff Sprecher has used acquisitions to put the muse of ICE and likewise to broaden on its choices. This aggressive strategy has labored to this point by quite a lot of acquisitions, each huge and small, which have been largely accretive to the general strategic and monetary course of the corporate.

The observe report of the corporate bodes effectively, which outweighs some execution threat provided that the corporate has been conducting these types of acquisitions for a very long time. Nevertheless, we should warning that each new deal is totally different, and there could also be long run dangers related to the eventual successor of Jeff Sprecher.

Different Dividend Lists

The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].