Published on November 3rd, 2023 by Bob Ciura

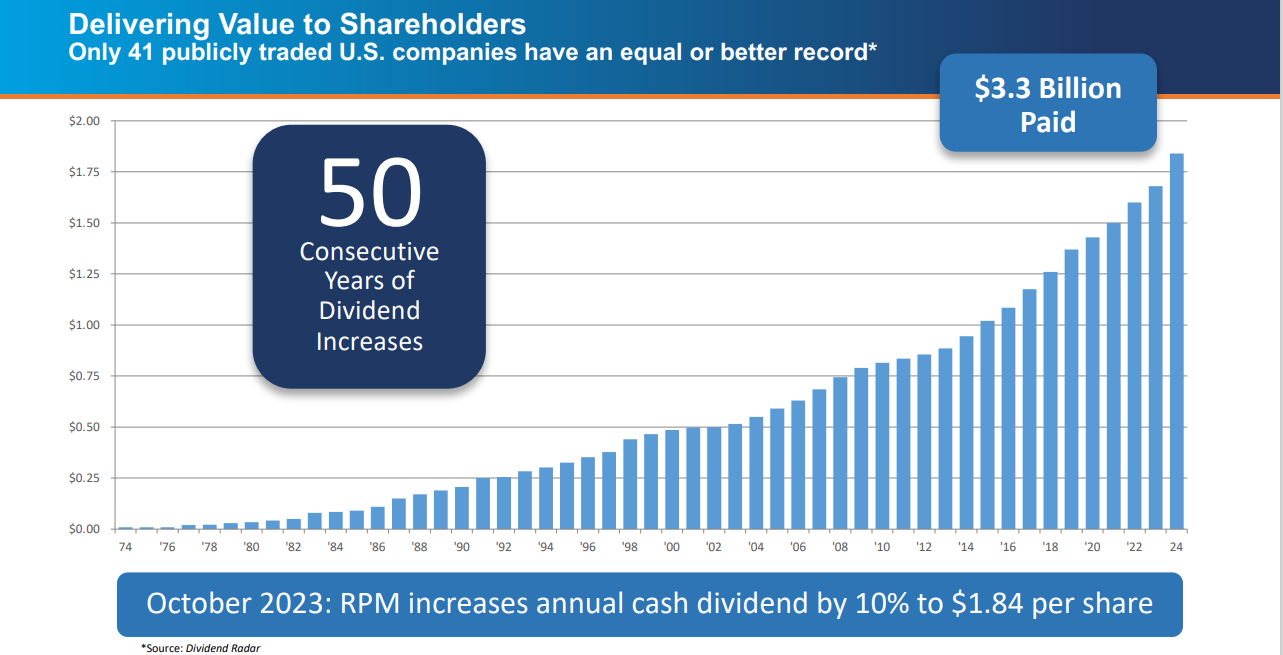

On October 5th, 2023, RPM International (RPM) announced that it was increasing its quarterly dividend for the 50th consecutive years.

As a result, it has joined the list of Dividend Kings.

The Dividend Kings are a group of just 51 stocks that have increased their dividends for at least 50 years in a row. Given this longevity, we believe the Dividend Kings are among the highest-quality dividend growth stocks to buy and hold for the long term.

With this in mind, we created a full list of all 51 Dividend Kings. You can download the full list, along with important financial metrics such as dividend yields and price-to-earnings ratios, by clicking on the link below:

RPM is a diversified company and a leader in the materials sector. We believe it has a long runway of growth up ahead, and that it can continue to be relied upon for annual dividend increases.

This article will discuss the company’s business overview, growth prospects, competitive advantages, and expected returns.

Business Overview

RPM International manufactures, markets and distributes chemical products to industrial, retail and specialty customers. The majority of sales are made to industrial customers. RPM was founded in 1947 and employs more than 15,000 people.

Source: Investor Presentation

On October 4th, 2023, RPM reported earnings results for the first quarter of fiscal year 2024 for the period ending August 31st, 2023. For the quarter, revenue grew 4.1% to a first quarter record $2.01 billion, which was $40 million above estimates. Adjusted earnings-per-share of $1.64 compared to $1.47 in the prior year, which was $0.10 better than expected.

Three out of four segments of the company produced record revenue for the first quarter. Companywide, organic sales improved 3.9% for the period. Revenue for the Consumer Group increased 1.5% to $670 million. This segment had organic growth of 1.7% due to pricing action.

The Construction Products Group grew 10.8% to $783 million. This segment had organic growth of 9.5% due to strength in restoration systems for roofing and parking structures. Performance Coatings Group revenue was up 4.1% to $379 million.

Organic sales were up 4.0% as infrastructure related businesses saw higher demand. Revenue of $181 million for Specialty Products Group was a 10.7% decrease year-overyear due once again to lower volumes in those businesses that serve OEM markets. Organic sales declined 9%.

RPM now expects sales to be up a low single-digit for fiscal year 2024, which is down from a projection of mid-single digit growth. We forecast earnings-per-share of $4.98 for the fiscal year, up from $4.92 previously. This would be a 15.8% increase from the prior year.

Growth Prospects

In recent years, growth has been much steadier. From fiscal year 2014 to fiscal year 2023, earnings per share grew at a rate of 7.0% per year. That growth rate has accelerated to 10.1% over just the last five years.

Factoring in the strength of recent results with the likely declines in earnings during the next recession, we now forecast annual earnings growth of 7%, up from 5%, through fiscal year 2029.

