Printed on March nineteenth, 2025 by Bob Ciura

The Dividend Kings are a selective group of shares which have elevated their dividends for at the least 50 years in a row.

We consider the Dividend Kings are among the many highest-quality dividend development shares to purchase and maintain for the long run.

With this in thoughts, we created a full listing of all of the Dividend Kings.

You may obtain the total listing, together with essential monetary metrics akin to dividend yields and price-to-earnings ratios, by clicking the hyperlink under:

RLI Corp. (RLI) is the most recent member of the Dividend King listing, having introduced its fiftieth consecutive annual dividend improve on February thirteenth.

This text will focus on the corporate’s enterprise overview, development prospects, aggressive benefits, and anticipated returns.

Enterprise Overview

RLI Corp. is an insurance coverage firm that operates the next enterprise models: Casualty (healthcare & transportation insurance coverage), Property (hearth, earthquake, distinction in circumstances, marine, and many others.) and Surety (contract surety protection, licenses, and bonds).

Supply: Investor Presentation

RLI Company reported its fourth quarter earnings outcomes on January 22. The corporate reported revenues of $440 million for the quarter, which was up 1% year-over-year. Web earned premiums rose by 15% year-over-year.

Realized positive factors had been greater than in the course of the earlier 12 months’s interval, which had a constructive affect on the corporate’s reported revenues, however web unrealized positive factors had been decrease in comparison with the earlier 12 months’s quarter, offset a few of the income tailwinds.

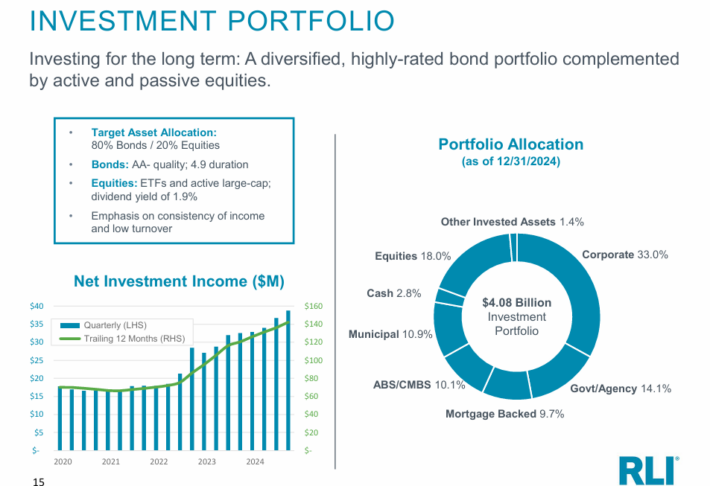

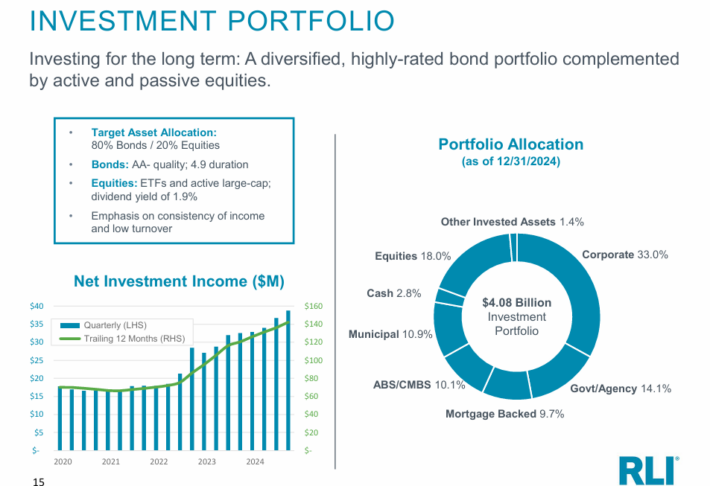

Increased web funding earnings, which was up 19% 12 months over 12 months, was a tailwind for RLI’s profitability in the course of the quarter.

