Updated on September 18th, 2023 by Aristofanis Papadatos

Parker-Hannifin (PH) is in very exclusive company when it comes to its dividend track record. Parker-Hannifin has paid quarterly dividends to shareholders for the past 70+ years, and it has raised its dividend for 67 years running.

Given that, Parker-Hannifin has one of the top five longest-running dividend increase streaks in the S&P 500 Index.

This amazing accomplishment puts it in the elite Dividend Kings, a group of stocks that have increased their payouts for at least 50 consecutive years.

You can see the full list of all 50 Dividend Kings here.

Additionally, you can download your free copy of the entire Dividend Kings list (along with metrics that matter like price-to-earnings ratios and dividend yields) by clicking on the link below:

Dividend Kings are the best of the best when it comes to rewarding shareholders with higher cash returns each year.

This article will discuss Parker-Hannifin’s qualities that have put it in such rare company.

Business Overview

Parker-Hannifin was founded back in 1917 by Art Parker, who was an entrepreneurial man in every sense of the word. He used his penchant for solving engineering problems to file over 160 patents and created the foundation for what Parker-Hannifin has become today.

The company continues to embody Mr. Parker’s approach to solving the world’s engineering problems, and the formula has certainly worked over the past several decades.

Parker-Hannifin sells a wide array of components that help power the world’s factories and machines. Part of the company’s appeal is its broad diversification in terms of product categories and offerings.

The company has a very long and diverse customer list and is not reliant upon one or two industries for its revenue and profits. Indeed, Parker-Hannifin is one of the most diversified industrial stocks.

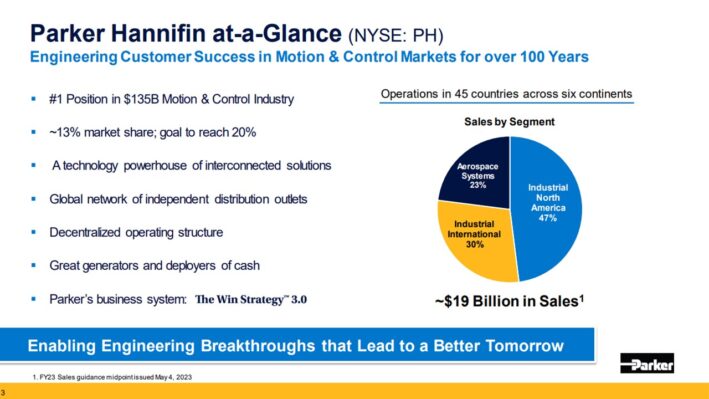

Source: Investor Presentation

Parker-Hannifin’s market capitalization is right at $50 billion and the company has generated $19 billion in revenue in the last 12 months.

The company operates in three major segments called Industrial North America, Industrial International, and Aerospace Systems.

The North America business is the largest segment of the three. This segment provides industrial solutions to engineering problems on a massive scale including valves and fittings, cylinders and actuators, hoses, piping, tubing and a host of other product categories.

The International business provides the same sort of solutions to its customers outside the US.

The Aerospace Systems business focuses on an industry where Parker-Hannifin has decades of experience in making the world’s aircraft more efficient and safer to operate.

Parker-Hannifin recently acquired Meggitt, a global leader in aerospace and defense motion and control technologies for $8.8 billion in cash. Meggitt offers technology and products on every major aircraft platform and has annual revenues of $2.3 billion.

As the value of the transaction is 18% of the market capitalization of Parker-Hannifin, the acquisition will certainly be a significant growth driver for the company in the upcoming years.

Growth Prospects

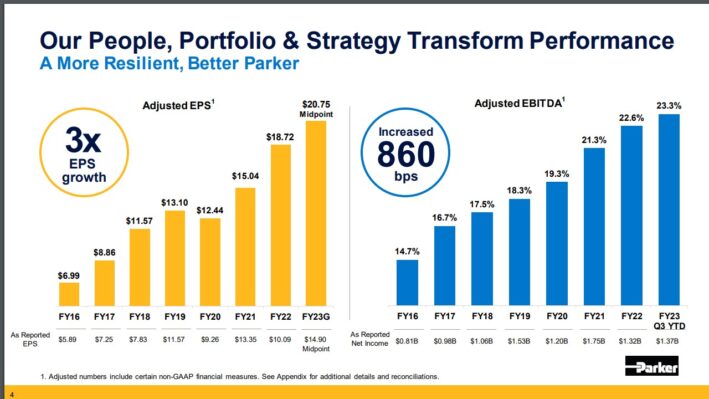

Thanks to its focus on its niche markets, Parker-Hannifin has exhibited an admirable performance record. The company has grown its earnings per share in 8 of the last 9 years, by 14.3% per year on average. The consistent performance combined with the high growth rate of the company are testaments to its rock-solid business model.

