Updated on October 1st, 2023 by Felix Martinez

Utility stocks are often associated with long histories of paying dividends to shareholders. Their relatively predictable earnings and recession resistance combine to make increasing dividends somewhat easier over the long term than a highly cyclical business.

However, not all utility stocks are created equal in this sense.

There are six utility stocks on the prestigious list of Dividend Kings, a group of stocks with at least 50 consecutive years of dividend increases. You can see all 50 Dividend Kings here.

You can also download an Excel spreadsheet with the full list of Dividend Kings (plus important metrics such as price-to-earnings ratios and dividend yields) by clicking on the link below:

Northwest Natural Holdings (NWN) is among the six utility stocks on the list of Dividend Kings. It has increased its dividend for 67 consecutive years, giving it one of the longest streaks in the market.

Below, we’ll assess Northwest’s business, growth prospects, and whether to buy, sell, or hold.

Business Overview

Northwest was founded over 160 years ago as a natural gas utility in Portland, Oregon.

It has grown from a very small, local utility that provided gas service to a handful of customers to a very successful regional utility with interests that now include water and wastewater, which were purchased in recent acquisitions.

The company’s locations served are shown in the image below.

Source: Investor Presentation

Northwest provides gas service to 2.5 million customers in ~140 communities in Oregon and Washington, serving more than 795,000 connections. It also owns and operates ~35 billion cubic feet of underground gas storage capacity.

Finally, its fairly recent move into water has grown to over 33,000 connections, serving more than 80,000 people. Once the company’s pending acquisitions close, the company’s water connections will grow to 60,000 connections, ready to serve roughly 145,000 people.

Northwest reported Q2 results on Aug. 3rd, 2023. Revenue grew by 22% year–over–year to about $238 million. However, Net income was down $0.03 per share compared to $0.05 in the prior-year period. The company also reported adding 6,400 natural gas meters over the past 12 months, equating to a 0.8% growth rate.

In the first six months of 2023, Northwest also invested nearly $151 million in their utility systems for greater reliability and resiliency.

Meanwhile, the management team reaffirmed its guidance for 2023, with earnings–per–share expected to come in at between $2.55 and $2.75.

Next, we’ll assess Northwest’s future growth prospects.

Growth Prospects

Northwest has had difficulty growing earnings-per-share in the past decade, even though the company acquired customers fairly steadily during that time.

The company has struggled with rate cases in some of its localities, although it experienced more recent success in Oregon with raising prices. Since Northwest is a regulated utility, it must ask for pricing increases from local authorities.

Northwest’s customer growth has been quite strong over the past decade. It has a combination of conversions and new construction, both of which have helped move the needle over time by low single digits.

We believe the demographics of Northwest’s served communities support continued customer growth, so this should be a tailwind for revenue and earnings.

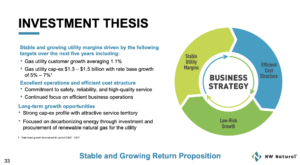

Below, Northwest has outlined what it sees as growth targets for the next five years.

Source: Investor Presentation

The company believes it can grow earnings-per-share at 4% to 6% annually while increasing its dividend.

It plans to get there by growing its customer count by at least 1.5% annually, consistent with historical performance, and rate base growth of 5% to 7%.

We believe customer growth will be steady, but Northwest’s history on rate cases has us a bit more cautious on rate growth.

Accordingly, we assess Northwest’s long-term growth potential at 1.9% annually in the coming years.

Competitive Advantages & Recession Performance

Northwest’s competitive advantage is much like any other utility; it has a virtual monopoly in its service area. The utility business model is vastly different from just about any other type of business as it requires regulatory approval for things like CAPEX and pricing increases.

In return, the company generates a highly predictable and consistent stream of profits from year to year, even during recessions. Approximately 88% of the company’s net income last year was derived from the natural gas utility business.

Additionally, almost two-thirds of Northwest’s customers are residential. We believe Northwest’s fairly heavy concentration on residential customers will continue to serve it well during future recessions.

Below, we have Northwest’s earning-per-share before, during, and after the Great Recession:

- 2007 earnings-per-share: $1.44

- 2008 earnings-per-share: $1.52 (5.6% increase)

- 2009 earnings-per-share: $1.60 (5.3% decrease)

- 2010 earnings-per-share: $1.68 (5.0% increase)

Northwest was able to not only maintain its earnings during a deep and long recession, but it produced at least 5% earnings-per-share growth each year before, during, and following the Great Recession.

While utilities can afford to distribute a high level of profits in the form of dividends, given their predictable earnings base, investors should note that increases are likely to be small. The most recent increase was just 0.5%, illustrating this point.

We believe the current dividend is safe for the foreseeable future, but we note that dividend growth will likely be difficult to achieve.

Valuation & Expected Returns

Northwest stock has declined significantly from its 52-week high, bringing the stock back to an appealing valuation and dividend yield.

At today’s price, Northwest trades for 14.3 times this year’s earnings, which is below our fair value estimate of 17 times earnings. We, therefore, expect a 2.2% annual boost to total returns from the rising P/E multiple.

The current dividend yield is 5.1%, which is very high by Northwest’s own historical standards. Combining it with the valuation and expected EPS growth, we forecast total annual returns of 13.6% moving forward.

A mid-to-high single-digit total return potential earns Northwest a buy rating.

Final Thoughts

While Northwest has some challenges to face, we believe its strategic direction of focusing on building out its residential business will lead to positive growth. Steady customer growth is attractive and should help at least buoy earnings at current levels, if not produce a small amount of EPS growth each year.

With the share price decline in the past year, Northwest offers an improved value proposition. With total returns projected to roughly 13.6% annually, Northwest can be proven a fruitful investment for conservative income-oriented investors.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500.

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].