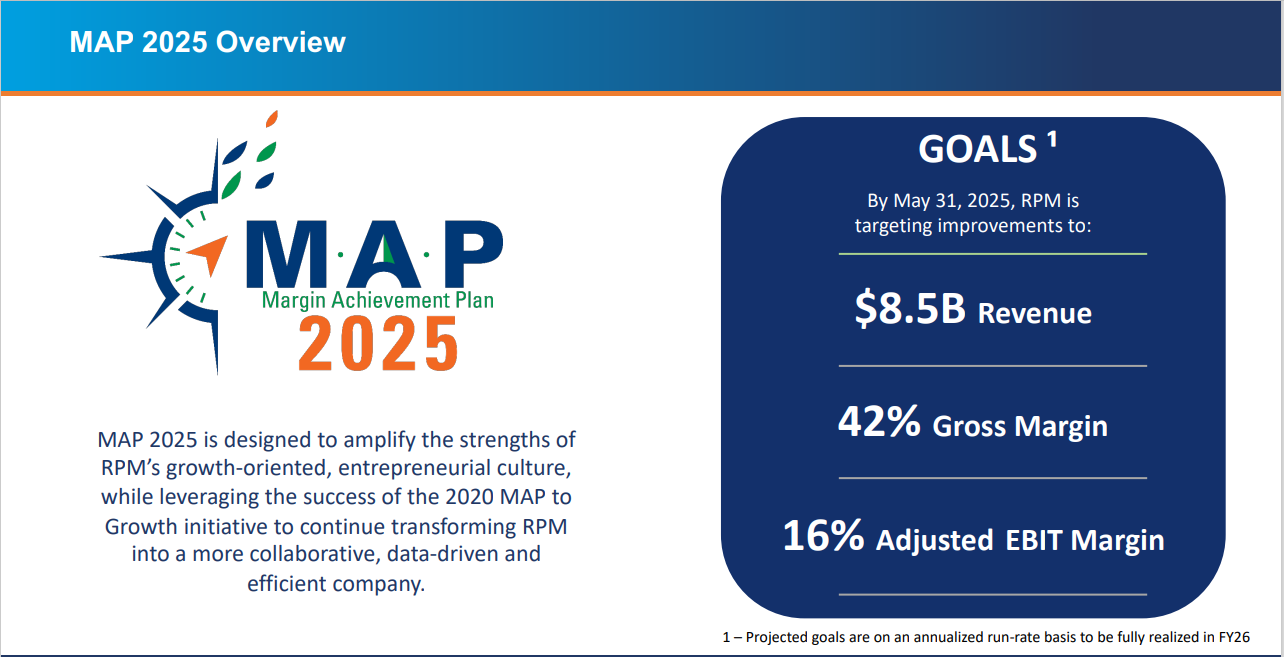

Organic revenue growth is expected to be the primary contributor. Expanding profit margins will also play a key role in the company’s future EPS growth.

Source: Investor Presentation

Growth slowed during the last recession, but RPM was able to maintain and increase its dividend payments to shareholders even in an adverse economic climate.

Competitive Advantages & Recession Performance

RPM is a leading manufacturer and distributor of paints, coatings, construction chemicals, colorants and adhesives to consumers, contractors, and construction businesses. These businesses perform well when the economy is growing due to the increases in construction and home improvement spending.

However, RPM is very susceptible to recessions. You can see the company’s earnings-per-share performance during the Great Recession below:

- 2007 earnings-per-share of $1.64

- 2008 earnings-per-share of $0.36 (78% decline)

- 2009 earnings-per-share of $0.93 (158% increase)

- 2010 earnings-per-share of $1.39 (49% increase)

As you can see, the company’s earnings-per-share declined significantly in 2008, but recovered in the following two years as the economy emerged from the recession.

We expect this recession-resistant Dividend King to perform similarly during future downturns in the business environment.

RPM is not recession proof, as shown by the company’s decline in earnings, and in the time that it took for earnings growth to return to the company following the last recession. The company also has a high level of debt that could make acquisitions or high dividend growth difficult if earnings were to weaken.

From a dividend perspective, RPM’s dividend also appears very safe.

Source: Investor Presentation

The company has a projected dividend payout ratio of 37% for 2023. RPM has raised its dividend for 50 consecutive years.

Valuation & Expected Total Returns

Based on expected EPS of $4.98 for 2023, RPM stock trades for a price-to-earnings ratio of 19.4. We reaffirm our target P/E of 20 as this is more in-line with the long-term average valuation and reflects the quality of earnings results over the past few years.

If the stock were trade with this multiple by fiscal 2029, then valuation would be a 0.6% tailwind to annual returns over this period.

The other major component of RPM’s future total returns will be the company’s earnings-per-share growth. We expect 7% annual EPS growth for the company.

Lastly, total returns will receive a boost from the company’s dividend payments. RPM shares currently yield 2%.

Overall, RPM’s expected total returns could be composed of:

- 7.0% earnings-per-share growth

- 2.0% dividend yield

- 0.6% multiple reversion

Total expected annual returns are forecasted at 9.6% per year over the next five years. We now rate RPM a hold.

Final Thoughts

RPM International continues to deliver record setting results, an impressive feat considering the growth rates that the company experienced last fiscal year. The company has an impressive dividend growth streak as well.

With expected returns just below our 10% buy threshold, we currently rate RPM stock a hold.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

The major domestic stock market indices are another solid resource for finding investment ideas. Sure Dividend compiles the following stock market databases and updates them monthly:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].