RLI Company earned $0.41 per share on a non-GAAP, or adjusted, foundation in the course of the quarter, which is the place RLI backs out one-time objects that may distort the image in the case of the corporate’s underlying earnings energy.

RLI’s backside line was decrease than in the course of the earlier 12 months’s interval, however for your entire 12 months of 2024, earnings had been up. RLI Corp is forecasted to see its earnings-per-share develop properly this 12 months, to greater than $3.00.

Progress Prospects

RLI Corp. has not been in a position to develop its earnings very constantly previously, as earnings moved sideways for a lot of the final decade.

That is, largely, as a result of low rates of interest lowered the earnings RLI can generate with its insurance coverage float at instances.

Since 2020, nevertheless, RLI Corp. has grown its earnings-per-share very properly, with earnings-per-share rising by greater than 100% between 2020 and 2024.

Increased rates of interest permit RLI Corp. to deploy its insurance coverage float in a extra worthwhile manner, thus a higher-rates setting is constructive for the corporate, all else equal.

Supply: Investor Presentation

RLI has grown its premiums within the current previous, and because of additional premium development, RLI ought to see its gross sales develop sooner or later.

We consider that 3% annual earnings-per-share development is a practical long-term estimate, factoring within the current efficiency and the longer-term monitor report.

Aggressive Benefits & Recession Efficiency

Many monetary companies, together with some insurers, skilled vital issue in the course of the Nice Recession.

RLI remained worthwhile, and its earnings-per-share truly grew in the course of the 2008-to-2010-time body. We consider that RLI Company might be comparatively secure throughout future recessions as nicely.

RLI Company has raised its common dividend very steadily through the years, which was doable resulting from ongoing will increase within the firm’s payout ratio over a few years.

Extra lately, the dividend payout ratio has come down once more, and the dividend seems very sustainable for now.

Through the Nice Recession of 2008-2009, it steadily grew earnings-per-share every year in that point:

- 2008 earnings-per-share of $3.60

- 2009 earnings-per-share of $4.32 (20% improve)

- 2010 earnings-per-share of $6.00 (39 improve)

Valuation & Anticipated Complete Returns

Primarily based on anticipated 2025 earnings-per-share of $3.10, RLI inventory trades for a ahead P/E of 24.4. That is above our honest worth estimate of 19, that means shares seem overvalued.

RLI Company’s value to earnings a number of has been shifting in a really wide selection previously. Shares had been valued at a low double-digit value to earnings a number of shortly after the Nice Recession, however the firm’s valuation a number of has exploded upwards since then.

RLI’s valuation stays elevated. We consider that shares are buying and selling above honest worth and that a number of compression is probably going going ahead.

For instance, if the P/E a number of declines from 24.4 to 19 over the following 5 years, it might cut back shareholder returns by -4.9% per 12 months over that time-frame.

Apart from adjustments within the P/E a number of, RLI also needs to generate returns from earnings development and dividends. A projection of anticipated returns is under:

- 3% earnings-per-share development

- 0.8% dividend yield

- -4.9% a number of reversion

RLI has a daily quarterly dividend, and periodically pays particular dividends as nicely. For instance, the corporate paid shareholders a particular dividend of $4.00 per share in 2024, and a $2.00 particular dividend in 2023.

Nonetheless, since particular dividends are irregular, we exclude them from our evaluation and as an alternative give attention to the common quarterly payouts.

On this situation, RLI inventory is projected to generate a damaging complete return of -1.1% per 12 months over the following 5 years.

Ultimate Ideas

RLI Company is an insurance coverage firm which generated stable working outcomes lately, with written premiums and funding earnings rising at a pleasant tempo.

Earnings will probably proceed to develop in the course of the subsequent couple of years, however not at a very quick tempo.

RLI Company doesn’t have a really robust long-term monitor report, though outcomes throughout current years had been robust, whereas the outlook for 2025 is compelling as nicely.

Nonetheless, we consider that shares are overvalued at the moment. Due to this, RLI Company earns a promote advice from Positive Dividend on the present valuation degree.

Further Studying

The next articles include shares with very lengthy dividend or company histories, ripe for choice for dividend development buyers:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].