Parker-Hannifin has achieved this outstanding performance record primarily thanks to its ability to acquire smaller competitors, incorporate their products in its immense global network and achieve great synergies from these acquisitions. Parker-Hannifin has always maintained a strong financial position in order to have sufficient cash for highly profitable acquisitions.

As shown in the chart below, Parker-Hannifin has more than tripled its earnings per share since 2016.

Source: Investor Presentation

Given the sustained business momentum of the company and its recent acquisition of Meggitt, we expect 9% growth of earnings per share over the next five years.

Parker-Hannifin reported fourth quarter earnings on August 3rd, 2023. Organic sales grew 6% and sales grew 22% over the prior year’s quarter, to a new all-time high. It was the third quarter after the acquisition of Meggitt. Adjusted earnings per share grew 18%, from $5.16 to a record $6.08, thanks to robust demand in aerospace, which more than offset the headwind of cost inflation.

Parker-Hannifin exceeded the analysts’ consensus by $0.59. Notably, the industrial manufacturer has exceeded the analysts’ EPS estimates for 32 consecutive quarters. Thanks to its sustained business momentum and record backlog, the company provided strong guidance for its earnings-per-share in fiscal 2024. It expects 3%-6% sales growth and adjusted earnings per share of $21.90-$22.90.

As management has proved conservative in its guidance for several years in a row, we expect earnings per share of at least $22.90, which is the upper limit of the guidance. Such a level of earnings per share will mark 6% growth over the prior year. As per multi-year experience, we expect management to raise its guidance more than once in the running fiscal year, which began in July.

Parker-Hannifin has made some significant acquisitions in recent years, with CLARCOR, Lord, and Exotic Metals being three examples. More recently, the company completed a major $8.8 billion acquisition of Meggitt. The company’s focus on supportive acquisitions as well as improvement in its operating efficiency, should provide it with strong long-term earnings growth.

Competitive Advantages & Recession Performance

Parker-Hannifin’s competitive advantages include its scale, global distribution network, and its 100+ years of experience in solving engineering problems.

The company manufactures some relatively obscure – but very critical – components of heavy machinery, factory equipment, aircraft, etc. and competition in many of these arenas is light. As a result, it enjoys a wide business moat and strong pricing power.

Of course, as an industrial manufacturer, Parker-Hannifin is not immune to recessions. After all, its customers need customers of their own in order to justify production. Consequently, when a recession does strike, Parker-Hannifin is significantly affected.

During the Great Recession, revenue fell from about $12 billion before the downturn to about $9 billion at the bottom.

Naturally, this had a corresponding negative impact on earnings-per-share in 2009, as shown below:

- 2007 earnings-per-share of $4.67

- 2008 earnings-per-share of $5.53 (18% increase)

- 2009 earnings-per-share of $3.13 (43% decline)

- 2010 earnings-per-share of $3.40 (8.6% increase)

However, revenue recovered to pre-crisis highs by 2011 the company recovered swiftly and strongly from that fierce recession.

This company isn’t beholden to any one particular industry and that diversification of product offerings and customers is what helps it weather economic storms. Given these factors, we see its dividend as very safe, regardless of future economic conditions.

Valuation & Expected Returns

Based on $22.90 in earnings-per-share for this year, shares of Parker-Hannifin trade for a forward P/E ratio of 17.1. This is well under our fair value P/E of 15.7, meaning the stock is slightly overvalued right now.

We note that Parker-Hannifin has traded with significantly varying price-to-earnings multiples in the past decade. Still, over the next five years, we expect the current valuation to result in a -1.7% annual headwind to total returns.

Parker-Hannifin’s dividend history is obviously very impressive, and that has been made possible by the company’s outstanding free cash flow generation over time.

Even when the global economy was extremely challenged, Parker-Hannifin posted strong cash flow. This provides a huge margin of safety for the dividend, and we believe Parker-Hannifin’s payout is ultra-safe as a result.

If we assume long-term earnings growth of 9% and add in the current yield of 1.5%, Parker-Hannifin’s total expected return over the next five years is 8.6%.

We continue to think Parker-Hannifin has promising prospects ahead. We view the stock as attractive from a long-term perspective. The stock receives a hold rating but it will be upgraded to “buy” if it incurs a 5% correction from its current price of $392.

Final Thoughts

Parker-Hannifin is not a high dividend stock, and it almost certainly never will be. But its dividend track record is impressive, and it appears that it will continue for years to come.

The company uses its free cash flow to reward investors via a decent yield that grows over time, but also through growing by acquisitions and investing in its business.

The stock has rallied ,this year so it now has a hold rating but it will be upgraded to “buy” if it incurs a mild correction from its current price.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].