Published on February 24th, 2023, by Samuel Smith

The Dividend Kings are a selective group of stocks that have increased their dividends for at least 50 years in a row. We believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all the Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

The newest member to join this list is Walmart Inc. (WMT), an American retail giant that has successfully navigated the significant cyclicality and stiff competition facing the industry over the years in order to consistently grow its dividend and create value for shareholders.

Back in 1974, Walmart paid its initial dividend of $0.05 per share, which has been raised annually since for 50 consecutive years, making it a Dividend King. In recent times, various retailers have faced challenges due to competition from internet retail, spearheaded by Amazon (AMZN), as well as the lingering adverse effects of the COVID-19 pandemic.

Nevertheless, Walmart has demonstrated its ability to thrive in a rapidly changing environment by adapting to it. The company has made substantial investments in its e-commerce platform, and its shareholders have enjoyed strong returns. Unlike many other retailers, Walmart has shown it can compete with Amazon and is well-equipped to do so.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

In 1945, Sam Walton opened his first discount store which served as the starting point for what later became known as Walmart. Since then, Walmart has expanded to become the world’s largest retailer, catering to over 230 million customers every week. The company’s revenue exceeded $600 billion in 2022 and its market capitalization is approximately $384 billion. As one of the most prominent employers globally, Walmart has a workforce of about 2.3 million people.

Source: Investor Presentation

Walmart has also expanded into a variety of different services, making it a true conglomerate. The Walmart U.S. segment includes retail stores in all 50 U.S. states, Washington D.C., and Puerto Rico. It also includes Walmart’s digital business. Walmart International consists of operations in 25 countries outside of the U.S.

Lastly, Sam’s Club consists of membership-only warehouse clubs and operates in 48 states in the U.S. and in Puerto Rico.

Growth Prospects

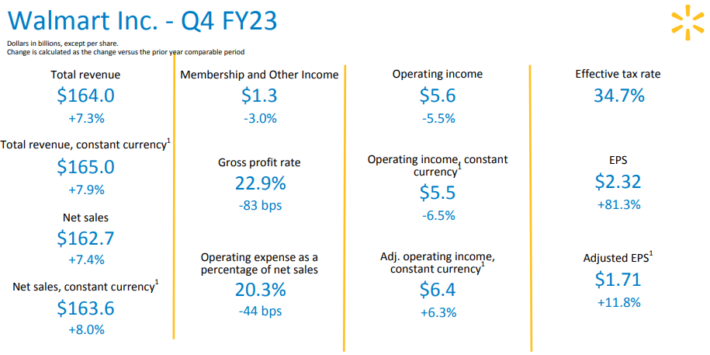

Walmart reported fourth quarter earnings on February 21st, 2023. The company saw its revenue grow by 7.3%, Walmart U.S. comparable sales grow by 8.3%, and its global ads business grow by over 20%. Management also returned $16 billion to shareholders over the course of the year via buybacks and dividends while generating an attractive 12.7% return on investment for shareholders.

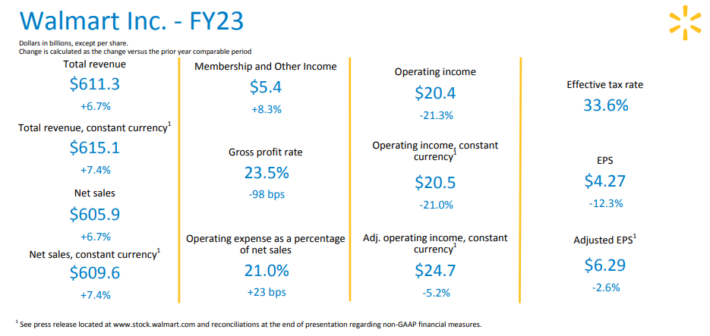

For the fiscal year, total revenue for Walmart amounted to $611.3 billion, representing a 6.7% increase that was adversely affected by divestitures amounting to $5.0 billion. Excluding the impact of currency, the company’s revenue would have increased by 7.4% to $615.1 billion.

Walmart’s U.S. comparable sales rose by 6.6%, and on a two-year stack, there was an increase of 13.0%. Meanwhile, the company’s U.S. eCommerce sales grew by 12% and 23% on a two-year stack. In the case of Sam’s Club, the comparable sales increased by 10.5%, with a two-year stack increase of 20.3%. Membership income also grew by 8.6%.

While Walmart International’s net sales remained flat, the operating income dropped by 21.1%. However, the net sales grew by 9.0%, and the adjusted operating income increased by 8.9% for the retained markets on a constant currency basis. Walmart’s global advertising business grew by almost 30% to reach $2.7 billion, mainly driven by Walmart Connect in the U.S. and Flipkart Ads.

The company generated $29.1 billion in operating cash flow and GAAP EPS was $4.27, while the adjusted EPS was $6.29.

Source: Investor Presentation

We currently forecast Walmart to grow its earnings-per-share by 8% per year over the next five years.

Competitive Advantages & Recession Performance

Walmart’s primary competitive advantage is its extensive scale, enabling it to maintain low transportation costs and high distribution efficiencies. Consequently, the company can pass on these savings to customers through affordable prices, contributing to its everyday low prices strategy.

Advertising is another strength of Walmart that helps maintain its brand recognition. The company’s vast financial resources allow it to invest billions of dollars each year in advertising.

Moreover, Walmart’s competitive advantage ensures consistent profitability, even during economic recessions. The company performed remarkably well during the Great Recession, highlighting the resilience of its business model.

It steadily grew earnings-per-share each year in that time:

- 2007 earnings-per-share of $3.16

- 2008 earnings-per-share of $3.42 (8.2% increase)

- 2009 earnings-per-share of $3.66 (7% increase)

- 2010 earnings-per-share of $4.07 (11% increase)

Despite the economic recession being one of the most severe in decades, Walmart’s performance was commendable. The company managed to deliver robust results even last year, amid the onset of the coronavirus pandemic that led to a recession in the U.S. economy.

Walmart’s growth trajectory indicates that the company could potentially gain from recessions. As a retail leader offering low-cost products, Walmart may experience a surge in traffic during economic downturns, as consumers scale back from pricier retailers.

Valuation & Expected Total Returns

Walmart shares currently trade at a price of ~$142. Using our earnings-per-share estimate of $6.59 for the current fiscal year, the stock has a price-to-earnings ratio of 21.5x. This is slightly above out fair value estimate P/E ratio of 21x. Investors should also note that retailers have typically not held P/E multiples above 20. If the valuation multiple were to revert to our fair value estimate by fiscal 2028, the company’s total returns would face a 140 basis point annualized headwind over this period of time.

Walmart shares have performed very well for an extended period. While this has rewarded shareholders with strong returns, we view Walmart as a slightly overvalued stock right now.

Aside from changes in the P/E multiple, Walmart should also generate returns from earnings growth and dividends. A projection of expected returns is below:

- 8.0% earnings-per-share growth

- 1.6% dividend yield

- -1.4% multiple reversion

In this scenario, Walmart is projected to generate a total return of 8.2% per year over the next five years.

Final Thoughts

While many retailers have struggled with adapting to the change in commerce shopping habits, Walmart has made the proper strategic investments in our view. The company’s impressive e-commerce growth is reflective of this view.

The company has performed well and the stock has outperformed the S&P 500 Index in the past five years. We find the company’s dividend track record to be impressive, even if the most recent dividend hikes were on the small side.

Walmart is a safe, defensive stock in times of economic hardship, but the mediocre total return profile prevents it from being a buy today. As a result, we rate it a hold.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].