Published by Bob Ciura on November 14th, 2023

The Dividend Kings are an illustrious group of companies. These companies stand apart from the vast majority of the market as they have raised dividends for at least 50 consecutive years.

We believe that investors should view the Dividend Kings as the most high-quality dividend growth stocks to buy for the long term.

With this in mind, we created a full list of all the Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking the link below:

This group is so exclusive that there are just 53 companies that qualify as a Dividend King. United Bankshares (UBSI) recently increased its dividend for the 50th consecutive year, joining the list of Dividend Kings.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

United Bankshares was formed in 1982 and since that time, has acquired more than 30 separate banking institutions. This focus on acquisitions, in addition to organic growth, has allowed United to expand into a regional powerhouse in the Mid-Atlantic with about $29 billion in total assets, and annual revenue of about $1 billion.

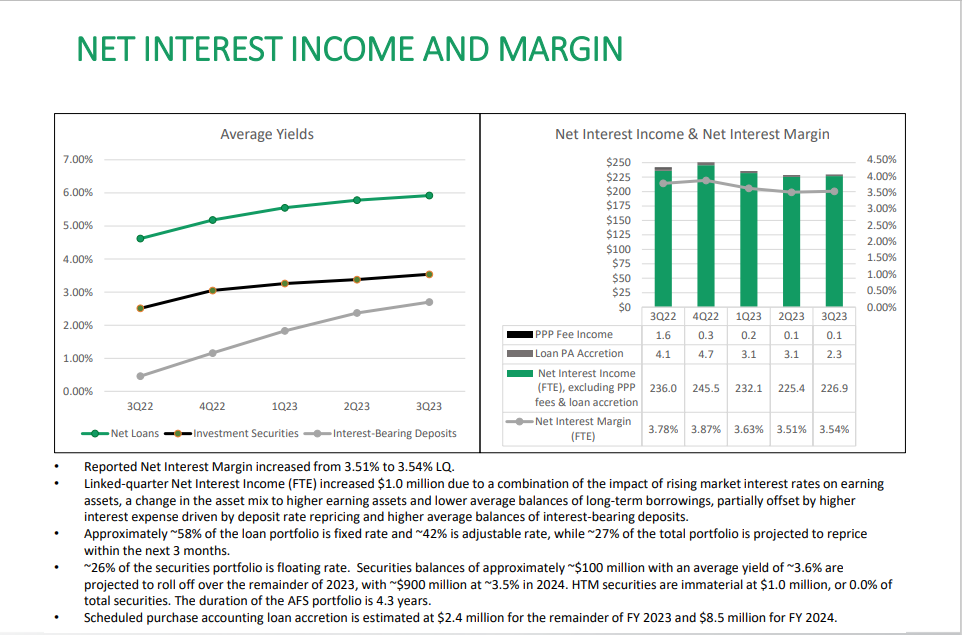

United posted third quarter earnings on October 25th, 2023, and results were somewhat weaker than expected. Earnings-per-share came to 71 cents. Revenue was $262 million, off 4.1% year-over-year. Net interest income was up $992 thousand, or less than 1%, from this year’s Q2.

Source: Investor Presentation

Q3 results benefited from rising market interest rates on earning assets, a change in the asset mix to higher earning assets, and lower average balances of long-term borrowings. This was partially offset by higher interest expense, which was driven by the impact of deposit rate balances.

The yield on average earning assets rose 19 basis points to 5.52%. Net interest margin of 3.54% was an increase of three basis points from Q2. Provisions for credit losses were $5.9 million, down from $11.4 million for Q2. The lower amount of provisions were due to adjustments on assumptions of future macroeconomic conditions, partially offset by additional expenses accrued due to loan growth.

Growth Prospects

Earnings-per-share have been flat for a few years now, as the company has struggled with translating asset and loan growth into profits. We now see -2% annual earnings growth. We note the relatively high base in earnings for 2023 as making future growth more challenging.

United has always grown through acquisition, and we do not believe that will change. However, its net interest margin is going to be at risk in the coming quarters as the rapid decline in rates in 2020 produced a huge decline in the cost of funds. Rates moved favorably for banks in 2021, and moved sharply higher in 2022.

Assuming rates remain elevated, United will be subject to potentially much higher funding costs, which will see its NIM deteriorate if it cannot produce commensurate gains in lending yields. Lending margins rose fractionally in Q3, which is a positive turn from Q2 results.

Competitive Advantages & Recession Performance

United’s competitive advantage is in its strong market position in the areas it serves. It is headquartered in West Virginia where competition is relatively light, and it is expanding into more densely populated areas like northern Virginia.

That does not make it immune from recessions, but its performance in 2008 and 2009 was exemplary, and held up in very challenging conditions in 2020, and thrived in 2021.

Below are the company’s earnings-per-share results during, and after, the Great Recession:

- 2007 earnings-per-share: $1.32

- 2008 earnings-per-share: $1.52 (15% increase)

- 2009 earnings-per-share: $1.51 (~1% decrease)

- 2010 earnings-per-share: $1.81 (20% increase)

The company grew its diluted earnings-per-share in 2008, followed by just a minor decline in 2009, which was the worst of the recession. Fortis then quickly rebounded with 20% earnings growth in 2010.

Valuation & Expected Total Returns

We expect United Bankshares to generate earnings-per-share of $2.80 for 2023. At the current share price, UBSI stock trades for a price-to-earnings ratio of 11.9.

We see fair value at 12 times earnings, given where peer valuations are at present. We see increased risk for United given the relatively weak performance historically of the company’s net interest margin and we think investors will pay slightly less for the stock as a result. Shares are slightly undervalued at the moment.

An expanding P/E multiple could boost annual returns by 0.2% over the next five years. Dividends will also boost shareholder returns. UBSI stock yields 4.5% right now.

These returns will be offset by expected EPS decline of 2% per year through 2028. Therefore, UBSI is expected to return 2.7% annually through 2028. This is a relatively weak expected rate of return, making UBSI stock a hold.

Final Thoughts

United is now expected to produce 2.7% annual returns in the coming years. The yield is attractive at 4.5% and should remain safe for years to come, so United could be worth a look for income investors.

Shares earn a hold rating as we see the road ahead being very tough from a growth perspective for a variety of reasons, but the stock is cheap and has an attractive yield.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].